The market extended a sharp run for the second consecutive session on May 17, supported by positive global cues and the rally across sectors. Metal was the biggest gainer, rising nearly 7 percent, followed by bank, financial services, auto, FMCG, IT, and pharma which gained 1-3 percent.

The BSE Sensex climbed over 1,300 points to 54,318, while the Nifty50 jumped more than 400 points to 16,259 and formed a robust bullish candle on the daily charts.

"On the daily charts, the index formed a Bullish Marubozu candle and closed at a three-day high. The index has protected the low of 15,735 made on May 9 and saw broad-based buying in session on Tuesday," Malay Thakkar, Technical Research Associate at GEPL Capital said.

Going ahead, he feels the index can bounce higher towards 16,480 followed by 16,650 levels. Bounce back view will be neglected if the index breaks below 15,900 levels, he said.

The broader space also joined the rally as nearly seven shares advanced for every share declining on the NSE. The Nifty Midcap 100 and Smallcap 100 indices gained around 3 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,012, followed by 15,765. If the index moves up, the key resistance levels to watch out for are 16,395 and 16,532.

Nifty Bank rose 704 points or 2.1 percent to close at 34,302 on Tuesday. The important pivot level, which will act as crucial support for the index, is placed at 33,866, followed by 33,431. On the upside, key resistance levels are placed at 34,552 and 34,802 levels.

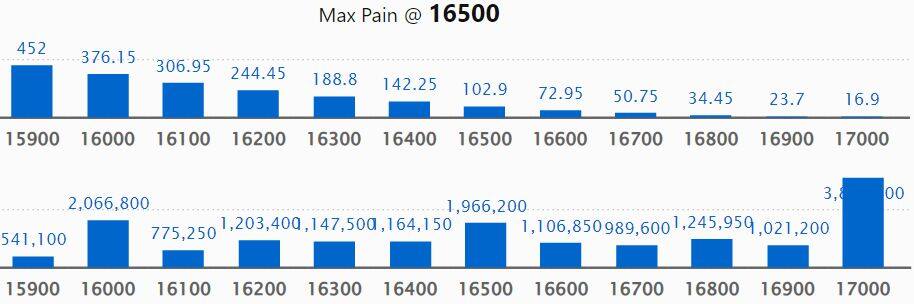

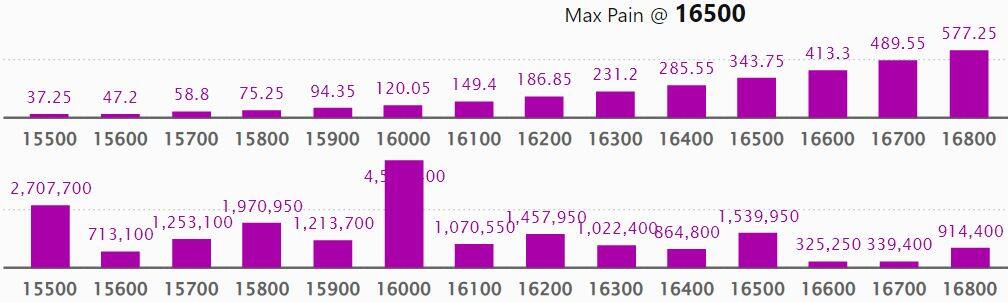

Maximum Call open interest of 38.38 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 16,000 strike, which holds 20.66 lakh contracts, and 16,500 strike, which has accumulated 19.66 lakh contracts.

Call writing was seen at 17,200 strike, which added 2.32 lakh contracts, followed by 16,900 strike which added 2.18 lakh contracts and 17,300 strike which added 1.8 lakh contracts.

Call unwinding was seen at 16,000 strike, which shed 3.68 lakh contracts, followed by 16,500 strike which shed 3.42 lakh contracts and 15,900 strike which shed 3.34 lakh contracts.

Maximum Put open interest of 45.62 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the May series.

This is followed by 15,000 strike, which holds 28.1 lakh contracts, and 15,500 strike, which has accumulated 27.07 lakh contracts.

Put writing was seen at 16,000 strike, which added 7.55 lakh contracts, followed by 16,200 strike, which added 4.97 lakh contracts and 15,700 strike which added 2.92 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 2.67 lakh contracts, followed by 15,800 strike which shed 2.29 lakh contracts, and 15,000 strike which shed 1.82 lakh contracts.

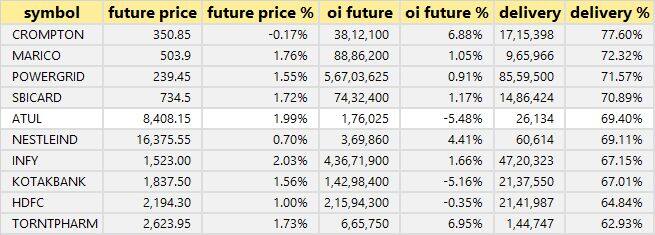

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Crompton Greaves Consumer Electricals, Marico, Power Grid Corporation of India, SBI Cards and Payment Services, and Atul, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Coromandel International, Chambal Fertilizers, Bajaj Finserv, ABB India, and HPCL, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the three stocks - Gujarat Gas, Escorts, and Vodafone Idea, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the seven stocks including Metropolis Healthcare, Dr Lal PathLabs, Crompton Greaves Consumer Electricals, Tata Consumer Products, and Aurobindo Pharma, in which a short build-up was seen.

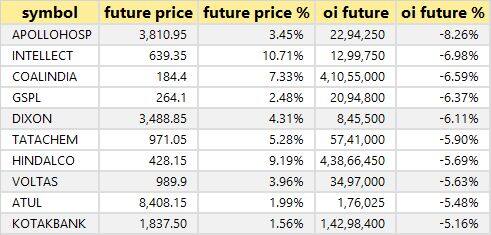

94 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Apollo Hospitals Enterprises, Intellect Design Arena, Coal India, Gujarat State Petronet, and Dixon Technologies, in which short-covering was seen.

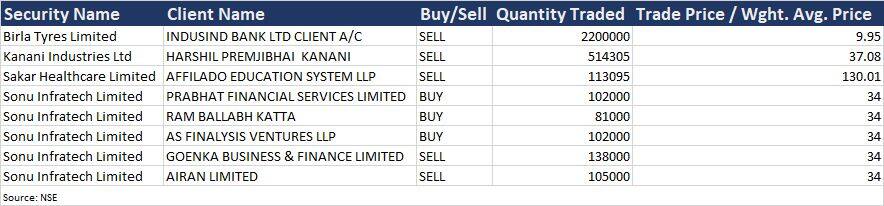

(For more bulk deals, click here)

ITC, Aditya Birla Fashion and Retail, Arvind, Barbeque Nation Hospitality, Brookfield India Real Estate Trust REIT, Finolex Industries, GIC Housing Finance, GMR Power and Urban Infra, GTL, Indraprastha Gas, InterGlobe Aviation, Indian Overseas Bank, JK Lakshmi Cement, LIC Housing Finance, Lupin, Manappuram Finance, NDTV, Pidilite Industries, Route Mobile, Shyam Metalics, Shriram Asset Management, and Westlife Developments will be in focus ahead of March quarter earnings on May 18.

Stocks in News

Bharti Airtel nearly tripled its consolidated net profit for the fiscal fourth quarter, driven by the sharp tariff hikes taken last November which helped boost average revenue per user (ARPU), and one-time gains. Consolidated net profit increased to Rs 2,008 crore in the March quarter from Rs 759 crore a year earlier. Revenues for the quarter grew by 22 percent to Rs 31,500 crore. Airtel continues to have the highest ARPU at Rs 178 from Rs 163 in the December quarter.

TVS Motor Company has announced the sale of Intellicar Telematics Pvt Ltd, bought in December 2020, to Fabric IOT Pvt Ltd for Rs 45 crore. The divestment is part of the value creation initiatives on its digital portfolio.

Shares of Zydus Lifesciences will be in focus on Wednesday after the firm said its board will meet on May 20 to consider share buyback. The stock was under pressure since November 2011 and corrected nearly 50 percent from its high of Rs 664 a share.

Dr Lal Pathlabs reported lower than expected earnings for the March quarter. Net profit for the quarter stood at Rs 61.30 crore, down 23 percent from a year ago. Analysts expected a net profit of Rs 82.31 crore for the quarter. Revenue rose 13 percent YoY to Rs 486 crore. Analysts estimated revenue at Rs 534 crore for the quarter. Total cost rose 24 percent to Rs 414 crore.

Indian Oil Corporation consolidated net profit for the quarter ended March stood at Rs 6,645.72 crore, down 26.37 percent from Rs 9,026.49 crore in the same quarter last year due to a margin squeeze in petrochemicals and losses on auto fuel sales. Its revenue from operations, however, climbed 26.13percent from Rs 1,65,734.27 crore in the corresponding quarter last year to Rs 2,09,049.16 crore. The board approved a bonus issue of 1:2 for its shareholders.

IRB Infrastructure Developers reported a 79.04 percent jump in its consolidated net profit to Rs 175 crore for the March quarter against Rs 97.45 crore a year ago. Its total income during the January-March 2022 quarter rose to Rs 1,682.72 crore from Rs 1,650.40 crore in the year-ago period. Total cost fell 6 percent to Rs 1380 crore.

DLF said its net profit for the March quarter fell 16 percent year-on-year to Rs 405 crore from Rs 481 crore. Revenue dropped 9 percent from a year ago to Rs 1,550 crore. Total cost declined 10 percent to Rs 1,340 crore. Net profit rose to Rs 1,500.86 crore during the last financial year from Rs 1,093.61 crore in the 2020-21 fiscal year. Total income rose to Rs 6,137.85 crore in 2021-22 from Rs 5,944.89 crore in the previous year.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 2,192.44 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 2,294.42 crore worth of shares on May 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - GNFC, Indiabulls Housing Finance, and Punjab National Bank - remained under the F&O ban for May 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.