The market seems to be in a complete bear trap as the benchmark indices fell more than 2 percent on May 12, dented by selling across sectors. Global growth concerns, higher-than-expected US inflation and contraction in UK economy weighed on sentiment in global counterparts including India.

The BSE Sensex plunged 1,158 points to 52,930, while the Nifty50 tanked 359 points to 15,808 - continuing downtrend for fifth consecutive session and formed bearish candle on the daily chats.

"A long bear candle was formed on the daily chart, which is indicating steep selling in the market. The short term trend of Nifty continues to be negative," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels there is a possibility of further weakness down to 15,670 and one may expect downside breakout of it in the coming sessions. However, there is a higher possibility of Nifty forming lower bottom reversal around 15,500 levels and confirmation of reversal pattern could open upside bounce in the market, Shetti said.

The Nifty Midcap 100 and Smallcap 100 indices have corrected 2.3 percent and 1.87 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,682, followed by 15,556. If the index moves up, the key resistance levels to watch out for are 15,988 and 16,168.

The selling pressure continued in banking stocks as the Nifty Bank plunged 1,161 points or 3.35 percent to 33,532 on Thursday. The important pivot level, which will act as crucial support for the index, is placed at 33,106, followed by 32,680. On the upside, key resistance levels are placed at 34,150 and 34,767 levels.

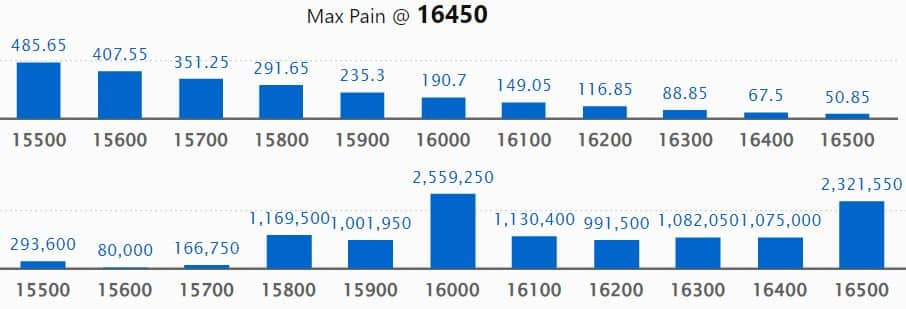

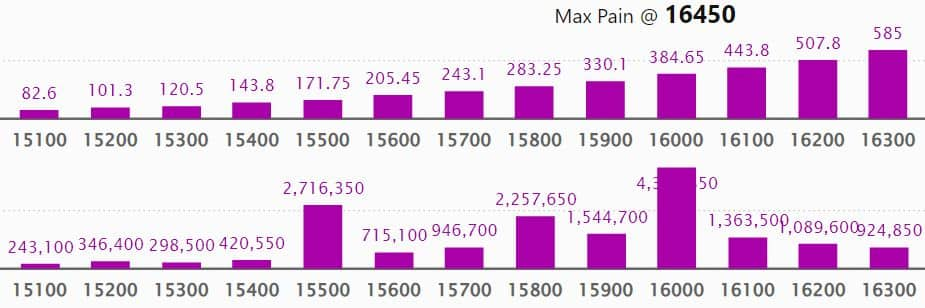

Maximum Call open interest of 35.29 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 16,000 strike, which holds 25.59 lakh contracts, and 16,500 strike, which has accumulated 23.21 lakh contracts.

Call writing was seen at 16,000 strike, which added 12.72 lakh contracts, followed by 15,800 strike which added 10.66 lakh contracts and 15,900 strike which added 9.4 lakh contracts.

Call unwinding was seen at 16,700 strike, which shed 60,050 contracts.

Maximum Put open interest of 43.35 lakh contracts was seen at 16,000 strike. This is followed by 15,000 strike, which holds 27.32 lakh contracts, and 15,500 strike, which has accumulated 27.16 lakh contracts.

Put writing was seen at 15,800 strike, which added 7.84 lakh contracts, followed by 15,900 strike, which added 6.07 lakh contracts and 15,000 strike which added 4.63 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 6.79 lakh contracts, followed by 16,500 strike which shed 4.51 lakh contracts, and 16,200 strike which shed 3.98 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Infosys, M&M, HDFC, Bharti Airtel, and Alkem Laboratories, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the five stocks - Ambuja Cements, ACC, Abbott India, Gujarat Gas, and Alkem Laboratories - in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Voltas, ABB India, Polycab India, Birlasoft, and Dixon Technologies, in which long unwinding was seen.

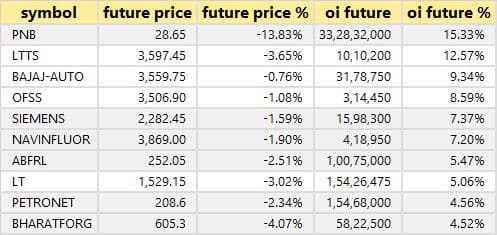

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Punjab National Bank, L&T Technology Services, Bajaj Auto, Oracle Financial Services Software, and Siemens, in which a short build-up was seen.

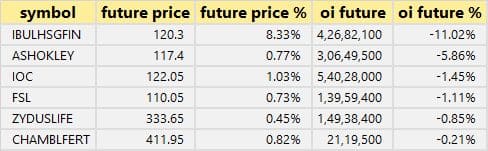

6 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the six stocks - Indiabulls Housing Finance, Ashok Leyland, IOC, Firstsource Solutions, Zydus Life, and Chambal Fertilizers, in which short-covering was seen.

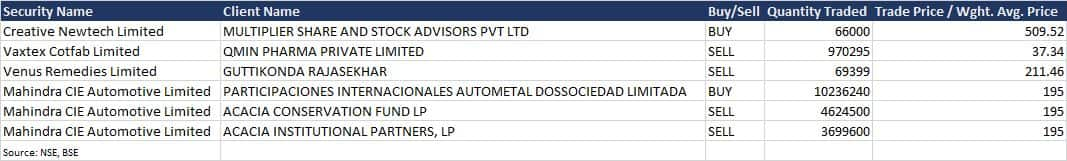

Mahindra CIE Automotive: Participaciones Internacionales Autometal Dossociedad Limitada acquired 1,02,36,240 equity shares in the company via open market transactions at an average price of Rs 195 per share. However, Acacia Conservation Fund LP sold 46,24,500 equity shares and Acacia Institutional Partners, LP offloaded 36,99,600 shares at an average price of Rs 195 per share.

(For more bulk deals, click here)

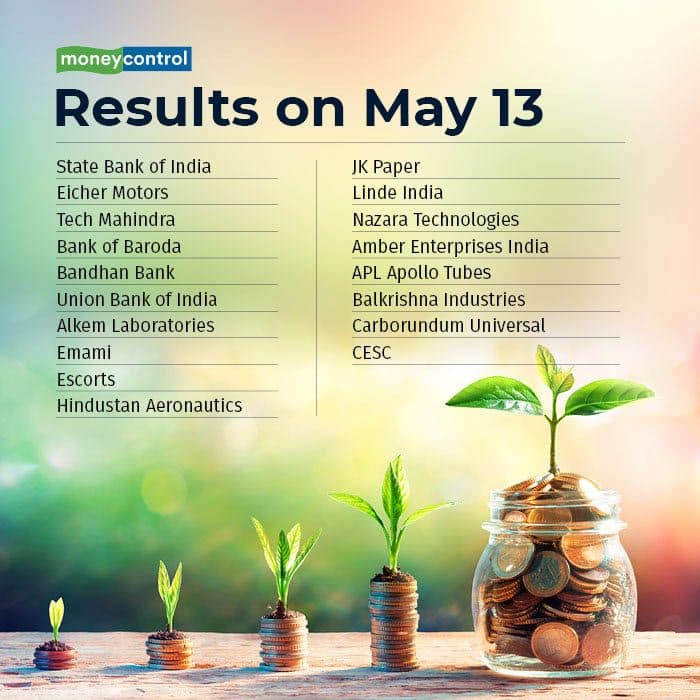

State Bank of India, Eicher Motors, Tech Mahindra, Bank of Baroda, Bandhan Bank, Union Bank of India, Alkem Laboratories, Emami, Escorts, Hindustan Aeronautics, JK Paper, Linde India, Nazara Technologies, Amber Enterprises India, APL Apollo Tubes, Balkrishna Industries, Carborundum Universal, CESC, Coromandel Engineering Company, DB Corp, Elgi Equipments, Gujarat Fluorochemicals, REC, Reliance Infrastructure, Reliance Power, Sharda Cropchem, Sigachi Industries, Steel Strips Wheels, Triveni Turbine, UCO Bank, and Vakrangee will release quarterly earnings on May 13.

Avenue Supermarts, Heranba Industries, Affle (India), Anant Raj, GPT Infraprojects, Kalpataru Power Transmission, Neogen Chemicals, Share India Securities, Transformers and Rectifiers (India), Triveni Engineering & Industries, TVS Electronics, and Vinati Organics will release quarterly earnings on May 14.

Stocks in News

Larsen & Toubro: The engineering & infrastructure major reported a 10 percent year-on-year growth in profit at Rs 3,621 crore in the quarter ended March 2022, with revenue rising 10 percent to Rs 52,851 crore and EBITDA climbing 2.1 percent to Rs 6,520.5 crore compared to year-ago period. Order inflow grew by 46 percent YoY to Rs 73,941 crore in Q4FY22.

Tata Motors: The company posted a loss of Rs 1,032 crore in Q4FY22, which narrowed from loss of Rs 7,605 crore in same period last year. Revenue during the quarter declined by 11.5 percent to Rs 78,439 crore YoY, impacted by subsidiary Jaguar Land Rover, whose revenues in Q4 quarter fell 27.1 percent year-on-year to 4.8 billion pound sterling amid semi-conductors shortage, and disruption in the European and China business.

Tube Investments of India: The company clocked a whopping 57.5 percent year-on-year growth in consolidated profit at Rs 225 crore in the quarter ended March 2022, driven by higher operating income and topline. Revenue grew by 25 percent to Rs 3,415 crore compared to year-ago period.

Apollo Tyres: The tyre maker reported a 60.5 percent year-on-year decline in consolidated profit at Rs 113.5 crore in Q4FY22 dented by higher input cost and lower other income. Revenue grew by 11 percent to Rs 5,578.3 crore compared to year-ago period.

Siemens: The company reported a 2.6 percent year-on-year growth in consolidated profit at Rs 340 crore in quarter ended March 2022 with EBITDA rising 6.1 percent to Rs 484.8 crore and revenue growing 13.5 percent to Rs 3,954.7 crore compared to year-ago period. Higher input cost, finance cost, and other expenses hit profitability.

Matrimony.com: The company in a BSE filing said the board approved to buyback shares worth up to Rs 75 crore of the company, at a price of Rs 1,150 per share.

Ujjivan Small Finance Bank: The bank reported a 7 percent year-on-year decline in profit at Rs 127 crore in quarter ended March 2022 dented by higher provisions. Net interest income grew by 48 percent to Rs 544 crore and pre-provision operating profit increased by 40 percent to Rs 217 crore compared to year-ago period.

Windlas Biotech: The company reported a 151 percent year-on-year growth in profit at Rs 14.8 crore in quarter ended March 2022, driven by operating income and topline. Revenue grew by 14.3 percent YoY to Rs 122.1 crore and EBITDA rose by 28.7 percent to Rs 14.3 crore compared to year-ago period.

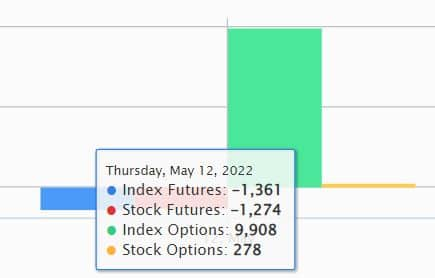

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 5,255.75 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 4,815.64 crore worth of shares on May 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Punjab National Bank and Indiabulls Housing Finance - are under the F&O ban for May 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.