The market has seen a robust recovery from day's low for yet another session and closed with moderate gains on August 24, ahead of the expiry day for August derivative contracts. The volatility index India VIX also cooled off to 18.43 levels, down by 3.25 percent, making the trend favourable for bulls.

The BSE Sensex rose 54 points to 59,085, while the Nifty50 climbed 27 points to 17,605 and formed a bullish candle on the daily charts by defending 17,350 as well as 17,500 levels.

The broader markets also participated in recovery and outperformed frontliners. The Nifty Midcap 100 and Smallcap 100 indices have gained 0.7 percent and 0.8 percent respectively.

"A small positive candle was formed on the daily chart, that was placed beside the long positive candle of the previous session. Technically, this pattern indicated a rangebound movement in the market after a pullback rally from the lower supports. This also reflects a lack of selling interest in the last couple of sessions after a sharp reversal on the downside on August 19 and 22," Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

The market is in an attempt to come back from the lows and further sustainable upmove from here could bring bulls into the driver's seat. Immediate resistance to be watched is 17,650 and a sustainable move above this area is expected to pull the Nifty towards another hurdle of 17,850 levels in the short term, the market expert said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,528, followed by 17,451. If the index moves up, the key resistance levels to watch out for are 17,653 and 17,700.

The Nifty Bank closed with 341 points gains at 39,038.50 and formed a bullish candle on the daily charts on Wednesday. The important pivot level, which will act as crucial support for the index, is placed at 38,687, followed by 38,335. On the upside, key resistance levels are placed at 39,255 and 39,472 levels.

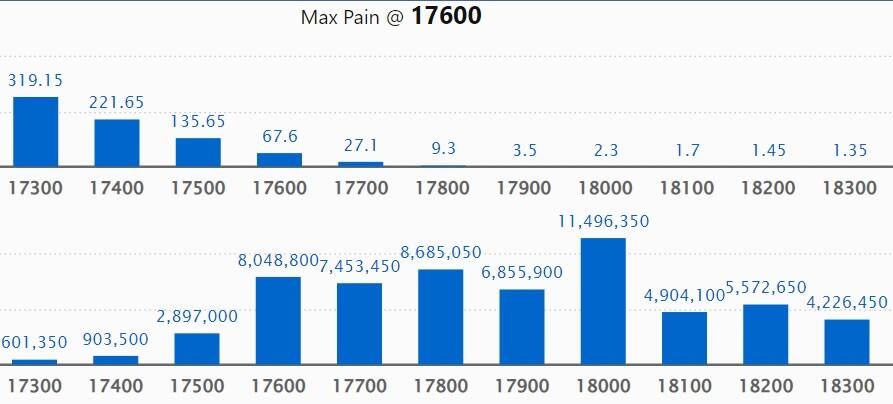

Maximum Call open interest of 1.14 crore contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,800 strike, which holds 86.85 lakh contracts, and 17,600 strike, which has accumulated 80.48 lakh contracts.

Call writing was seen at 17,700 strike, which added 20.12 lakh contracts, followed by 17,800 strike which added 19.54 lakh contracts and 17,600 strike which added 8.61 lakh contracts.

Call unwinding was seen at 18,500 strike, which shed 11.49 lakh contracts, followed by 18,200 strike which shed 10.31 lakh contracts and 18,000 strike which shed 8.61 lakh contracts.

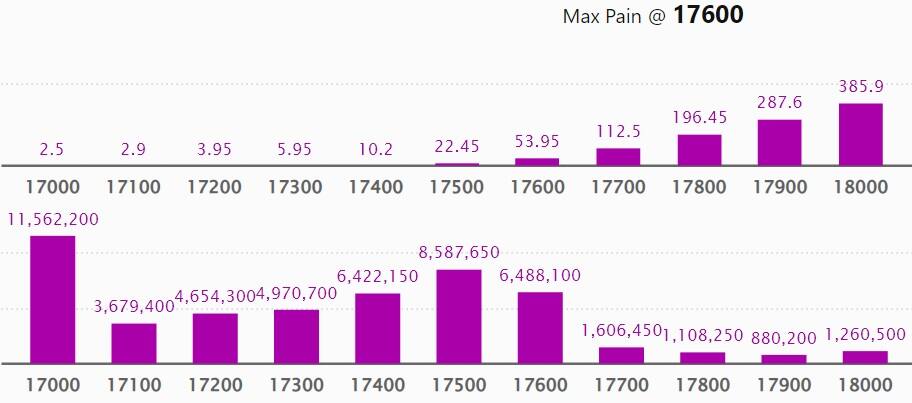

Maximum Put open interest of 1.15 crore contracts was seen at 17,000 strike, which will act as a crucial support level in the August series.

This is followed by 17,500 strike, which holds 85.87 lakh contracts, and 17,600 strike, which has accumulated 64.88 lakh contracts.

Put writing was seen at 17,000 strike, which added 41.38 lakh contracts, followed by 17,600 strike, which added 17.25 lakh contracts and 17,500 strike which added 7.87 lakh contracts.

Put unwinding was seen at 16,800 strike, which shed 28.43 lakh contracts, followed by 16,600 strike which shed 9.58 lakh contracts, and 16,900 strike, which shed 7.31 lakh contracts.

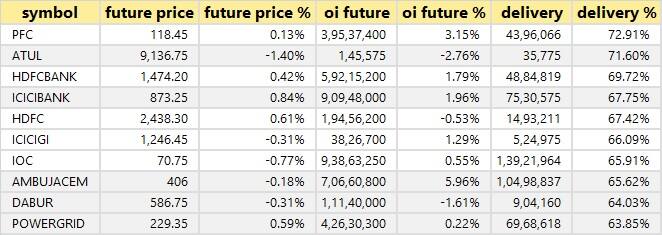

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Financial Corporation, Atul, HDFC Bank, ICICI Bank, and HDFC, among others.

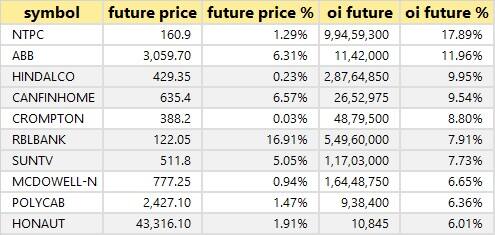

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including NTPC, ABB India, Hindalco Industries, Can Fin Homes, and Crompton Greaves Consumer Electricals, in which a long build-up was seen.

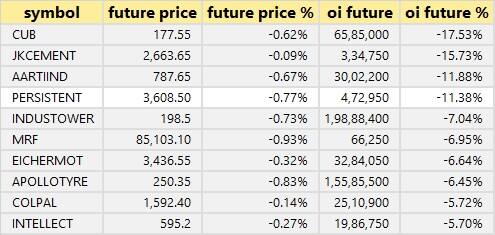

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including City Union Bank, JK Cement, Aarti Industries, Persistent Systems, and Indus Towers, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Bosch, Divis Laboratories, GMR Infrastructure, Mphasis, and Ambuja Cements, in which a short build-up was seen.

70 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Nippon Life India, IDFC First Bank, Dixon Technologies, Info Edge, and Piramal Enterprises, in which short-covering was seen.

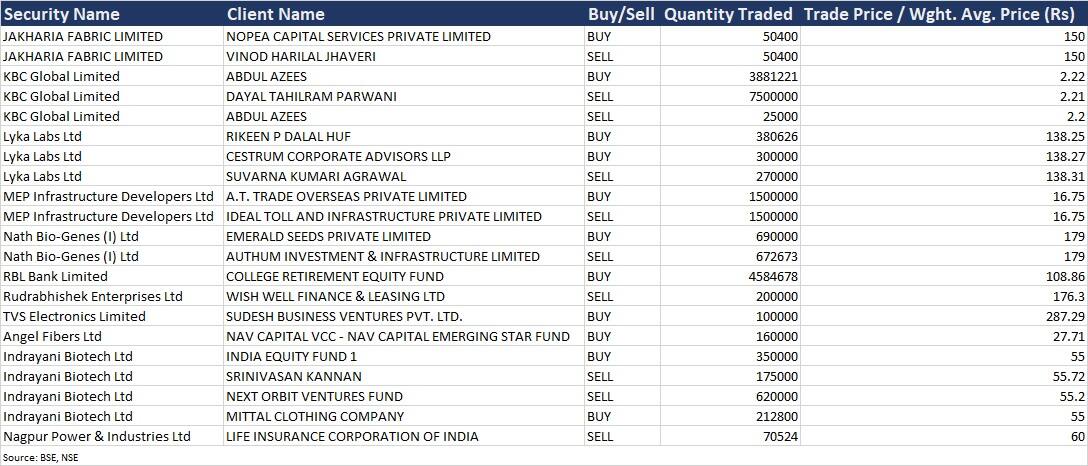

RBL Bank: College Retirement Equity Fund bought 45,84,678 equity shares or a 0.7 percent stake in the bank via open market transactions at an average price of Rs 108.86 per share.

Angel Fibers: Nav Capital VCC - Nav Capital Emerging Star Fund acquired 1.6 lakh equity shares in the company via open market transactions at an average price of Rs 27.71 per share.

Indrayani Biotech: India Equity Fund 1 acquired 3.5 lakh equity shares in the company at an average price of Rs 55 per share, and Mittal Clothing Company also bought 2,12,800 shares at same price. However, Srinivasan Kannan sold 1.75 lakh shares at an average price of Rs 55.72 per share, and Next Orbit Ventures Fund offloaded 6.2 lakh shares at an average price of Rs 55.20 per share.

Investors Meetings on August 25

Dr Reddy's Laboratories: Officials of the company will participate in the investor group meeting organised by Macquarie Capital Securities (India).

Sapphire Foods India: Officials of the company will meet JM Financial, Taiyo Pacific Partners Lp, and CLSA.

Data Patterns (India): Officials of the company will meet Kotak PMS.

Sonata Software: Officials of the company will attend HDFC Securities IT Sector Conference.

Apar Industries: Officials of the company will meet various analysts and investors.

Jindal Stainless: Officials of the company will meet various analysts and investors.

Sportking India: Officials of the company will meet various analysts and investors.

Greaves Cotton: Officials of the company will meet various analysts and investors.

Meghmani Organics: Officials of the company will meet Vasuki India Fund.

MCX India: Officials of the company will meet DAM Capital Advisors.

Eicher Motors: Officials of the company will meet Uluwatu.

Aptus Value Housing Finance India: Officials of the company will meet KC Capital.

Stocks in News

NHPC: The company said that its subsidiary NHPC Renewable Energy (NHPC REL), and the Government of Rajasthan have signed a Memorandum of Understanding (MoU) for the development of ultra mega renewable energy power parks in Rajasthan. The main objective is to set up 10 GW ultra mega renewable energy power parks, and renewable energy projects will be developed either on EPC or developer mode by NHPC REL.

Wipro: The IT services provider has appointed Wagner Jesus as the Country Head and Managing Director for operations in Brazil. Jesus joined Wipro three years prior, taking the lead of the non-financial business cluster.

Barbeque-Nation Hospitality: Credit rating agency ICRA has upgraded the credit rating for the bank facilities of Rs 15.50 crore of the company to A (Stable) and for Rs 5 crore bank facilities, the rating has been upgraded to A2+.

PSP Projects: The company has received contracts worth Rs 247.35 crore from precast and government segments. With this, the total order inflow for the current financial year 2022-23 stands at Rs 1,344.24 crore.

Indian Metals & Ferro Alloys: Investor Fox Consulting Services Pte Ltd offloaded a 0.02 percent stake in the company via open market transactions on August 19. With this, its shareholding in the company reduced to 6.35 percent, from 6.37 percent earlier.

Future Lifestyle Fashions: Investor PI Opportunities Fund I has sold 6.24 lakh equity shares or 0.31 percent stake in the company via open market transactions. With this, its shareholding in the company reduced to 2.76 percent, down from 3.07 percent earlier.

Fund Flow

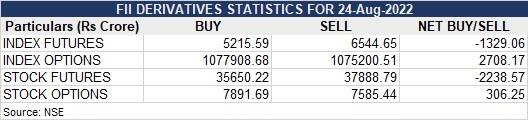

Foreign institutional investors (FIIs) have net bought shares worth Rs 23.19 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 322.34 crore on August 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added RBL Bank to its F&O ban list for August 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.