IVH: Moving From Sell To Hold After A -15% Return

Summary

- IVH is a high yield bonds and leveraged loans CEF.

- We assigned IVH a Sell rating late last year expecting an underperformance in NAV.

- The fund is down more than -15% since our rating and given the substantial move in rates we are now moving from Sell to Hold.

- This article covers CEFs from our suite of products - we focus on macro portfolio allocation, CEFs and yield producing options strategies, targeting overall returns of 9%+.

Nuthawut Somsuk/iStock via Getty Images

Thesis

Ivy High Income Opportunities Fund (NYSE:IVH) is a closed-end-fund focusing on US high yield bonds and leveraged loans. The fund takes significant credit risk with all the portfolio being either B or CCC rated. We wrote an article late last year assigning the fund a Sell rating based on the incoming monetary tightening cycle and low absolute levels in credit spreads. The fund is down more than -15% since our rating with the duration matched 3-year Treasury yields having moved up more than 150 bps (1.5%) since the start of the year. Credit spreads have widened out modestly as well on the back of the Ukraine conflict as well as the duration avoidance by market participants. We feel the bulk of the rates move is now behind us. We are therefore moving from Sell to Hold on IVH, from the lens of a pure short-seller where the trade is now more likely to give up already realized gains.

Performance

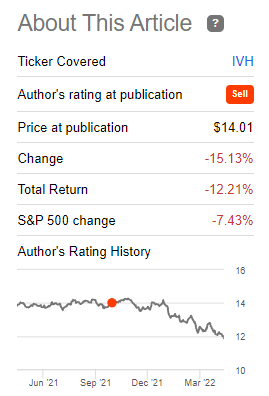

The fund is down more than -15% on a price basis since our rating:

Rating (Seeking Alpha)

When factoring in the fund's dividend yield the total return since our rating moves slightly higher to -12.21%, still a very underwhelming performance that accounts for almost two years of dividends. It is always extremely important, even when dealing with buy and hold instruments, to trade the macro environment - i.e. lighten up on positioning during monetary tightening environments, and conversely layering into exposure during a recession.

On a year-to-date basis the fund underperformed the unleveraged junk bonds ETF JNK:

YTD Performance (Seeking Alpha)

The underperformance is due to the leverage embedded in the CEF which works to magnify returns both on the way up as well as on the way down. Although the fund has a low duration of approximately 3.3 years, 3-year treasury yields have risen by more than 150 bps since the beginning of the year contributing to a deep negative performance for IVH.

Interest Rate Environment

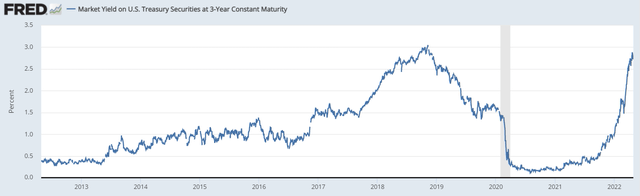

The 3-year point in the yield curve is now very close to 3%:

We can see from the above graph of 3-year CMT rates that we are closing in on the highs seen in 2018, and some of the highest levels in over a decade for this point in the curve. The move has been abrupt and violent - if we look at the graph and the slope of the upwards curve we realize the violence of the rates re-pricing in the market. Nobody wants to be caught behind the bonds move so the market has been very aggressive in pricing the next steps to be undertaken by the Fed.

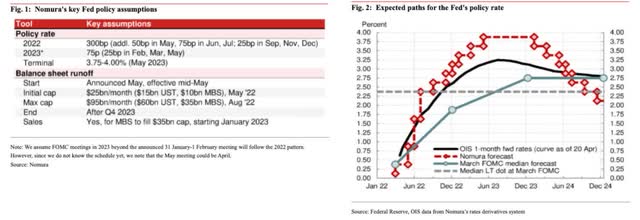

Some banks are now even penciling in Fed Funds rates close to 4%:

Nomura Rates Prediction (Nomura)

While the OIS curve only implies a rate a bit north of 3% for Fed Funds, Nomura now put out a research piece where they see rates coming close to 4%. We think this is far-fetched and geared more towards garnering attention by being the outlier bank with the most aggressive rate call. We re-iterate our stance where we see rates revisiting the 2018 highs with a very front-loaded schedule, but we do not think we are going to go much further out than that. We see an aggressive Fed this summer followed by a very slow tightening schedule and a "wait and see" attitude from the Fed in terms of real economic impact derived from the higher rates levels.

Holdings

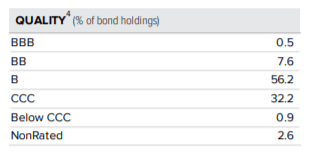

The fund has a below average credit distribution, with most underlying credit names falling into the B and CCC buckets:

Credit Distribution (IVY)

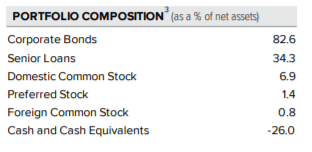

The fund invests mostly in bonds. The fund is nonetheless not a pure debenture vehicle, with a 34% allocation to leveraged loans:

Portfolio (IVY)

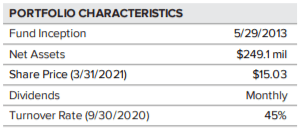

The fund does not disclose much else in terms of industry concentration, seniority and liens for the leveraged loan portfolio, so it gets a minus from my end for this extreme opacity. It does show a very significant annual turnover of assets:

Portfolio Characteristics (IVY)

The fund, therefore, has a high risk credit composition, with most of the name in the riskiest high yield categories and leverage on top.

Conclusion

IVH is a closed end fund focused on high yield bonds and leveraged loans. Although the fund has a short duration of 3.3 years it has nevertheless been significantly affected by the violent rise in rates this year on the back of a hawkish Fed. With 3-year treasury yields up more than 150 bps in 2022 the fund has experienced a negative return in excess of -15%. We feel the bulk of the move in rates is now done, with the front end of the curve closing in on the highs not seen since 2018. We are therefore moving from Sell to Hold on the fund.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.