IUSG: Beware Of Risks As Higher Rates Dent Growth Premia

Summary

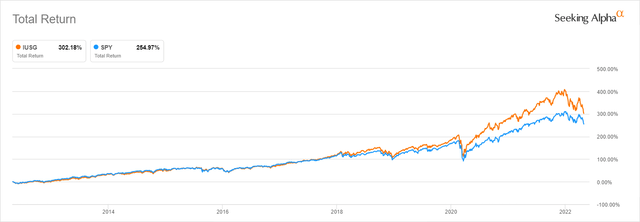

- For IUSG, a top-heavy bet on the U.S. growth bellwethers, April 2022 had appeared to be the toughest since inception as higher interest rates were denting growth premia.

- 1Q22 earnings of tech behemoths failed to prop up investor sentiment.

- IUSG's microscopic exposure to value stocks (measured using the Quant data) means more losses should rotation out of expensive stocks continue.

- IUSG has quality close to perfect as over 97% of its net assets are allocated to stocks with at least B- Profitability grades, but this alone is not enough for a Bullish rating.

PercyAlban/iStock Unreleased via Getty Images

This week, exultancy amongst growth style skeptics has had solid reasons.

First, Alphabet's (GOOG) (GOOGL) Q1 appeared rather mixed. Then euphoria bolstered by Meta Platforms' (FB) earnings beat that catapulted its share price evaporated quickly when Amazon (AMZN) reported rather sluggish Q1 results and shared soft guidance. The strong results from Microsoft (MSFT) also did little to prop up optimism. Apple's (AAPL) Q1 report also received a rather cold response.

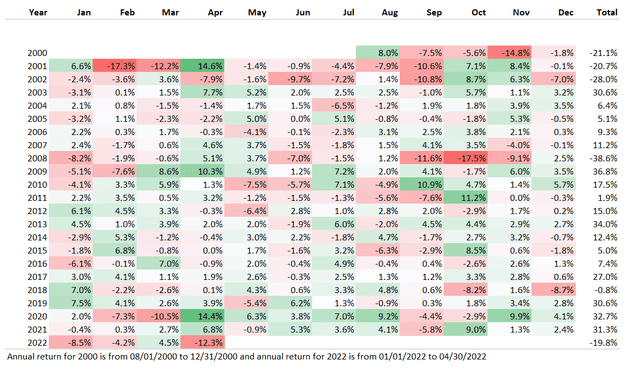

As a consequence, the SPDR S&P 500 Trust ETF (SPY) saw its worst April since 2000, with a negative return of ~8.8%.

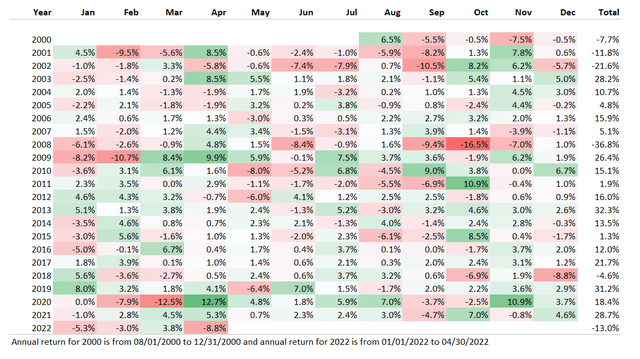

Created by the author using data from Portfolio Visualizer

For the iShares Core U.S. Growth ETF (NASDAQ:IUSG), the fund we will be discussing today, which is heavy in all the above-mentioned tech behemoths (a massive ~41% allocation), last month was also amongst the worst in its more than a two-decade history, with only November 2000, February 2001 (the dot-com bubble era), and October 2008 (the first shock of the Great Recession) being more dismal. Even March 2020, though marred by the coronavirus crisis, was better for the fund, with just ~10.5% decline. And most importantly, lackluster April essentially nullified IUSG's March attempt to par losses incurred earlier this year, e.g., in February, when it declined by ~4.2%.

Created by the author using data from Portfolio Visualizer

What does that mean? Unnerved by inflation and interest rates, investors are now hyper-sensitive to gloomy news. Every piece of news pointing to the deceleration of growth results in a brutal sell-off.

And even though I was gradually becoming optimistic about the large-cap tech echelon in March, a solid bullish case is hard to construct right now.

That said, IUSG is clearly not the best pick at the moment, considering 2022 might turn out to be one of the toughest years for growth investors in the last two decades.

The investment strategy and the portfolio

IUSG's investment mandate is to track the float-adjusted market-cap-weighted S&P 900 Growth Index, which is supposed to encompass the large- and mega-cap U.S. equities sporting relative growth characteristics.

In essence, a candidate's profile is assessed using the same minimalist ratio set as in the case of the value-focused version of the index which is tracked by the iShares Core S&P U.S. Value ETF (IUSV), which I covered in July last year. Assessing growth, the index provider takes into account the 3-year net changes in adjusted EPS over the current stock price, 3-year SPS growth, and a twelve-month change in price (momentum).

Unlike the index tracked by the Invesco S&P 500 Pure Growth ETF (RPG), IUSG's benchmark can contain stocks that exhibit both value and growth characteristics, so the fact that it has ~34% overlap with IUSV does not come as a surprise. More details on the index construction process can be found in the methodology.

As of April 27, IUSG had approximately 73% of the net assets invested in companies with market values north of $100 billion, and around 39% allocated to the $1 trillion league consisting of the tech bellwethers mentioned above. Companies valued at less than $10 billion accounted for slightly below 5%. This is seemingly ideal for investors seeking concentrated exposure to the largest U.S. companies delivering robust growth rates. More likely, its reliance on a just handful of winners allowed it to beat SPY six times since 2012, including stellar 2020 notable for over 14% higher return vs. the SPY ETF. However, the flip side is that four years of underperformance (2012, 2014, 2016, and 2019) and dismal first months of 2022 were also likely caused by the exact same issue: too much capital allocated to only a few names. So, yes, IUSG is extremely top-heavy, and this substantially amplifies risks, especially amid the persisting inflation, the market's expectations for the interest rates' trajectory, and the growth premia becoming slimmer as the prospects of capital scarcity take their toll.

It is worth noting that its peer iShares Russell 1000 Growth ETF (IWF), which I covered a few months ago, has the exact same issue given methodology similarities. Besides, both are overweight in information technology and consumer discretionary (mostly because of both funds' material investments in AMZN and Tesla (TSLA)) and underweight in energy, the sector that has delivered phenomenal gains year-to-date on the back of the oil price rally, and utilities, which have been mostly flat.

Created by the author using data from the funds

Next, the fact that IUSG has an overlap with IUSV begs a question of how substantial its exposure to the value factor is. A few quick observations should be sufficient to answer that question. First, just 3.8% have Quant Valuation grades of at least B-, including 15 tech players like Cisco Systems (CSCO) and Seagate (STX). Anyway, a trace amount, to be frank.

Meanwhile, over 80% are priced for perfection, with Valuation grades of D+ or worse, like the era of almost free capital has not come to an end. Those with an F grade, the worst possible, have an over 41% weight. Moreover, 34% of the IUSG holdings are $100 billion+ companies with an F rating, including four in the top ten, namely AAPL, AMZN, TSLA, and Nvidia (NVDA). So it goes without saying that IUSG's portfolio will continue suffering should the rotation out of expensive stocks gain momentum.

Put another way, its valuation profile is currently offering no margin of safety, at all.

What surprised me a bit is that IUSG has only ~19% exposure to stocks with a Quant Growth rating of at least B-. It should be noted that in November, IWF had a much larger allocation, ~44%. Another peer, RPG, which I dissected in January, had ~53%. However, it all comes down to the methodology difference; IUSG's underlying index is based on only three growth indicators, while the Growth grade relies on a much broader set of metrics which are compared to the sector medians and a company's five-year averages.

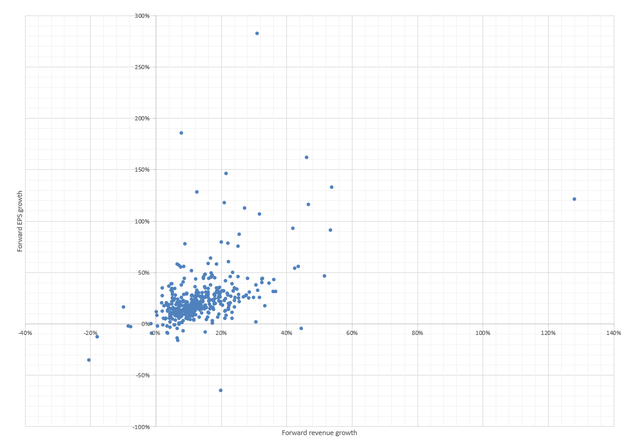

Next, it should be noted that with IUSG, investors also get small exposure to companies that are forecast to either encounter earnings decline or sales contraction, or both, like Navient (NAVI) and Azenta (AZTA). For better context, the scatter plot below summarizes forward revenue and EPS estimates for ~98% of the IUSG holdings.

Created by the author using data from Seeking Alpha and the fund

As usual, I should touch upon the quality factor measured by the Profitability grade. There is little to criticize here. Over 97% of the holdings have sector-leading margins and capital efficiency while all the 20 major holdings accounting for ~60% of the net assets have A+ grades. Again, as the fund is naturally heavy in mega-caps, its quality is barely a concern. But valuation is much more important now.

Final thoughts

Is IUSG a Buy? On the one hand, the fund is relatively cheap, with a microscopic expense ratio of just 4 bps. Its past performance was robust, and even after the sluggish first months of 2022, its 10-year total return is still grossly ahead of SPY.

Additionally, as April 2022 appeared to be one of the softest since inception, contrarians will likely highlight that the opportunity has emerged. But I am not that optimistic.

On the other hand, its blockbuster 2020 performance that is responsible for the bulk of the 10-year return would be extremely hard to replicate in the future, if possible, at all, especially considering its dangerous valuation. Persistent inflation, gloomier expectations for the interest rates, and soft guidance from a few tech heavyweights add to the difficulties of loyal tech and growth bulls. That said, IUSG is a Hold, at best.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.