Source Capital: 60/40 CEF That Works

Summary

- SOR is a closed-end fund that broadly follows a 60% equity, 40% fixed income allocation.

- The fund has very robust long-term trailing total returns.

- The vehicle displays strong risk/reward analytics, currently trades at a 7.42% discount to NAV.

- This article covers CEFs from our suite of products - we focus on macro portfolio allocation, CEFs and yield-producing options strategies, targeting overall returns of 9%+.

William_Potter/iStock via Getty Images

Thesis

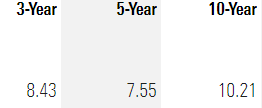

Source Capital (NYSE:SOR) is a closed-end fund following a general 60/40 allocation but with significant mandate flexibility. The fund follows a fairly concentrated approach when it comes to equity selection, currently having only 45 names in the portfolio. On a long-term basis the fund has delivered very robust results, with the 5- and 10-year trailing total returns coming in at 7.55% and 10.21% respectively. These results have been obtained with a low standard deviation of 12.2 (5-year time frame) which is below what is seen for a pure equities portfolio that mirrors the S&P 500. The fund generates alpha through its stock selection and fixed income allocation. While currently the fixed income bucket is dedicated to high yielding bonds, historically we can see long periods of time when the fixed income allocation is entirely composed of treasuries.

SOR is a true buy-and-hold vehicle that has all the necessary ingredients for a retail investor - robust long term results, low standard deviation and shallow drawdowns when compared to the broader equity index. The fund has always traded at a discount to NAV and represents a good portfolio allocation tool for an investor looking for the 60/40 equity-debt allocation but not wanting to actively manage and choose the slicing on their own. The fund's yield is only 5.67% currently, diverging from the usual fund structure that offers eye popping dividends. SOR nonetheless has proven itself in the long term as being able to generate strong total returns and alpha.

The vehicle displays strong risk/reward analytics, currently trades at a 7.42% discount to NAV (which is close to its historic norm) and has declined less than the broad index on a year to date basis. We like this fund for a long term buy and hold investor and while there might be more market weakness ahead in the next months we feel this is a good time to start layering in exposure. We therefore rate it a Buy.

Holdings

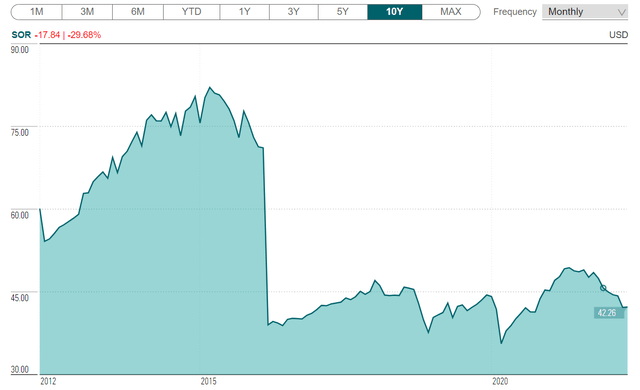

The fund holds a mix of equities and fixed income:

Asset Allocation (Fund Fact Sheet)

To note that while the fixed income portion of the portfolio is a little bit under 34% currently, that figure can fluctuate as the investment manager sees fit. As per the fund's literature "under normal conditions, 50-70% of the Fund’s assets will be allocated to equities, and 30-50% allocated to fixed-income". The fund has a flexible mandate that allows an increase in the fixed income allocation as the manager feels is favorable. Also to note that the fixed income allocation is not exclusively dedicated to investment grade instruments, with a private credit bucket in the portfolio. In a normalized rates environment, a risk-off event that can trigger a lower price in equities can be partially offset by lower yields in treasuries and IG bonds. That offset is not currently in play with higher yields driven by a hawkish Fed pummeling both equities and fixed income.

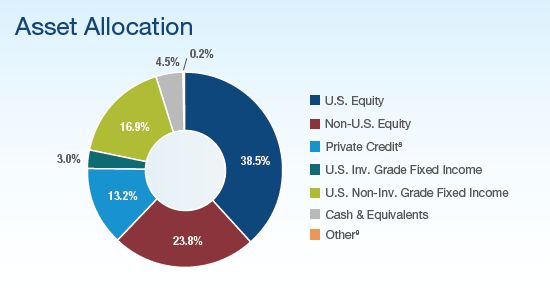

On the fixed income side there is a significant bucket of high yield allocation:

Ratings (Fund Fact Sheet)

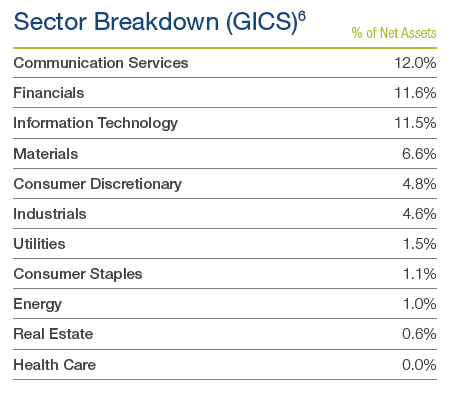

On the equities side the portfolio is overweight communication services:

Sectors (Fund Fact Sheet)

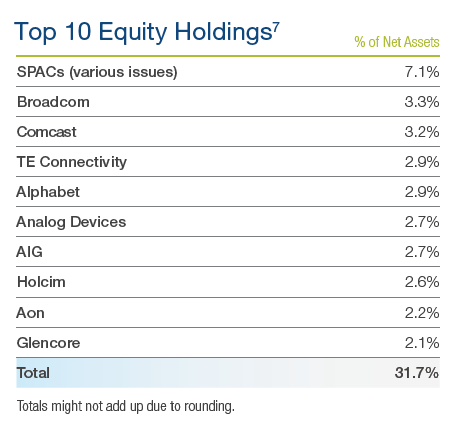

To note however that the portfolio is composed of only 45 names on the equities side, hence very concentrated. The top ten holdings compose more than 31% of the portfolio:

Top 10 Holdings (Fund Fact Sheet)

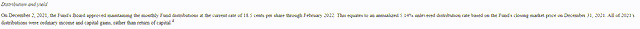

Performance

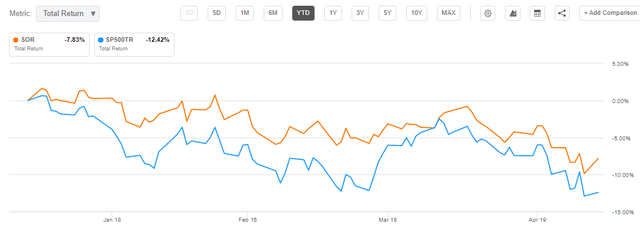

The fund is outperforming the S&P 500 on a year to date basis:

YTD Performance (Seeking Alpha)

Given the short duration of the fixed income assets in the portfolio, the equities and fixed income mix have helped the fund outperform the index so far in 2022.

On a longer-term basis, despite its extremely robust annual returns the fund trails a pure S&P 500 return:

5-Year Total Return (Seeking Alpha)

3-, 5- and 10-year trailing total returns are nonetheless outstanding for the fund:

Trailing Total Returns (Morningstar)

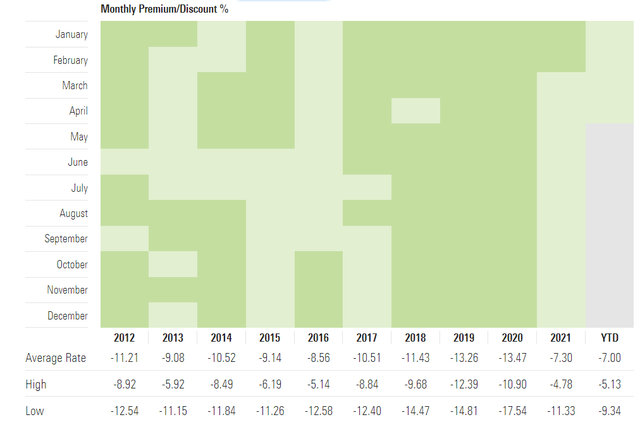

Premium/Discount

The fund has always traded at a discount to net asset value:

Premium/Discount (Morningstar)

Even during the zero rate environment witnessed in 2021 the vehicle traded at a discount to NAV. We surmise this is due to its dividend policy, which amounts to 2.22% of NAV which is not as eye catching as other CEF dividend yields.

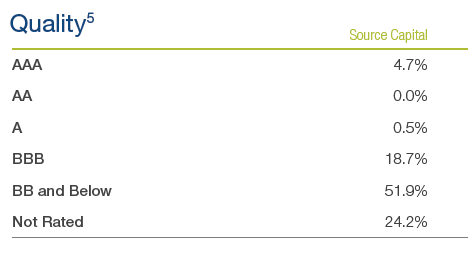

Distributions

To note that the current fund distribution is fixed at 18.5 cents monthly:

The fund has tweaked its distribution in the past, with the dividends being quarterly and based on NAV until recently. It looks like management has taken steps to make it more marketable by switching to a monthly distribution.

To also note that all of the 2021 dividends were characterized as ordinary income and capital gains, rather than return of capital.

Although 2021 did not see any ROC, through its distribution policy the fund has seen its NAV have an annual give-up of approximately -3% in the past decade:

Conclusion

SOR is a 60% equity, 40% fixed income allocation CEF with a flexible mandate. The fund can trade and allocate equities within a large band while the fixed income bucket can be switched from AAA securities to high yield bonds. The alpha generation capabilities of the manager reside with the chosen allocation for the respective macro cycle. The fund has outstanding long term trailing total returns, obtained with a standard deviation which is below the S&P 500 index. The fund is currently trading at a discount to NAV which is approaching historic norms and has outperformed the S&P 500 on a year to date basis. We like this fund for a long term buy and hold investor and while there might be more market weakness ahead in the next months we feel this is a good time to start layering in exposure. We therefore rate it a Buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.