A-Mark Precious Metals: Consistently Profitable In A Growth Business

Summary

- Long-term bull markets in gold and silver.

- Platinum group metals have been volatile.

- Inflation has caused investment demand to grow.

- A-Mark has a diversified metals business and impressive earnings.

- An explosive trend looks set to continue.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

PashaIgnatov/iStock via Getty Images

I began my career in the early 1980s at Philipp Brothers, a leading commodity merchant company. After working in the traffic department transporting raw materials from producers to consumers, I found myself in the precious metal department, where I learned the business from the bottom up in the operations department. My job was to fulfill the traders' commitments by transferring gold, silver, and platinum group metals by book entry and shipping the metals to the company's many customers. Philipp Brothers was a worldwide wholesaler, with trading partners ranging from other bullion dealers, producers, consumers, central banks, supranational institutions, and retailers. A-Mark Precious Metals was a customer that bought physical precious metals from the company for resale to its' customer base. The California-based company began its operations in 1965. By the time I started dealing with them, it was already a decade and a half old with an excellent reputation and growing customer base. Four decades later, Philipp Brothers is long gone, but A-Mark Precious Metals, Inc. (NASDAQ:AMRK) is still going strong as a publicly traded company with a nearly $910 million market cap.

Long-term Bull Markets In Gold And Silver

Bull markets attract speculative and investment interest. Since the turn of this century, gold and silver have been trending higher and providing positive returns for market participants.

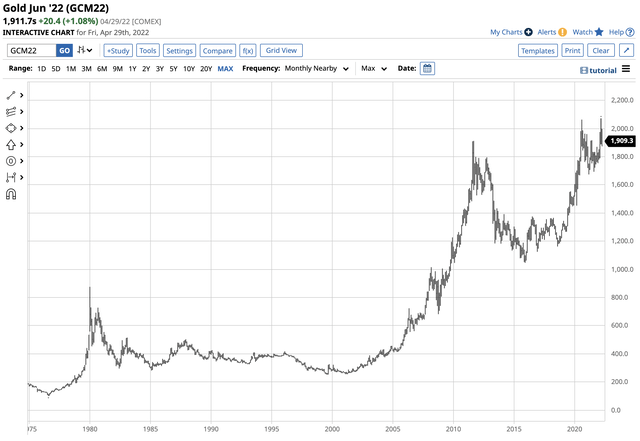

Long-term Gold Futures Chart (Barchart)

As the chart dating back to the 1970s shows, gold reached a significant bottom in 1999 at $252.50 per ounce. Since then, the precious metal has made higher lows and higher highs, with the most recent peak in March 2022 at $2072 per ounce. Holding gold, the world's oldest means of exchange and a hybrid between a commodity and currency, has been a store of wealth and value for investors over the past twenty-two years.

Silver is a lot more volatile than gold, but it has also provided positive returns over the past two decades.

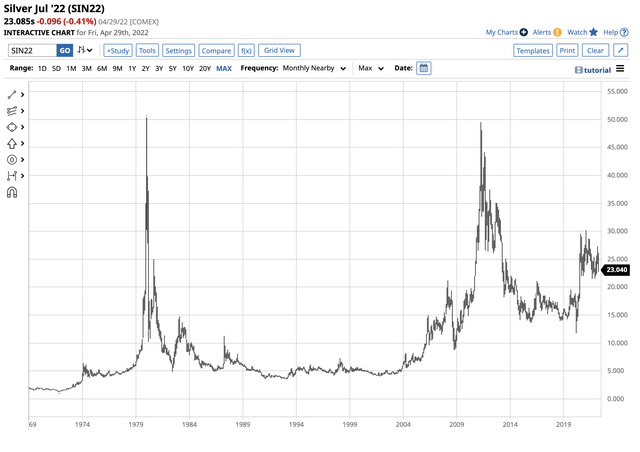

Long Term Silver Futures Chart (Barchart)

Nearby silver futures fell to a low of $4.026 per ounce in late 2001, and the volatile precious metal that trades like a commodity has made higher lows over the past twenty years.

Buying gold and silver for long-term investment has been a profitable strategy since the late 1990s. While gold and silver were below highs on April 29, Gold was around the $1910 level with silver just above $23 per ounce, with both providing attractive returns for long-term holders who purchased the metals around the turn of this century.

Platinum Group Metals Have Been Volatile

Platinum group metals that trade on the CME's NYMEX division have been volatile. The namesake metal, platinum, has lagged the other precious metals, while palladium has been a leader. However, since the late 1990s, both metals have appreciated for investors and long-term holders.

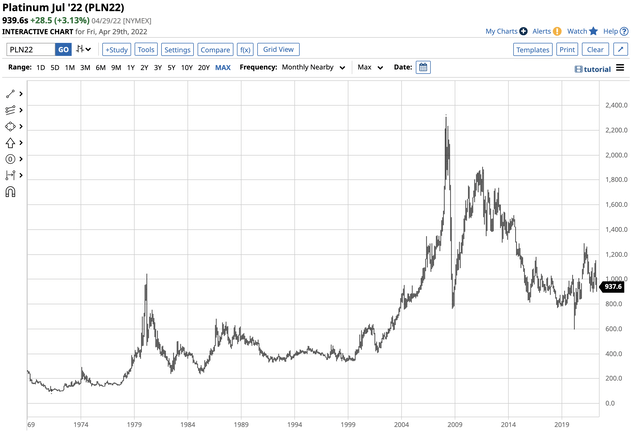

Long-term NYMEX Platinum Futures Chart (Barchart)

In 1998, platinum reached a low of $332 per ounce. While it exploded to over the $2,300 level in 2008 and imploded the same year, the price at the $940 level on April 29, 2022, was significantly higher than the 1998 low.

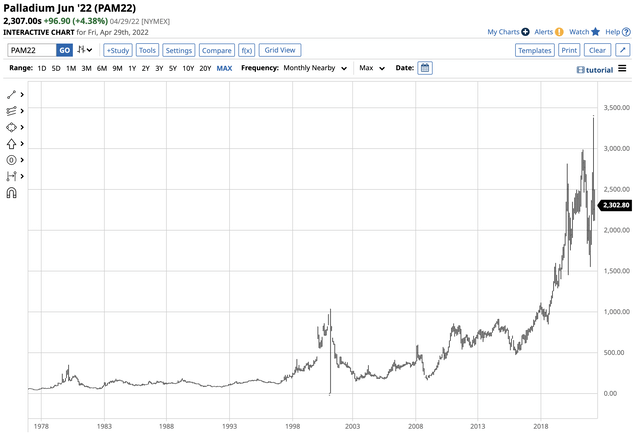

Long-term NYMEX Palladium Futures Chart (Barchart)

Palladium futures traded below $100 per ounce in the early 1990s as the former Soviet Union liquidated its stockpiles. By the end of 1999, the price was near the $450 level. In 2022, palladium reached over $3,380 per ounce and was at the $2,307 level on April 29, 2022.

Platinum and palladium are industrial and precious metals that clean toxins from the environment. Addressing climate change has caused the demand and utility for platinum group metals to rise. Gold is a financial asset and the world's oldest means of exchange. Central banks continue to validate gold's role in the financial system, and governments hold gold as an integral part of their foreign exchange reserves. Moreover, they have been net buyers of gold over the past years, with China and Russia significantly increasing their reserves. The war in Ukraine and western sanctions on Russia caused the Russian government to tie its currency, the ruble, to gold, declaring that 5,000 rubles are exchangeable for one gram of gold. If Russia's ally China follows and backs its yuan with gold, it would have substantial ramifications for the US dollar's standing as the world's reserve currency and the gold price.

Silver is also an industrial and precious metal, and silver is a critical component in solar panels, electronics, water purification, and other industrial products. It is also an investment metal that tends to magnify gold's price volatility, making it attractive for trend-following speculators.

Inflation Has Caused Investment Demand To Grow

The most recent March consumer and producer price indices rose by 8.5% and 11.2%, respectively, the highest levels in over four decades. The central bank liquidity and government stimulus programs planted inflationary seeds that began to spout in 2020 and moved into full bloom in 2021 and 2022.

The US Fed will meet this week and will likely increase the short-term Fed Funds rate by 50-basis points to a range of 0.75% to 1.00%. The FOMC will also roll out a program to reduce its balance sheet, pushing rates higher further out along the yield curve. The prospects for higher rates have been bullish for the US dollar.

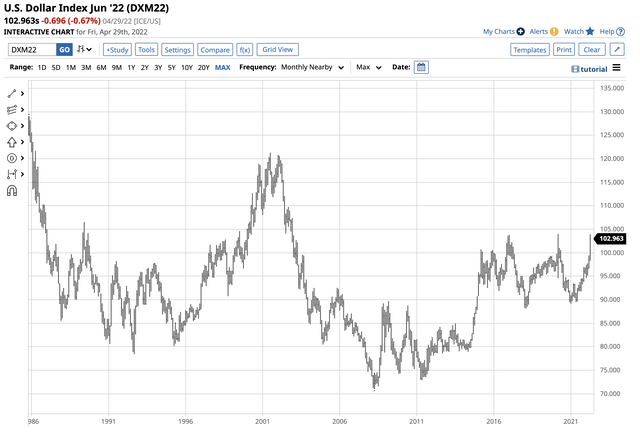

US Dollar Index Futures Chart (Barchart)

The chart of the US dollar index shows the move to a high of 103.95 level last week, only 0.010 below the March 2020 peak, which was the highest level for the US currency since 2002.

Typically, higher interest rates and a strong US dollar are bearish for precious metals prices. Rising rates increase the cost of carrying physical precious metals positions and make other fixed-income investments more attractive, shifting capital away from precious metals. The dollar is the world's leading currency and the pricing benchmark for precious metals. As the dollar rises, the prices of the metals increase in other currency terms, causing an increase in selling. Historically, higher US rates and a rising dollar causes selling pressure for the metals, but 2022 is anything but an ordinary time in history.

Raging US and global inflation, the first major military conflict in Europe since World War II, an ideological bifurcation with China-Russia on one side and the US-Europe on the other, and supply chain bottlenecks, trade barriers, and sanctions create uncertainty. Meanwhile, the rising US dollar against other currencies is a mirage as the dollar is only the healthiest horse in the glue factory. Anyone buying goods and services with dollars knows that the purchasing power in 2022 is far less than in 2021, even though the dollar index has moved considerably higher.

Uncertainty in the economic and geopolitical landscapes creates a compelling case for precious metal investments.

A-Mark Has A Diversified Metals Business And Impressive Earnings

A-Mark Precious Metals, Inc. and its subsidiaries are a precious metals trading company operating in three segments:

- Wholesale Sales- This segment sells gold, silver, platinum, palladium bars, plates, wafers, grains, ingots, and coins. The wholesale segment also offers customers other services, including financing, storage, consignment, logistics, and customized financial programs. It also designs and produces minted silver products.

- Direct-to-consumer- This e-commerce segment provides gold, silver, platinum, palladium, and copper products through websites, marketplaces, and media channels, targeting the retail metals markets.

- Secured lending- This segment originates and acquires commercial loans secured by bullion and numismatic coins, servicing coin and precious metals dealers, investors, and collectors.

A-Mark (AMRK) has a broad range of wholesale and retail customers with operations in the US, North America, Europe, Asia-Pacific, Africa, and Australia. The company headquarters are in El Segundo, California.

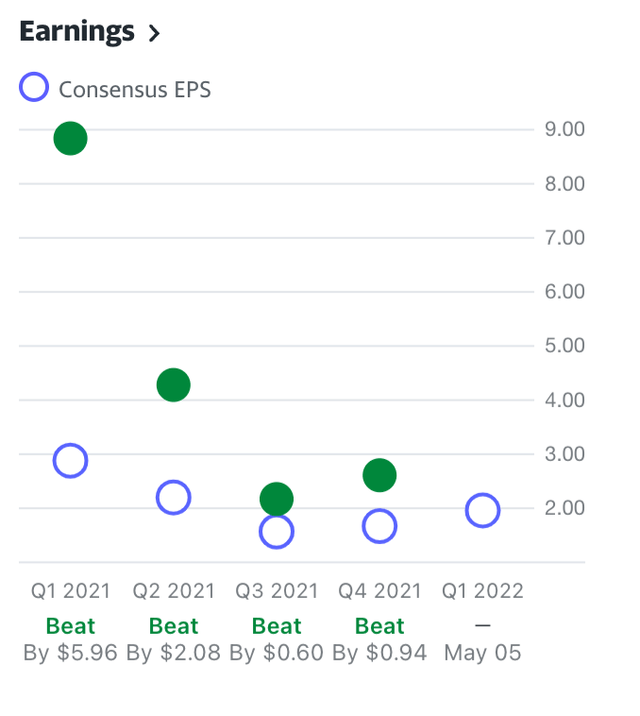

A-Mark EPS Q1 2021- Q4 2021 (Yahoo Finance)

The chart shows that AMRK has beat analysts' quarterly earnings forecasts over the past four consecutive quarters.

An Explosive Trend Looks Set To Continue

At $78.80 per share, AMRK's market cap stood at $907.3 million. An average of 98,450 shares changed hands each day. AMRK pays no dividends, but the trend in the stock has been explosive.

Chart of AMRK Share Price (Barchart)

AMRK shares opened for trading in March 2014 at $12.49. The stock dropped to a low of $7.47 in January 2020 before taking off on the upside, reaching a peak of $89.19 in April 2022, making AMRK an over ten-bagger from the early 2020 low. The recent correction in precious metals prices pushed AMRK shares down to the $78.80 level at the end of last week, but the trend remains bullish.

AMRK is a pick-and-shovel play on the precious metals sector with lots of upside in the current environment.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

The author is long precious metals.