Representative image

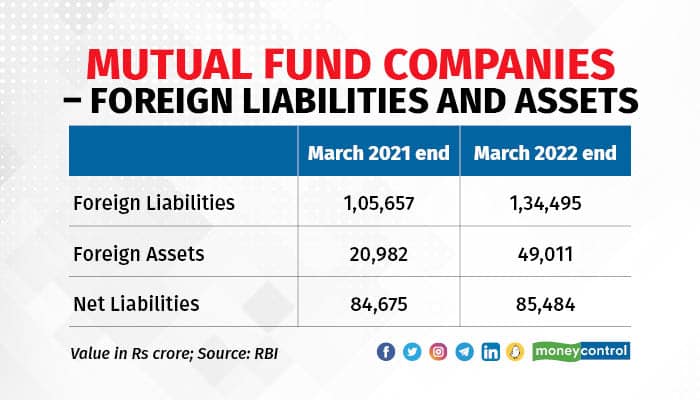

Foreign liabilities of mutual fund (MF) companies increased by $3.4 billion during 2021-22 due to the rise in units issued to non-resident Indians (NRIs). As in March 2022, it stood at $17.7 billion (at market value), shows data published by the Reserve Bank of India (RBI) on August 8.

According to analysts and mutual funds industry experts, globally the rate of returns has been considerably low lately. And hence, NRIs looked for opportunities to invest and allocate money to Indian equities.

Foreign assets of MF companies increased by $3.6 billion during the year on the back of rise in their holdings of equity securities, to reach $6.5 billion in March 2022. As a result, net foreign liabilities of MF companies stood at $11.3 billion in March 2022.

Investments in foreign liabilities are the outstanding limits of mutual funds held by NRIs.

Of the total MF units held abroad, NRIs in the United Arab Emirates (UAE), the United Kingdom (UK), the United States of America (USA), and Singapore together held nearly 44 percent, both at face value as well as market value.

Industry experts pointed out that there has been a considerable rise both, in investments by NRIs in mutual funds in India as well as overseas direct investments by asset management companies (AMCs), following COVID-19.

Factors leading to the rise

The MF industry witnessed steady growth with ample investments from NRIs, till the beginning of April this year when inflation started buffeting the Indian economy hard. While the lower rate of returns in other countries was one of the major factors till then, the stable performance of the rupees too contributed significantly.

“The rupee was very stable last year, which encouraged a lot more investors to invest here. The depreciation of the rupee was not in play last year,” added Vishal Dhawan, founder of Plan Ahead Wealth Advisors, a financial services firm.

In 2021-22, both foreign and domestic equities performed well. From a trading perspective, investors started chasing those returns. “It also provides good diversification. So, those investors who have the ability to take some amount of risk often consider investing,” Rishad Manekia, founder, Kairos Capital, a SEBI-registered investment advisory firm, said.

Industry experts pointed out that during the pandemic, expenses of various higher income groups came down, due to restrictions on activities like travel, and so they could save more. “Higher savings resulted in higher investments,” said Dhawan. According to experts, NRIs are generally known to invest in bank fixed deposits and real estate. However, COVID saw the mutual fund industry becoming the beneficiary, with more NRI money flowing into this segment.

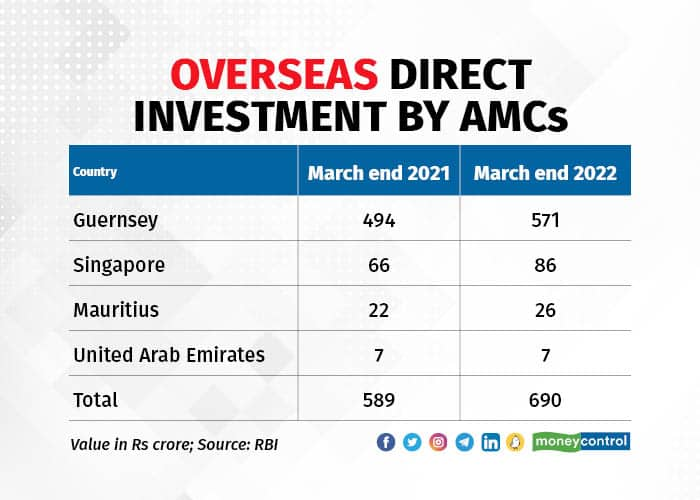

Overseas Direct Investment by AMCs

There has been a significant rise of over 17 percent in overseas direct investment by AMCs from Singapore, Mauritius, and the United Arab Emirates between 2021 and 2022, shown in the RBI data.