USO: Why Crude Oil May Be On The Verge Of An Even Larger Breakout

Summary

- Both U.S and OPEC crude oil output remains abnormally low due to many financial, operational, and regulatory issues facing new oil-well drilling.

- Since U.S drilled-but-uncompleted oil-well inventories are reaching extreme lows, we may soon see production decline as new oil-well production levels deplete without replacement.

- The economic slowdown may cause some declines in oil demand, but demand appears unlikely to reach supply unless draconian lockdown measures in China spread.

- As long as crude oil is in a shortage, USO is likely to have a positive carry due to heavy backwardation in the oil futures market.

- Overall, while demand fluctuations could halt oil's rally, it seems more likely that crude will reach a new all-time high this year due to the output gap and abysmal storage levels.

Bet_Noire/iStock via Getty Images

Since 2020, the global economy has been plagued by rising inflation. Unlike typical cyclical inflation, today's ongoing price hikes stem from global goods and labor shortages, most notably in crude oil and other energy commodities. In my view, the ongoing energy crisis may be the most critical trend today since, in a global trade network, transportation costs drive goods prices and, therefore, inflation.

Global oil output remains around 5% below 2019 levels and may soon fall more as the E.U and Russia block trade. There are also many other factors, such as dwindling oil-well inventories, which may quickly result in a significant drop in U.S. oil production regardless of the situation in eastern Europe. Of course, horrific authoritarian lockdowns in China that have halted its already flailing economy will likely cause some crude oil demand destruction. Combined with accelerating stagflation in the U.S. and Europe, peak oil demand may be passing.

In my view, the best investments today may be commodity futures. While crude oil producers such as those of XOP have been excellent investments, growing labor, regulative, and financial constraints may soon weigh on their margins. For example, "windfall profit taxes" may soon cause much of oil investors' would-be dividends to be taken by the government. Thus, investors bullish on crude oil or those simply looking to hedge against inflation may be much better off with ETFs such as NYSEARCA:USO. Indeed, "roll yield" dividends may cause USO to have a superior yield over the next year than most crude oil stocks, even if spot prices decline slightly. Let's look at USO and the overarching supply & demand dynamics facing the critical commodity.

USO Is Still Benefiting From Positive Carry

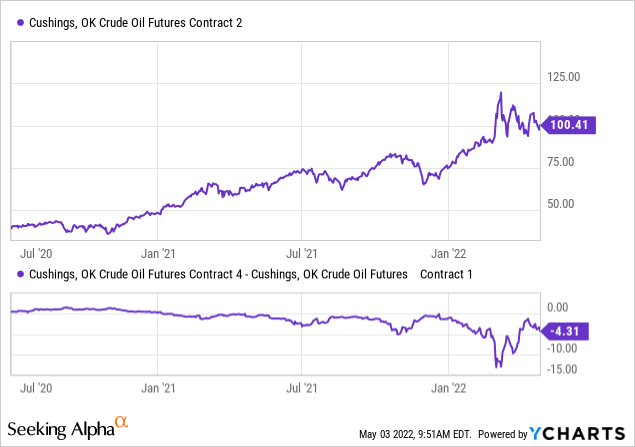

Overall, both supply and demand for crude oil may be declining. This view is somewhat speculative as, until the recent large wave of economically bearish events, oil demand was stellar, and supply was normalizing, albeit very slowly. It is rare for a commodity to face both supply and demand woes simultaneously, but this is the nature of a stagflationary environment. Indeed, looking at the potential "bull flag" price pattern in crude oil, the commodity may rise much higher or reverse much lower. See below:

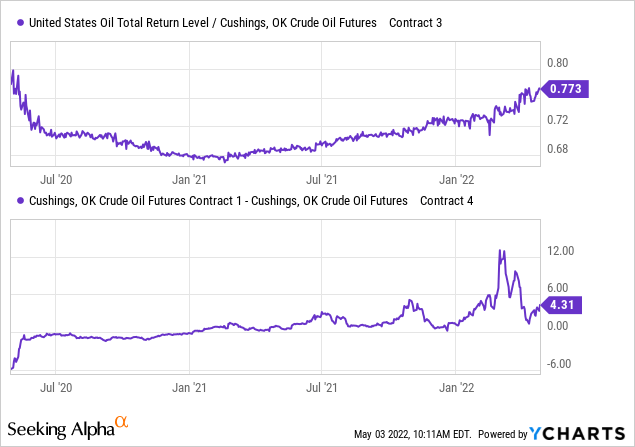

Importantly, crude oil also remains in a state of backwardation where longer-term futures prices are below spot prices. This situation usually occurs during shortages where there is minimal demand for storage. Backwardation is beneficial to crude oil futures investors and funds such as USO since they generate a positive "roll-yield" as longer-term futures appreciate toward spot prices as the delivery date becomes nearer.

For example, June 2023 crude oil futures are currently (as of the time of writing) at $86.13, while June 2022 contracts are at $104.2. If investors purchase those June 2023 futures, they'll earn a ~21% annual "roll yield" as long as spot prices remain constant. Since the 2020 crude oil storage crisis, the market has been firmly stuck in backwardation, leading to excess profits for USO investors. See below:

Indeed, USO has generally been a poor investment due to "contango," where longer-dated contracts are more expensive than spot prices, leading to its long-term decay. However, that was essentially the case during the 2014-2020 "oil glut" era when there was an excess demand for oil storage. As long as the market remains in shortage, USO will generate a positive carry. Looking at the rising spread between contract prices (shown above), it seems this carry yield may still be rising. This yield is also likely to remain somewhat stable since USO now owns a full year of contracts instead of just the front month as it detrimentally did in the past.

Draconian Policies Could Kill Oil Demand

On the one hand, draconian lockdown measures in China are likely leading to some material reductions in crude oil demand. Additionally, global air travel prices have skyrocketed due to the cost of crude oil. Over time, this will undoubtedly lead to some demand destruction as people and companies avoid unnecessary air travel. Given the significant decline in U.S. personal savings rates, some domestic demand destruction seems assured.

Of course, crude oil consumption can only fall by so much. During a "normal" economic slowdown or even a significant recession, oil consumption only declines by around 5% since most oil demand sources have very low price elasticity. Specific energy uses, such as vacation travel, are likely far more price-sensitive than others, such as food transportation. On the other hand, the labor, capital, the war, and other factors impairing oil producers' output may lead to declines in production that outstretch cyclical decreases in demand. For example, even if a severe recession causes oil demand to drop 10% if crude oil output falls 15%, the oil price will likely rise dramatically.

That said, in places like China, even gas consumption for food transportation is likely slowing as many of its citizens are not currently allowed to go to grocery stores, with many people starving at home. China's situation demonstrates how draconian government policies can lead to massive declines in economic activity - far more extensive than declines stemming from regular economic demand cycles.

In my view, this is crucial for investors to keep in mind since recent trends suggest even western governments are not immune to pursuing such strict and extreme government policies. Regardless of one's opinion on the virus issue, it is a proven fact that "zero-covid" type lockdown measures are economically disastrous, and the struggle to normalize output since 2020 implies the consequences are long-lasting.

If draconian measures in China remain or, once again, spread to western nations, then I believe the potential decline in crude oil consumption will outstretch the expected production decline. In 2020, widespread lockdowns led to a severe build in crude oil inventories and an extreme drop in the oil price to <$20. On the one hand, strict lockdowns cause highly deflationary demand declines. On the other, the long-lasting impact on production would likely cause oil output losses to become more severe as it is much easier to turn off an oil well than to turn it back on.

Why The Crude Oil Shortage May Worsen

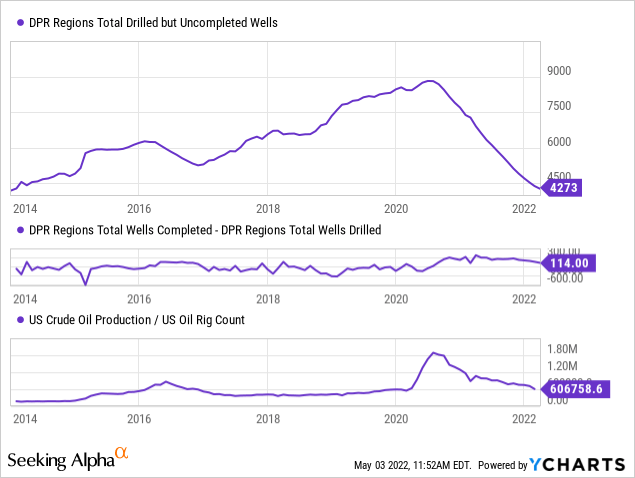

There is evidence that the uptick in U.S. oil output may not last even if prices remain high. Despite high profits, most large oil companies are keeping capital spending and exploration expenses to a minimum due to growing regulation, financial pressure, labor and parts shortages, and a lack of explored drilling sites. As such, the bulk of recent crude oil development has been from "drilled but uncompleted" or "DUC" oil wells, which were mainly drilled before 2020. As oil producers run out of "DUC" well inventories, it will become far more expensive for them to maintain production levels since most new oil wells see an ~80% decline in output during their first two years (as well pressure declines).

Importantly, for oil companies to maintain constant production, they must continuously drill new wells since most are highly reliant on young wells (as they're the most profitable). This was particularly true during 2020 as oil producers rapidly shut off older (far less productive) oil wells to save money. As oil prices have risen, per-well oil production has declined as most of those wells are now back online. Even still, "DUC" inventories are very low and show few signs of improvement as new drilling activity remains depressed. See below:

Since few new wells have been drilled since 2020, we may soon face a "gap" as recently completed wells see significant first-year oil production declines. This has already been the case, as seen in the oil production-to-rig count ratio declines. That said, total oil production has remained constant since the rig count has been rising back to normal. Problematically, however, the rig count is now almost back at pre-COVID levels, so that factor can no longer offset the impact of young well depletions. Since drilling activity has been low and DUC inventories are minimal, oil companies have very few means of keeping production flat and may soon see production drop even lower.

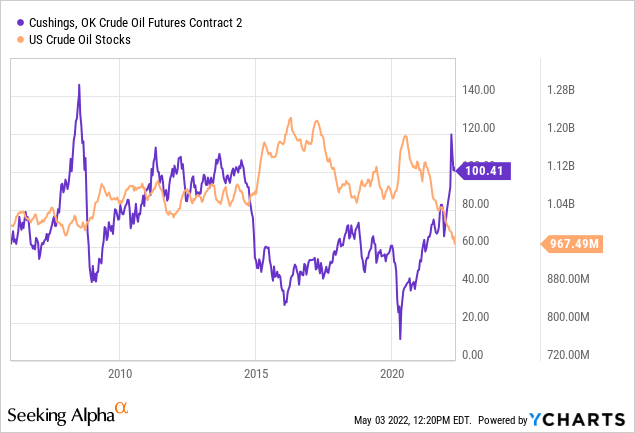

Eventually, new drilling activity should rise as DUC inventories are entirely depleted, but there may be a year or so of production declines due to the lag. This issue does not appear to be limited to the U.S. OPEC nations have been unable to meet already-strict production limits. Combined with Russia's (the second-largest crude exporter) difficulties selling oil, it seems global crude oil production is volatile. Given the abysmal state of U.S. oil storage levels, a potential further increase in shortages may cause prices to rise astronomically. See below:

In 2008, when crude oil storage levels were similar, the oil price rose to $140/barrel. Of course, oil storage levels were far more stable then and were not declining rapidly. Indeed, based on the"DUC dilemma" issue, the rate of oil storage declines may accelerate over the coming months and potentially reach critically low levels.

Strategic petroleum reserve levels are also very low and falling exceptionally quickly, so if the shortage continues, there may not be an easily accessible backup reserve available. In such a situation, I would not be surprised to see crude oil reach and likely surpass $200/barrel since most oil consumption sources are not price-sensitive. In my view, the only way this can be avoided is through some strict government mandates that result in extreme declines in oil demand. Of course, looking at Shanghai's nightmare, it seems there may be growing global pushback against overarching government mandates. Thus, I believe it is generally unlikely oil demand will decline enough for the worldwide shortage to end quickly.

The Bottom Line

While a bearish case regarding crude oil and the ETF USO can be made, the bullish case seems much stronger. A slowing global economy may indeed depress some oil demand, but a recession alone is unlikely to have a sufficient impact to offset chronically low output. For oil demand to decline enough for the shortage to end, the price will need to rise to such extreme highs that demand falls by 5-15%.

Assuming the short-term price-demand elasticity of crude oil is still around -0.05, the oil price would need to double for only a 5% decrease in demand. Long-run price elasticity is less extreme, and elasticity measures are not always reliable. Still, considering there is still a 5-10% supply-demand gap and no reliable signs of output normalization, crude may need to reach the $200-300 level for the shortage to end.

Of course, government actions could hypothetically exogenously restrict demand (as seen today in China), so USO is undoubtedly a more speculative bet today. That said, the upside potential in crude seems to be larger than the downside risks, and, combined with its attractive positive roll yield, the fund has some cushioning against another demand shock. Overall, I am bullish on USO and, unless significant changes occur, believe crude oil is headed to an all-time high this year.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in USO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.