CareTrust REIT: 6.5% Yield With 40% Upside

Summary

- The market has not been kind to CareTrust REIT lately. Shares are down 27.41% year-to-date and 30.96% over the past 12 months.

- As a result, the Yield has run up to 6.79%, and Wall Street analysts see upside of as much as 42% in this company.

- I recently named CareTrust REIT as the best buy in healthcare REITs.

- This article examines growth, balance sheet, dividend, and valuation metrics on this unloved Cinderella.

- This idea was discussed in more depth with members of my private investing community, Hoya Capital Income Builder. Learn More »

Artecke/iStock via Getty Images

You may recall that Cinderella was an unloved stepchild, relegated to the dirtiest cleaning jobs in the house. Then one day her fairy godmother came, gave her a righteous makeover, and turned a pumpkin into a golden carriage, to take her to the ball in style, on the chance to meet the handsome prince. And the rest is fairy tale history.

Much like Cinderella, CareTrust REIT (NASDAQ:CTRE) is unloved, and does the dirty work (think bedpans). Though it is a sound company (as Cinderella was a fine girl), the market has not been kind to CareTrust REIT lately, and for good reasons that are not the company's fault. Shares are down 27.41% year-to-date, and 30.96% over the past 12 months. CTRE is sitting in the ashes like a red-haired stepchild.

As a result, the Yield has run up to 6.79%, and yet Wall Street analysts see upside of as much as 42% in this company. I myself recently named CareTrust REIT as the best buy in healthcare REITs.

So is that a golden carriage I see out there in the drive? Or is it just a pumpkin in disguise?

Meet the company

CareTrust REIT

Headquartered in San Clemente, California, CareTrust REIT was founded in October 2013. Its market cap has quadrupled since its IPO, and now stands in the lower mid-cap range, at $1.62 billion. It has escaped the gravitational pull of small-cap status, having crossed the $1.4 billion threshold in 2018.

CareTrust is in the business of acquiring and triple-net leasing senior housing and healthcare properties, with an unusual focus on "helping top-notch healthcare operators realize their growth potential." The company believes its competitive advantage lies in its experienced management team's ability to identify talented operators. However, their extensive use of UPREIT partnerships, where the acquired facility obtains a junior partnership share in the company (OP units), and gets tax advantages in the process, certainly has something to do with it.

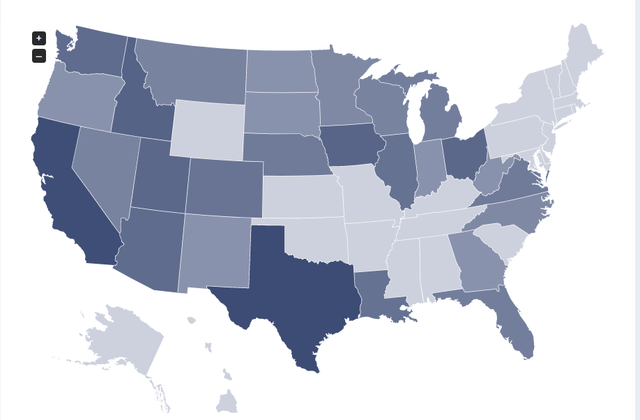

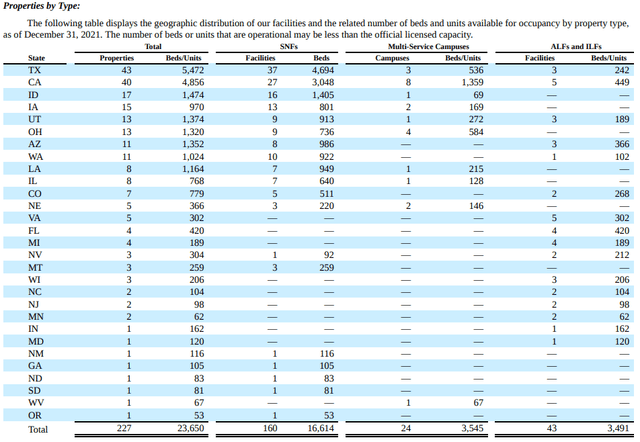

Roughly 70% of the company's assets are skilled nursing facilities (SNFs), with 17% assisted living and independent living facilities (ALFs and ILFs), and the remainder combination campuses, mixing two or more of these types of operations. As of the close of 2021, the company's 227 properties totaling 23,650 beds were spread across 29 states, with the strongest concentrations in Texas (19%) and California (18%).

Geographic distribution of CTRE properties (CareTrust REIT annual 10-K)

Finer details are shown in the table below.

Geographic distribution details (CareTrust REIT annual 10-K)

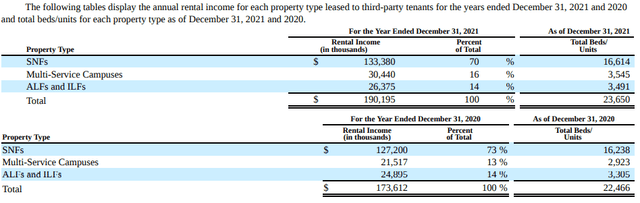

The pandemic has been especially difficult for these types of facilities, and occupancy was down into the 60 - 75% range in 2021. Nevertheless, rental income rose 9.5% from 2020 to 2021, thanks in large measure to the intervention of the federal government, and an increase in the skill level mix resulting from the COVID-related rules of care. The official COVID-19 emergency expired April 16, and the additional funding with it. Despite the stresses on the operators, rent collection in Q4 2021 was 100%.

Rental revenue by property type (CareTrust REIT annual 10-K)

A company called Ensign currently accounts for 32% of annual rents, so while CTRE's geographic diversity is impressive, the tenant diversity is not.

In the first 6 weeks of 2022, CTRE acquired 5 SNFs and four multi-service campuses at a cost of about $192.5 million, and expects to realize an "initial blended yield" of 7.4%. The company also acquired two empty ALFs for a $12.4 million price tag.

Growth metrics

Here are the 3-year growth figures for FFO (funds from operations), TCFO (total cash from operations), and market cap.

| Metric | 2018 | 2019 | 2020 | 2021 | 3-year CAGR |

| FFO (millions) | $101.5 | $113.0 | $133.6 | $145.9 | -- |

| FFO Growth % | -- | 11.3 | 18.2 | 9.2 | 12.84 |

| TCFO (millions) | $99.4 | $126.3 | $145.7 | $156.9 | -- |

| TCFO Growth % | -- | 27.1 | 15.4 | 7.7 | 16.44 |

| Market Cap | $1.58 | $1.96 | $2.12 | $2.21 | -- |

| Market Cap Growth % | -- | 24.1 | 8.2 | 4.2 | 11.84 |

Source: TD Ameritrade, CompaniesMarketCap.com, and author calculations

As you can see, they are all in double digits. However, all these growth rates slowed considerably in 2021, compared to previous years.

That makes all the sense in the world, given the pandemic's ravages of the Medical REIT sector, and CTRE's positioning in the last sub-segment to recover, and yet the company managed to grow at a healthy pace, even so. FFO grew every quarter in 2021.

The Bloomberg analysts' consensus forecast calls for FFO per share to remain flat in 2022, at $1.49

Balance sheet metrics

Here are the key balance sheet metrics for CTRE. This company is in very solid shape, with liquidity, debt ratio, and Debt/EBITDA all considerably stronger than the Medical sector average and the overall REIT average, and a BB bond rating, which is rare for a company this young and small.

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| CTRE | 2.28 | 24% | 4.0 | BB |

| Medical REIT average | 1.96 | 30% | 7.2 | -- |

| Overall REIT average | 1.90 | 25% | 6.5 | -- |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

This company is a FROG, based on its double-digit growth rates and its excellent balance sheet.

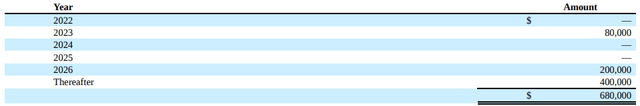

CTRE has a $500 million ATM (at the market) equity issuance line of credit, but issued only 990 shares in 2021, increasing the share count by only 1%. That shows a strong focus on shareholder returns, since share trade at a substantial discount to NAV. The company faces no debt maturities in 2022 or 2024, and only $80M in 2023.

Debt maturity schedule (CareTrust REIT annual 10-K)

Dividend metrics

CareTrust is twice as good a dividend proposition as the average REIT. The sell-off in share price has run the current dividend up to 6.79%. Meanwhile the company has a solid track record for growing its dividend, and during the pandemic, they raised the payout, while most other Medical REITs were cutting back. CTRE gets the Green Light, all the way across the Dividend Metrics board.

| Company | Div. Yield | Div. Growth | Div. Score | Payout Ratio | Div. Safety |

| CTRE | 6.79% | 10.4% | 8.28 | 70 | C+ |

| Medical REITs | 3.94% | (-4.3)% | 3.45 | 65 | C |

| All REITs | 2.96% | 5.5% | 3.48 | 59 | C |

Source: Hoya Capital Income Builder, TD Ameritrade, Seeking Alpha Premium

Valuation metrics

With a Price/FFO ratio of just 10.9, barely half the sector average and less than half the overall REIT average, and trading at a discount of (-11.9)% to NAV, this company has "value investor" written all over it.

| Company | Div. Score | Price/FFO | Premium to NAV |

| CTRE | 8.28 | 10.9 | (-11.9)% |

| Medical REIT average | 3.45 | 21.0 | 7.2% |

| All REITs average | 3.48 | 25.8 | (-5.5)% |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

What could go wrong?

The pandemic has been a bitter headwind for the company, and if it lingers or reignites via some new strain, this could get worse. On the other hand, if it finally abates, pent-up demand could be a major boost for CTRE.

But CareTrust's biggest challenge is the shortage of skilled nurses. Bedside RN turnover rose to an all-time high of 18.6% in 2020, and in a survey in May 2021, another 22% of nurses reported strongly eyeing the exits.

After what they went through during the pandemic, it's no wonder so many nurses quit the profession. As McKinsey's Gretchen Berlin writes on mckinsey.com:

. . . increasing demands placed on healthcare workers created both a physical strain on those working on the frontlines, and a psychological strain for those losing patients, or in some tragic cases, coworkers and loved ones.

The ANA (American Nurses Association) predicts another 500,000 nurses will leave the profession in 2022, leaving a shortage of 1.1 million. That leaves the remaining nurses in a strong position to negotiate salary and benefits, if they are so inclined, raising CTRE's cost of operation and restricting their ability to serve more patients. According to the ANA:

During the pandemic, demand for RNs surged. This combined with other existing factors to considerably worsen the nursing shortage and expose the workplace challenges nurses face. Nurses are under immense stress and feel the full weight of an overburdened, poorly functioning health care system.

And skilled nurses don't grow on trees. It will take years for the supply of new nurses to meet the demand for their services. The aging of the U.S. population, which is a tailwind for most Medical REITs, works against CTRE to some extent, because it intensifies the demand for skilled nurses. According to the ANA, more registered nurse jobs will be available through 2022 than any other profession in the United States.

CareTrust also competes with other alternative ways of caring for seniors, such as Medicare PACE and adult foster care.

Investors' bottom line

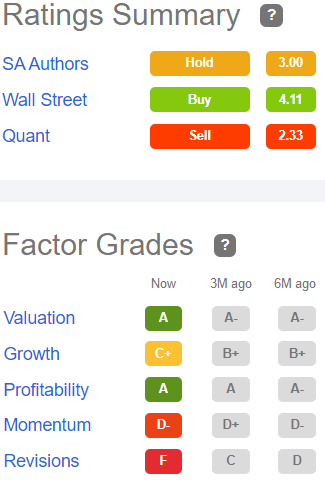

Opinions about CTRE's near-term future run the gamut. Seeking Alpha authors rate the company a Hold, but the Wall Street analysts that cover it say Buy, and the Quant ratings urge a Sell, horrified by the momentum and revisions. The Street, Ford Equity Research, and TipRanks are all neutral on this subject.

Seeking Alpha Premium Keybanc and Raymond James have high opinions of CTRE, and although their price targets have recently been reduced, they maintain an Overweight/Strong Buy rating, and peg it at $23, implying 41.9% upside. Barclays and BMO recently downgraded their opinion from Buy to Hold, with price targets of $17 and $20 respectively, implying 4.9% and 23.4% upside. Taking the second-lowest price target and adding the Yield, you are looking at a return of almost 30%, if the analysts prove correct.

Hard to say whether it is a carriage or a pumpkin. From a value investor's perspective, the 6.5% yield and 10.9 Price/FFO with 4% to 42% upside have to look tempting, and I can comfortably call this company a Buy.

From a growth investor's point of view (that's me), caution is warranted, because of the shortage of skilled nurses, the remaining headwinds from the pandemic, and the uncertainty of the overall REIT market, which has almost exactly as much downside risk as head room right now. Since I am a growth investor, I rate CTRE a Hold, until its growth rates head north again, even though it is a FROG. I think selling would be a terrible idea.

CareTrust reports Q1 2022 results on Friday, May 6. Carriage or pumpkin?

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.