The market snapped a three-day losing streak and closed with nearly one percent gains on May 26 driven by banking & financial services, IT, metal, and select auto stocks on the last day of the futures & options (F&O) contracts for the May series.

The BSE Sensex rallied 503 points to 54,253, while the Nifty50 rose 144 points to 16,170 and formed a bullish candle on the daily charts as the closing was higher than opening levels.

The rally was also seen in broader space on positive market breadth. The Nifty Midcap 100 index rose 1.35 percent and Smallcap 100 index gained 0.77 percent as five shares advanced for every four declining shares on the NSE.

On the daily charts, the Nifty managed to sustain above the 16,000 mark for the last 5 days which shows an initial sign of short-term bottoming out.

"On the indicator front, the RSI (relative strength index) plotted on the daily charts is sustaining above 40 mark and making higher top higher bottom formation which shows positive momentum for the short term," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

Sawant further said the Nifty has immediate resistance placed at 16,400 & 16,800 followed by 17,105 levels. The downside support for the index is placed at 16,000, 15,671 followed by 15,450 levels, he added.

He feels that the Nifty is in bounce-back mode. "If the Nifty sustains above 16,400 mark then it will move towards 16,800 mark in the coming days. Our positive view will be negated if it sustains below the 16,000 mark."

The volatility declined significantly, indicating comfort for bulls but experts feel unless and until it falls decisively below the 20 mark, the volatile swings can't be ruled out. India VIX, the fear index fell by 10.14 percent to 22.72 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,981, followed by 15,792. If the index moves up, the key resistance levels to watch out for are 16,282 and 16,394.

Nifty Bank jumped 755 points or 2.2 percent to close at 35,095 on Thursday, outshining broader space. The important pivot level, which will act as crucial support for the index, is placed at 34,606, followed by 34,117. On the upside, key resistance levels are placed at 35,403 and 35,711 levels.

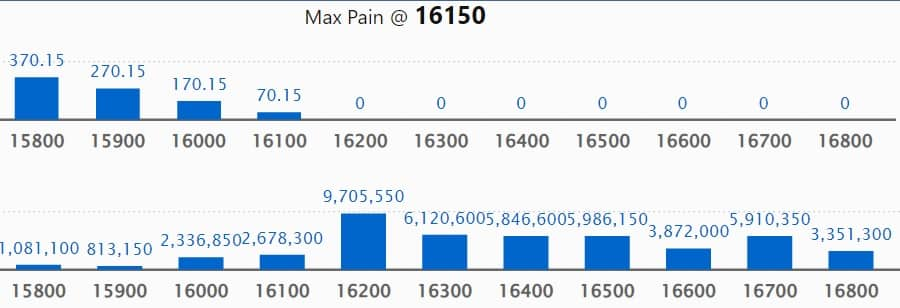

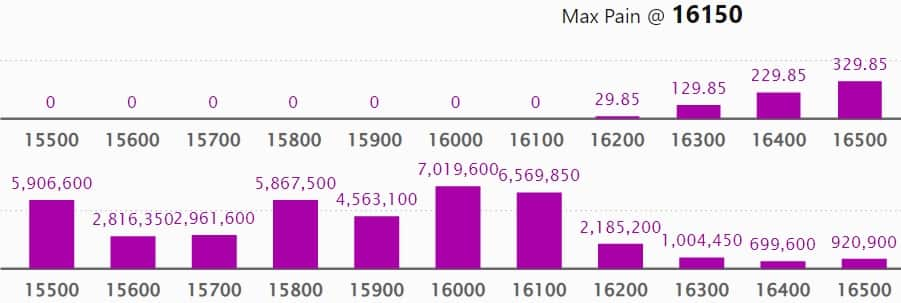

Maximum Call open interest of 97.05 lakh contracts was seen at 16,200 strike, which will act as a crucial resistance level in the June series.

This is followed by 16,300 strike, which holds 61.20 lakh contracts, and 16,500 strike, which has accumulated 59.86 lakh contracts.

Call writing was seen at 15,900 strike, which added 3 lakh contracts, followed by 16,200 strike which added 2.01 lakh contracts.

Call unwinding was seen at 16,500 strike, which shed 36.89 lakh contracts, followed by 16,400 strike which shed 29.6 lakh contracts and 17,000 strike which shed 28.87 lakh contracts.

Maximum Put open interest of 70.19 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the June series.

This is followed by 16,100 strike, which holds 65.69 lakh contracts, and 15,500 strike, which has accumulated 59.06 lakh contracts.

Put writing was seen at 16,100 strike, which added 45.93 lakh contracts, followed by 15,900 strike, which added 14.24 lakh contracts and 16,000 strike which added 5.29 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 15.71 lakh contracts, followed by 15,500 strike which shed 13.02 lakh contracts, and 15,200 strike which shed 8.41 lakh contracts.

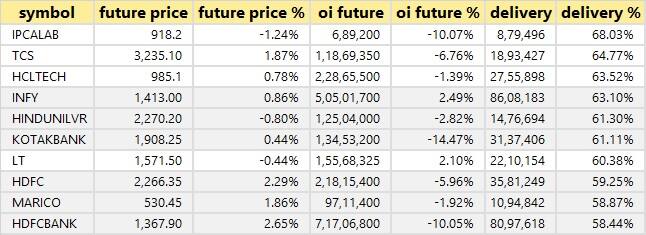

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Ipca Laboratories, TCS, HCL Technologies, Infosys, and Hindustan Unilever, among others.

Here are the top 10 stocks which saw highest rollovers on expiry day including Nifty Financial, PI Industries, City Union Bank, Trent, and Oberoi Realty.

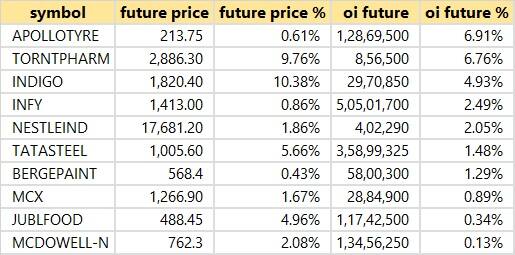

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Apollo Tyres, Torrent Pharma, InterGlobe Aviation, Infosys, and Nestle India, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Abbott India, IOC, Honeywell Automation, Vodafone Idea, and ONGC, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the five stocks - Divi's Laboratories, Havells India, Larsen & Toubro, Reliance Industries, and Adani Enterprises, in which a short build-up was seen.

155 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Zydus Life, GNFC, PFC, and Tata Communications, in which short-covering was seen.

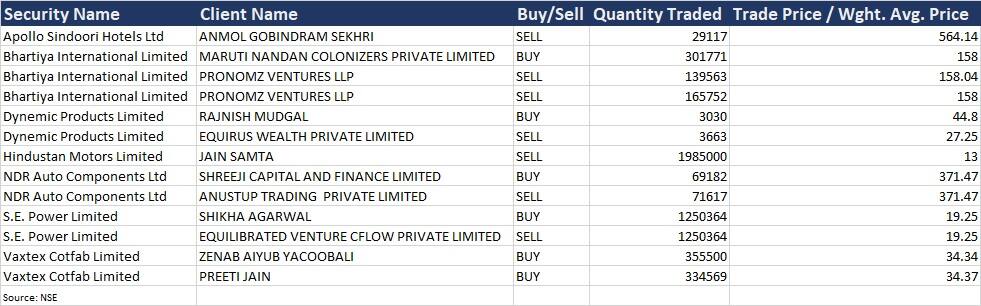

(For more bulk deals, click here)

JSW Steel, FSN E-Commerce Ventures (Nykaa), GAIL, Glenmark Pharma, Godrej Industries, India Cements, PB Fintech (Policy Bazaar), Ruchi Soya, Jubilant Pharmova, Jubilant Industries, Aarti Industries, Ion Exchange, Info Edge India, JP Power, Aegis Logistics, Akzo Nobel India, Apar Industries, Arvind Fashions, Astral Pipes, Atul Auto, Balmar Lawrie, BEML, Crompton Greaves Consumer Electricals, City Union Bank, Edelweiss Financial Services, Engineers India, ESAB India, Everest Industries, Exxaro Tiles, Future Consumer, Force Motors, Heritage Foods, HT Media, Inox Wind, IRCON International, Kalyani Forge, Karnataka Bank, Lemon Tree Hotels, Man Industries, Oil India Ltd, Ramky Infrastructure, Sun TV, Tarsons Products, TCNS Brands, United Spirits, and VRL Logistics will release their quarterly earnings scorecard on May 27.

Stocks in News

Muthoot Finance consolidated net dipped 2.3 percent year-on-year to Rs 997 crore for the quarter ended March 2022, as compared to a profit of Rs 1,020 crore recorded during the same period last year. The consolidated revenues also witnessed a YoY decline of 2.7 percent to Rs 3,021 crore. The dip in profit is attributable to lower revenues and higher employee costs partially negated by lower impairment on financial instruments.

Page Industries' profit after tax surged 65 percent on year to Rs 190.5 crore for the quarter ended March 2022. Net margin for the quarter at 17.1 percent was higher by 400 bps on year and higher by 240 bps on a sequential basis. The revenues for the quarter increased by 26.2 percent on year to Rs 1,111 crore. The growth was fueled by increasing trend across and product categories and channels.

Bharat Dynamics' Q4 net profit improved marginally by 1.5 percent year-on-year to Rs 2,644 crore as compared to a profit of Rs 2,604 crore during the same period last year. The dip was due to higher employee and inventory costs as well as rise in other expenses which was partially negated by an exceptional income of Rs 335 crore during the quarter. The revenues increased by 21.5 percent on year to Rs 13,811 crore.

Tata Power Renewable commissioned 100 MW project for MSEDCL in Partur, Maharashtra. The installation is comprised of over 4,11,900 numbers of monocrystalline PV modules and is expected to reduce around 234 million tonnes of CO2 annually. With this addition of 100 MW, the renewables capacity in operation for Tata Power now stands at 3,620 MW with 2,688 MW of Solar and 932 MW of Wind. Tata Power’s total Renewable capacity is 4,920 MW including 1,300 MW of Renewable projects under various stages of implementation.

Hindalco Industries Q4 consolidated net doubled YoY to Rs 3,851 crore as against Rs 1,928 crore recorded a year ago. Consolidated revenue for one of the largest metals company in India rose 37.7 percent on-year to Rs 55,764 crore as compared to a revenue of Rs 40,507 crore registered in the year-ago quarter. The growth was aided by the surge in commodity prices and higher volumes. The company recommended a dividend 400 percent (Rs 4 per share) for FY22 as against 300 percent (Rs 3 per share) for FY21.

RITES signed a memorandum of understanding (MoU) with Titagarh Wagons to synergise their efforts in their respective fields. Under this agreement, RITES will provide expertise in design, marketing, operations & maintenance, and support for tapping domestic and international markets while Titagarh Wagons will develop and manufacture suitable products and submit competitive offer as per the requirement of potential clients and customers in domestic and overseas markets.

Zee Entertainment Enterprises has reported 34 percent fall in its March quarter (Q4FY22) net profit at Rs 181.9 crore from Rs 275.7 crore in the same quarter last fiscal. The company revenue rose 18.1 percent at Rs 2,322.9 crore versus Rs 1,965.8 crore, YoY. The company board recommended for approval of the equity shareholders, equity dividend of Rs 3 per equity share of Re 1 each for the financial year 2021-22.

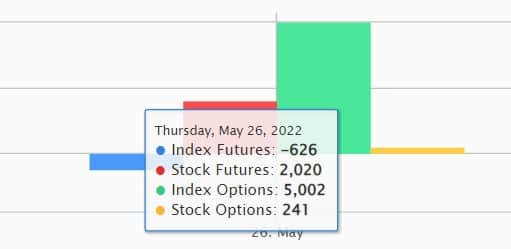

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,597.84 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 2,906.46 crore worth of shares on May 26, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.