Weekly Yield Hunting CEF Commentary - April 24, 2022

Summary

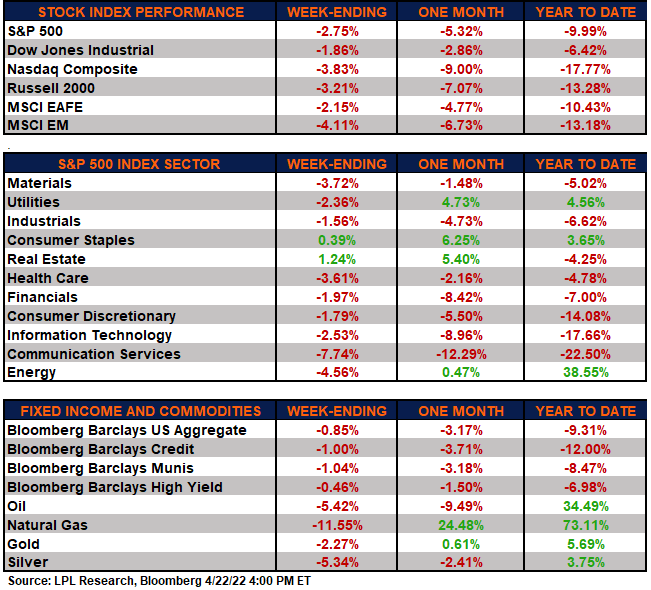

- We had another down week nearly across all asset classes with the markets shedding nearly 3% and the Nasdaq nearly 4%. Fixed income was also down. Nothing worked.

- Yields were up again with the 10-year touching 2.95% on the week but finishing at 2.90%. Oil was down $5 to $101/bl and the VIX was up again to 23.

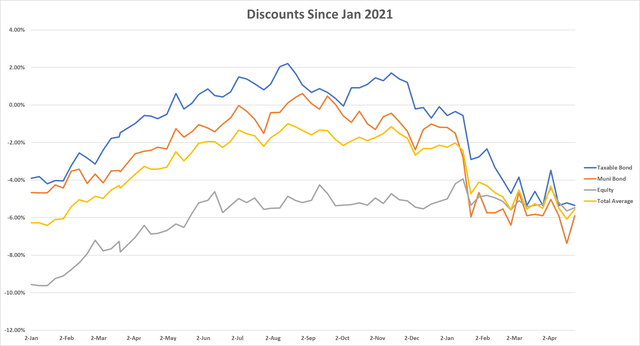

- Discounts in muni CEFs tightened up back to the levels of a few weeks as NAVs fell hard towards prices. Equity/taxable CEF discounts haven't budged in April.

- Top buys and sells of the week below.

- I do much more than just articles at Yield Hunting: Alt Inc Opps: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

master1305/iStock via Getty Images

(This report was first issued to members of Yield Hunting on April 24. All data herein is from that date. This is an example of our Commentary sent to members each Sunday evening.)

Macro Picture

We had another down week nearly across all asset classes with the markets shedding nearly 3% and the Nasdaq nearly 4%. Fixed income was also down sharply as well as commodities. Nothing really worked in the last week.

Yields were up again with the 10-year touching 2.95% on the week but finishing at 2.90%. Oil was down $5 to $101/bl and the VIX was up again to 23. The broad municipal bond market delivered firmly negative returns through most of the week and underperformed U.S. Treasuries by a wide margin.

The weakness in the markets came from a bad earnings report from Netflix (NFLX) which fell another 35%, but also continued rhetoric from the Fed about being aggressive at taming inflation. In fact, there is now talk of a further pivot to doing a few 75 bps moves on the front end in order to 'catch up' as they found themselves working from behind.

At the same time, Fed officials are expected to commence the runoff of assets from the Fed's near $9 trillion balance sheet. Treasury yields rose on the news, particularly on the short end where the 2-year Treasury increased to 2.73% after starting the week around 2.50%.

Mortgage rates in the US continue to rise with average 30-year rates reaching 5.2%, their highest level in more than a decade. MBA mortgage applications fell for the week ending April 15 with a 3% drop in purchases and a 7.7% drop in refinances. I have a hard time believing that these sharp rise in rates won't in some way affect the housing market.

lpl financial

CEF Market Review

alpha gen capital

Discounts in muni CEFs tightened up back to the levels of a few weeks as NAVs fell hard towards prices. Equity and taxable bond CEFs were largely unchanged and haven't moved much at all in April.

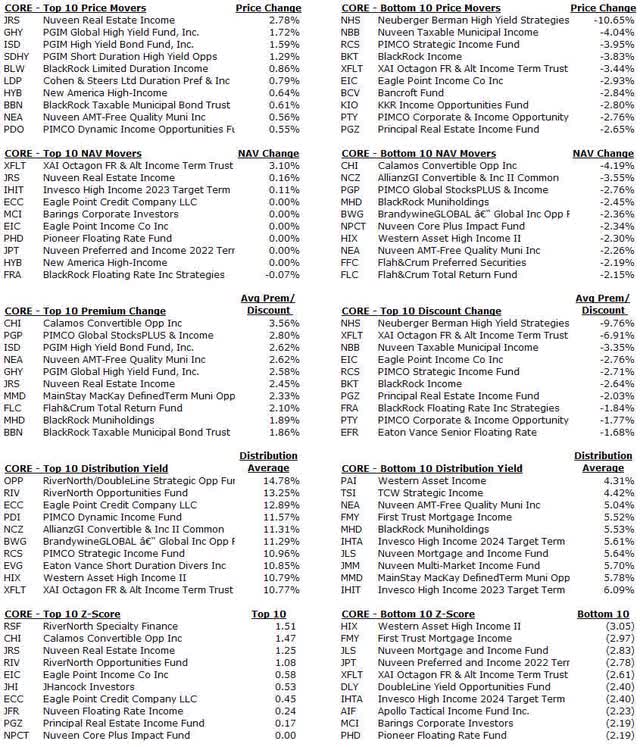

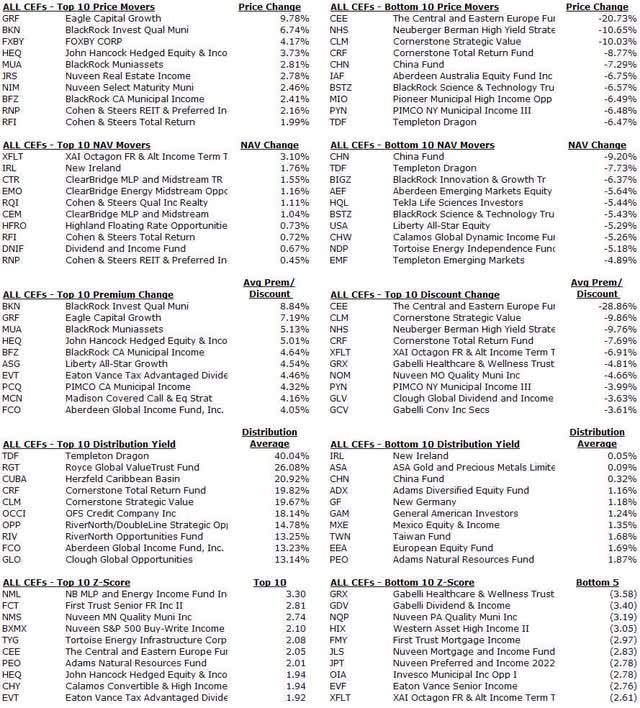

The only sector that was up on the week in price was real estate which rose 1.1%. The same on NAVs with real estate the lone sector in the green rising 0.27%. The worst performer was EM equity which fell -3.9% on price and -5.6% on NAV.

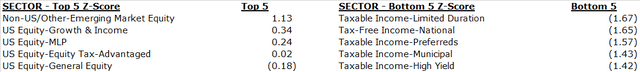

The bottom z-score sectors are all on the bond side. What's surprising is that 'limited duration' is the cheapest of them all. In bonds today, investors want limited duration and not duration so it is surprising that it is cheaper than munis and preferreds which have significant duration.

alpha gen capital

Taxable bond CEF NAVs have shown some resilience in the face of fast-rising interest rates. You do have to question a few of the NAVs where perhaps the underlying aren't being accurately priced. Regardless, most of these are loan funds that have some insulation towards rising rates.

ycharts

Loan funds are trading at a -6.8% average discount which is now the widest it has been in a while. This is about the 66th percentile meaning that 66% of the time they are trading at a discount that is tighter. For one of the best NAVs in the taxable space to be trading at a cheaper valuation that is cheaper than high yield, real estate, taxable munis, and utilities.

----------------------

The big loser on the week was Neuberger Berman High Yield Strat (NHS) which tanked in the last week by over 9%. Most of the decline was because of a prior week's run-up. The yield is 10.7% which is well more than it earns. That has had an effect on the NAV which has moved lower by more than $2 in the last year.

On the other side, PIMCO Global StocksPLUS & Inc (PGP) and Mainstay MacKay DefintedTerm Muni Opp (MMD) both saw decent gains in valuation. The two PGIM high yield funds also rose in value with High Yield Bond (ISD) and Global High Yield (GHY) rising 2.5%.

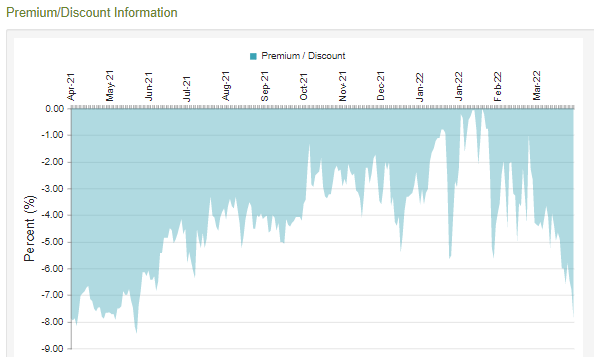

If investors want to look at some taxable CEF ideas, in addition to XFLT above, check out BlackRock Floating Rate Strategies (FRA). This fund has been on my "sell list" for some time as it was trading near NAV for about six months. In the last two weeks, the price has fallen off while the NAV has been firm. The discount has widened out to nearly -8% with a yield of 6.4%.

You can see from the chart below the discount is back to where it was a year ago.

cefconnect

Top Buys of the Week:

- XAI Octagon FR & Income (XFLT)

- BlackRock Floating Rate Strategies (FRA)

- Neuberger Berman High Yield Strat (NHS)

Top Sells of the Week:

- First Trust Senior FR Inc II (FCT)

- RiverNorth Specialty Finance (RSF)

- Calamos Conv & High Inc (CHY)

- Aberdeen Inc Credit Strat (ACP)

- Guggenheim Strategic Opp (GOF)

Next Week:

April 29: Nuveen Enhanced Municipal Value (NEV) and Nuveen Municipal Credit Income (NZF) are voting to merge the funds. NZF will be the surviving fund. There's a little bit of play here as the discount variance between the two funds is about 1.4% meaning you pick up some juice by rotating from NZF to NEV only to get NZF shares back should the merger go through.

May 6: Western Asset High Income II (HIX) has a rights offering that is expiring. If you own the rights and do NOT plan to subscribe for new shares, I would sell them on the open market. They are not trading for much but you get something.

Commentary

I received several questions in the last week asking if I really believed that we would see muni distribution cuts totaling 15-25% over the next year among nearly all funds, why would I hold them today?

It is a good question and gets back to assessing the type of investor you want to be. If you want to be tactical and avoid market value declines then you would likely have sold or still sell today. Even after the declines that we have seen since the start of the year.

In my personal portfolio, I did cut back my muni CEF positions significantly from the end of January through mid-February. Obviously, that wasn't at the top as most had already experienced a 5% decline or more. But since then, they've fallen another 5% or more. However, for me, I don't need the income currently.

Many investors who live off the income would and probably should, just ride the wave. As I've been noting several times in the past couple of months, interest rate changes causing value declines are typically not a permanent impairment of capital. As rates rise the value of bonds falls. But when rates go back down, the value rebounds.

The question will be how long rates will keep rising and then even when they are not, how long will they stay elevated as opposed to come down?

The cuts that we will experience this year, especially in munis, were just the opposite in 2020 with many distribution increases. That came from substantially falling interest rates after the start of the pandemic.

Before that, in 2018, we saw a rash of distribution cuts from rising rates during that time period. And back and back we go. You could attempt to be tactical and avoid the cuts- which we tend to do on a fund-specific level. Or you can focus on the income production.

We can also take a counter-cyclical approach and rotate away from muni CEFs towards muni mutual funds to reduce our discount/valuation risk. This is something we did at the end of last summer as muni CEF valuations were at premiums and in the top 10% of historical observations.

I don't consider this overly tactical though it does move us away from a strict buy-and-hold philosophy. I call it the buy-and-rent method or a long-term buy strategy that is not as strict in the covenant against rotating away during periods of overvaluation.

Even with the massive declines so far this year for a supposedly 'safe' asset class, you are still generating 3.5%-4.5% returns on average over the long-term. If/when the class rebounds, the long-term numbers will rise back towards 5%-5.50% where they were at the start of the year.

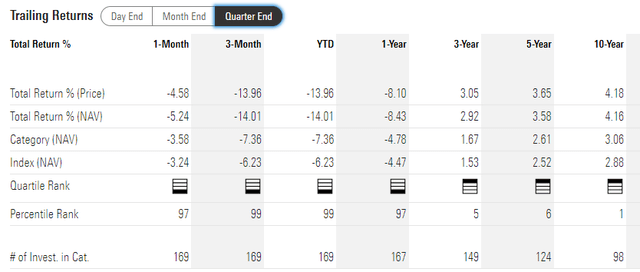

morningstar

For those looking to solve the retirement income challenge, bond CEFs, tax-free or taxable, remains a key component of the solution. They are, of course, not infallible. There will always be a negative with every security in your portfolio. The key is fitting different pieces together for your own personal solution to the problem.

More to come...

CEF News And Corporate Actions

Distribution Increase

N/A

Distribution Decrease

Neuberger Berman Muni (NBH): Distribution decreased by 19.5% to $0.05025

F&C Preferred and Income (PFD): Distribution decreased by 4.85% to $0.0785.

F&C Dynamic Preferred and Income (DFP): Distribution decreased by 4.75% to $0.1505

F&C Total Return (FLC): Distribution decreased by 4.7% to $0.122

F&C Preferred Sec Income (FFC): Distribution decreased by 4% to $0.119

F&C Preferred Income Opp (PFO): Distribution decreased by 2.2% to $0.0655.

Rights Offering

Gabelli Utility Tr (GUT): The fund announced the successful completion of their transferable rights offering in which the fund will issue 9.13mm shares of new common shares raising $50.2mm.

- The Offering was over-subscribed. Pursuant to the Offering, the Fund issued one transferable right (a “Right”) for each common share of the Fund held by shareholders of record as of March 10, 2022 (“record date shareholders”). Holders of Rights were entitled to purchase common shares by submitting seven Rights and $5.50 for each share to be purchased (the subscription price). The Offering expired at 5:00 PM Eastern Time on April 19, 2022 and the Rights no longer trade on the New York Stock Exchange.

Liquidation

Nuveen Credit Opp 2022 Target Term (JCO): The fund announced new details concerning its liquidation. It is expected to liquidate on or about June 1, 2022.

- As the fund approaches liquidation, its common shares will continue trading on the New York Stock Exchange through May 25, 2022 and will be suspended from trading before the open of trading on May 26, 2022.

- The fund will not declare its regular monthly distribution in May 2022 and expects to make a special income distribution in connection with the fund’s liquidation. The amount and dates applying to any special income distribution will be announced at a later date.

- The fund anticipates making its final liquidating distribution on or about June 1, 2022. As previously announced, the fund entered its wind up period in anticipation of its termination date. Leading up to the final liquidating distribution date, as the fund’s portfolio securities continue to mature and are sold, the fund may further deviate from its investment objectives and policies, and its portfolio will continue to transition into high quality, short-term securities or cash and cash equivalents.

Statistics

Sector:

alpha gen capital

Core:

alpha gen

All CEFs:

alpha gen

----------------

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

This article was written by

- YH Core Income Portfolio: yield ~8%

- YH Flexible Income Portfolio: yield 7.53%

- YH Taxable Core Portfolio: yield 5.24% (some tax free)

- YH Financial Advisor Model

Plus: Muni CEF Shopping List.

Our team includes:

1) Alpha Gen Capital - I am a former financial advisor and investor. Not someone from another career doing this on the side. My analysis is meant to provide safe and actionable insight without the fluff or risky ideas of most other letters. My goal is to provide a relatively safer income stream with CEFs and mutual funds. We also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies:1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.3) Landlord Investor- spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.

www.YieldHunting.com

Disclosure: I/we have a beneficial long position in the shares of XFLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.