PayPal: Q1 Resets Expectations And Points To Bottom

Summary

- PayPal shares have rebounded 11% since results, but remain 71% below their July 2021 peak, having more than halved in the past year.

- Q1 results were weak, due to a further loss of eBay volumes and poor macro. 2022 outlook was cut, and 2025 outlook was withdrawn.

- PayPal was too optimistic on growth, but the strategy has been refocused. We expect growth to reaccelerate and margin to expand.

- We believe a mid-teens EPS growth is achievable, based on PayPal's track record and what it expects to achieve even in 2022.

- With shares at $91.53, even if they never return to their peak, we expect a total return of 134% (27.1% annualized) by 2025 year-end. Buy.

Erikona/iStock Unreleased via Getty Images

Introduction: Why is PYPL Stock Up?

We review our investment case on PayPal Holdings, Inc. (NASDAQ:PYPL) after Q1 2022 results were released post-market last Wednesday (April 27).

PayPal shares have rebounded 11% since results, but remain 71% below their July 2021 peak, having more than halved in the past year:

| Librarian Capital PayPal Rating History vs. Share Price (Last 1 Year)  Source: Seeking Alpha (03-May22). |

Compared to when we upgraded our rating on PYPL to Buy in May 2020, shares are down 34%, after PayPal's P/E de-rated from 47.0x (based on 2019 EPS) then to 23.7x now (based on the midpoint of the 2022 outlook).

Q1 results were weak due to a further loss of legacy eBay (EBAY) volumes (nearly complete) and poor macro. 2022 outlook was cut, and 2025 outlook was withdrawn, resetting expectations.

While we clearly overestimated PayPal's growth, we believe a mid-teens EPS CAGR remains achievable, and at the current price, PYPL stock can generate a 134% total return (27.1% annualized) by 2025 year-end. Buy.

PayPal Buy Case Recap

Our investment case consists of the following:

- Payment networks are great businesses, thanks to their mission-critical nature, network effect, recurring revenues, natural pricing power, and operational leverage; there is a structural shift to electronic payments

- As a two-sided payment platform with visibility over both parties in every transaction, PayPal has key advantages in data, speed, security, etc.

- PayPal also has a long-term vision of building an integrated payments ecosystem that includes both online and in-store purchases, payments (including P2P and B2C), consumer rewards, Buy Now Pay Later, etc.

| PayPal Example Innovations in 2020  Source: PayPal results presentation (Q4 2020). |

- There is significant potential in new geographies, beyond the U.S. and the U.K., which were historically 65% of revenues (in 2019)

- PayPal's margin expansion potential in future years is not fully appreciated by investors, as management chose to rapidly increase investments

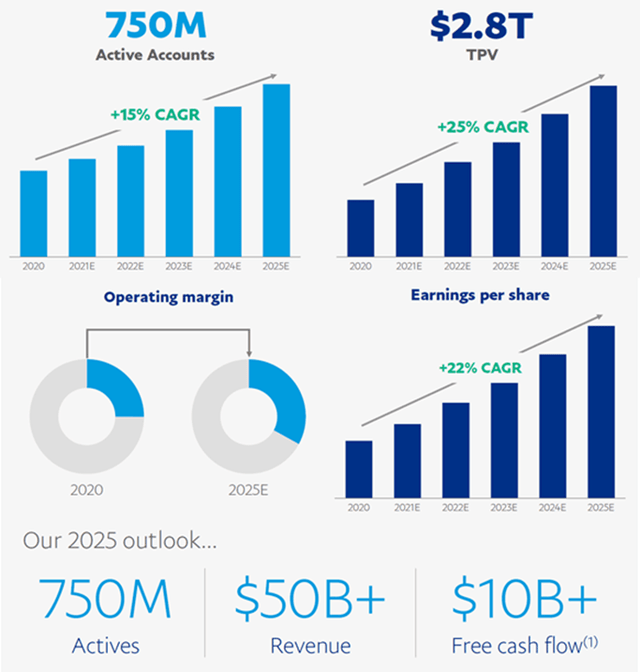

We had previously relied on PayPal's medium-term outlook, released at its February 2021 results day, which included a 2020-25 EPS CAGR of 22% and 2025 Free Cash Flow ("FCF") of $10bn+ (as defined by management, which excludes stock-based compensation).

Growth now looks set to be lower, with the medium-term outlook withdrawn, but we believe the structural drivers listed above remain in place and PayPal will be able to achieve substantial growth (albeit lower than prior targets).

PayPal Q1 2022 Results Headlines

PayPal's Q1 2022 results were weak, due to continuing loss of legacy eBay volumes (nearly complete) and poor macro (including in China and the U.K.):

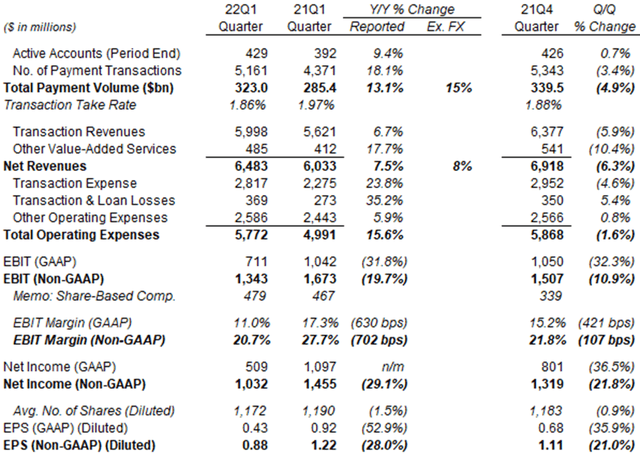

| PayPal Key Financials (Q1 2022 vs. Prior Periods)  Source: PayPal company filings. |

Year-on-year comparisons show the impact of these headwinds:

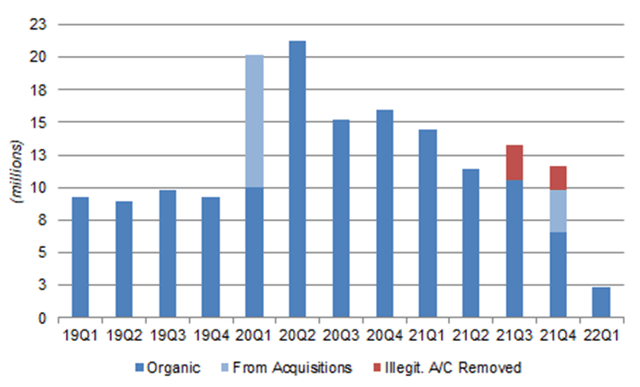

Active Accounts grew 9.4% year-on-year (or 36.9m) including 3.2m acquired with Paidy in Japan. Payment Transactions grew 18.1%.

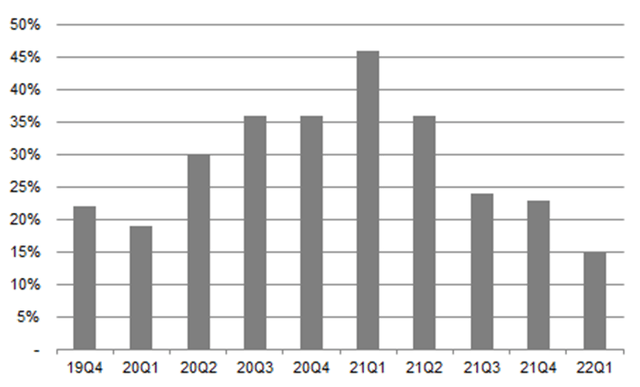

Total Payment Volume ("TPV") grew 13.1% year-on-year, or 15% ex-currency, the first time the latter has been below 20% since Q1 2020:

| PayPal TPV Growth Year-on-Year (ex-Currency)  Source: PayPal company filings. |

The out-migration of eBay volumes, which began in July 2020, was again a significant headwind - eBay TPV fell 48%, and excluding eBay, group TPV growth was 17%. TPV growth was 21% in the U.S. but only 5% in International, with the latter affected by revenue declines in China and the U.K. (due to macro, including supply chain issues) and impact from eBay.

Net Revenues grew 7.5% year-on-year, or 8% ex-currency, lower than TPV due to negative mix (eBay volumes were materially higher-margin). Excluding eBay, revenue growth was 15% (including currency).

Transaction Expense grew 23.8%, far more than TPV, due to negative mix. Much of the new volume was in channels like Braintree that carry much higher funding costs (for example, when it pays the costs of customers depositing funds from Visa (V) and Mastercard (MA) debit cards).

Transaction & Loan Losses grew 35.2% (or $96m), due to an $84m credit reserve release in the prior year. Excluding this, it only grew 3.4%.

Other Operating Expenses grew 5.9% as reported, but 8% on a non-GAAP basis, in line with revenue.

Overall, EBIT fell 31.8% year-on-year on a reported basis and 19.7% on a non-GAAP basis, with margins contracting significantly, mainly due to the mix-driven growth in Transaction Expense and prior-year reserve releases.

The sequential comparison is less meaningful, as Q4 included the holiday season. Active Accounts grew just 0.7% (or 2.4m), in line with the Q1 decision to focus on existing customers and let low-return accounts churn:

| PayPal Net New Accounts by Quarter (Since 2019)  Source: PayPal company filings. |

(We assume all of the illegitimate accounts were added in Q3-4 of 2021.)

PayPal 2022 Outlook Cut

PayPal reduced 2022 outlook significantly at Q1 results.

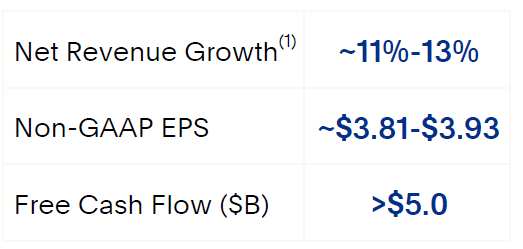

| PayPal 2022 Outlook Headlines  Source: PayPal results presentation (Q1 2022). |

Including both eBay and currency, management now expects:

- Net New Accounts to be approx. 10m (was 15-20m)

- TPV to grow 13-15% (was 19-22%)

- Revenue to grow 11-13% (was 15-17%)

- Non-GAAP EPS to be $3.81-3.93 (was $4.60-4.75)

- FCF of more than $5bn (was approx. $6bn)

The outlook assumes a $725m decline in eBay-related revenues (was $600m), halving from $1.4bn in 2021 (they were $2.8bn in 2019). Excluding eBay, growth would have been higher, with:

- TPV to grow 16% * (was 21-24%)

- Revenue to grow 15-17% (was 19-21%)

(* is estimated based on actual outlook of a 3-year CAGR of 29%. Excluding eBay, TPV growth was 38% in 2021 and 33% in 2020.)

Macro pressures were cited as the reason for the lower outlook:

At the last quarter, when we gave a revenue range of 15% to 17%, we very clearly said if things did not improve, we would be at the low end of that range ... Not only have things not improved ... they've gotten worse. We've got a war that's broken out in Ukraine. We've seen more supply chain issues that are acute in places like China. You've got even higher inflation now, which is ... disproportionately affecting our customer base that skews more towards discretionary spend"

John Rainey, PayPal CFO (Q1 2022 earnings call)

We believe PayPal is also likely to be disadvantaged, relative to other payment companies, by its higher mix in e-commerce (where growth has decelerated as post-COVID normalization continues) and in countries such as the U.K. PayPal's exit from Russia also had an $0.08 impact on full-year EPS.

PayPal 2025 Outlook Withdrawn

PayPal withdrew its medium-term outlook. These had previously included an 2020-25 EPS CAGR of 22% and 2025 FCF of $10bn+ (the target for Active Accounts was already withdrawn at Q4 2021 results):

| PayPal's Previous 2025 Outlook  Source: PayPal investor day presentation (Feb-21). |

The stated reason for withdrawing the 2025 outlook was a change in the expectations for e-commerce penetration and macroeconomic factors.

What Went Wrong at PayPal

We attribute what went wrong at PayPal to over-optimistic expectations, as a result of extrapolating the growth during COVID-19, including:

- An overestimate of the speed and size of potential growth

- Excessive growth targets set for both 2022 and the medium term

- Over-expansion in the scope of activities, including its cost base

- Too much effort at targets when they started looking unachievable

The aborted attempt to acquire Pinterest (PINS) in October 2021 and the build-up of 4.5m "illegitimate" accounts that took advantage of PayPal incentives during the year were both examples of "too much effort".

Management Has Corrected Course

Management appears to have realized their error and corrected course.

At Q4 2021 results in February, PayPal has already refocused its strategy on raising activity levels among existing customers (instead of acquiring new customers) and improving operational leverage.

PayPal executives made even more explicit commitments this quarter, ruling out transformative acquisitions, promising a greater focus on checkout and digital wallet, and on PayPal's core markets.

"Transformative acquisitions are not on our growth agenda at this time. We currently expect that any activity for the foreseeable future will be focused on straightforward deals that have clear and unassailable alignment with our skills and capabilities"

"There are less things we need to do extremely well ... [Checkout and digital wallet] are the 2 things that we really need to double-down on ... We need to go back to where we were before we came into the pandemic, with a real focus on our operating model, making sure we simplify and streamline"

"One of the places that we are de-emphasizing now are some of the international markets that we were looking at before."

- Dan Schulman, PayPal CEO (Q1 2022 earnings call)

We believe this more focused strategy will help reaccelerate growth and resume operating margin expansion.

Mid-Teens EPS Growth Still Reasonable

We believe PayPal's EPS CAGR can be at mid-teens, lower than the 20%+ targeted previously, but still highly attractive.

Excluding the one-off loss of the eBay volumes, 2022 revenue growth is expected to be 15-17%, and management expects to exit the year with mid-teens growth in both revenues and EPS:

"The back half [of 2022] implies with our 11% to 13% [revenue growth outlook] is a 15.5% revenue growth in the back half, so mid-teens, in general, with that. And then as we think about EPS, there are a number of one-time events on our EPS growth rates. But when we think about ... what is an exit as we go into next year ... on a normalized basis, it's probably in the mid-teens as well"

- Dan Schulman, PayPal CEO (Q1 2022 earnings call)

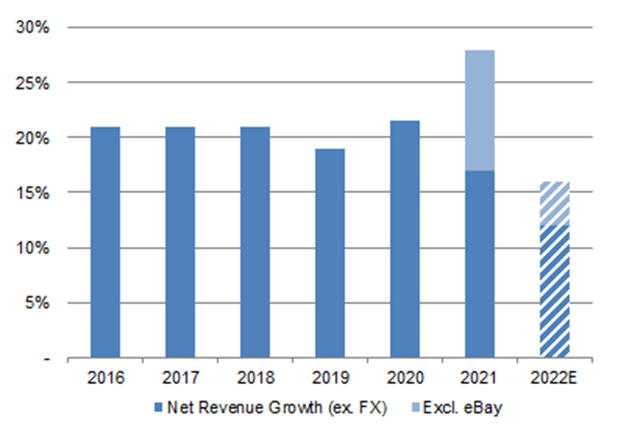

PayPal's TPV growth was far higher than mid-teens before COVID-19, with the non-eBay part growing faster, only decelerating slightly as the base became larger. TPV growth is guided to be 16% for 2022, even with a tough prior-year comparable (boosted by COVID-19) and macro headwinds:

| PayPal Net TPV Growth (ex-Currency) (2016-22E)  Source: PayPal company filings. |

Similarly, PayPal's revenue growth was at around 20% before COVID-19 and expected to be 15-17% excluding eBay in 2022:

| PayPal Net Revenue Growth (ex-Currency) (2016-22E)  Source: PayPal company filings. |

eBay revenues have fallen to 3% of PayPal's total as of Q4 2021 and are expected to halve year-on-year in 2022, with the bulk of the decline ($610m of $725m) in H1. They will soon cease to be a material headwind.

PayPal has continued to win new partners. Amazon (AMZN) agreeing to add Venmo to its U.S. checkout is a key example, and this is now scheduled to launch "in the back half" of 2022.

With a payment platform's natural operational leverage and management's new focus on streamlining activities, we expect earnings to grow faster than revenues over time, helping to achieve EPS growth of mid-teens or more.

Valuation: Is PayPal Stock Cheap?

PayPal's valuation is attractive for a mid-teens EPS CAGR.

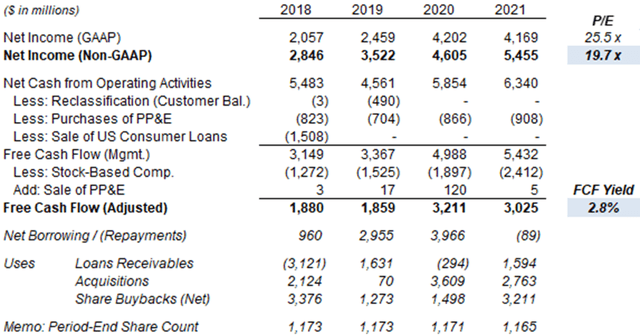

At $91.53, relative to 2021 financials, PYPL stock is trading at a 19.7x P/E on non-GAAP EPS and 2.8% FCF Yield; P/E is 25.5x on GAAP EPS:

| PayPal Valuation & Cash Flows (Since 2018)  Source: PayPal company filings. |

Relative to 2022 outlook, PYPL stock is trading at a P/E of 23.7x (at midpoint) and an FCF Yield of 2.8% (assuming $2bn of share-based compensation).

PayPal does not pay a dividend. It repurchased $1.5bn of its shares in Q1 2022; the average share count was 0.9% lower sequentially.

PayPal Stock Forecasts

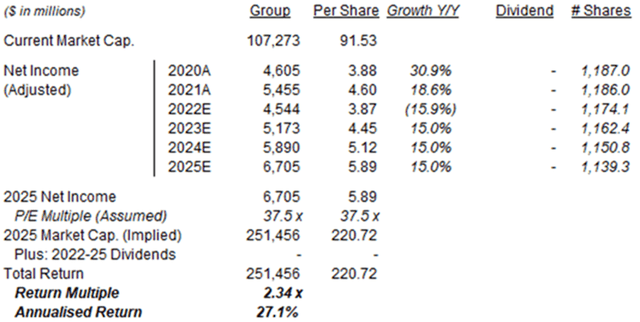

We significantly reduce our EPS and exit P/E assumptions:

- 2022 EPS to be $3.87 (was $4.68), midpoint of the new outlook

- Thereafter EPS growth to be 15% (was 20%)

- No dividends (unchanged)

- Share count to fall by 1.0% annually (was flat)

- P/E to be at 37.5x at 2025 year-end (was 40.0x)

Our new 2025 EPS forecast is 27% lower than before ($5.89):

| Illustrative PayPal Returns  Source: Librarian Capital estimates. |

With shares at $91.53, we expect an exit price of $220 and a total return of 134% (27.1% annualized) by 2025 year-end. The exit price is 30% lower than PYPL's peak of around $310 in July 2021.

Conclusion: Is PYPL Stock a Buy?

We reiterate our Buy rating on PYPL stock.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PYPL, V, MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.