Market witnessed yet another weak session on May 24, following weakness in global counterparts amid fears of recession and possibility of US tariff cuts on Chinese goods.

The BSE Sensex fell 236 points to 54,053, while the Nifty50 declined 90 points to 16,125 and formed a bearish candle on the daily charts.

"Tuesday’s fall was also accompanied with a negative moving average (MA) crossover as the 20 period MA moved below the 50 period MA. This indicates weakness. Traders will now need to watch if the Nifty can hold above the immediate support of 16,078. Else, we could see a further correction. The bears would gain more control once the recent intermediate low of 15,735 is broken," Subash Gangadharan, Senior Technical and Derivative Analyst at HDFC Securities said.

He further said many stocks are also correcting and failing to hold on to their recent gains. This is a sign of weakness and caution is therefore warranted. Traders should wait for strength to emerge before going aggressively long, he advised.

The volatility index (VIX) spiked by 9.56 percent to 25.64 levels, which clearly indicates the discomfort for bulls.

The correction in broader space was more than benchmarks as about three shares declined for every share rising on the NSE. The Nifty Midcap 100 index dropped 0.6 percent and Smallcap 100 index fell 1.51 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,048, followed by 15,971. If the index moves up, the key resistance levels to watch out for are 16,232 and 16,340.

Nifty Bank has outperformed broader space as well as benchmark indices, rising 43 points to 34,290 on May 24. The important pivot level, which will act as crucial support for the index, is placed at 34,075, followed by 33,860. On the upside, key resistance levels are placed at 34,546 and 34,801 levels.

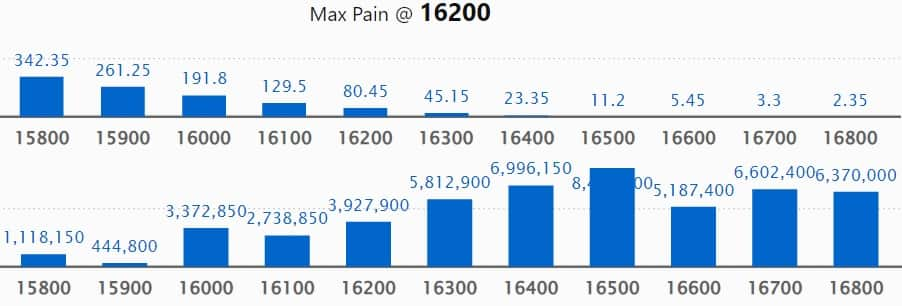

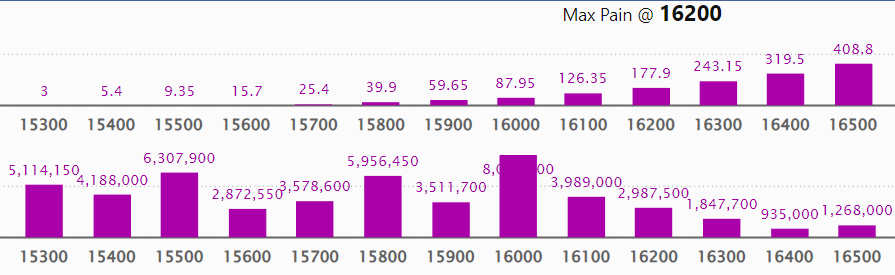

Maximum Call open interest of 88.09 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 16,500 strike, which holds 84.38 lakh contracts, and 16,400 strike, which has accumulated 69.96 lakh contracts.

Call writing was seen at 16,500 strike, which added 30.11 lakh contracts, followed by 16,700 strike which added 26.97 lakh contracts and 16,400 strike which added 26.85 lakh contracts.

Call unwinding was seen at 17,000 strike, which shed 12.46 lakh contracts, followed by 16,900 strike which shed 6.66 lakh contracts and 17,200 strike which shed 5.78 lakh contracts.

Maximum Put open interest of 80.14 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the May series.

This is followed by 15,500 strike, which holds 63.07 lakh contracts, and 15,800 strike, which has accumulated 59.56 lakh contracts.

Put writing was seen at 15,300 strike, which added 13.17 lakh contracts, followed by 15,400 strike, which added 12.57 lakh contracts and 15,700 strike which added 10.34 lakh contracts.

Put unwinding was seen at 15,100 strike, which shed 5.12 lakh contracts, followed by 14,900 strike which shed 4.59 lakh contracts, and 16,200 strike which shed 2.74 lakh contracts.

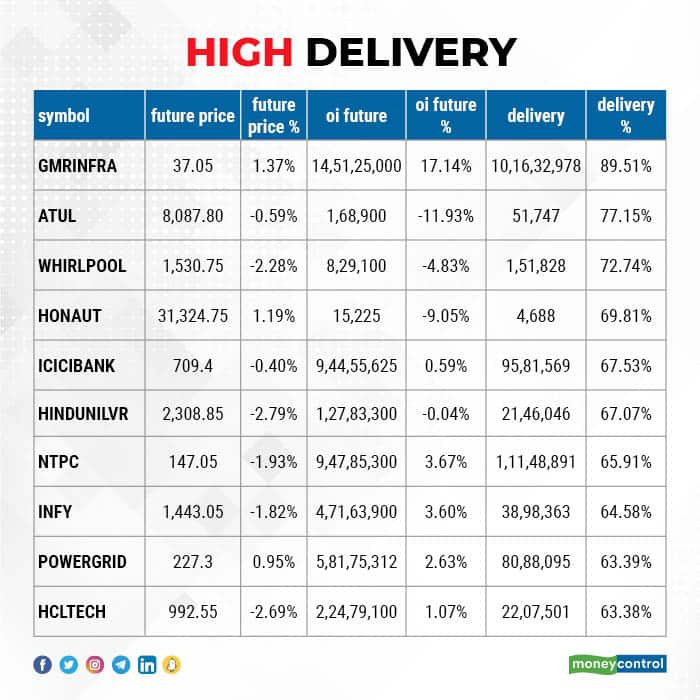

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in GMR Infrastructure, Atul, Whirlpool of India, Honeywell Automation, and ICICI Bank, among others.

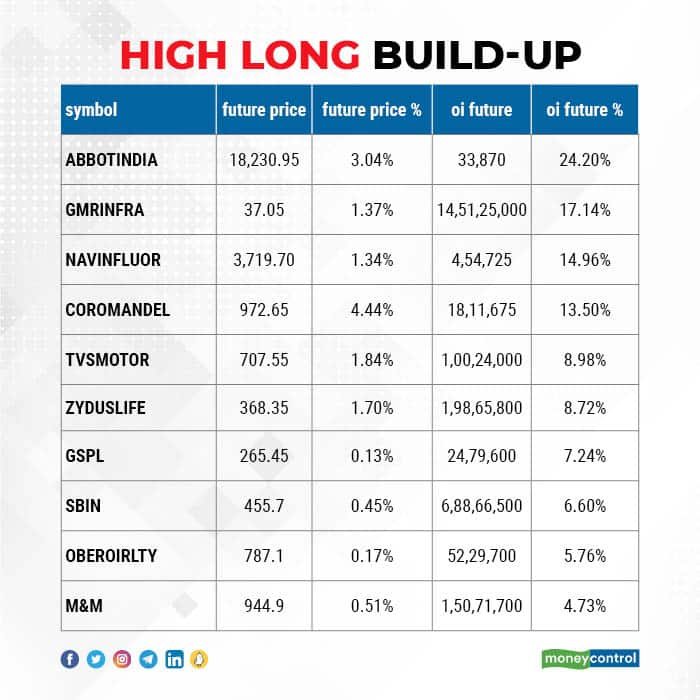

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Abbott India, GMR Infrastructure, Navin Fluorine International, Coromandel International, and TVS Motor Company, in which a long build-up was seen.

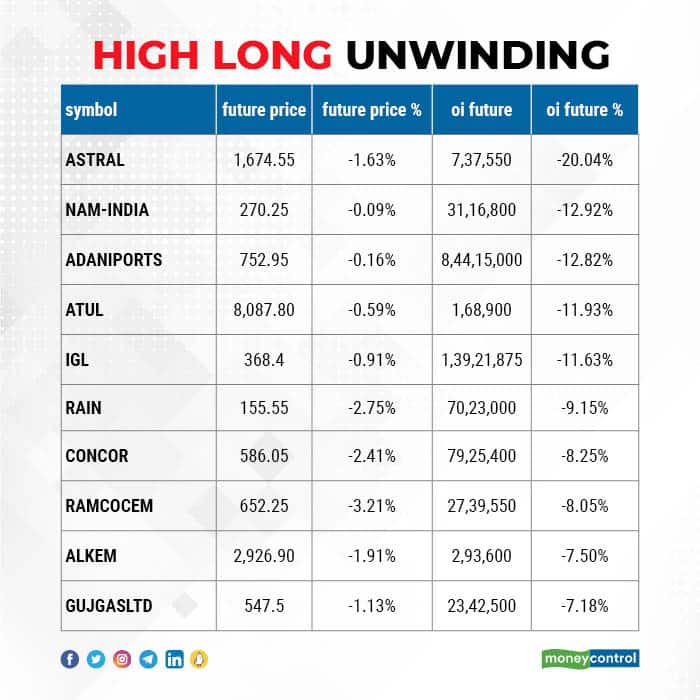

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Astral, Nippon Life, Adani Ports, Atul, and Indraprastha Gas, in which long unwinding was seen.

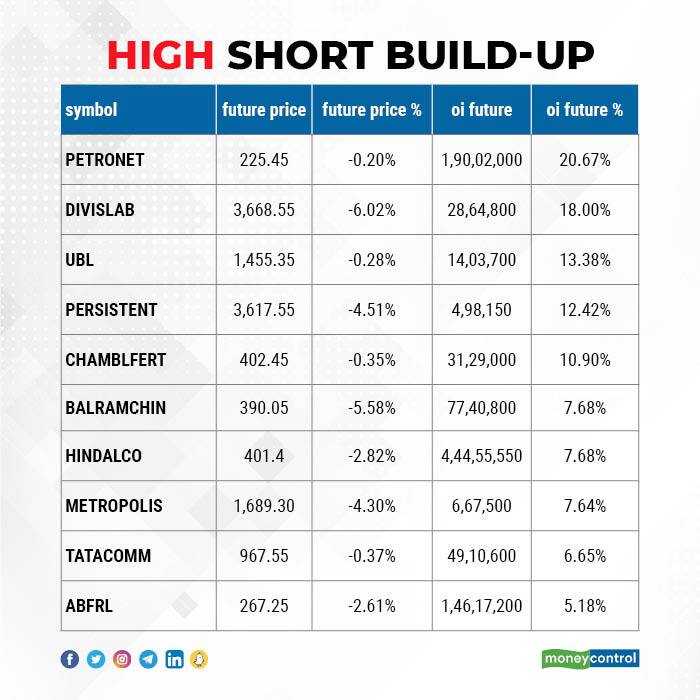

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Petronet LNG, Divi's Laboratories, United Breweries, Persistent Systems, and Chambl Fertilizers, in which a short build-up was seen.

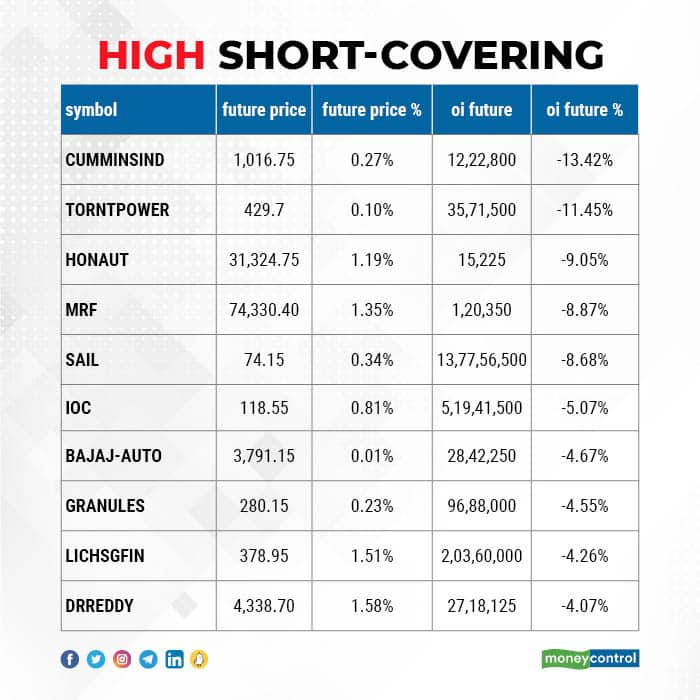

25 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Cummins India, Torrent Power, Honeywell Automation, MRF,and SAIL, in which short-covering was seen.

GMR Infrastructure: Veda Investors Fund LP bought 7,83,63,000 equity shares in the company via open market transactions, CD Investors Fund LP acquired 3,36,07,200 shares, Deccan Value Investors Fund LP purchased 5,88,81,100 shares and AD Investors Fund LP acquired 4,05,75,100 shares in the company. However, DVI Fund Mauritius 27 crore equity shares in the company. All these shares were sold at an average price of Rs 36.65 per share.

(For more bulk deals, click here)

BPCL, Coal India, Deepak Fertilisers, Apollo Hospitals Enterprises, HEG, NHPC, Easy Trip Planners, Fortis Healthcare, NALCO, GMM Pfaudler, InterGlobe Aviation, Jai Corp, Kolte-Patil Developers, Bata India, PFC, Suzlon Energy, Torrent Pharma, Whirlpool, MSTC, MOIL and Peninsula Land will be in focus ahead of their March quarter earnings on May 25.

Stocks in News

Grasim Industries posted a consolidated net profit of Rs 2,777 crore for the March quarter (Q4FY22), up 62 percent from the year-ago period. Revenue from operations surged 18 percent year-on-year (YoY) to Rs 28,811 crore against Rs 24,402 crore last year in the same quarter. The firm is planning to invest Rs 10,000 crore in the paints business in the next three years. The company spent Rs 2,437 crore on its capex spent in the fiscal year ending March this year. Of this, Grasim invested Rs 579 crore in the paints business alone.

Minda Industries said its net profit rose 3 percent to Rs 144 crore in the March quarter as against Rs 140 crore a year ago. Revenue rose 7.90 percent to Rs 2,415 crore. The firm said its board approved raising Rs 1,000 crore via debt. It also approved bonus shares of 1 new share for every 1 share held.

Brookfield India REIT said its board will meet on May 27 to consider fund raising. " Board to meet on May 27 to consider various fund raising options and approve the raising of funds and issue of units of Brookfield India Real Estate Trust, subject to applicable law and, in relation thereto, issue of notice to the unit holders of Brookfield India Real Estate Trust for approval of such fund raise, as applicable" the company said.

Future Retail informed exchanges that it won't be able to release its March quarter earnings on May 30 due to board structure imbalance amid multiple resignations by its top level managements. The firm said it is taking necessary actions to the fill the vacancies caused by such cessation/ resignation. The company said it will announce the captioned results as early as possible after composition of the Board of Directors and the Audit Committee is complied with the provisions of the Act and the Listing Regulations and statutorily capable to approve it.

Bank of India is planning to raise Rs 2,500 crore through eigher a follow on offer or a qualified institutional placement in the current financial year. The lender said it will lower government stake to 75 percent from current 81 percent.

Metropolis Healthcare reported 35 percent year-on-year drop in net profit to Rs 40 crore in the March quarter. Revenue for the quarter rose 5 percent from a year ago to Rs 306 crore. According to Bloomberg poll, the firm expected to report a profit of Rs 52.43 crore while revenue was pegged at Rs 335 crore during the quarter. Total cost rose 20 percent YoY to Rs 255 crore. Earlier according to news report, the firm was planning to raise more than $300 million and bring on a strategic partner by selling a major minority stake.

Ipca Laboratories said its board approved merging Tonira Exports Ltd. and Ramdev Chemical Pvt. Ltd., wholly owned subsidiaries with the Company, subject to necessary approvals. The firm earlier reported consolidated net profit that fell 19.3 percent YoY to Rs 130.23 crore. Revenue rose 15.6 percent from a year ago to Rs 1,289.10 crore in the quarter.

Indian Hotels said its board reappointed managing director and chief executive officer Puneet Chhatwal for further term of five years commencing from November 6, 2022 up to November 5, 2027 (both days inclusive).

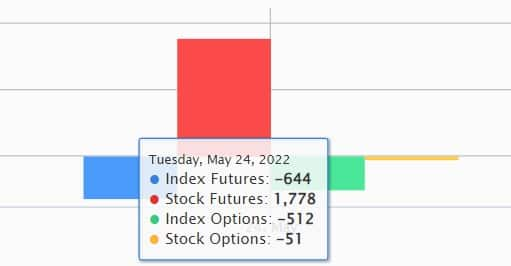

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) have net sold shares worth Rs 2,393.45 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 1,948.49 crore worth of shares on May 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Indiabulls Housing Finance - is under the F&O ban for May 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.