The market registered fresh four-month high on August 12, with the Nifty50 closing near 17,700 mark, supported by metal, oil & gas, select banking & financial services stocks.

The BSE Sensex rose 130 points to 59,463, while the Nifty50 climbed 39 points to 17,698 and formed small bodied bullish candle on the daily charts. The index gained 1.7 percent for the week and saw bullish candlestick pattern with higher high higher low formation for fourth consecutive week.

At a high of 17,720 levels on Friday, it seems to have reached critical resistance points with over-bought zones. Hence, for a fresh breakout, the index needs to close above 17,800 levels. In that scenario, the strength can expand towards 18,114 levels, said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

Meanwhile, a close below 17,597, the day's low, may induce some weakness with an initial target of 17,359.

Hence, traders should not initiate fresh longs unless the Nifty registers a close above 17,800 levels whereas intraday shorting may be considered below 17,550 levels for a modest target, the market expert advised.

The market was shut on August 15 for Independence Day.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,622, followed by 17,547. If the index moves up, the key resistance levels to watch out for are 17,749 and 17,800.

The Nifty Bank also gained momentum, rising 162 points to 39,042 and formed bullish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 38,825, followed by 38,608. On the upside, key resistance levels are placed at 39,174 and 39,306 levels.

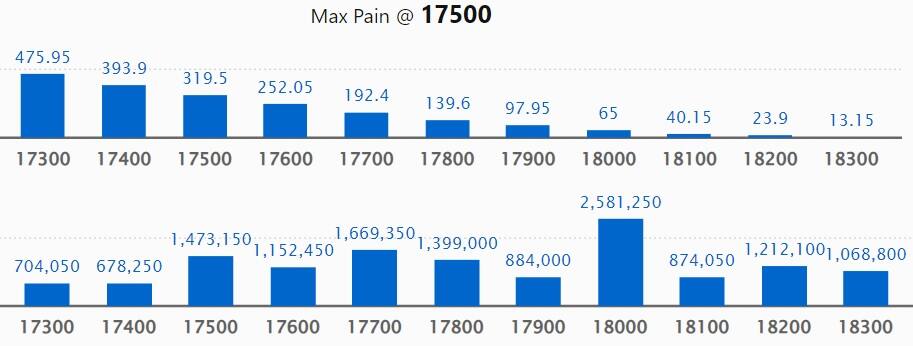

Maximum Call open interest of 25.81 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,700 strike, which holds 16.69 lakh contracts, and 17,800 strike, which has accumulated 13.99 lakh contracts.

Call writing was seen at 17,600 strike, which added 3.82 lakh contracts, followed by 17,700 strike which added 3 lakh contracts, and 18,100 strike which added 2.81 lakh contracts.

Call unwinding was seen at 17,500 strike, which shed 1.19 lakh contracts, followed by 17,000 strike which shed 43,800 contracts and 17,200 strike which shed 31,150 contracts.

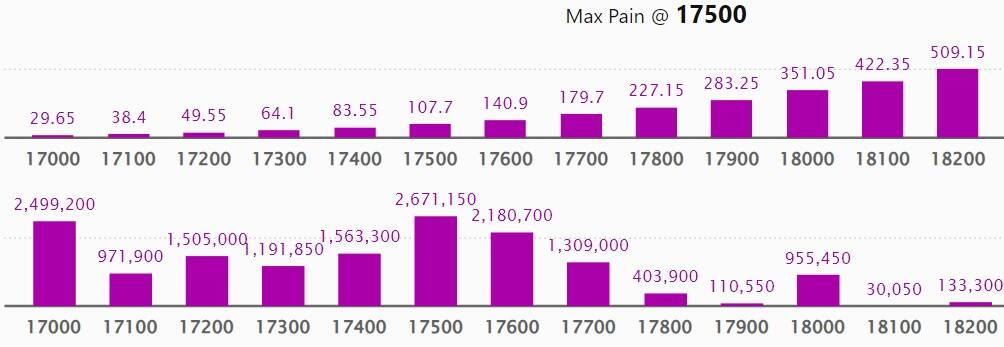

Maximum Put open interest of 26.71 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the August series.

This is followed by 17,000 strike, which holds 24.99 lakh contracts, and 16,500 strike, which has accumulated 21.91 lakh contracts.

Put writing was seen at 17,600 strike, which added 9.9 lakh contracts, followed by 17,700 strike, which added 5.64 lakh contracts and 17,400 strike which added 4.1 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 1.87 lakh contracts, followed by 16,600 strike which shed 69,100 contracts, and 17,300 strike which shed 25,400 contracts.

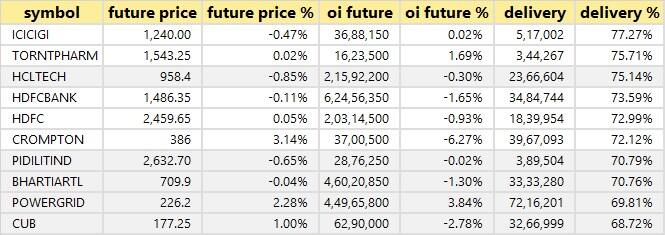

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ICICI Lombard General Insurance, Torrent Pharma, HCL Technologies, HDFC Bank, and HDFC, among others.

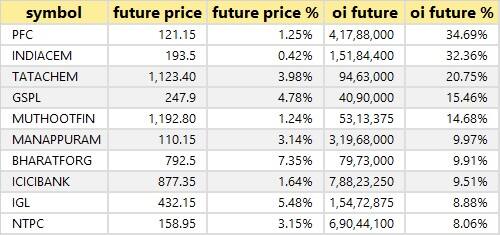

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Power Finance Corporation, India Cements, Tata Chemicals, Gujarat State Petronet, and Muthoot Finance, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Bata India, Alkem Laboratories, Atul, Canara Bank, and IDFC First Bank, in which long unwinding was seen.

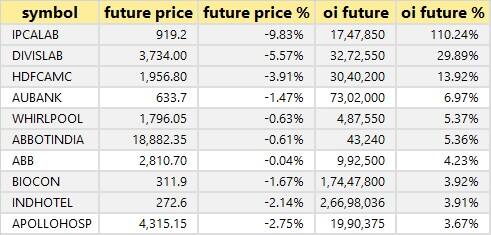

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Ipca Laboratories, Divis Laboratories, HDFC AMC, AU Small Finance Bank, and Whirlpool of India, in which a short build-up was seen.

50 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Eicher Motors, GNFC, Aarti Industries, Granules India, and L&T Technology Services, in which short-covering was seen.

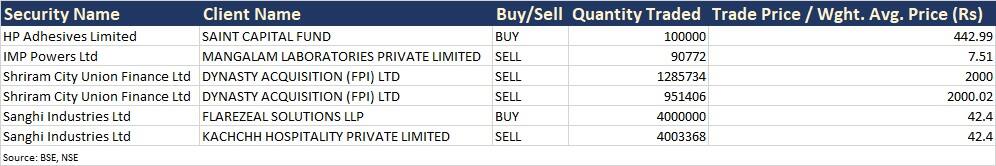

HP Adhesives: Saint Capital Fund acquired 1 lakh equity shares in the company via open market transactions at an average price of Rs 442.99 per share.

Shriram City Union Finance: Dynasty Acquisition (FPI) sold 22.37 lakh equity shares in the company at an average price of Rs 2,000 per share.

(For more bulk deals, click here)

Investors Meetings on August 16

Apar Industries, Neogen Chemicals: Officials of the companies will attend NBIE - Investor Conference - August 2022 hosted by Nirmal Bang Institutional Equities.

Rainbow Children's Medicare: Officials of the company will attend Investor Roadshow host by Kotak Securities.

Metro Brands: Officials of the company will meet Nirmal Bang, and JP Morgan Asset Management.

Ramco Cements: Officials of the company will attend investors' meets at Singapore, organised by B & K Securities.

Aegis Logistics: The company will hold Q1FY23 earnings conference call to discuss operational & financial performance.

Tata Chemicals: Officials of the company will meet Ruane Cunniff Goldfarb.

UPL: Officials of the company will meet several fund houses, analysts, institutional investors in a virtual conference organised by Kotak Securities.

Hindware Home Innovation: Officials of the company will meet analysts and investors to discuss financial results for the first quarter ended June 2022.

Fiem Industries: Officials of the company will meet analysts and investors to discuss financial results for the first quarter ended June 2022.

Stocks in News

Life Insurance Corporation of India: The life insurance major registered an increase of 20.35 percent in total premium income at Rs 98,352 crore in June FY23 quarter, against Rs 81,721 crore for the quarter ended June FY22. The profit for the quarter was Rs 682.88 crore against Rs 2.94 crore in corresponding period last fiscal. The market share of LIC in individual first year premium income was 43.86 percent for June FY23 quarter and in the group first year premium income, the market share was 76.43 percent.

Oil and Natural Gas Corporation: ONGC reported a standalone profit of Rs 15,206 crore for the quarter ended June FY23, up 251 percent YoY driven by strong operating performance and topline growth. Standalone revenue for the June FY23 quarter grew by 84 percent YoY to Rs 42,321 crore. EBITDA came in at Rs 24,731 crore for the June FY23 quarter, rising 125 percent YoY, and margin jumped by 1,065 bps YoY to 58.43 percent during the quarter led by higher crude realisation following spike in oil prices and increase in domestic gas prices.

Hero MotoCorp: The two-wheeler maker recorded 71 percent year-on-year increase in profit at Rs 625 crore for the quarter ended June FY23 on low base. Revenue grew by 53 percent YoY to Rs 8,393 crore and EBITDA surged 83 percent to Rs 941 crore compared to year-ago period. The company sold 13.90 lakh units of motorcycles and scooters in Q1FY23, a growth of 36 percent over the corresponding quarter in the previous fiscal. The year-ago quarter was affected by second Covid wave.

Zee Entertainment Enterprises: The company recorded a 49 percent year-on-year decline in profit at Rs 106.6 crore for the quarter ended June FY23, dented by dismal operating performance and tepid topline growth. Revenue grew by 4 percent to Rs 1,846 crore compared to year-ago period with 5.4 percent YoY increase in advertising revenue and 5 percent fall in subscription segment.

Apollo Tyres: The tyre maker clocked a 49 percent year-on-year growth in consolidated profit at Rs 190.7 crore for the quarter ended June FY23 on low base. Strong operating income and top line lifted bottomline. Revenue grew by 30 percent to Rs 5,942 crore compared to year-ago period.

Sun TV Network: The company reported a 35.3 percent year-on-year growth in consolidated profit at Rs 494 crore for the quarter ended June FY23 driven by operating income and top line growth. Revenue from operations grew by 49 percent to Rs 1,219 crore compared to year-ago period.

Wockhardt: The company recorded consolidated loss of Rs 75 crore for the quarter ended June FY23, against a loss of Rs 7 crore in year-ago period. Revenue fell 31 percent to Rs 595 crore compared to year-ago period. The corresponding quarter of previous year included revenue and profitability from UK Vaccines business.

Dilip Buildcon: The road developer posted a consolidated loss of Rs 55.1 crore for the quarter ended June FY23, against profit of Rs 32.86 crore in year-ago period, while sequentially the loss widened from Rs 41.09 crore in previous quarter on weak operating performance. The input cost was very high YoY. Revenue grew by 18.3 percent to Rs 2,884.4 crore compared to corresponding period last fiscal. The net order book as on June 2022 stood at Rs 25,160.2 crore.

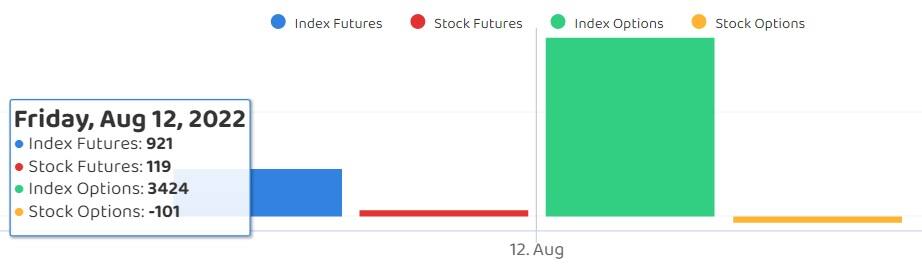

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 3,040.46 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 839.45 crore on August 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Tata Chemicals to its F&O ban list and made the list of total stocks to 3 including Balrampur Chini Mills, and Delta Corp for August 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.