VOOG: Returning To A Buy As The Market Rerates

Summary

- Behind the more popular VUG, Vanguard S&P 500 Growth fund offers an alternative choice for large-cap growth-factor investing.

- The fund offers a 0.7% dividend yield, and charges a 0.10% expense ratio.

- VOOG offers solid relative performance compared to its peers.

DKosig/iStock via Getty Images

Thesis

Growth investors have been on a rough stretch as of recently, even those avoiding stock picking and resorting to index ETFs and more passive practices. Overall, however, over the last decade, broader market growth ETFs have been exhibiting impressive performance, largely benefiting from the prolonged bull-market in large cap technology stocks. In this analysis, I examine Vanguard S&P 500 Growth ETF (NYSEARCA:VOOG) a relatively popular investment choice for investors looking to effectively track large-cap growth stocks.

Turbulent Market Activity

Growth factor ETFs became increasingly popular over the past decade, as superior performance relative to the broader market raised investors' attention and, subsequently, portfolio exposure. The rapidly growing technology sector has spearheaded the technology trade's performance with more traditional sectors falling behind. Especially after the Covid-19 pandemic accelerated the digital transformation of the economy, going long on tech stocks seemed like the obvious choice. Coupled with very relaxed monetary policy on the Fed's part, growth stocks delivered strong returns with valuations stretching to levels unseen since the 2000s, with many pointing that a pullback was imminent.

So far, 2022 has been a rough year for stocks, especially the more expensively valued ones. All major indices are having their worst first 4 months in many years, with the NASDAQ facing the most selling pressure. The S&P 500 is experiencing a correction marking -13.5% losses YTD, with the Nasdaq technically in a bear market, retreating -21%. It is becoming clear that valuations are bound to return to historic averages and the growth factor is suffering major losses in the midst of the rotation back to more traditional areas of the market.

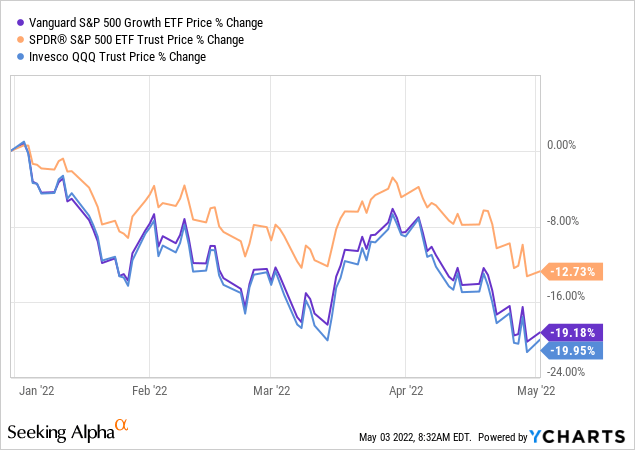

Technology stocks dominate the growth factor's performance. As shown in the graph below VOOG's performance, and the performance of the growth factor in general, is more or less tied to the performance of the Nasdaq, therefore carrying significant technology exposure.

Fund Identity

Vanguard's S&P 500 growth ETF invests in stocks in the Standard & Poor's 500 Growth Index, focusing on tracking the index's return, which is considered a gauge of overall U.S. growth stock returns. VOOG charges a 0.10% expense ratio and pays a 0.71% quarterly dividend yield, about half of the yield the S&P 500 offers. VOOG is often promoted as an alternative to VUG (Vanguard's flagship growth ETF) and although significantly less popular, it currently maintains around $7B in Assets Under Management.

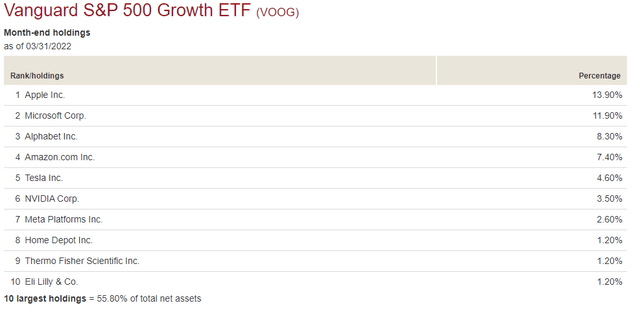

Like most growth-oriented ETFs, the fund displays a high degree of concentration in its top 10 holding and increased exposure towards large-cap tech. Apple and Microsoft are the fund's two largest holdings, accounting for 26% of total weighting combined.

Relative Performance

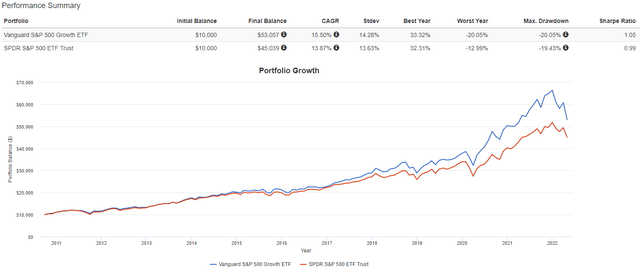

To examine performance and volatility metrics in an attempt to gauge VOOG's relative attractiveness, I employed the tools offered by Portfolio Visualizer. First, the fund's performance record is presented against S&P 500 risk and return metrics for the same time period. For the simulation below, and the one following, a $10,000 beginning balance, dividend reinvestment, and annual rebalancing were assumed, going back to September 2010, when VOOG was incepted.

Despite the recent aggressive pullback, VOOG maintains the long-term edge in performance, compared to SPDR's S&P 500 ETF (SPY). A $10,000 investment in VOOG would have yielded $53,000 versus the $45,000 the S&P would have produced (15.5% vs 12.9% CAGR). In terms of risk, VOOG carries a slightly higher standard deviation of 14.2% (vs 13.6% for SPY) and recorded a significantly more severe drawdown during its worst-performing year (-20% vs -13% for SPY). Still, in terms of risk-adjusted returns VOOG outperforms over the 10-year period (1.05 vs 0.99 Sharpe ratio).

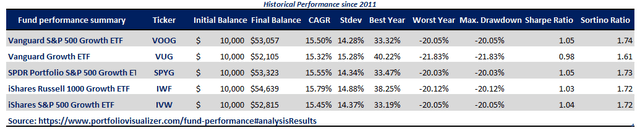

Moving along with the analysis, risk and return metrics are calculated and presented for a group of competing, large-cap, growth-factor ETFs consisting of VOOG, Vanguard's most popular Growth ETF (VUG), SPDR Portfolio S&P 500 Growth ETF (SPYG), iShares Russell 1000 Growth ETF (IWF) and iShares S&P 500 Growth ETF (IVW). Given the major similarities in exposure and structure between the ETFs, as expected, risk and return metrics are rather homogenous. The small differences observed are summarized below.

In terms of total return, IWF leads the pack, yielding $54,639 on a $10,000 investment, with VUG offering the smallest total gains. VOOG actually records the best risk-adjusted performance (shape ratio of 1.05), along with SPYG, with the two funds appearing almost identical and interchangeable. The worst drawdown belongs once again to VUG, along with the worst Sharpe and Sortino ratios in the group.

Valuation

Valuations in growth stocks have shrunk significantly as the market has entered bear territory. With both NASDAQ and S&P 500 P/E multiples reversing back to their historic averages, a fund like VOOG becomes more attractive. While most of its larger, Technology holdings are still valued at a premium compared to market averages, there is little doubt that companies like Apple, Microsoft, Amazon and Nvidia offer top-of-the-self prospects for the foreseeable future.

Final Thoughts

After all things are considered, given the current oversold status of the market and the large-cap growth-factor's prospects over the next decade, an ETF like VOOG makes for an interesting investment option. Moreover, based on the historic simulation analysis, VOOG stands firmly among competing growth ETFs, even slightly outperforming on many metrics.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.