RBI Monetary Policy: RBI hiked its key lending rate by 50 basis points to pre-pandemic levels.

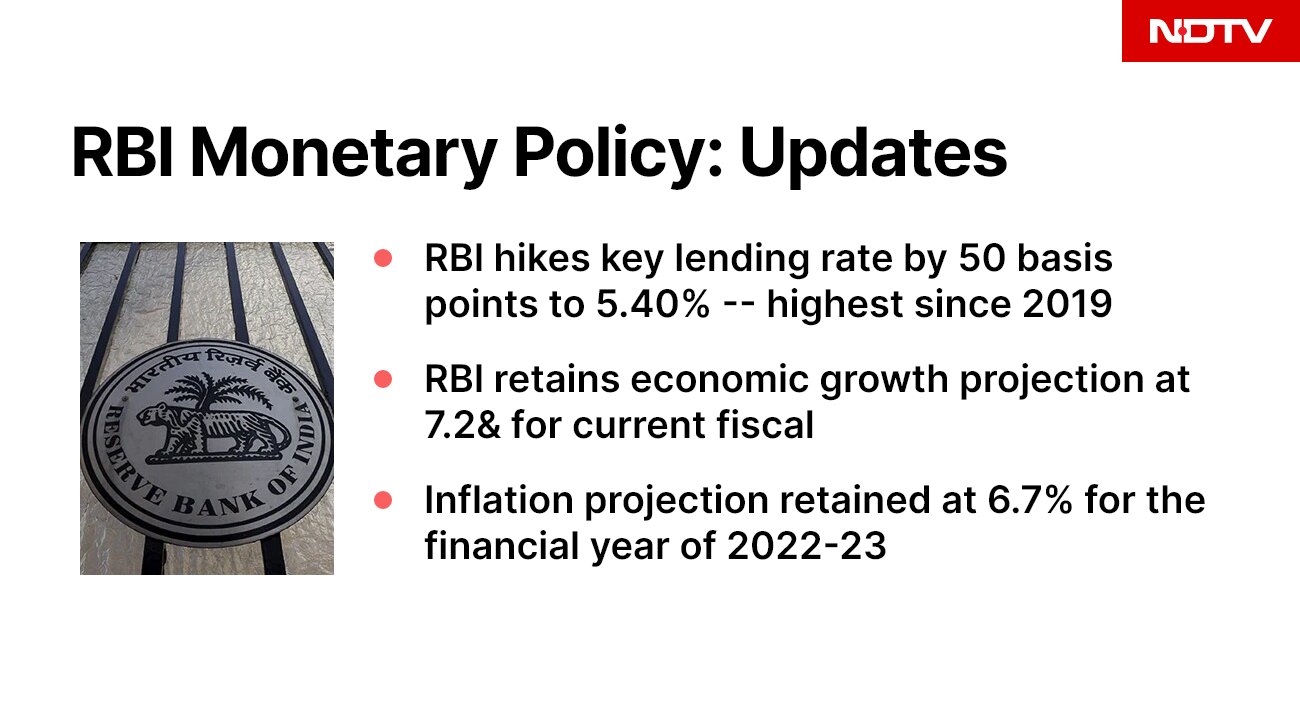

The Reserve Bank of India hikes its key lending rate by 50 basis points to 5.40 percent, the highest since 2019 and for the third time since the beginning of the current fiscal year.

The Reserve Bank of India's rate-setting panel on Wednesday began its three-day deliberations on the next bi-monthly monetary policy.

The central bank has already announced to gradually withdraw its accommodative monetary policy stance.

Here are the Highlights RBI Governor's Press Conference after RBI Monetary Policy:

The Reserve Bank of India (RBI) on Friday raised the benchmark lending rate by 50 basis points to 5.40 per cent to tame inflation.

Following are the highlights of the RBI's fourth monetary policy review of fiscal year 2022-23 announced by Governor Shaktikanta Das:

- Key short-term lending rate (repo) raised by 50 basis points (bps) to 5.4 per cent; third consecutive hike

- In all, 140 bps hike in repo since May 2022 to check inflation

- GDP growth projection for 2022-23 retained at 7.2 per cent (pc).

- GDP growth projection: Q1 at 16.2 pc; Q2 at 6.2 pc; Q3 at 4.1 pc; and Q4 at 4 pc

- Real GDP growth for Q1:2023-24 projected at 6.7 per cent

- Domestic economic activity exhibiting signs of broadening

- Retail inflation projection too retained at 6.7 pc for 2022-23

- Inflation projection: Q2 at 7.1 pc; Q3 at 6.4 pc; and Q4 at 5.8 pc; Q1:2023-24 at 5 pc

- India witnessed large portfolio outflows of USD 13.3 billion in FY23 up to August 3

- Financial sector well capitalised and sound

- India's foreign exchange reserves provide insurance against global spillovers

- Monetary Policy Committee decides to remain focused on withdrawal of accommodative stance to check inflation

- Depreciation of rupee more on account of appreciation of US dollar rather than weakness in macroeconomic fundamentals of the Indian economy

- RBI to remain watchful and focused on maintaining stability of rupee

- Rupee depreciated by 4.7 pc against US dollar this fiscal year till August 4

- India's foreign exchange reserves remain fourth largest globally

- Mechanism to be activated to allow NRIs to use Bharat Bill Payment System for payments of utility and education on behalf of their families in India

- Next meeting of rate-setting panel scheduled for September 28-30, 2022.

The Reserve Bank of India's key policy repo rate was raised by 50 basis points on Friday, the third increase in as many months to cool stubbornly high inflation.

Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank, Mumbai

"The MPC's decisions have been in line with our expectations. Given the increasing external sector imbalances and global uncertainties, the need for front-loaded action was imperative. We continue to see a 5.75% repo rate by December 2022."

Garima Kapoor, Economist, Institutional Equities, Elara Capital, Mumbai

"To rein in inflationary pressures and anchor inflation expectations, the MPC hiked the repo rate by 50 bps and retained its stance on withdrawal of accommodation."

Nikhil Gupta, Chief Economist at MOFSL group

The RBI hikes the repo rate by 50bp to 5.4%, more than the consensus (5.25%) and our expectation (5.15%). Further, there was no change in the stance or any relief in the Governor's statement, indicating a posible pause in the next policy. The rate decision was also taken unanimously today.

Aurodeep Nandi, India Economist and Vice President at Nomura

The RBI's 50bp hike was largely in line with market expectations, that was divided between it and a 35bp hike. Very importantly, with the RBI retaining the policy stance of "withdrawal of accommodation", the implicit message is that rates are yet to reach neutral territory, and that more rate hikes are warranted - a view that we agree with. The RBI continues to signal that all options are on the table, which is a prudent strategy given the elevated levels of uncertainties on both, growth as well as inflation."

Acuite Ratings & Research comments on RBI MPC Aug 5, 2022

The RBI continued to sound relatively hawkish while announcing a hike of 50 bps which is the third hike in the current cycle, aggregating to 140 bps. This has taken the repo rate to 5.40%, 25 bps higher than the pre-pandemic repo level. While a rate hike was given in the current context, it has been slightly higher than our expectations although consistent with the market expectation of front loading.

What is noteworthy is that the central bank has not revised its existing growth or inflation forecasts despite indications of a global slowdown, recessionary conditions in the developed economies, and the moderation already witnessed in commodity prices. Possibly, it would like to go through more data points over the next two months before reviewing these forecasts. At this point, the central bank believes that India's growth in the current year would be largely resilient with the mitigation of risks of a monsoon failure and a healthy pickup in rural demand.

While we await the inflation print for Q2FY23, we believe that rate hikes going ahead will be moderate and there can even be a pause if the CPI data throws up figures nearer to 6.0% over the next 2-3 months. For now, however, one can expect further deposit and lending rate hikes by banks, given the improved credit demand in the economy

#RBI retains its economic growth projection at 7.2 per cent for current fiscal pic.twitter.com/icYVbfo3bG

- NDTV (@ndtv) August 5, 2022

"Rupee fared much better than many other currencies. Depreciation more on account of strengthening dollar than weakening domestic conditions. Thanks to RBI's policy": RBI Governor pic.twitter.com/XeA1rOZOMS

- NDTV (@ndtv) August 5, 2022

- IMF has revised downwards economic growth projection and expressed risk of recession

- Indian economy has been grappling with high inflation

- India facing USD 13.3 billion capital outflow in last few months

- Financial sector remains well capitalised; India's forex reserves provide insurance against global spillovers

- MPC takes unanimous decision to raise benchmark lending rate by 50 bps to 5.40 per cent

- MPC decides to focus on withdrawal of accommodative policy stance to check inflation

- Consumer price inflation remains uncomfortably high; inflation expected to remain above 6 per cent

- Bank credit growth has accelerated 14 pc as against 5.5 per cent year ago

- Domestic economic activity showing signs of broadening; rural demand shows mix trend

- RBI retains its economic growth projection at 7.2 per cent for current fiscal

- Indian economy faces headwinds from global factors like geo-political risks

- Edible oil prices likely to soften further

- Inflation projection for FY23 retained at 6.7% on assumption of a normal monsoon and crude oil at $105 per barrel

- Rise in term deposit rates should increase liquidity for financial sector

- Surplus liquidity in the banking system has come down to Rs 3.8 lakh crore, from Rs 6.7 lakh crore in April-May

- Rupee has moved in orderly fashion, depreciating 4.7 pc till Aug 4; RBI remains watchful of INR movement

- FPIs after remaining in exit mode in first quarter have turned positive in July

- The rupee gains sharply early on Friday, reversing a sharp fall in the previous session, ahead of the Reserve Bank of India's policy announcement.

- Bloomberg quoted the rupee at 78.9713 against the greenback, a gain of 50 paise from its previous close of 79.4713.

- PTI reported that the rupee rose 46 paise to 78.94 against the US dollar in early trade.

- The dollar struggled to gain a footing on Friday after falling by its sharpest pace in two weeks, as investors remained on tenterhooks ahead of the widely anticipated US jobs data and amid growing worries about a recession.

- The US dollar index, which measures the greenback against a basket of currencies, fell 0.68 per cent overnight, the largest fall since July 19, and last traded 105.79.

The Reserve Bank of India will likely hike interest rates for the third time since the current fiscal year began in April. But the central bank's dilemma has multiplied, with pressing economic risks becoming a deeper concern for policymakers. Read more

- The rupee is expected to strengthen against the U.S. dollar at open on Friday as oil prices extended their recent slide to slip to their lowest since February.

- The Reserve Bank of India (RBI) policy decision will set the intraday direction for the rupee, traders said.

- The rupee will likely open at 79.15-79.20 per dollar, up from 79.47 in the previous session.

- Brent crude on Thursday fell 2.8%, taking its losses this month to over 14%. Oil prices have come under pressure amid concerns over demand, pushing Brent crude to its lowest since before Russia's February invasion of Ukraine.

- "The ongoing correction in oil prices will be a major relief for the rupee. Specially right now, when worries over the trade deficit are significant," a trader at a private sector bank said.

- "Oil will help rupee to open higher and from there it will be down to what the RBI does."

RBI Set To Hike Rates To Pre-Pandemic Levels; Focus On Policy Path https://t.co/PBj9cclB3Hpic.twitter.com/uBmpR7EhKW

- NDTV (@ndtv) August 5, 2022

- India's central-bank watchers agree that interest rates will be raised to pre-pandemic levels on Friday, yet they are split on the size of the increase aimed at fighting inflation and propping up a weak currency.

- Sixteen of 36 economists surveyed by Bloomberg see the Reserve Bank of India's six-member monetary policy committee lifting the repurchase rate by half-point to 5.40%, a level last seen in August 2019.

- Fourteen of them predict a 35-basis point hike, five a quarter-point action and one for a 40 basis-point increase -- with any of these moves seen enough to return borrowing cost to late 2019 levels.

- With Federal Reserve officials signaling a pause is out of the question until they see evidence of inflation easing, RBI watchers will be closely monitoring Governor Shaktikanta Das's remarks for any guidance on the pace and length of the monetary tightening cycle as he seeks to ensure a "soft landing" for the economy.

- The central bank has increased the key rate by 90 basis points since May, including a half-point hike in June.

- The rupee may decline to a new lifetime low versus the U.S. dollar if the Reserve Bank of India on Friday decides to opt for a smaller rate hike, a trader said.

- The RBI is widely expected to raise the repo rate as it continues its battle to control inflation.

- Economists, however, differ on the size of the rate hike that the RBI will deliver as the central banks aims to strike the right balance between inflation and growth.

- The estimates range from 25-basis points rate hike to 50-basis points.

- "We think there is decent chance that rupee will see a record low tomorrow," a trader at a Mumbai-based private sector bank said. "A 50-basis hike will not do much for the rupee, while anything less than that will take the rupee well below 80."

- The Reserve Bank of India is expected to raise interest rates today for the third time since the beginning of the current financial year, to bring down inflationary above the upper threshold of the central bank's target since January.

- The focus shifts to the RBI's growth and inflation outlook and the tone of the monetary policy path.

- The Monetary Policy Committee (MPC) meeting started on Wednesday abd the RBI Governor Shaktikanta Das is scheduled to announce the Monetary Policy Committee decisions at 10 am.

- The RBI had said, it was removing the policies introduced as COVID-support, and if the central bank hikes by a minimum of 25 basis points then interest rates will rise to pre-pandemic level.

- While the hike in policy interest rates is almost certain, analysts and economists have different opinions on the extent of the rate hike.

- It varies between 25 basis points to 50 basis points.