Illustration by C R Sasikumar

Illustration by C R SasikumarThe RBI has the unenviable task of keeping inflation within the 4+/-2 per cent range. But lately, despite its best efforts, inflation has remained defiant and above its tolerance band. In June 2022, consumer price index (CPI) inflation was at 7.01 per cent, and wholesale price index (WPI) inflation was at 15.18 per cent. For 2022-23, the RBI seems to have admitted that inflation will stay above 6 per cent, maybe settle at 6.7 per cent.

The RBI’s major policy tool, the repo rate, its brahmastra to tame inflation, has already been hiked by 90 basis points, raising it to 4.9 per cent in June. It is likely to rise to at least 5.5 per cent, if not more, over the course of this financial year. But will this be enough to tame inflation? The short answer is “probably not”. The underlying reason is the nature and structure of inflation in India.

The CPI basket in India comprises of 299 commodities grouped into six major categories. The food and beverages group has a weight of 45.86 per cent (with food at 39.06 per cent, prepared meals at 5.55 per cent and non-alcoholic beverages at 1.26 per cent). The consumer food price inflation (CFPI) was at 7.75 per cent in June, a bit higher than overall CPI inflation.

It is this overwhelmingly high weight of food in overall CPI, based on the consumer expenditure survey (CES) data of 2011-12, that distinguishes Indian inflation from many other developed countries where the food weight is much smaller. For example, it is much lower in Germany (8.5 per cent), the UK (9.3 per cent), the US (13.42 per cent), Canada (15.94 per cent), France (16.49 per cent), Australia (16.8 per cent), China (19.9 per cent), and Japan (26.3 per cent). Even developing nations like South Africa (17.24 per cent), Brazil (25.5 per cent), and Pakistan (34.83 per cent) have lesser weightage of food in overall CPI than India. The higher the weight of food in the overall CPI, the more difficult it is for the monetary policy squeeze alone to contain inflation.

Subscriber Only Stories

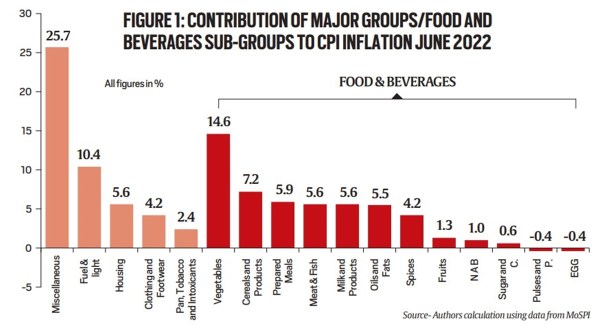

Let us explain this in detail. The figure shows the contribution of each group/item to CPI inflation in June. Food and beverages contributed about 52 per cent to CPI inflation, with CFPI alone contributing 45 per cent. The highest contribution to June inflation came from the vegetables group at 14.6 per cent. Within food, after vegetables, the next group was cereals and products at 7.2 per cent, meat and fish at 5.6 per cent, milk and products at 5.6 per cent, and oil and fats at 5.5 per cent.

Let us dive a bit deeper into vegetables. Interestingly, of the 299 commodities that comprise CPI, the highest contributor to overall inflation was tomatoes at 8.9 per cent. Inflation in tomatoes was stupendously high at 158.8 per cent (year-on-year). One of the prime reasons was the low base effect as inflation in June 2021 was minus 14.4 per cent. Due to low price realisation last year, this year tomato farmers shifted acreage to other crops. On top of that, some tomato growing areas got flooded, while many others faced heat waves that further depressed tomato supplies. No wonder it led to a perfect storm in tomato prices. What can the RBI’s repo rate hikes do to contain the troubles coming from tomatoes?

The real solution to tomato inflation may lie beyond the ambit of the RBI. It requires linking tomato value chains to processing of at least 10 per cent of tomato production into tomato paste and puree during bumper years and using them when fresh tomato prices spike. Further, to enhance the affordability of processed tomatoes, its GST rates need to be reduced from 12 per cent to 5 per cent. This would also help farmers to stabilise their incomes and avoid the typical cobweb problem they face in case of perishables.

This time it is tomato causing the trouble. Next time it could be onion or potatoes humbling the RBI on the inflation front. The RBI with its mighty repo rates policy may feel helpless. It is for this reason that the late Arun Jaitley sanctioned a scheme called TOP (Tomatoes, Onions, and Potatoes) and allocated Rs 500 crore to streamline their value chains. At one stage, even Prime Minister Narendra Modi proudly said in one of his speeches that “TOP is our top priority”. But the scheme went to the Ministry of Food Processing, and was expanded to TOTAL by including several other vegetables. Without having a champion, like Verghese Kurien was for milk, this scheme (from TOP to TOTAL) got diffused in focus and has not shown any visible impact in improving the value chains of vegetables.

Let us take another case to show how the RBI feels helpless in taming food inflation. Cereals and products have the highest weight of 9.67 per cent in the CFPI basket, and it had an inflation rate of 5.7 per cent in June. Within this, wheat registered the highest inflation at 10.1 per cent in June (year-on-year) due to the low availability on account of marginal drop (less than 5 per cent) in production but a massive fall (more than 50 per cent) in procurement (year-on-year). The government abruptly banned wheat exports on May 13, sensing trouble due to the heat wave impact as well as export demand that pulled domestic wheat prices above the minimum support prices (MSP). What could the RBI do in such a situation? Its monetary policy may not help contain wheat prices.

We can give several other examples of food items, such as milk and products, and meat and fish, which together contributed more than 10 per cent to CPI inflation in June, and how RBI’s reliance on the repo rate policy may not go a long way to containing this inflation. Edible oils inflation is strongly impacted by global prices of palm, soya and sunflower oils, and what Indonesia does with its export policy with regard to palm oil, etc.

The upshot of all this is that the nature and structure of inflation in India is different than in developed countries. So, monetary policy alone may not be as effective in the Indian case. India desperately needs to revise its CPI with the latest consumption survey weights. And our parliamentarians must recognise the limitations that the RBI faces in taming inflation. Tremors in tomato prices alone can humble the mighty RBI.

Gulati is Infosys Chair professor and Prasad is Research Assistant at ICRIER

- The Indian Express website has been rated GREEN for its credibility and trustworthiness by Newsguard, a global service that rates news sources for their journalistic standards.