Equity CEF Performances: Updated Through April 29, 2022

Summary

- Buying-opportunity or a falling-knife still? That's the question though there were definitely signs-of-panic on Friday as word got out that a couple big hedge-funds were liquidating their technology holdings.

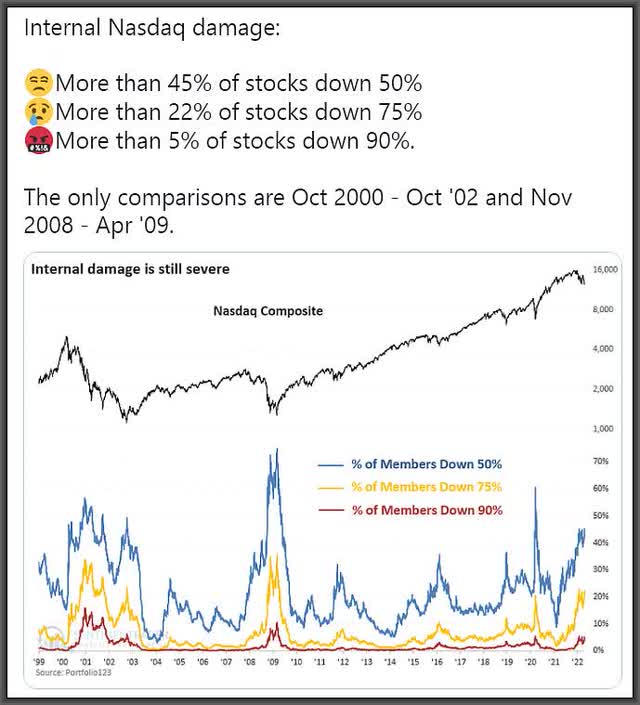

- Certainly, the damage and bearishness is starting to rival that of March of 2020 during COVID, the financial crisis of 2008 and the dot.com bear market of 2000.

- The big difference today is that the US economy isn't going through a major slowdown (at least, not yet) and thus, most of the major-market indices aren't in a bear-market.

- But with the Nasdaq-100 already in a bear market, down -21.2% YTD and a whopping -7.5% for the week, are the rest of the indices bound to follow? Well, that's the problem. We don't know what comes next in the global economy.

- Will the war in Ukraine widen? Will China's lock-down over COVID further gum-up supply chains? Both of these have the potential to knock the markets down again because both are inherently inflationary. Ironically, the Federal Reserve may be the most likely savior as the Fed rate decision and statement are set to come out Wednesday, May 4.

- Looking for a helping hand in the market? Members of CEFs: Income + Opportunity get exclusive ideas and guidance to navigate any climate. Learn More »

Ridofranz/iStock via Getty Images

*As I have done over the last two months, I'm making my last Equity CEF Performance spreadsheet at the end of each month available to my 11,000-plus followers.

**This article was released to subscribers of CEFs: Income + Opportunity on April 30th and includes a weekly market update and expectations for the coming week as well as a review of CEFs/ETFs in the news and any fund recommendations based on valuation and performance changes in the spreadsheet link.

---------------------------------------------------------------------------------------

Below is your YTD Equity CEF Performance spreadsheet link updated through April 29th, 2022:

2022CEFPerformance.4.29.22.xlsx

To start, I'd like to go back to my April 21 article titled, Equity CEFs/ETFs: Are We Seeing A Pattern Here? This article was essentially about how the markets, both bond and equity, we're being held hostage to what the Federal Reserve was saying and what they might actually do at their upcoming meetings this year. As we know, the markets hate uncertainty and they tend to price in a worst-case scenario over time if they don't know what the future holds. And that was exactly what was happening, particularly in the bond markets at the time.

But for equity markets, it was more of a one step forward, two steps back and that's why I have been saying for some time now that we would have stock rallies (maybe a day or a few days) but that the over-all trend would be down.

This has also come to pass and boy, did it last week for stocks. But things are evolving and if you've noticed, bonds have started to firm up while its now equities that are pricing in more of a worse case scenario, particularly as the war in Ukraine threatens to widen and the lockdown in China spreads.

So the real question in my mind is if the Fed has largely accomplished what they may have set out to do by talking down the markets and are already laying the ground-work for a slower and lower inflationary economy. And if that's the case, may they now sense that they don't want things to get too far out-of-hand in the equity markets and they may need to walk back their hawkish tone?

They might have to because the 'Market in Turmoil' headlines are starting to ramp up:

"The worst beginning to a year since 1939"

"The worst month for the NASDAQ in 13-years going back to 2008"

Or how about this statistic from Friday:

The bottom line is that all the signs are there for a short-term rally but by how much and for how long is the question. I still believe this is not a stock market you can invest-in and any buys should be considered short term only.

My preference actually is to sell hedges in this market because a). I own several that are either -2X the inverse of the index direction, i.e. the ProShares UltraShort -2X S&P 500 (SDS), $44.36 closing market price and the ProShares UltraShort -2X Dow30 (DXD), $47.16 closing market price or -3X the inverse in the ProShares UltraPro -3X (SQQQ), $49.03 closing market price, and b). Selling hedges builds up the cash position so you get a double positive out of selling inverse hedges, assuming the sells are at close to market lows.

Note: I sold out of the ProShares UltraShort -2X QQQ (QID), $22.67 closing market price, after only a couple days and obviously too soon

One thing I would NOT do is buy these hedges now. Hedges are only meant to be put-on into market strength and you will more-than-likely be disappointed if you buy them in extreme market weakness like late in the day on Friday.

Equity CEFs

Overall, I would be wary of buying equity CEFs in this market environment simply because emotion and lack of bids can drop these funds more than comparable ETFs which will just reflect their NAV drop.

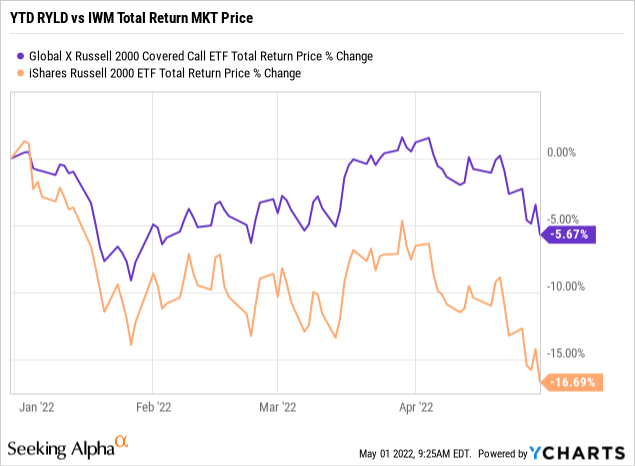

I still think the covered-call option ETFs like the Global X S&P 500 Covered Call Fund (XYLD), $46.61 closing market price, the Global X Russell 2000 Covered Call Fund (RYLD), $22.12 closing market price, and the JPMorgan Equity Premium Income Fund (JEPI), $58.58 closing market price, are your best bets on the long side since they are defensive and offer very high-yields paid monthly. XYLD is currently at a 10.6% market yield, RYLD is at a 13.5% market yield and JEPI is at an 8% market yield.

Here is how much better RYLD is performing over its correlated index, the iShares Russell 2000 Small Cap ETF (IWM), $184.95 closing market price, YTD and that is because RYLD sells (writes) options At-The-Money each month on 100% of the notional value of the portfolio. That brings in a huge amount of premium each month and most of that is being kept in this market environment.

Note: RYLD actually owns the Vanguard Russell 2000 ETF (VTWO), which is essentially no different than IWM

Though I do believe there are some equity CEFs with wash-out market prices, like the BlackRock Science and Technology II fund (BSTZ), $24.02 closing market price, I would still wait on technology focused CEFs and ETFs since you never know how low these can go and it's probably better to wait until we see a bottom in the NASDAQ-100 firmly in place.

In fact, there are only a couple CEFs I would be buying and holding here. One is the Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund (MFD), $9.95 closing market price, and the other is the Cornerstone Strategic Value fund (CLM), $10.37 current market price.

Note: CLM and Cornerstone's other fund, CRF are essentially interchangeable as buys

MFD is by far the more conservative of the two recommendations and I first highlighted MFD on January 19th as an Actionable Buy at $9.87. So with the fund here below $10 at $9.95, I am recommending MFD once again.

If you go to the Equity CEF Performance link above on Sheet1, MFD is in the Top 10 NAV total return performers YTD, up 4.1% YTD though with the drop in the fund's market price below $10, MFD's discount is now back over -8%.

What I like about MFD is the fact that its equity exposure is mostly in oil, gas and consumable sectors (26.5%), electric utilities (21.7%), water utilities (14.4%) and multi-utilities (11.7%). And on the fixed-income side of its 26% leveraged portfolio, MFD owns only senior floating rate loan securities tied mostly to LIBOR.

In other words, MFD's equity exposure, 82.9% of the leveraged total, is in the sweet-spot of securities and sectors that are actually benefiting from inflationary pressures while its fixed-income exposure, 36.4% of the leveraged total, are in securities that can "float-up" in yields as interest rates go up. Talk about a fund that was designed for high inflation and rate increases and your first stop would probably be MFD.

Source: MFD's Quarterly Holdings As Of 2/28/22

The other two CEFs I would recommend on a buy and hold basis, CLM (and CRF) are certainly much higher-risk than MFD though with both funds now down -22.4% YTD (includes distributions added back though not on a reinvested basis) and now trading at 26% market price premiums (see Sheet1 of the spreadsheet), down from 55% premiums before they went ex-Rights on April 14th, I believe you can establish positions in either one now.

That's because even though CLM's and CRF's NAVs are coming down hard in large part due to their portfolios owning a high percentage of the mega-cap technology names, the Rights that expire on May 20 will be priced based on the eroding NAVs of the funds. And since the exercise price of 112% of NAV would still be well below CLM's and CRF's current market prices, what we're seeing is shareholders selling shares while still planning of exercising their Rights.

This is exactly what happens each time the Cornerstone funds undertake these Rights Offerings but it seems to be a lot more pronounced this time because a). Both funds were starting at much higher premiums this year and b). We're in a bear market.

So even though a current buyer of CLM and CRF are still having to pay a high market price premium, around 26% in fact, there are two reasons why it would have made a lot more sense to sell your shares before the ex-Rights date and buy back the shares now, or if you didn't own before the ex-Rights date, just buying the shares now.

First, buying CLM at $10.37 or CRF at $9.98 now means you get the May distribution if you own before the May 13th ex-dividend date, something the Rights shares don't get. And second, the Rights are to be priced at 112% of NAV so that's accretive by about 4% (1/3 of the 12% premium over NAV).

In other words, even though you don't get any Rights by buying CLM or CRF now, it's the Rights shareholders who will be paying the 12% premium over NAV, not you. You just get the bonus accretive NAV value that will result even though you didn't have to pay for it.

What could go wrong? Well, if enough shareholders don't exercise their Rights and just abstain from wanting to buy anything in this market environment, that would be a problem but since the exercise price should still be at a solid discount to the current market price around May 20th, I think most shareholders who may have been selling their shares after the ex-Rights date are still more inclined to exercise their Rights to get 1 new share at a market price discount for every 3 shares they owned before April 14th.

The other risk is that the markets continue to sell-off and the Cornerstone funds don't get that market price premium bounce they usually get after the Rights offering is complete and as the year wears on. So if the markets stay weak, shareholders may just want out of their new Rights shares too.

Just remember, if you buy CLM or CRF, be sure to RE-INVEST the distributions.

Conclusion

I think there is a very good chance we get a rally next week, maybe Monday just on an over-sold bounce from Friday's -4.5% drop in the Nasdaq-100 (QQQ), $313.25 closing market price and the -3.7% drop in the S&P 500 (SPY), $412.00 closing market price. Or maybe on Wednesday after the Federal Reserve announces its rate hike decision since just getting the news out of the way can sometimes be a relief.

After that, we're in uncharted territory with much of it dependent on countries and governments that we don't have a lot of control over and may even be hostile to us. For example, Russia would probably like to see commodity prices keep going up since that helps them and hurts us. And of course, the more Russia plays the nuclear card, the tougher it will be for equity markets to sustain any gains.

China, on the other hand, could actually help the global equity markets if they could get a handle on dealing with their COVID spread. Here's an article from February in the New York Times that helps explain the mess China is in: These Vaccines Have Been Embraced By The World. Why Not In China?

China has already approved Pfizer's pill treatment for COVID called Paxlovid, which is used for patients who have already contracted the disease and has been shown to reduce the risk of death by COVID by 90%. But because of politics and pride mostly, China refuses to embrace a more effective mRNA vaccine from a foreign supplier like Pfizer or Moderna and instead has relied on zero tolerance and domestically produced non-mRNA treatments for their populace that aren't nearly as effective.

But the more COVID spreads and the more lock-downs China imposes, the more pressure China's government may feel that they need to act sooner rather than waiting for their own mRNA vaccine to be tested and shown effective.

And if that happens, that would probably be embraced as an extremely market friendly first step toward loosening up global supply-chains which in turn, would put less pressure on inflation.

But with so much hostility between China, Russia and the US right now, I don't see any breakthroughs even if that would be of great benefit to the US and especially the Biden administration, which frankly needs some positive developments if the Democrats hope to improve their re-election chances in time for the mid-term elections this November 8th.

Thank you for reading my article. My goal is to give you observations and actionable ideas in Closed-End funds while educating you on how these unique and opportunistic funds work.

CEFs can be one of the most exhilarating and yet most frustrating security classes to invest in, and it's important that you have someone who can be a level head during up and down periods of the market. I hope to be that voice of calm when necessary. ~ Douglas Albo

This article was written by

Registered Investment Advisor since 2009. Prior experience includes 12-years as a Vice-President, Financial Advisor at Smith Barney from 1994 to 2001 and Morgan Stanley from 2001 to 2007.

Disclosure: I/we have a beneficial long position in the shares of MFD, RYLD, XYLD, CLM, JEPI, SPY, BSTZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.