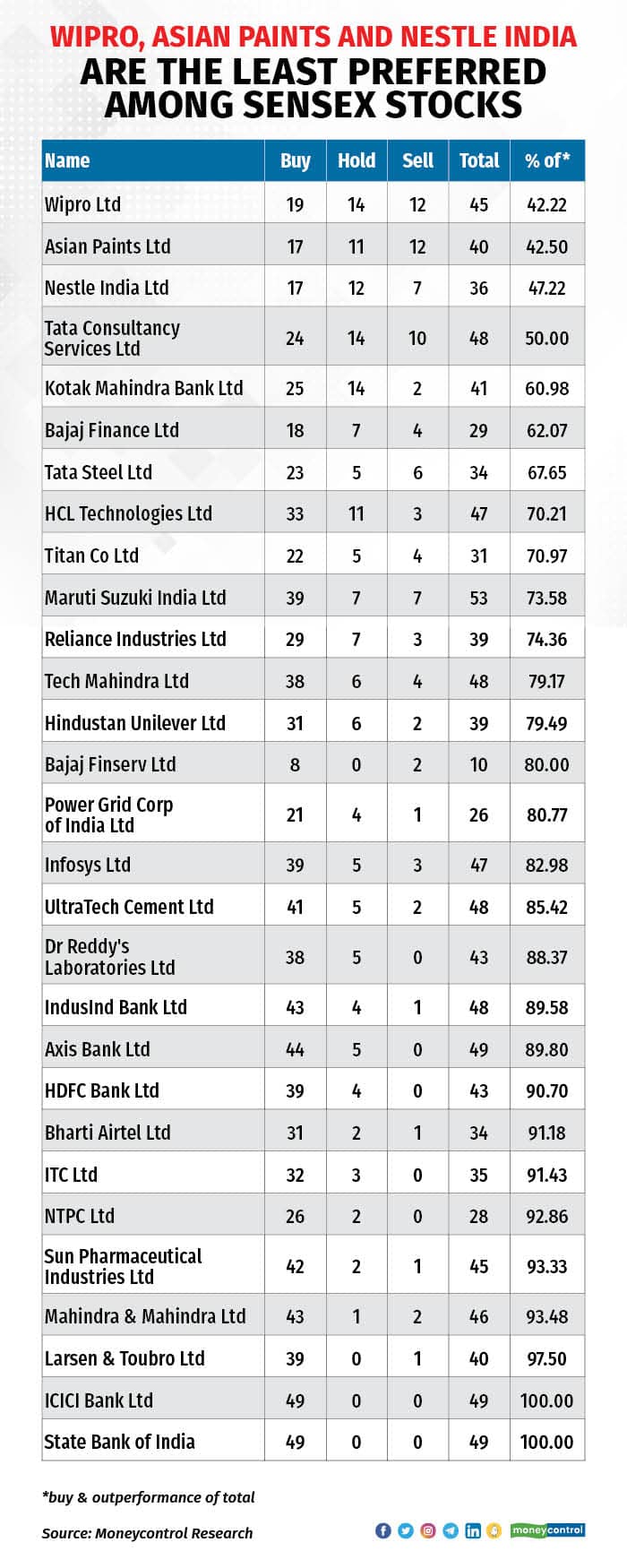

Shares of IT and consumer goods companies have reached the end of the first half of 2022 as least preferred by analysts with Wipro leading the pack, followed by Asian Paints and Nestle.

Banking stocks remained the most sought-after through the tumultuous six months marked by a sharp correction in equities in the face of escalating inflation, higher crude oil and commodity prices, rising interest rates and the Russian invasion of Ukraine.

The finding that IT and consumer stocks are the least favoured is based on the Sensex stocks that have the lowest percentage of buy/outperform/add ratings from analysts, according to Bloomberg.

Wipro has 42 percent or 19 out of the total 45 analysts tracking the company, recommending a 'buy' or 'outperform' rating on the stock. It has 14 'hold' or 'neutral' ratings and 12 'sell' or 'underperform' ratings.

Asian Paints has 43 percent or 17 out of a total of 40 analysts tracking the company having a 'buy' or 'outperform' rating. Eleven analysts have a ‘hold’ recommendation on the stock and 12 call it a ‘sell.’ Nestle India stock has 17 'buy' ratings, 12 'hold' and seven 'sell' ratings.

Since the start of the pandemic in 2020, Covid-led disruptions had been a blessing in disguise for IT and consumer stocks, spurring increased adoption of digital technology and demand for consumer products from residents stuck at home during the lockdowns.

Such demand has slackened in the last six months, with the third wave of the pandemic producing fewer disruptions. Rising commodity prices dented the margins of consumer companies and an expected slowdown in the US economy and higher employee attrition hurt investor sentiment on IT companies, analysts said.

High input costs, demand uncertainty

"Consumer stocks face headwinds of high raw material cost, uncertainty on demand growth and valuations that have not corrected majorly in this fall. IT stocks remain under pressure on fears of demand slowdown, continued attrition and margin headwinds," said Deepak Jasani, head of retail research at HDFC Securities.

Nomura Research, in a recent report, said the margin for Wipro in the first three quarters of FY23 would be lower than its indicative range of 17-17.5 percent and it would likely recover only in fourth quarter FY22.

Key headwinds for Wipro will come from higher-than-usual wage hikes led by higher-than-usual inflation, continued supply-side pressure, and the return of a part of Covid-related discretionary costs.

A note by PhillipCapital said Asian Paints in the near term may trade sideways, given the high level of noise surrounding new competition entering the sector.

Bank stocks

On the other hand, ICICI Bank Ltd and State Bank of India had 100 percent of the analysts tracking the firm, giving them a 'buy' or 'outperform' rating. These two stocks do not have any 'hold', 'neutral', 'sell' or 'underperform' rating, according to Bloomberg.

Analysts expect banks to benefit from rising credit growth and net interest margins that could expand for some time given interest rate increases.

"Most of the banking stocks have shown strong recovery in financials with improvement in asset quality and loan growth attracting investors’ buying interest. As a result, in the first half, IT and consumption companies took a backseat, while banking was the preferred bet," said Nirvi Ashar, manager-fundamental research at Religare Broking Ltd.

Jefferies India recently rated ICICI Bank as the best banking investment globally and gave it a price target of Rs 1,070, a potential upside of 50 percent from its current levels.

"ICICI Bank is not only well poised to leverage on growth pickup in Indian bank credit from 8-9 percent to 12 percent and the ramp-up of SME vertical, but the recent correction, coupled with high ROA (return on assets), arguably makes it among the best risk/reward across global banks,” Jeffries said in a report.

Securities firm Sharekhan has a 'buy' rating on State Bank of India with a target price of Rs 600 a share from current levels. Sharekhan expects volatility in the bank’s earnings due to mark-to-market losses from bond holdings in the near term. With improving asset quality, a higher provision coverage ratio, higher capital levels and highly rated loans in the corporate segment augurs well for the bank, which is well positioned to gain market share on the business front., the firm said

Its deposit franchise, a better performance by subsidiaries, and low risk of dilution as compared to public sector bank peers are likely to favour SBI, the Sharekhan said.