Anti-Quality Bubble

Summary

- Meta and Netflix—both major stay-at-home beneficiaries—now have market capitalizations that are well below pre-COVID-19 levels.

- Amazon, after plunging 14% on Friday, is nearly lagging the S&P 500 since 2019—an almost unimaginable scenario back in 2020.

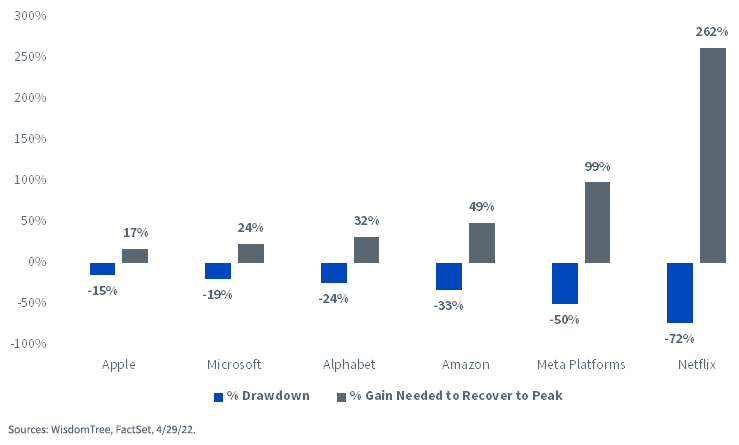

- After drawdowns of more than 50% for both Meta and Netflix, those companies would have to have returns of 99% and 262%, respectively, simply to recover back to their peak market caps.

mim.girl/iStock via Getty Images

By Matt Wagner

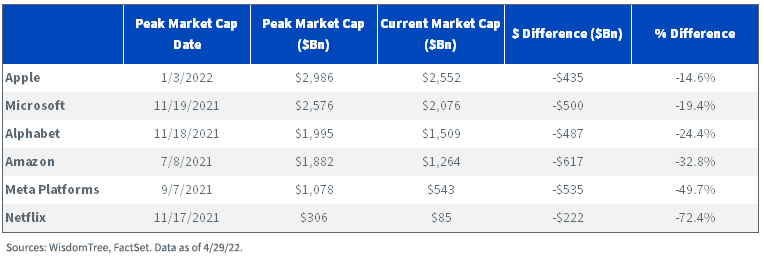

Nearly $2.8 trillion of market capitalization has been wiped out from just six companies—Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Amazon (AMZN), Meta Platforms (FB), and Netflix (NFLX) — in recent months.

Of this group, which we have dubbed FANAMA, four out of the six names are down 20% or more from all-time highs.

FANAMA Market Cap

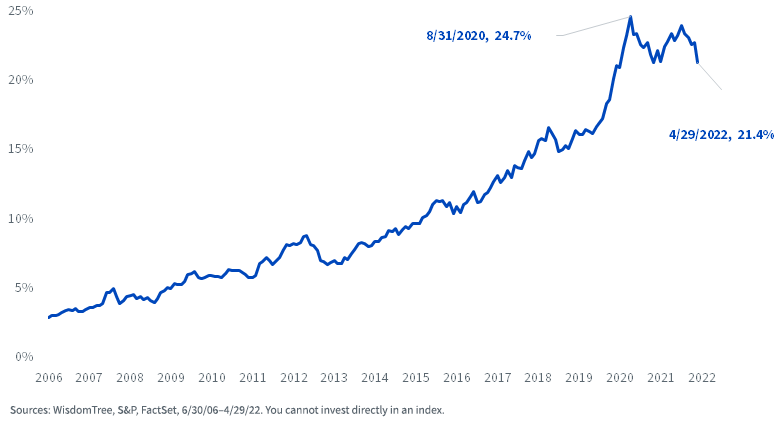

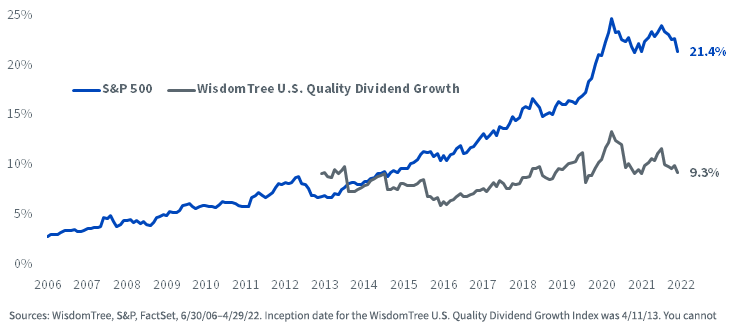

As a byproduct of this underperformance, the aggregate weight of these companies in the S&P 500 Index has slumped from nearly one-quarter of the Index at its peak to 21.4% currently.

S&P 500 Index Weights: Apple, Amazon, Meta, Alphabet, Microsoft, Netflix

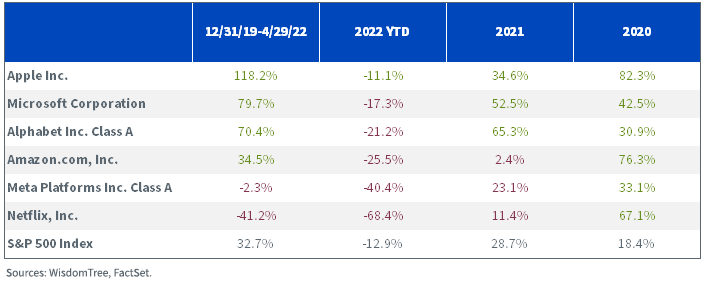

This performance has been a remarkable turnaround from 2020, where all six names handily outperformed the 18.4% return on the S&P 500.

Meta and Netflix—both major stay-at-home beneficiaries—now have market capitalizations that are well below pre-COVID-19 levels. Amazon, after plunging 14% on Friday, is nearly lagging the S&P 500 since 2019—an almost unimaginable scenario back in 2020.

Total Returns since 12/31/19

After drawdowns of more than 50% for both Meta and Netflix, those companies would have to have returns of 99% and 262%, respectively, simply to recover back to their peak market caps.

% Drawdown and % Gain Needed to Recover

The WisdomTree U.S. Quality Dividend Growth Index has been under-weight in this group since 2014 due to the lack of dividend payments from Alphabet, Amazon, Meta and Netflix.

The Index was constructed with a weighting approach aligned with WisdomTree’s original idea that weighting indexes by dividends, instead of market cap, can improve valuations and mitigate exposure to market bubbles.

While a quality company can be defined in many ways, WisdomTree has included a cash dividend screen on its quality Index as a consistent dividend payment is a signal of corporate health and cash management discipline.

From this perspective, this Index screens non-dividend payers like Amazon, Meta, Alphabet and Netflix as “anti-quality.”

Index Weights: Apple, Amazon, Meta, Alphabet, Microsoft, Netflix

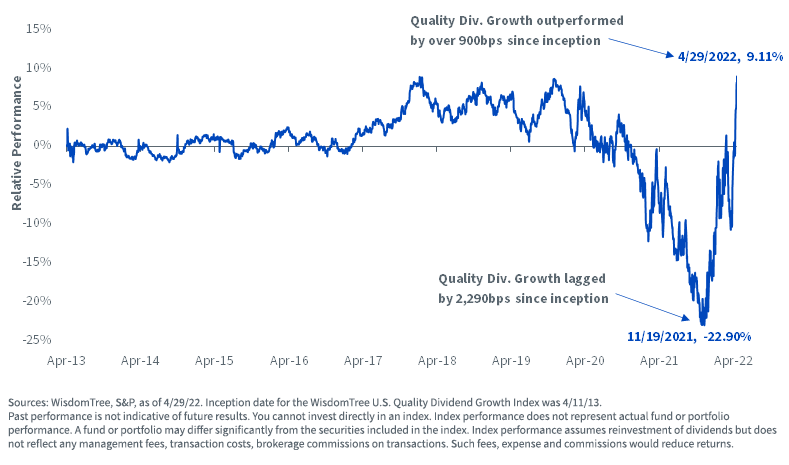

The under-weight weighed heavily on relative performance in 2020 and most of 2021 until a sharp turnaround last November.

Since November 19, the WisdomTree U.S. Quality Dividend Growth Index has outperformed the S&P 500 by 900 basis points (bps).

Cumulative Returns: WisdomTree U.S. Quality Dividend Growth/S&P 500

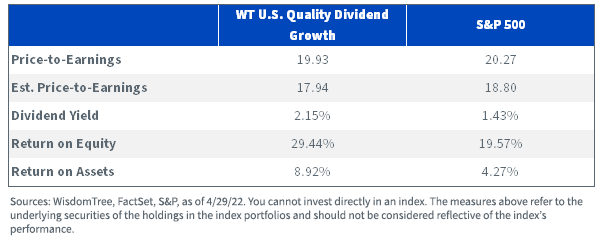

Going forward, with equities challenged by the combined forces of rising rates, elevated valuations, and profit margins being squeezed by inflation, a basket of dividend payers that is over-weight in high-quality companies may be best positioned to maintain margins, control for valuations, and provide a cushion to returns with stable and growing dividend payouts.

Index Fundamentals

Matt Wagner, CFA, Associate, Research

Matt Wagner joined WisdomTree in May 2017 as an Analyst on the Research team. In his current role as an Associate, he supports the creation, maintenance, and reconstitution of our indexes and actively managed ETFs. Matt started his career at Morgan Stanley, working as an analyst in Treasury Capital Markets from 2015 to 2017 where he focused on unsecured funding planning, execution and risk management. Matt graduated from Boston College in 2015 with a B.A. in International Studies with a concentration in Economics. In 2020, he earned a Certificate in Advanced Valuation from NYU Stern. Matt is a holder of the Chartered Financial Analyst designation.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by