Berkshire Hathaway's 10-Q And Path To $1T

Summary

- Berkshire Hathaway’s 10-Q report revealed operating earnings rose slightly YoY thanks to its manufacturing and retail businesses.

- Its capital allocation direction is another focus.

- It used about $3.2B of its cash to buy back its common stock in the first quarter of 2022.

- Given its high return on capital, share repurchases are very accreditive and are projected to propel its market capitalization to $1T in about 5 years.

- I do much more than just articles at Envision Early Retirement: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Scott Olson/Getty Images News

Thesis

The most recent 10-Q report for Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B), filed on May 2, 2022, reported strong performance. The conglomerate finally found some opportunities to deploy its mountain of cash this past quarter. Buffett mentioned that in the three weeks starting Feb. 21, BRK spent more than $40B buying investments. Notably, Warren Buffett substantially increased his Chevron position, which now replaced Coca-Cola as the 4th largest BRK equity holding.

Looking forward, I am optimistic about BRK's performance to continue and maintain our hold thesis for a few key considerations.

First, operating earnings remain strong and enjoy a bright growth perspective ahead. Operating earnings rose slightly YoY in the past quarterly thanks to its manufacturing and retail businesses. But insurance underwriting earnings declined. Looking ahead, I anticipate an earnings recovery from the insurance and underwriting segments. The aftermath of the Hurricanes Ida and Harvey claims should finally end in the near future. Auto insurance has been negatively impacted as people worked from home and travel was muted in recent quarters. With the vaccine progressing extensively and the economy renormalizing at a steady pace, the headwind should subside.

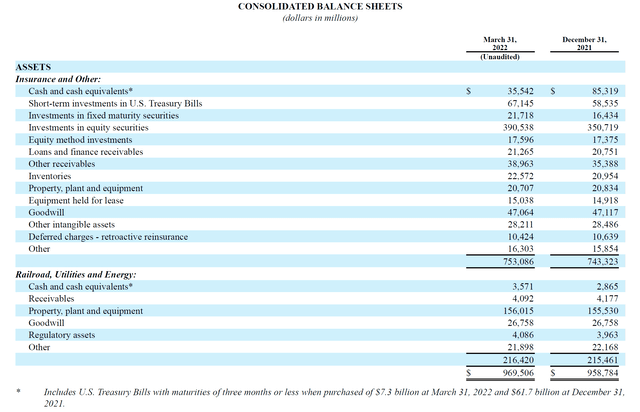

Secondly, the business maintains a fortress balance and plenty of capital allocation flexibility. After the $40B investment last quarter, Warren Buffet still had cash and short-term securities holdings of ~$106B on March 31, 2021. Furthermore, the strong cash generated from its operating segments will continue to flow in. So it has plenty of ammunition to fund its CAPEX projects, pursue investments, and repurchase its own shares.

Finally, share repurchases are highly accreditive under current conditions and can boost shareholder returns effectively. Its strong cash generation and low maintenance CAPEX requirements are such a potent combination for share repurchases. As Buffett commented, "Our appetite remains large" for share repurchases. Note that its market cap will reach $1T with or without the share repurchases. It is just that, as you will see, the potency of its share repurchase programs will accelerate it.

With this, we will elaborate on the highlights from the earnings, based on which we will analyze the projected returns in the next few years.

10-Q highlights and capital allocation

BRK has been lately pressured by a good problem - the cash that keeps building up. And the problem is partially alleviated during the past quarter. Its cash and short-term securities holdings were reported to be ~$106.3B at the quarter ended March 31, 2021, according to the 10-Q filing. This was down about 28% from the $146.7B it held at the end of the last quarter ended Dec. 31, 2021.

Out of the ~$40B it deployed, the major items included about $3.2B of its cash to buy back its common stocks, a big purchase of Occidental (OXY), and $4.2B of HP Inc. (HPQ). It also reached an agreement to buy Alleghany (Y) for $11.6B. The acquisition of Alleghany is expected to close in the fourth quarter of 2022 and is subject to approval by Alleghany shareholders and the receipt of various regulatory approvals.

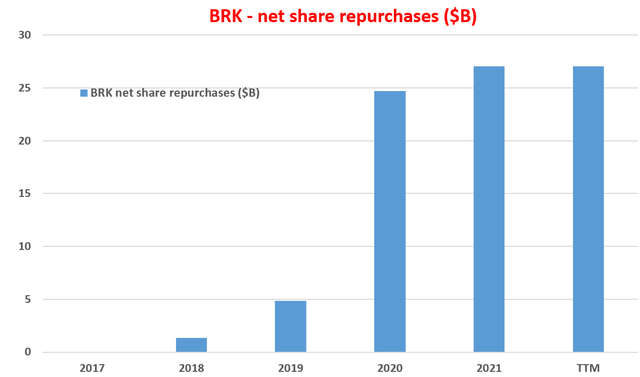

BRK share repurchases

BRK has been aggressively buying its own shares in recent years as you can see from the following chart. It did not start purchasing its own stock still 2018. Then once it started, it did it in earnest. It spent close to $25B per year in both 2020 and 2021 on share repurchases. In the first quarter of 2022, the company repurchased $3.2 billion of its own stock. As a result, its net outstanding shares have shrunk from about 2.46 billion in 2018 to roughly 2.21 billion currently, a more than 10% decline.

Even though the company hasn't repurchased any of its stock in April 2022, as Buffett commented during the annual shareholder meeting, "We're back somewhat to our more lethargic mood, but anything could change for sure." He further commented on the beauty of share repurchases:

For example, the last time Berkshire Hathaway (BRK.B) bought American Express (AXP) shares was in 1998, giving it a 11.2% stake in the credit card company. But through AXP's stock buybacks, Berkshire now holds a 20% stake without spending anymore money.

I am sure the repurchase will resume and continue, as Buffett is always a strong advocate for repurchasing shares (at the right prices though). Furthermore, my view is that BRK's appetite for share repurchases remains large and it makes great economic sense, as elaborated on next.

Economics of BRK share repurchases

The economics of share repurchase is quite simple - not only for BRK but for any business. It is always a good idea to repurchase your own shares whenever your cost of capital is lower than your return on capital. All the trouble is in estimating the cost of capital. As Charlie Munger famously commented:

"I've never heard an intelligent discussion about 'cost of capital.'"

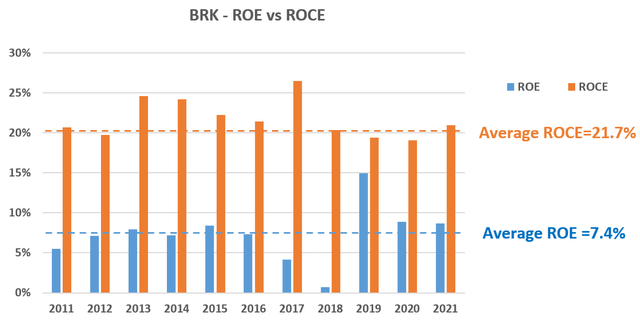

Munger is absolutely right. And it is beyond the scope of this article to analyze the different ways of estimating the cost of capital and their problems. But fortunately, in the case of BRK, the economics is really simple because of its high return on capital. As a result, it does not matter which method we use to estimate its cost of capital and how much variance is among these methods - its cost of capital will be much lower than its return on capital for sure. As an example, my previous article analyzed the cost of capital estimated by the method of Weighted Average Cost of Capital (WACC). And it has been in the range of 8.3% to 8.7% over the past 10 years, with an average of 8.5%.

Now, the next chart also shows its ROCE (return on capital employed) and also ROE (return on equity). As seen, the ROCE has been on average 21.7%, much higher than WACC. As a result, whether we believe WACC to be an accurate estimate of its "cost of capital" or not, this comparison shows that the business can sustainably earn a healthy return on capital far exceeding the cost of capital raised - which makes share repurchase potent and accreditive in BRK's case.

Finally, do not be alarmed by the seemingly lower ROE. In BRK's case, ROE does not represent the true profitability of BRK due to a large amount of idle cash and insurance float.

BRK's path to $1T

The following chart shows its path to $1T market capitalization. Note that its market cap will reach one trillion with or without the share repurchases. It is just the potency of its share repurchase programs that will accelerate it. The chart is made under the following assumptions:

- Firstly, it assumes that BRK spends a fixed percentage of its operating cash flow on share repurchases. The percentage is taken to be 68%, consistent with the average in recent years.

- Secondly, it assumes that its profits grow at an 8% CAGR according to consensus estimates.

- And finally, it assumes that its valuation is maintained as the worth of its equity portfolio plus 15x of its operating cash, which is approximately its current valuation and also a good long-term model as argued in my earlier analysis.

Based on these assumptions, you can see that BRK will be able to reduce its total share count by another 10% in the next five years. And also its share price is projected to reach about $530 per share by 2027 due to the combination of earnings growth and share count shrinkage. Finally, you can see that its market value will reach about $1T by 2027.

Conclusions and risks

In summary, BRK reported another strong quarter. Operating income remains strong, and I am optimistic about the growth perspective ahead. As the aftermaths of the hurricanes come to an end and travel renormalizes, so should the insurance sector's profits. The business maintains a fortress balance and has plenty of capital allocation flexibility. Furthermore, the strong cash generated from its operating segments will continue to flow in, providing plenty of ammunition to fund its CAPEX projects, pursue investments, and repurchase its own shares.

In particular, share repurchases are highly accreditive under current conditions. BRK shareholders should be very happy that BRK is deploying cash with a cost of around 8% to repurchase shares with a ROCE consistently above 20%. The repurchase is projected to propel its share price to about $530 and total market cap to $1T by 2027.

Finally, a few words about risks. First, there is the downside risk of short-term volatility and valuation. Its valuation is at a secular peak level in a decade and the overall market itself is also near a historical record valuation. Second, there is a concentration risk in its equity portfolio. Its Apple position now represents almost 50% of its entire investment portfolio or almost 35% of its entire book value. Lastly, as to the projections presented in this article, there can be some uncertainties in the estimation of its book value given that a large part of its equity is in the investment portfolio, which fluctuates together with the market on a daily basis.

This article was written by

** Disclosure: I am associated with Sensor Unlimited.

** Master of Science, 2004, Stanford University, Stanford, CA

Department of Management Science and Engineering, with concentration in quantitative investment

** PhD, 2006, Stanford University, Stanford, CA

Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions

** 15 years of investment management experiences

Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends.

** Diverse background and holistic approach

Combined with Sensor Unlimited, we provide more than 3 decades of hands-on experience in high-tech R&D and consulting, housing market, credit market, and actual portfolio management. We monitor several asset classes for tactical opportunities. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities.

I also take a holistic view and watch out on aspects (both dangers and opportunities) often neglected – such as tax considerations (always a large chunk of return), fitness with the rest of holdings (no holding is good or bad until it is examined under the context of what we already hold), and allocation across asset classes.

Above all, like many SA readers and writers, I am a curious investor – I look forward to constantly learn, re-learn, and de-learn with this wonderful community.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.