Top Searches

- News

- Business News

- India Business News

- Sensex sinks 1,307 points on fear of fund outflow

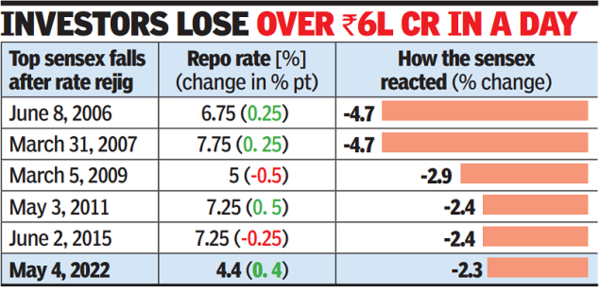

MUMBAI: The sensex slumped by 1,307 points to 55,669 as Dalal street investors were unnerved by the shock mid-policy hike of 40 basis points (100bps = 1 percentage point) in interest rate by the RBI on Wednesday. Rate-sensitive stocks along with Reliance Industries led the slide, BSE data showed.

The day’s plunge left investors poorer by Rs 6.2 lakh crore with the BSE’s market capitalisation now at Rs 260 lakh crore. Of the 30 sensex stocks, only three — Power Grid, NTPC and Kotak Bank — closed with gains. The selloff was led by foreign funds with the net selling figure at Rs 3,288 crore, BSE data showed. Domestic funds, on the other hand, bought aggressively with the net buying figure at Rs 1,338 crore.

In the government bond market, the benchmark yield on the 10-year gilts shot up by 26bps to 7.38%. Bond market players expect further hardening of rates. The rupee appreciated by 24 paise to settle at 76.42 against the US dollar on Wednesday.

With the US Fed having raised rates late on Wednesday and also announced plans to pare down its balance sheet by $95 billion per month, easy availability of funds will end. This, in turn, would prompt foreign fund managers to take money off markets that are relatively riskier, including emerging ones like India.

According to Religare Broking VP (research) Ajit Mishra, investors were cautious from the start of trading on Wednesday ahead of the US Fed meeting outcome scheduled late in the evening. “However, the surprise rate hike by the RBI caught the participants completely off guard and triggered a knee-jerk reaction. Apart from the policy tightening, hawkish commentary on inflation dragged the key indices lower.”

Brokers are still cautious with all eyes on the US Fed meeting outcome amid the 50bps rate hike decision. Market players are also cautious about the RBI’s sudden turn from an ‘accommodative’ stance to a hawkish posture. Some are also expecting another rate hike in the next policy meeting.

The day’s plunge left investors poorer by Rs 6.2 lakh crore with the BSE’s market capitalisation now at Rs 260 lakh crore. Of the 30 sensex stocks, only three — Power Grid, NTPC and Kotak Bank — closed with gains. The selloff was led by foreign funds with the net selling figure at Rs 3,288 crore, BSE data showed. Domestic funds, on the other hand, bought aggressively with the net buying figure at Rs 1,338 crore.

In the government bond market, the benchmark yield on the 10-year gilts shot up by 26bps to 7.38%. Bond market players expect further hardening of rates. The rupee appreciated by 24 paise to settle at 76.42 against the US dollar on Wednesday.

With the US Fed having raised rates late on Wednesday and also announced plans to pare down its balance sheet by $95 billion per month, easy availability of funds will end. This, in turn, would prompt foreign fund managers to take money off markets that are relatively riskier, including emerging ones like India.

According to Religare Broking VP (research) Ajit Mishra, investors were cautious from the start of trading on Wednesday ahead of the US Fed meeting outcome scheduled late in the evening. “However, the surprise rate hike by the RBI caught the participants completely off guard and triggered a knee-jerk reaction. Apart from the policy tightening, hawkish commentary on inflation dragged the key indices lower.”

Brokers are still cautious with all eyes on the US Fed meeting outcome amid the 50bps rate hike decision. Market players are also cautious about the RBI’s sudden turn from an ‘accommodative’ stance to a hawkish posture. Some are also expecting another rate hike in the next policy meeting.

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagram

Looking for Something?

Start a Conversation

end of article

Visual Stories

Quick Links

Budget 2022Cryptocurrency NewsITR Filing Last DateSensex TodayGSTElon MuskTax CalculatorStock MarketSavings Growth CalculatorIncome Tax SlabsMutual FundsBanking ServicesAadhaar CardSBICredit Card NewsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC Code