Maruti Suzuki (Representative image)

After a downbeat 2021-22, analysts can sniff a turnaround in Maruti Suzuki India’s fortunes in the coming year.

A lack of substantial car launches, especially in the trending sports utility vehicle space, over the last few years has seen the country's largest car manufacturer cede ground to rivals such as Tata Motors.

In 2021-22, the company’s share of the domestic market shrank 410 basis points to 45 percent, reflecting the damage caused by price hikes to combat commodity price inflation, the impact of semi-conductor shortage and a lack of new models.

The March quarter earnings have likely changed that narrative. Maruti Suzuki reported overall in-line earnings for the quarter, however, its margin performance was sturdier than what most analysts expected.

The car-maker reported an operating margin of 9 percent, which was ahead of Street’s estimate by 40-50 basis points. One basis point is one-hundredth of a percentage point.

The company has suggested that higher input costs were neither beneficial nor detrimental to the company.

Also read: Maruti Suzuki Q4 Results | Key Takeaways

Beginning of comeback

More importantly, the company has restarted a new cycle of launches with fresh models for Baleno, Celerio and XL6. The company is also working on launching a new SUV in the coming months with test runs already underway.

“We expect Maruti Suzuki to gain 150-200 bps market share over the next two-three years due to newer product launches; however we believe it will be challenging for the company to reach greater than 50 percent market share as competitive intensity remains elevated,” brokerage firm Kotak Institutional Equities said in a note.

Motilal Oswal Financial Services, which has a buy rating on the stock, echoed Kotak Equities in suggesting that it expects both market share and margins of the automaker to improve in the coming year aided by a favourable product lifecycle, price action or cost-cutting, and operating leverage.

The sense that the company is turning a corner after two underwhelming years is reflected in the fact that brokerage firm Nirmal Bang Equities has resumed its coverage on the stock with a “buy” rating. It is banking on 13 percent annualised growth in volumes for Maruti Suzuki hereon led by new products and better exports.

Analysts believe that the rising preference for the compressed natural gas (CNG)-enabled vehicle in the face of persistently high petrol and diesel prices could be the gamechanger in the management’s pursuit of reclaiming the 50-percent market-share mark.

“Elevated fuel prices, awareness on cleaner fuel, the government’s push for CNG infra to accelerate CNG penetration to result in outsized gains for Maruti Suzuki,” ICICI Direct said in a note.

Of the 320,000 pending orders on Maruti Suzuki’s book, almost 40 percent are for CNG cars, reflecting the company’s leadership in the space.

Catch all the market action on our live blog

Margin outlook dicey

While volume recovery may be on the anvil for Maruti Suzuki, margin recovery still remains muddled.

With operating margins sinking to a 20-year low of 6.5 percent in 2021-22 due to unprecedented inflation in input prices, analysts are unsure if the company will see a recovery in profitability given that the Russia-Ukraine war will likely keep commodity prices higher for a longer time.

The company was unwilling to commit to any notion of margin recovery in the post-earnings conference call with analysts, as it is negotiating with steel producers.

While steel prices saw an upward swing in March on account of sanctions on Russia and COVID-19 lockdowns in China, they have fallen in the past four weeks, brokerage firm Edelweiss Securities said in a recent note.

“The market view for May-22 appears mixed at this stage with certain primary producers eyeing a further increase in price, however, our channel checks indicate discounts are likely to rise as primary steel markers look to avoid inventory build-up and boost demand,” Edelweiss Securities said.

Valuations attractive

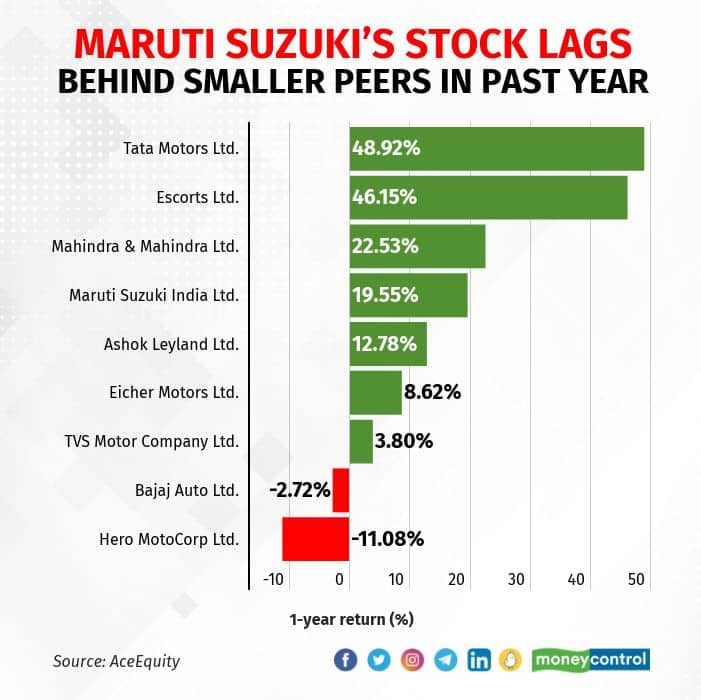

The recent underperformance of Maruti Suzuki compared with the likes of Tata Motors and Mahindra & Mahindra leaves risk-reward comfortable for investors.

Brokerage firm UBS Securities raised its price target on the stock to Rs 10,000 following the March quarter earnings, while Motilal Oswal Financial left its price target unchanged.

Both UBS Securities and Motilal Oswal Financial are among the most bullish on the stock but consensus analysts’ price target for the stock is at Rs 8,900, implying a 15 percent upside from current levels, data available on Bloomberg shows.

The enthusiasm of some analysts, however, did not reflect on May 2, as the stock was trading lower by 0.4 percent at Rs 7,686.4 on the National Stock Exchange at 10.30 am.