Paramount Global: 13.86% Yielding Shares No Longer A Trap

Summary

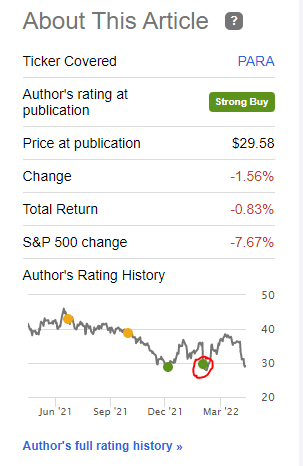

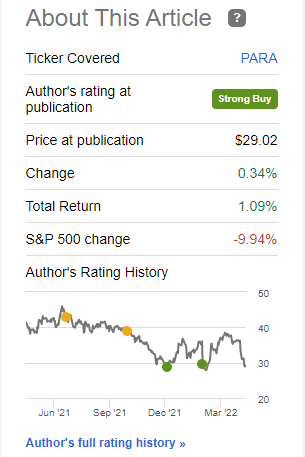

- When we last covered Paramount Global, we gave the shares a strong buy rating.

- We examine the recent round trip and tell you where we stand.

- We also look at the 13.86% yielding preferred shares.

- I do much more than just articles at Conservative Income Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Eamonn M. McCormack/Getty Images Entertainment

When we last covered Paramount Global (NASDAQ:PARA), we identified the key risk that we worried about.

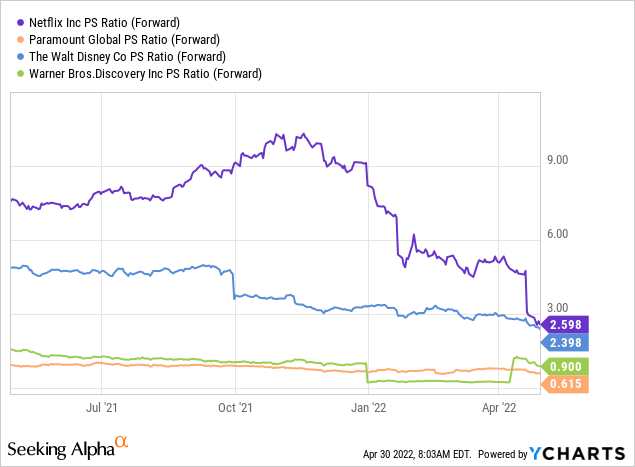

The risk here and one that is common to all four of the ones we mentioned above, is that there is an upper limit of streaming time that we have. That is likely to come into play at some point and perhaps the most optimistic growth projections will not pan out. That said, Discovery Inc. (DISCK) and PARA are far better priced for that scenario than Netflix Inc. (NFLX) and The Walt Disney Company Inc. (DIS).

Source: The ViacomCBS Put Remains In Place

Our call appeared well-timed and the stock rallied all the way to $38.52 before turning back down and giving us the ultimate roundtrip nausea.

Returns Since Last Article (The ViacomCBS Put Remains In Place)

We examine the recent developments and tell you how we are playing it.

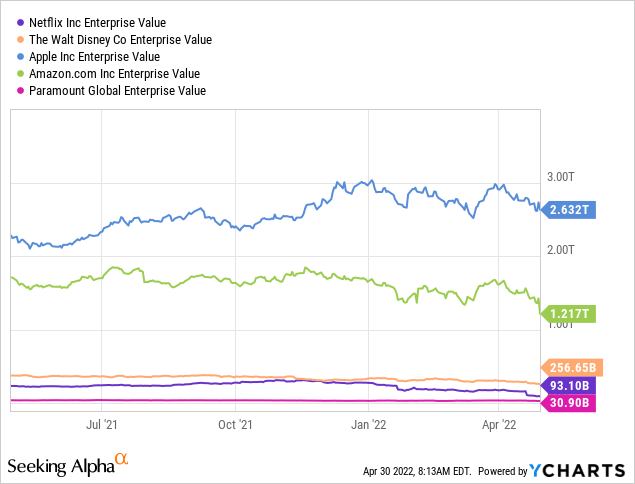

Market Saturation

NFLX had two consecutive quarters where they missed badly on subscriber adds. They are bumping up against their natural limits and are likely to try different tactics to rein in more subscribers. DIS had a terrific quarter last time but they were still early in their growth phase. PARA is likely to have a great start, especially at the price point they are coming in at. They are even earlier in the cycle and should have no problems maintaining this trajectory for some time. But what NFLX's numbers put out for everyone to see was that the Wall Street famous hook, the total addressable market or TAM, was likely a lot lower for streaming than what was being passed around. This is likely to be even more true in an era of 8% inflation. At this point it appears glaringly obvious to us that there has to be more consolidation in this space. DIS is likely to lead this, perhaps in partnership with Apple Inc. (AAPL) or Amazon Inc. (AMZN).

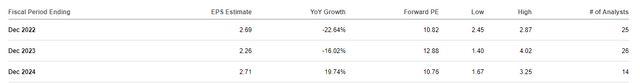

PARA can fight the battle alone for now. It has the cash flow and balance sheet strength to spend for some time. Despite the spend, PARA should maintain healthy profitability.

PARA EPS Estimates (Seeking Alpha)

But it is clear that this PARA is not the old PARA or ViacomCBS as it was previously called. The glaring reductions in EPS for one show how offside all analysts were in relation to its spending plans.

PARA EPS Revisions (Seeking Alpha)

PARA still stands out, for its relative valuation here and with its content library, we think the fair value is still closer to $45 per share.

Getting there though has two paths. The first is a rather long slog of developing and marketing streaming content for multiple years and this will likely test the patience of many analysts. The other of course is via a sale. NFLX and DIS could be seen as contenders but antitrust issues likely make either deal as a no-go. NFLX also has lost value recently and issuing shares at this point to pay a huge premium for PARA is likely to be out.

That leaves the behemoths and both could easily afford to pay a 100% premium to the price. Of course, to get deal to be accepted, PARA would have to let it be known that it was open to sale. Out thinking is that the company will likely come to this decision when it sees just how difficult the streaming sector has become. In the interim, PARA is likely to be range bound. It still remains the only one in the sector we have a strong buy rating on.

Paramount Global 5.75% SR A MDR CON PRE 01/04/2024 USD100 (NASDAQ:PARAP)

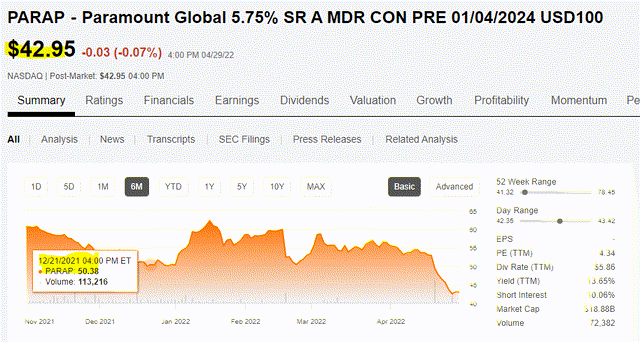

The mandatory convertible preferred shares continue lower and have now delivered negative total returns across all time frames. We have warned about the horrendous pricing on these shares on 4 separate occasions. From all of those time frames, the total return on these shares has been lower than that on owning PARA. For example, since late December 2021, PARA has been flat.

PARA Returns Since Dec 2021 Article (Yield Chasing Gone Bad)

PARAP, on the other hand, is down, a lot.

PARAP Returns Since December Article (Seeking Alpha)

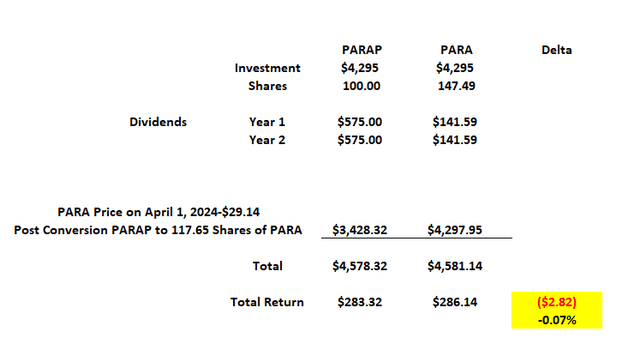

This is of course the market slowly coming to grips with the built-in terms of mandatory conversion. But does it make sense to buy it today? After all there is a huge built-in yield. PARAP are mandatory convertible shares, and they have a "high-end" conversion value of 1.1765 shares. So, if the conversion happened today the PARAP value would be $29.14 X 1.1765=$34.28. So based on that alone, significant downside remains. But the dividends here are huge for PARAP and we have to take that into account. If we assume PARA price remains unchanged till April 1, 2024, we can run an easy analysis as to whether PARAP is a better choice or not.

PARAP Vs PARA Returns (Author's Calculations)

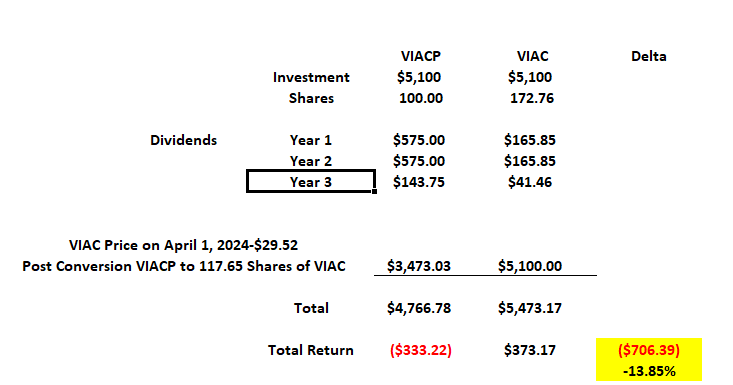

Whoa! We were surprised by that, as every other time we ran this calculation PARAP shares looked (and were) Class A loss-making machines. For example, here are the calculations from December 2021 article (excuse the old symbols).

PARAP vs PARA Return Expectations-December 2021 (Yield Chasing Gone Bad)

Back then we said,

"You are not getting paid to wait, you are the patsy financing this free transaction."

But today we are splitting hairs between the two. It is also possible that in a market selloff, PARAP could become the relatively cheaper choice, although this article is not considering the taxation of dividends here.

Verdict

Having carefully dodged DIS and NFLX downdrafts by staying firmly negative on both, we were still hit with PARA drop. Our adjusted cost basis on this is close to $28 (after option premiums) so we are certainly not hurting badly. But obviously the correct course was to lock in profits when it soared, something we missed and now regret. Mea Culpa. At current valuations though, we still like PARA and it remains our best play in the media sector.

After doling loads of criticism on "investors" holding PARAP without understanding what they were buying, we have to take a victory lap and be done with it. At present, PARAP should track PARA very well, although your relative total return will be impacted to some extent on taxation of dividends. We will be watching PARAP carefully to see if it offers an advantaged long entry into PARA at some point.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations and low bonds yields have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Disclosure: I/we have a beneficial long position in the shares of PARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.