Deutsche Bank: Good Start To The Post-Restructuring Period

Summary

- 2022 is the first year after 2019 with limited restructuring expenses for Deutsche Bank.

- Management reaffirmed an 8% RoTE target and a 26-27B EUR revenue target range for 2022 (2021 25.4B EUR).

- The CET 1 ratio stood at 12.8% and should recover later in the year.

- 354M have already been provisioned for distributions for 2022 (circa 33% expected payout out of a 1.06B EUR profit in Q1 2022).

- Manageable Russia exposure with 0.5B EUR in net loans and 1B EUR in contingent liabilities out of 53B of tangible equity.

code6d/iStock Unreleased via Getty Images

Investment Thesis

Deutsche Bank (NYSE:DB) shares have suffered a real reversal of fortunes this year, with a 30% year-to-date rally in February reversed to a 13% year-to-date drop to around 9.6 EUR/share. This comes against a backdrop of still rising tangible book to 25.15 EUR/share and a 90 bps rise in 10-year German yields. Direct Russia exposure seems very manageable and will likely be wound down in the coming quarters via a combination of write-offs and roll-offs.

Although the whole European banking space is trading at very appealing valuations after the latest correction, I think Deutsche Bank stands out largely on the back on no material restructuring expenses, a very appealing current valuation at 0.38 tangible book, potential for further capital relief from the Capital Release Unit and a 5B EUR stake (based on 79.5% ownership) in asset manager DWS which represents around 25% of Deutsche bank's market cap. Last but not least absent negative tail risk events RoTE will likely end up close to management's 8% target for 2022 on the back of positive rate developments and a strong start of the year for the market-sensitive businesses.

Company Overview

Deutsche Bank operates in four key segments, namely the Investment Bank at around 43% of Q1 2022 revenues, Asset Management at 9% of Q1 2022 revenues, the Private Bank at 29% of Q1 2022 revenues and the Corporate Bank at circa 19% of Q1 2022 revenues.

Operational Overview

The immediate impact of the Ukraine conflict on Q1 results was limited and Deutsche bank managed to record a 8.1% RoTE, or 11.2% if bank levies were to be spread evenly across the year. The bank levies were up 28% year-over-year as so far European banks have been unsuccessful in their lobbying efforts to limit contributions to the Single Resolution Board (SRB).

Revenue came in at 7.3B EUR and management reaffirmed their 2022 guidance for a range of 26-27B EUR, some 4% higher than the 25.4B EUR achieved in 2021.

Russia exposure is gradually going down, with 0.5B EUR in net loans exposure and 1B EUR in contingent liabilities. Combined it comes in at 2.8% of the 53B EUR tangible shareholders' equity.

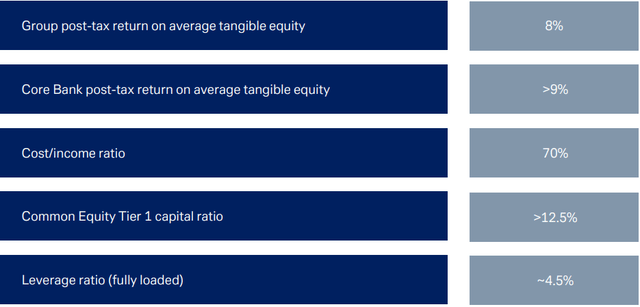

Overall, despite mounting challenges on several fronts (cost pressures, slowing growth, geopolitical risks etc.), buoyed by a favorable interest rate environment (German 10-year yields are up about 90 bps year-to-date), management reaffirmed their 2022 targets and ambitions:

DB 2022 Q1 Results Presentation

Capital Position

The CET 1 ratio came in at 12.8% which is markedly lower than the 13.7% recorded in Q1 2021. Looking at the maximum distributable amount (MDA) requirement of 10.43% the current buffer is on the low side compared to recent years. Pertinent in this regard are the disclosures in the annual report:

In January 2022, the BaFin announced a countercyclical buffer of 0.75 % for Germany effective February 1, 2023, which translates into approximately 30 bps CET1 capital requirement for Deutsche Bank Group given our current share of German credit exposures. Additionally, the BaFin is considering a sectoral systemic risk buffer of 2 % for German residential real estate exposures effective February 1, 2023. If implemented as considered, this sectoral buffer could increase the CET1 capital requirement for Deutsche Bank Group by approximately 20 bps, considering our current German residential real estate exposure.

Source: DB 2021 Annual Report

All in all, it is safe to say that the CET 1 ratio requirement for 2023 will be somewhere around 11%. Management seems confident in their ability to drive the CET 1 ratio back to around 13% given retained earnings in the rest of the year and limited restructuring charges. Underscoring this is the provision for 2022 capital distributions:

CET1 capital now includes a capital deduction for common share dividends of 354 million euros for 2022, in addition to the roughly 400 million euros which were already put aside last year to pay the proposed 2021 dividend of 20 cents per share post the AGM this May

Source: DB 2022 Q1 Analyst Call Transcript

Comparing the 354M EUR provision with the 1.06B EUR Q1 2022 profit attributable to shareholders, the payout ratio for 2022 should be around 33%. That said, management seems cautious about additional buybacks in H2 2022 and we will likely have to wait until next year for the actual implementation of the shareholder distributions.

Some relief on the capital front may still come from the Capital Release Unit (CRU) as it continues to hold a disproportionately large amount of operational risk-weighted assets (RWA), namely 31.6% of all operational RWAs, while only holding 6.8% of all of Deutsche Bank's RWA:

| DB total RWA | Of which in the CRU | |

| Operational Risk RWA | 60 | 19 |

| Market Risk RWA | 22 | 1 |

| Credit Valuation Adjustments | 6 | 1 |

| Credit Risk RWA | 276 | 4 |

| Total | 364 | 25 |

Source: DB Q1 2022 Results presentation and Earnings report.

If the CRU ends up holding only 6.8% of operational RWAs this would release some 15B EUR of RWA, or 1.9B EUR of capital at the current 12.8% CET 1 ratio.

DWS

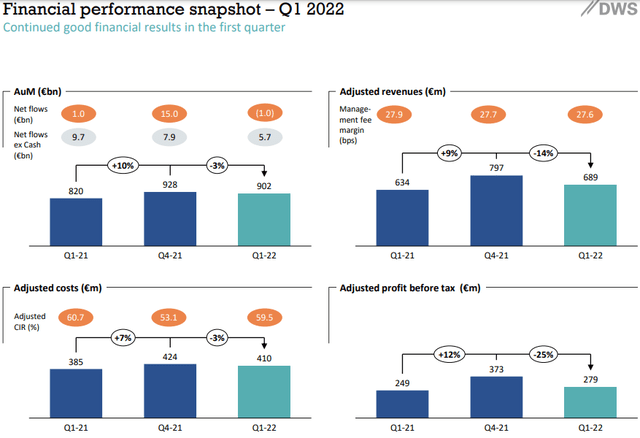

DWS reported a 12% year-over-year increase in adjusted net profit before tax. However the red flag for the quarter was a 1B EUR in net assets under management outflows driven by cash products:

DWS 2022 Q1 Analyst Presentation

For comparison, Amundi (OTCPK:AMDUF) which manages 2.02T EUR continued to record inflows in the quarter.

With a market capitalization of 6.3B EUR the market continues to partially discount the circa 3.65B EUR in goodwill DWS carries on its books as the shareholders' equity stood at 7B EUR in Q1 2022. Nevertheless Deutsche Bank's 79.5% stake is worth around 5B EUR and a potential sale would boost tangible book value by upwards of 1.4B EUR.

Investor Takeaway

While the 300M EUR buyback has already been executed at an average price of 11.3079 EUR per share and there is unlikely to be any near term support for the share price, once there is more clarity on the geopolitical front I think the stock offers solid rerating potential as a good portion of the distributions will likely be executed via very accretive to tangible book buybacks, given recent trading ranges.

As the recent correction in the share price has coincided with general market weakness against overall solid reported numbers by the bank, personally I will consider moving to an outright long position after my covered call expires in June. That said, owning a mix of several banks looks like to be the best course of action so as to minimize impacts from idiosyncratic events such as the recent prosecutor search of Deutsche Bank's HQ.

Thank you for reading.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.