The market squandered the day’s again in the last hour of trade to end lower on April 29, with benchmark indices losing around 1.5 percent from the day's peak to settle eight-tenth of a percent lower.

The Sensex declined 460 points to close at 57,061 and the Nifty shed 143 points to 17,102.

In the next trading session, "if the Nifty trades below 17,050 levels for at least 30 minutes then it may revisit the recent corrective swing low of 16,800 levels," Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia said.

A sustainable rally should not be expected until the close above 17,400. Considering the volatility, it would be prudent to avoid index bets, the market analyst said.

The broader space also traded in line with benchmarks, as the Nifty Midcap 100 index fell 0.84 percent and Smallcap 100 index declined 1.16 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support, resistance levels on the Nifty

As per the pivot charts, the key support for the Nifty is at 16,978, followed by 16,853. If the index moves up, the resistance levels to watch out for are 17,302 and 17,502.

Axis Bank and PSU banks weighed on the banking index as the Bank Nifty dropped nearly a percent to close at 36,088 on April 29. The important pivot level, which will act as crucial support for the index, is at 35,805, followed by 35,522. On the upside, key resistance levels are placed at 36,545 and 37,002 levels.

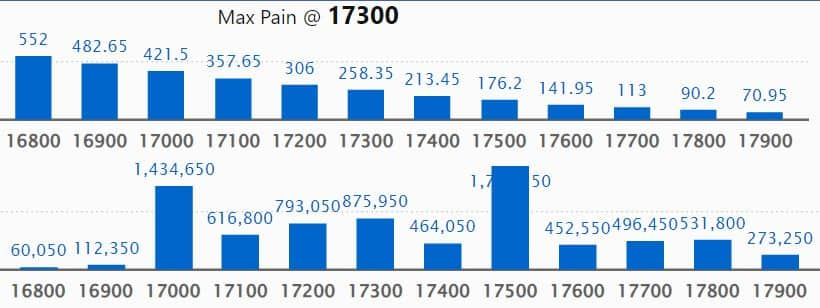

Maximum Call open interest of 19.08 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 17,500 strike, which holds 17.78 lakh contracts, and 17,000 strike, which has accumulated 14.34 lakh contracts.

Call writing was seen at 17,300 strike, which added 2.47 lakh contracts, followed by 17,500 strike which added 2.44 lakh contracts and 17,400 strike which added 1.36 lakh contracts.

Call unwinding was seen at 17,100 strike, which shed 1.5 lakh contracts, followed by 17,000 strike, which shed 58,100 contracts and 18,100 strike, which shed 28,300 contracts.

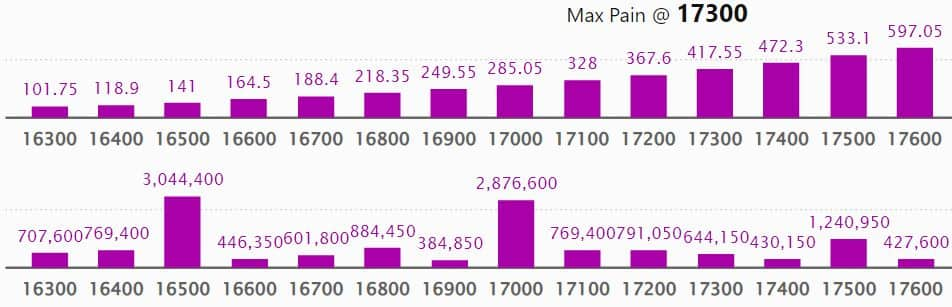

Maximum Put open interest of 35.01 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the May series.

This is followed by 16,500 strike, which holds 30.44 lakh contracts, and 17,000 strike, which has accumulated 28.76 lakh contracts.

Put writing was seen at 16,000 strike, which added 3.76 lakh contracts, followed by 17,600 strike, which added 2.72 lakh contracts and 17,300 strike which added 1.7 lakh contracts.

Put unwinding was seen at 17,100 strike, which shed 33,500 contracts, followed by 17,000 strike, which shed 1,400 contracts, and 18,100 strike, which shed 750 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Petronet LNG, Ipca Laboratories, Crompton Greaves Consumer Electricals, Tech Mahindra, and Infosys among others.

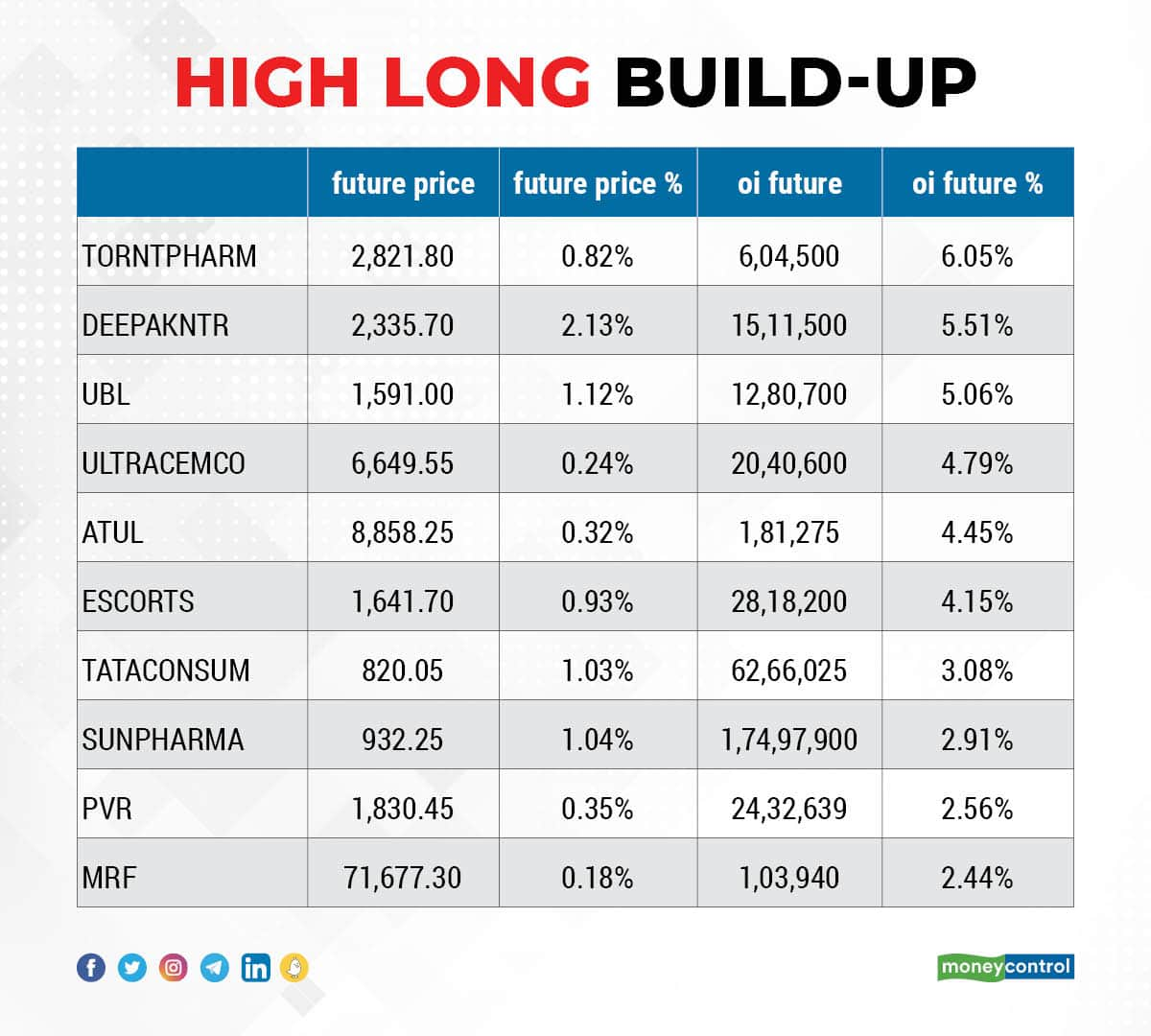

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

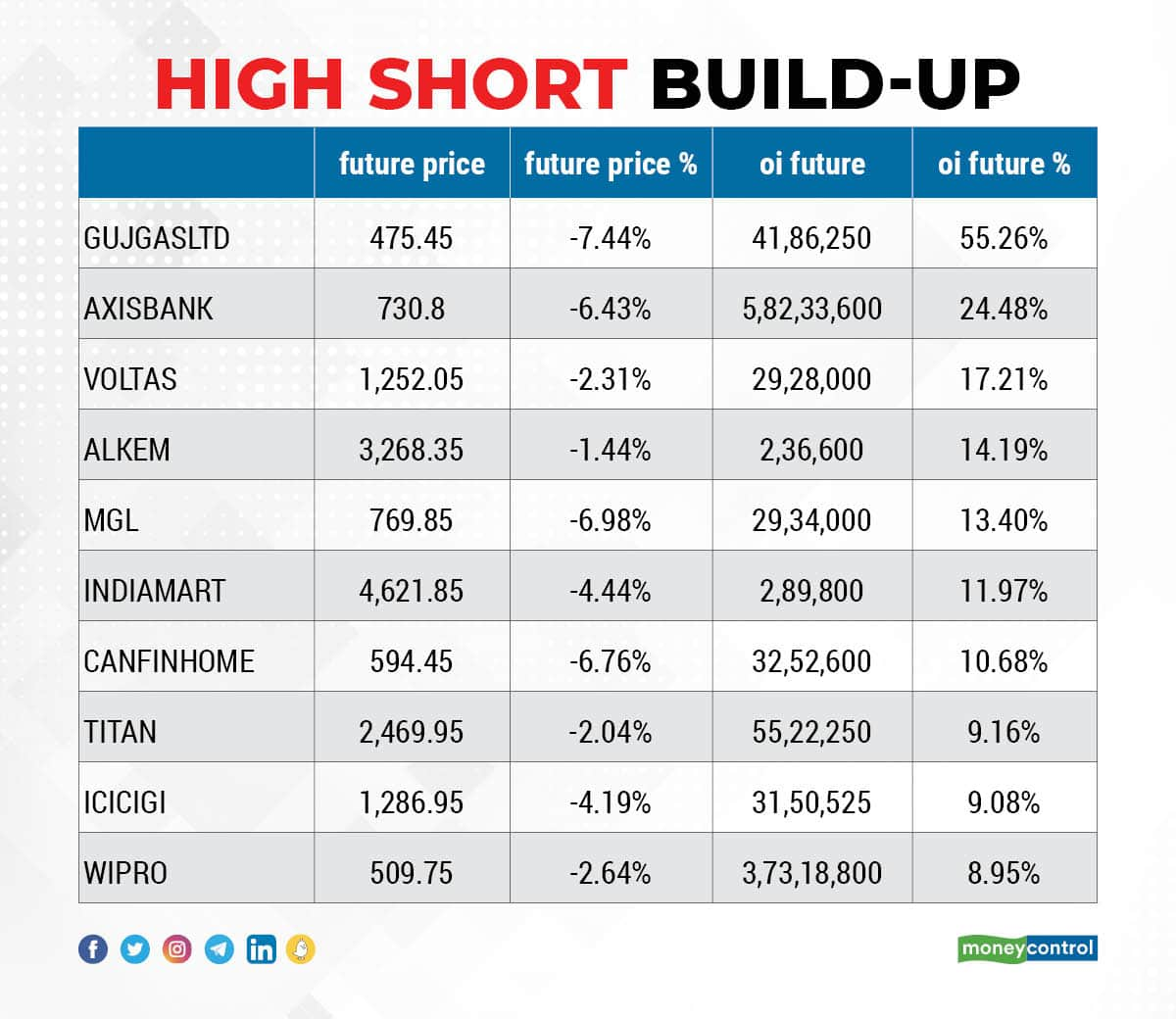

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

29 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

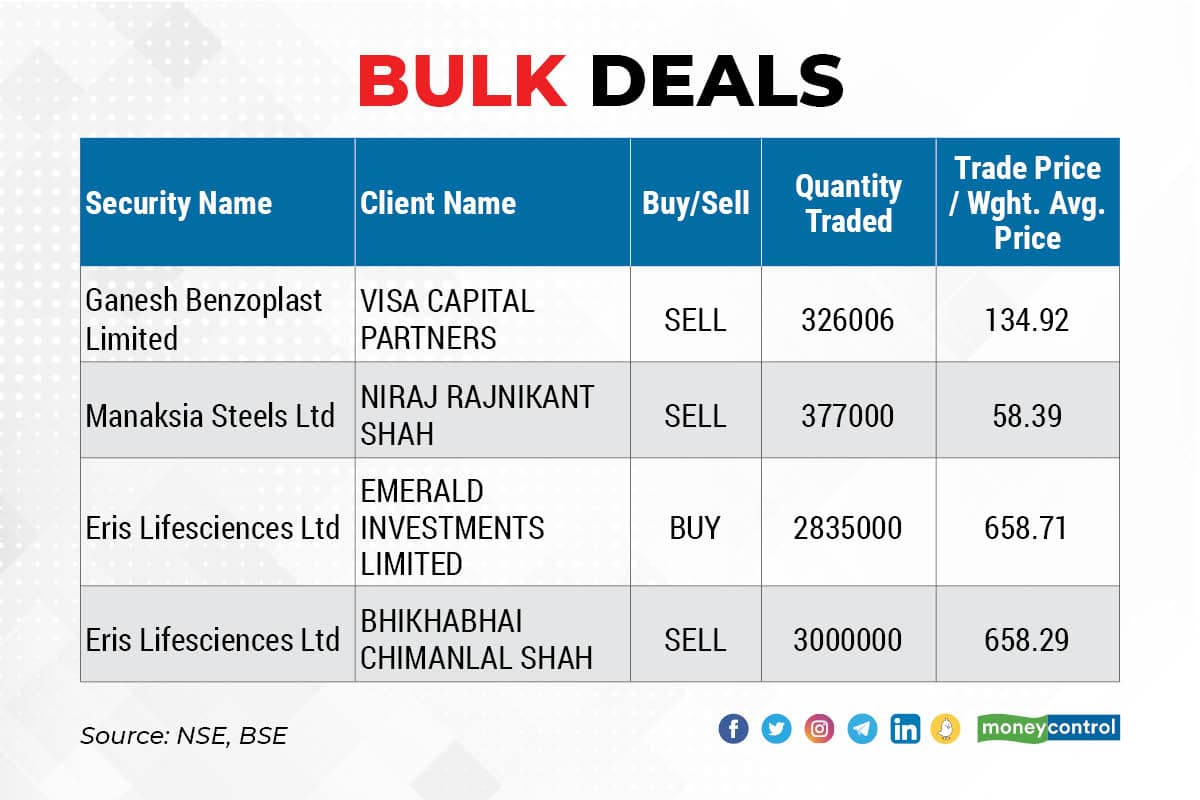

(For more bulk deals, click here)

HDFC, Britannia Industries, Alembic Pharmaceuticals, Astec Lifesciences, Adani Wilmar, Castrol India, CG Power and Industrial Solutions, Devyani International, Dwarikesh Sugar Industries, EIH Associated Hotels, IDBI Bank, Inox Leisure, JBM Auto, Jindal Stainless, Mahindra & Mahindra Financial Services, Mahindra Holidays & Resorts India, Meghmani Organics, NGL Fine-Chem, Olectra Greentech, Saregama India, Shakti Pumps (India), and Surana Solar will release quarterly earnings on May 2.

Stocks in News

Wipro: The IT services company clocked a 3.1 percent sequential increase in dollar revenue at $2,721.7 million for the quarter ended March 2022 and revenue in constant currency grew at 3.1 percent QoQ. Wipro expects 1-3 percent sequential growth in Q1FY23 revenue at $2,748-2,803 million. Profit during the March 2022 quarter grew by 3.98 percent QoQ to Rs 3,087.3 crore and revenue increased by 2.68 percent QoQ to Rs 20,860 crore in Q4FY22.

IndusInd Bank: The private sector lender registered 55.4 percent year-on-year growth in profit at Rs 1,361.4 crore for the quarter ended March 2022 as provisions declined 21.5 percent with an improvement in asset quality performance. Net interest income grew by 12.7 percent YoY to Rs 3,985.16 crore in Q4.

Yes Bank: The private sector lender reported a profit of Rs 367 crore in Q4FY22 against a loss of Rs 3,788 crore in the corresponding quarter of the previous fiscal, driven by a sharp downtick in provisions, strong net interest income, and pre-provision operating profit (PPoP) with an improvement in asset quality performance. For the full year, it reported a profit for the first time since FY19, at Rs 1,066 crore against a loss of Rs 3,462 crore in FY21 and a loss of Rs 22,715 crore in FY20, but net interest income (NII) declined 12.5 percent to Rs 6,498 crore compared to the previous year.

Usha Martin: The company clocked a 60.1 percent year-on-year growth in consolidated profit at Rs 108.7 crore in Q4FY22 driven by subsidy of Rs 31.18 crore from the Jharkhand government, and topline. Revenue during the quarter grew by 17.4 percent to Rs 766.56 crore YoY.

GHCL: The company clocked a healthy 144 percent year-on-year growth in Q4FY22 profit at Rs 271.3 crore despite rising input cost, led by strong topline and operating income. Revenue during the quarter grew by 77 percent to Rs 1,273.3 crore compared to the year-ago period.

Just Dial: The local search engine company recorded a 34 percent year-on-year decline in profit at Rs 22.1 crore for the quarter ended March 2022 hit by lower topline and operating loss. Revenue from operations stood at Rs 166.7 crore for the quarter, down 5.1 percent compared to the year-ago period but total traffic of unique visitors) for the quarter at 144.8 million grew by 12.2 percent YoY and total active listings at 31.9 million increased by 4.9 percent YoY, while active paid campaigns at the end of the quarter stood at 4,61,495, which rose by 0.9 percent YoY.

Tanla Platforms: The largest CPaaS provider reported a 37 percent year-on-year growth in profit at Rs 140.6 crore on strong topline and operating performance. Revenue increased by 32 percent year-over-year to Rs 853.1 crore and operating income grew by 37 percent to Rs 184.1 crore compared to the year-ago period.

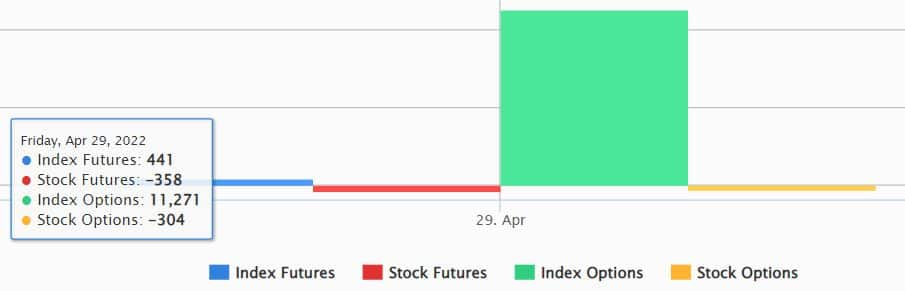

Fund Flow

Foreign institutional investors (FIIs) net offloaded shares worth Rs 3,648.30 crore, while domestic institutional investors (DIIs) managed to offset the outflow by buying shares worth Rs 3,490.30 crore on April 29, as per the provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of the May series, the NSE has not put any stock under the F&O ban for May 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclosure: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.