Welltower: Pricing In Chickens Before The Eggs Hatch

Summary

- WELL is banking on growth in the senior housing space.

- While the COVID headwind is lessening, structural oversupply remains.

- I'm not willing to value this as a growth stock yet given the challenges that still remain.

- This idea was discussed in more depth with members of my private investing community, Portfolio Income Solutions. Learn More »

YvanDube/E+ via Getty Images

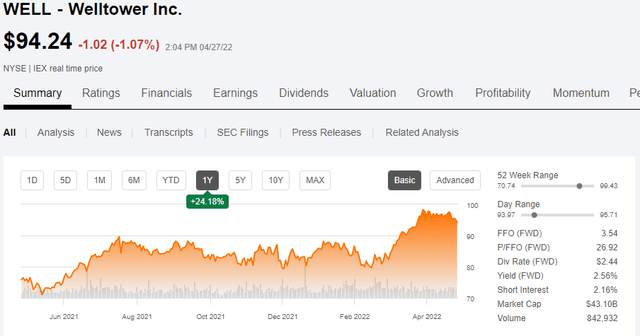

Welltower (NYSE:WELL) is the largest healthcare REIT with a $42.8B enterprise value. Its portfolio contains a variety of healthcare properties, but is heavily weighted toward senior housing in which it has both an operating segment and a triple net segment.

The stock has done tremendously well as of late, managing to rise in the face of the general market crash.

Its gains can be attributed to the story of a great recovery in senior housing post-COVID.

This article will examine the fundamentals of the company and of the senior housing industry more broadly to ascertain whether this is an exciting recovery play or perhaps a bit too much cool-aid drinking.

The Sell Thesis

Welltower is grossly overvalued with the absolute rosiest of recovery scenarios already priced into the stock. Frankly, senior housing fundamentals were weak before COVID, and with the combination of labor costs and oversupply the situation has only gotten worse. I anticipate a moderate bounce off the fundamental bottom followed by continued lackluster performance. The market price, however, is assuming a full recovery into secular growth.

Valuation

I normally do the fundamental review first and close with valuation analysis, but in this case, I want to open with valuation because it is rare to see such a juxtaposition of fundamental struggle with an ambitious multiple.

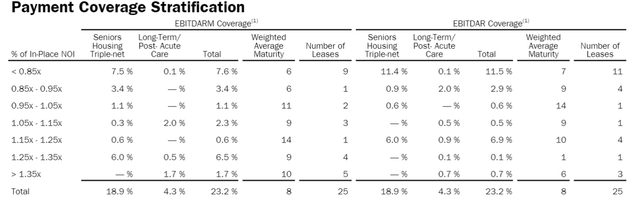

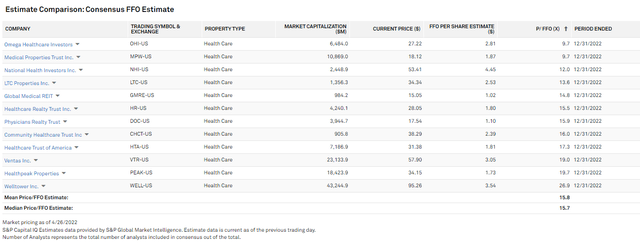

Welltower is anticipated to earn $3.54 of FFO in 2022 which, based on today's price, places it at a 26.9x multiple. The healthcare REIT sector trades at a mean and median P/FFO of 15.8x, and 15.7x multiple, respectively.

S&P Global Market Intelligence

The second most expensive REIT, Healthpeak (PEAK), comes in at 19.7x. That makes Welltower close to double the multiple of the peer average. Given this disparity, one would expect WELL to be the golden goose in a land of ordinary poultry.

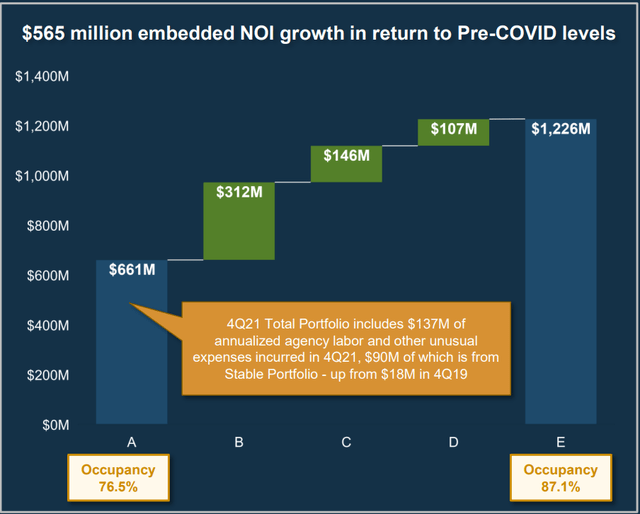

In presentations, business updates and earnings calls, Welltower has painted a picture of a sort of slingshot out of the troubles caused by the pandemic. They predict NOI nearly doubling in the post-pandemic recovery.

This story seems to be predicated on the idea that senior housing is a great asset type that simply got clobbered in the pandemic and that once the pandemic ends it will suddenly be a great asset class once again.

Having analyzed the healthcare REIT sector for a decade, I can't say that I agree with this outlook. In fact, senior housing has been a reliable source of disappointment.

Pre-pandemic weakness

Senior housing tenants have been handing back keys and/or renegotiating rents with the healthcare REITs for years. This isn't the case of big tenants trying to bully weak real estate owners. It is a fragmented tenant base demanding concessions from massive REITs like Ventas (VTR) and Welltower.

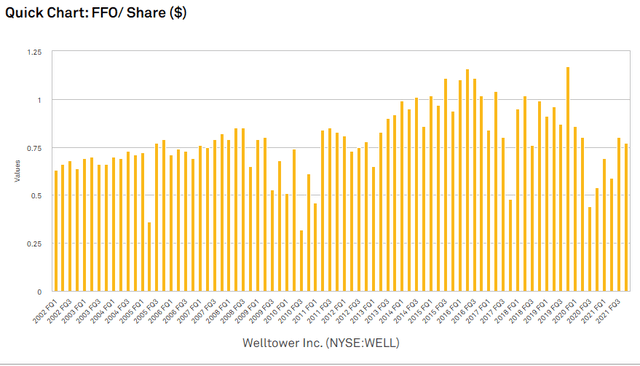

It is not that the tenants have negotiating power over the REITs, but rather that there aren't enough profits to go around. Either the REITs give concessions or the tenants go out of business. This shows up in Welltower's numbers. FFO/share has been weak for a long time with virtually no growth in 20 years.

S&P Global Market Intelligence

WELL's stock has done okay over a long time period, but almost all of that is multiple expansion, not actual growth. Shown below is WELL's trailing FFO multiple creeping up from 11x 20 years ago to 33x today.

S&P Global Market Intelligence

Virtually all of its 242% price rise was just multiple expansion.

S&P Global Market Intelligence

Price growth without FFO/share growth is a stock getting expensive, not a company succeeding.

Effects of pandemic

Across real estate, the pandemic had some impact with some sectors getting hit harder than others, but what it gave everyone was a great excuse.

If rents were too high relative to operating metrics, the leases had to get rolled down and what better time to do that than when the whole world is a mess.

If dividends were too high relative to FFO, the dividend eventually needs to get cut and the pandemic provided cover to do so.

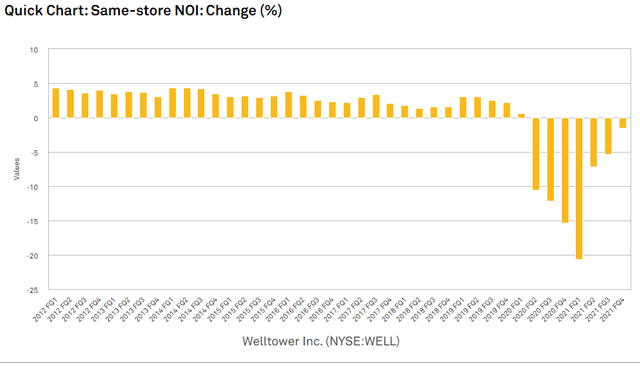

This caused the pandemic to simultaneously reveal operating strengths and weaknesses. There is no doubt that senior housing along with the rest of healthcare was operationally impacted. The inability to take in new residents inevitably led to occupancy erosion. I think the 2020 drop in same store NOI can largely be chalked up to the pandemic.

S&P Global Market Intelligence

However, it is worth noting that strong real estate sectors bounced back very quickly.

- Casinos were partially or even fully shut down for an extended duration but their profits have fully recovered.

- Triple net tenants that deferred rent during the pandemic are largely repaying their owed rent.

- Hospital tenant EBITDAR coverage of rent has bounced back nicely.

Broadly speaking, the post-pandemic environment started to improve in early to mid-2021 for most REITs. Yet for senior housing, the pandemic seems to still be going.

I get that there are more direct impacts in healthcare, especially considering the vulnerability of the population with which they work, but if there was going to be as powerful of a recovery as what is priced into WELL, it seems like it would have already started.

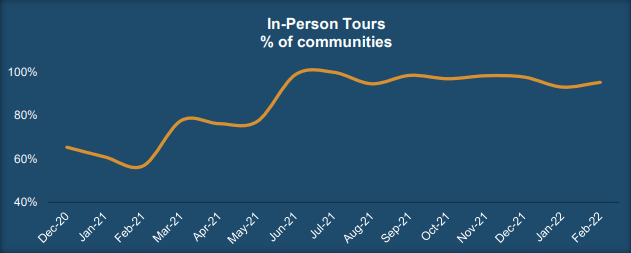

In-person property tours for new tenant move-ins have been back in full swing since June of 2021.

WELL

Surely if it were just the pandemic stopping move-ins, this would have been the time where the rebound began.

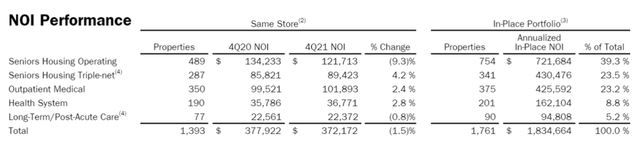

However, if you look at WELL's fundamental data, it is still on the downswing even as of the most recent quarter. Total NOI dropped 1.5% led downward by a 9.3% drop in senior housing operating NOI.

This is against the pandemic comp of 4Q20.

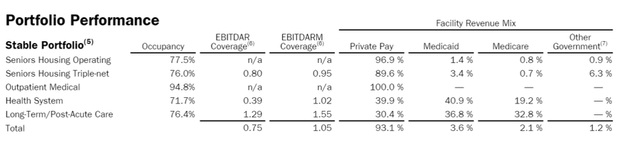

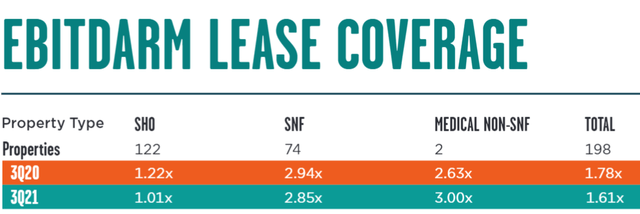

Something beyond the pandemic is clearly still hurting senior housing. That problem shows up in their EBITDAR coverage. 1x coverage means that the tenant can afford to pay rent, but there isn't any profit left after paying rent. Comfortable coverage would be closer to 2x+ where hospitals tend to be or 5-9x where medical office sits.

The 0.80x coverage of WELL's senior housing or 0.75x coverage in its total portfolio means tenants cannot afford to pay rent. The REIT is not immediately affected by the tenant's profitability struggles, but EBITDAR coverage does signal what is likely to happen down the road.

Low EBITDAR coverage indicates leases are likely to get renegotiated or rolled down, not up.

In a world where the REIT market is selling off Medical Properties Trust (MPW) on fears that its tenants are struggling with their roughly 2x-3x EBITDAR coverage, I do not see why one would pay a 27x multiple for Welltower with 0.75x EBITDAR coverage.

WELL breaks down the EBITDAR coverage of their tenants and the majority (11.4% out of 18.9%) are below 0.85x.

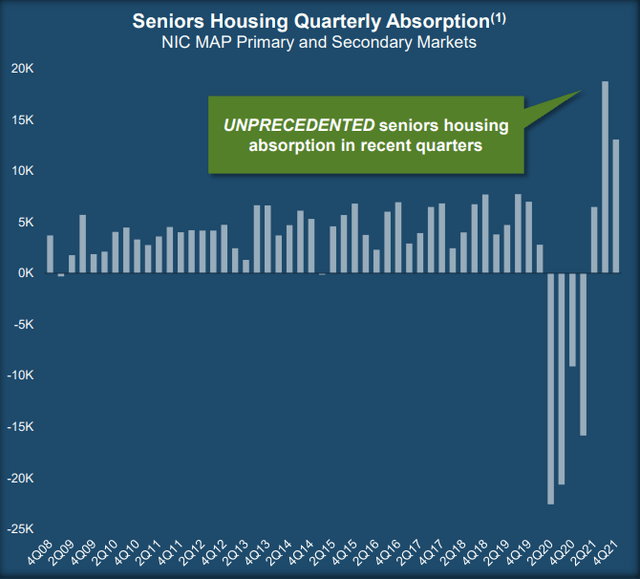

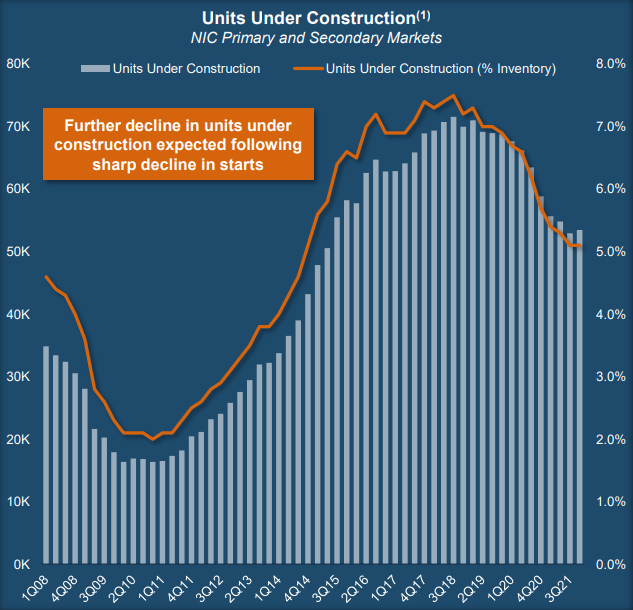

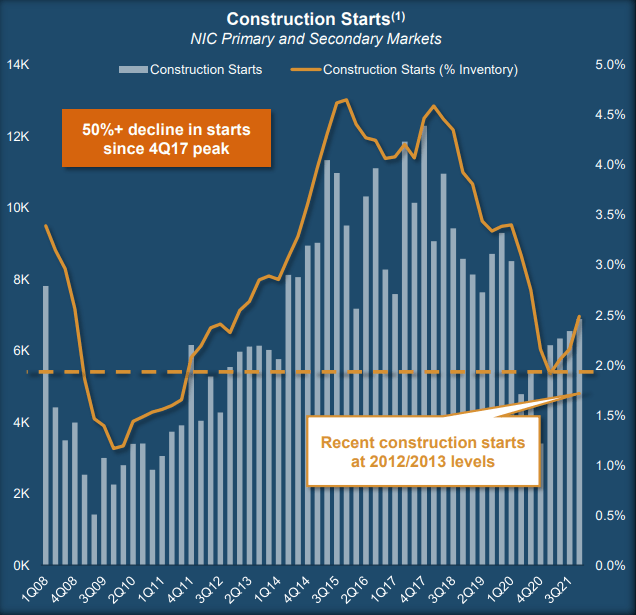

I believe the continued weak performance of senior housing has less to do with the pandemic and more to do with systemic oversupply.

Oversupply began well before the pandemic with units under construction fluctuating between 2% of inventory and 7.5% of inventory.

WELL

That is massive supply growth and quite simply, absorption did not keep up.

Note that units in construction are multiple quarters' worth as they take a while to build. So to get a more accurate number with which to compare, we can look at unit starts.

See above that net absorption sat somewhere a bit south of 5K for the past decade. In contrast, construction starts were 10K in the pre-pandemic era.

WELL

Oversupply started to get bad in 2015, but it was the 2017-2018 deliveries that really flooded the market.

This excess supply has yet to be absorbed and I think continual cost pressures will keep demand down.

Labor, particularly skilled labor like that involved in senior housing, will continue to hurt operators. The crashing stock market has eroded nest eggs by 10%-20% which further reduced demand.

On the bright side, home values have remained very strong, so reverse mortgages or property sales could be used to fund entry into senior housing.

Growth trajectory

Even with my bearishness on the sector in general, I do think there will eventually be some sort of rebound. Operator profitability challenges will keep rental rates from growing and the cost pressures will hurt SHOP, but occupancy should bounce back at least a bit.

Overall, I anticipate a partial recovery of the NOI lost to COVID followed by tepid mid-single-digit growth going forward.

Outlook for WELL stock

Lots of companies give a rosy fundamental outlook in presentations. One could even say that it is standard practice. Presumably a company chooses to be in a property sector because its management deeply and firmly believes in that property sector.

The difference here is how completely and thoroughly the market has bought into WELL's rosy outlook.

Maybe WELL will surprise me and manage a strong recovery, but even that is not a great scenario for the stock because it is already priced in.

At nearly double the peer multiple, anything but complete success could be viewed as a disaster.

For a 27x multiple one could buy a high quality apartment or industrial REIT where growth is rampant. It is quite the price tag for a wobbly, yet to be proven rebound.

Greener pastures in senior housing

I do think there is something to be said for the timing of the senior housing sector. It is not strong, but it is arguably at a cyclical bottom. As such, there could be some fundamental recovery ahead.

Rather than buying WELL where the recovery is fully baked into the price, one could consider National Health Investors (NHI).

Keeping in mind that EBITDARM is different than EBITDAR, NHI's 1.01x senior housing coverage is quite similar to WELL's.

I don't anticipate NHI's fundamental performance differing all that much from WELL's but the valuation is the polar opposite. NHI is on the cheap side of healthcare REITs with a P/FFO of 12x.

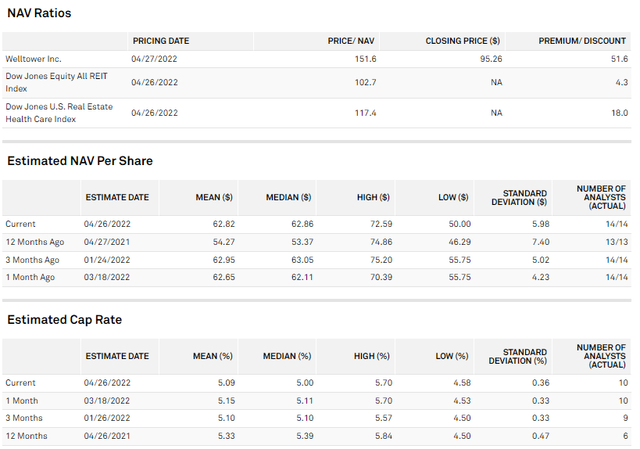

NHI trades roughly at NAV while WELL trades at 151% of NAV.

S&P Global Market Intelligence

I still don't particularly like senior housing fundamentals, but if one wants to play the recovery, the value play seems the better way to go. That way, if you are right about the rebound, at least the upside isn't already priced in.

Opportunistic Market Sale: 20% off till the end of this week!

Right now there are abnormally great investment opportunities. With the market crash, some fundamentally strong stocks have gotten outrageously cheap and I want to show you how to take advantage and slingshot out of the dip.

To encourage readers to get in at this time of enhanced opportunity we are offering a limited time 20% discount to Portfolio Income Solutions. Our portfolio is freshly updated and full of babies that were thrown out with the market bathwater.

Grab your free trial today while these stocks are still cheap!

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation.

Our Portfolio Income Solutions Marketplace service provides stock picks, extensive analysis and data sheets to help enhance the returns of do-it-yourself investors.

Investment Advisory Services

We now offer a way to directly invest in our Proprietary Investment Portfolio Strategy via REIT Total Return, which replicates our activity in client accounts. Total Return client’s brokerage accounts are automatically invested simultaneously and at the same price when we make a trade in the REIT Total Return Portfolio (also known as 2CHYP).

Learn more about our REIT Total Return Portfolio.

Dane Bowler, along with fellow SA contributors Simon Bowler and Ross Bowler.

is an investment advisory representative of 2nd Market Capital Advisory Corporation (2MCAC). As a state registered investment advisor, 2MCAC is a fiduciary to our advisory clients.

Full Disclosure. All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of the specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Disclosure: I/we have a beneficial long position in the shares of MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Important Notes and Disclosure

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles.

It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.