The launch of new fund offers (NFOs), paused for the last few months, is likely to start again as the July 1 deadline for discontinuing the use of pool accounts approaches. According to industry sources, market regulator Securities and Exchange Board of India (SEBI) will allow NFOs after Association of Mutual Funds in India gives final confirmation that the new processes are in place.

Meanwhile, mutual fund houses have already lined up the NFOs that they want to launch after the ban is lifted.

Last week, five fund houses filed for new funds with SEBI. Sundaram MF has filed for a flexicap fund, Baroda BNP Paribas MF for a floater fund, LIC MF for a multi cap fund, Franklin Templeton MF for a Balanced Advantage Fund and Axis MF for a long duration fund.

Earlier in the month, PGIM India Mutual Fund had filed for a focused equity fund.

Several of the new fund houses were waiting for this deadline so that they can get back to launching their funds. These include Flipkart-co-founder Sachin Bansal-backed Navi MF, White Oak MF, Samco MF and NJ MF.

Industry executives say SEBI has already started to issue observations on the NFO filings.

Earlier, the mutual fund industry had assured SEBI that there won’t be any new fund launches till the new system is in place. After failing to meet the March 31 deadline, the industry had asked for an extension.

SEBI had asked mutual fund houses to ensure that no mutual fund distributor, online platform, stockbroker or investment advisor pools investors’ money in a bank account and then transfers it to the fund house to purchase units of schemes for those investors. This is to ensure that the money does not get misused.

NFO run

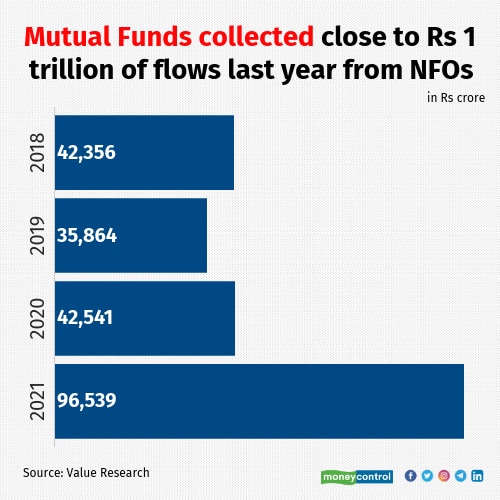

Last year, the mutual fund industry had one of the strongest years in terms of NFO collections. The industry collected around Rs 96,000 crore of investor flows from NFOs alone (see table).

Several of the fund launches were index funds or exchange traded funds (ETFs) with theme-based focus or sector orientation.

Index and ETFs are the only categories where SEBI’s one scheme per category rule doesn’t apply.

Financial planners say even though new fund launches will start again, investors should avoid dabbling in too many NFOs and stick to existing funds with long-term track record.

“Usually, 8-10 funds are good enough to take care of your investment requirements and diversify your investment portfolio. The core portfolio should ideally be in a combination of large, mid and small-cap funds and a couple of debt funds,” says Nisreen Mamaji, founder, MoneyWorks Financial Services.

“Sector or theme-based funds can be part of your satellite portfolio, but in a limited manner,” she added.