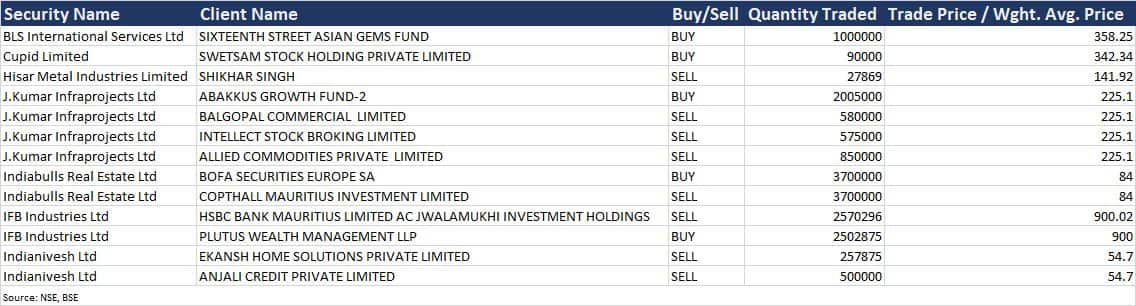

Ace investor Sunil Singhania's Abakkus Growth Fund has picked 2.6 percent equity stake in J Kumar Infraprojects, while Jwalamukhi Investment almost exited IFB Industries via open market transactions on May 4.

Abakkus Growth Fund-2 has bought 20.05 lakh equity shares in J Kumar at an average price of Rs 225.1 per share, as per bulk deals data.

However, Balgopal Commercial sold 5.8 lakh shares, Intellect Stock Broking offloaded 5.75 lakh shares and Allied Commodities sold 8.5 lakh shares in J Kumar at same price. The stock rallied 9 percent to close at Rs 242.

Allied Commodities had held 1.21 percent or 9.15 lakh shares in J Kumar Infraprojects as of March 2022.

Among other deals, BofA Securities Europe SA purchased 37 lakh shares (0.6 percent of total paid up equity) in Indiabulls Real Estate at an average price of Rs 84 per share.

However, Copthall Mauritius Investment, which had held 1.11 percent stake (or 60 lakh shares) as of March 2022, was the seller in Indiabulls Real Estate. The stock fell 5 percent to Rs 81.85.

Sixteenth Street Asian Gems Fund bought 10 lakh equity shares in BLS International Services at an average price of Rs 358.25 per share.

HSBC Bank Mauritius AC Jwalamukhi Investment Holdings offloaded 25,70,296 equity shares in IFB Industries at an average price of Rs 900.02 per share. Jwalamukhi Investment Holdings had held 25,98,556 equity shares or 6.41 percent stake in IFB as of March 2022.

However, Plutus Wealth Management LLP bought 25,02,875 shares in IFB at an average price of Rs 900 per share. The stock corrected 8 percent to Rs 877.40.