Bulls retained their stronghold over Dalal Street for a third consecutive session on May 30, backed by positive global cues and buying across sectors barring pharma. The volatility also cooled down below the 20 mark, supporting stability in the market.

The BSE Sensex jumped 1,041 points or 1.9 percent to close at 55,926, while the Nifty50 surged 309 points or 1.9 percent to 16,661 and formed a bullish candle on the daily charts.

"A long bull candle was formed on the daily chart with a gap-up opening. Technically, this action indicates an upside breakout of the consolidation pattern at 16,400 levels. This is a positive indication and signals more upside for the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He further said the sharp upside bounces after minor consolidation over the last two weeks, formation of higher bottoms and slowing down of sharp weakness are all pointing towards a probable bottom reversal for the Nifty at the swing low of 15,735 (May 12).

As per this pattern, any downward correction from here is going to be short lived and could be a buy-on-dips opportunity for the near term. The next upside levels to be watched are 16,900-17,000 levels, the market expert said.

The broader space outperformed benchmark indices as the Nifty Midcap 100 index gained 2.4 percent and Smallcap 100 index rose 3 percent on strong breadth. About three shares advanced for every falling share on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,547, followed by 16,432. If the index moves up, the key resistance levels to watch out for are 16,736 and 16,810.

Nifty Bank participated in run-up but underperformed broader space, rising 214 points to 35,827 on Monday. The important pivot level, which will act as crucial support for the index, is placed at 35,689, followed by 35,551. On the upside, key resistance levels are placed at 36,024 and 36,222 levels.

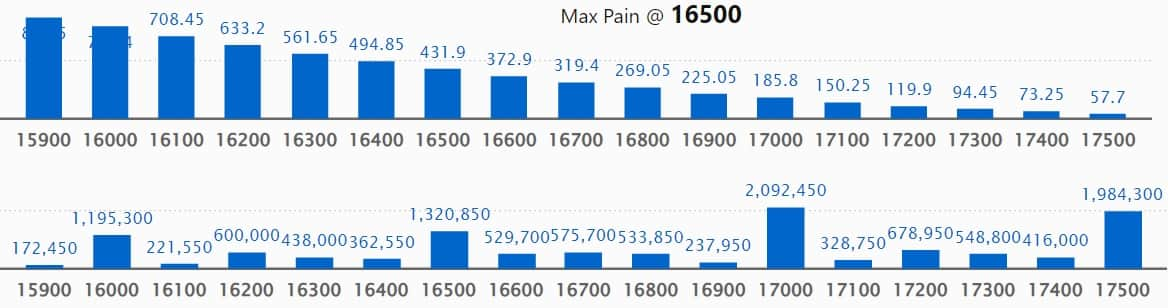

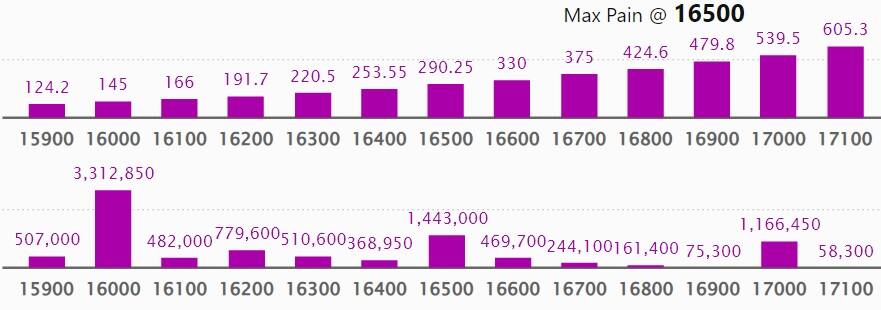

Maximum Call open interest of 20.92 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 17,500 strike, which holds 19.84 lakh contracts, and 18,000 strike, which has accumulated 14.02 lakh contracts.

Call writing was seen at 17,500 strike, which added 3.47 lakh contracts, followed by 16,600 strike which added 2.61 lakh contracts and 17,200 strike which added 1.85 lakh contracts.

Call unwinding was seen at 16,300 strike, which shed 2.2 lakh contracts, followed by 17,000 strike which shed 2.03 lakh contracts and 16,000 strike which shed 1.4 lakh contracts.

Maximum Put open interest of 33.12 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 31.26 lakh contracts, and 15,000 strike, which has accumulated 23.45 lakh contracts.

Put writing was seen at 16,600 strike, which added 3.68 lakh contracts, followed by 16,500 strike, which added 3.09 lakh contracts and 16,000 strike which added 3.03 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 1.65 lakh contracts, followed by 15,100 strike which shed 1.04 lakh contracts, and 16,300 strike which shed 42,050 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in HDFC, Crompton Greaves Consumer Electricals, Atul, Infosys, HDFC AMC, Zydus Life, Power Grid Corporation of India, and Kotak Mahindra Bank, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including ABB India, Astral, Honeywell Automation, Dixon Technologies, and ONGC, in which a long build-up was seen.

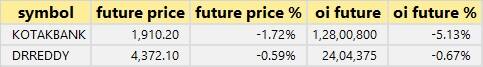

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the two stocks - Kotak Mahindra Bank, and Dr Reddy's Laboratories - in which long unwinding was seen.

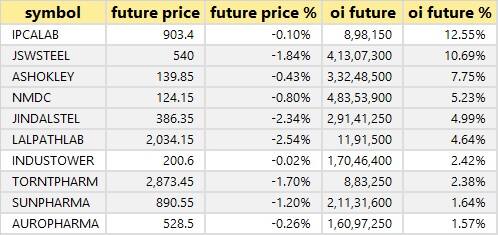

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Ipca Laboratories, JSW Steel, Ashok Leyland, NMDC, and Jindal Steel & Power, in which a short build-up was seen.

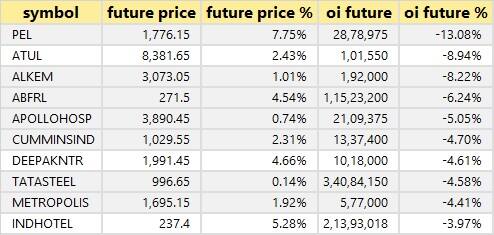

74 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Piramal Enterprises, Atul, Alkem Laboratories, Aditya Birla Fashion & Retail, and Apollo Hospitals Enterprises, in which short-covering was seen.

(For more bulk deals, click here)

Investors Meetings on May 31

UltraTech Cement: The company's officials will meet Fidelity International.

FSN E-Commerce Ventures (Nykaa): The company's officials will participate in Citi’s Flagship Pan Asia Regional Conference 2022.

Gateway Distriparks: The company's officials will participate in investor conference organised by Nirmal Bang Institutional Equities.

Tata Consumer Products: The company's officials will meet Jefferies.

Tube Investments of India: The company's officials will meet Premji lnvest.

GMM Pfaudler: The company's officials will attend Ambit Conference.

Apollo Tyres: The company's officials will meet Batlivala & Karani Securities India.

Stocks in News

Life Insurance Corporation of India: The country's largest life insurance company recorded an 18 percent year-on-year decline in profit at Rs 2,371.55 crore for the quarter ended March 2022. However, net premium income rose by 18.2 percent to Rs 1,43,746 crore during the same period.

Campus Activewear: The fashion and athleisure footwear brand reported a 296 percent year-on-year growth in consolidated profit at Rs 39.60 crore in quarter ended March 2022, driven by operating income and topline, and lower tax cost. Revenue grew by 28 percent to Rs 352.3 crore during the same period.

Sun Pharma: The pharma major recorded loss of Rs 2,277.2 crore for the quarter ended March 2022 dented by exceptional loss, against profit of Rs 894.1 crore in the same period last year. EBITDA increased by 14.6 percent YoY to Rs 2,279.7 crore in Q4FY22. Revenue grew by 11 percent YoY to Rs 9,446.8 crore in Q4FY22 with India formulation sales rising 16 percent, US formulation growth of 5 percent, emerging markets formulation sales increasing 7 percent and Rest of World formulation sales rising 7 percent YoY.

PC Jeweller: The company posted a loss of Rs 173 crore in March 2022 quarter against a profit of Rs 60 crore in the same period last year on lower revenue. Revenue from operations declined sharply to Rs 189 crore in Q4FY22, compared to Rs 868 crore in the corresponding period last year.

Wockhardt: The pharma company posted loss of Rs 311 crore in the quarter ended March 2022, widened from loss of Rs 107 crore in the same period last year. Revenue grew marginally to Rs 655 crore during the quarter, up from Rs 632 crore in the same quarter last year.

IRCTC: The company recorded a 106 percent year-on-year growth in profit at Rs 213.8 crore in the quarter ended March 2022 driven by strong topline and operating performance. Revenue surged 104 percent to Rs 691 crore compared to the same period last year.

Dilip Buildcon: The company posted loss of Rs 41.09 crore for March 2022 quarter against profit of Rs 186.2 crore in the corresponding period last year, impacted by operating loss and lower topline. Revenue declined 15 percent YoY to Rs 2,663.7 crore in Q4FY22. The company appointed Sanjay Kumar Bansal as Chief Financial Officer in place of Radhey Shyam Garg, who has been designated as President - Finance.

Lemon Tree Hotels: The company has signed a Licence Agreement for a 40-room hotel at Chirang, Assam under its brand 'Keys Select, by Lemon Tree Hotels'. The hotel is expected to be operational by June 2026. Subsidiary Carnation Hotels Private Limited will be operating this hotel.

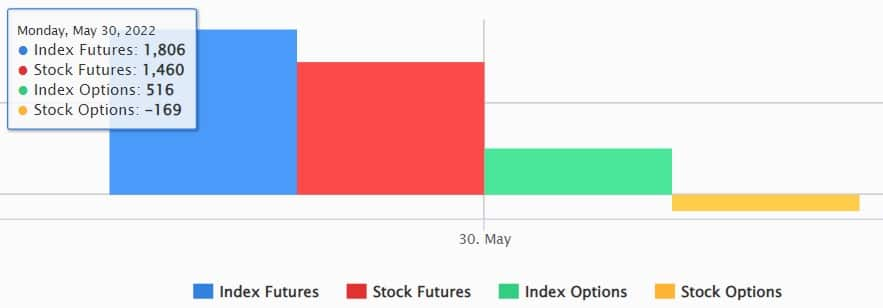

Fund Flow

Foreign institutional investors (FIIs) turned net buyers for the first time since April 28 this year, buying shares worth Rs 502.08 crore, while domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 1,524.49 crore worth of shares on May 30, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not put any stock under its F&O ban segment for May 31. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.