Microsoft: 20% Off Highs, But Still Not A Bargain

Summary

- Microsoft has sold off to start 2022 along with the other big tech names.

- They have made several acquisitions to add new products and services to their offerings.

- The Activision acquisition offers an interesting arbitrage opportunity.

- The valuation is too expensive at 31x earnings, and the yield of 0.9% isn't much to get excited about.

HJBC/iStock Editorial via Getty Images

Investors in big tech companies over the last decade have had explosive returns driven by liquidity, low interest rates, and passive index investing flows. The wheels have started to fall off the big tech trade in 2022, with Facebook (FB), Amazon (AMZN), Netflix (NFLX), Nvidia (NVDA), and Google (GOOG) all down more than 20% from highs. Microsoft (NASDAQ:MSFT) and Apple (AAPL) have held up a little better but are still down double digits. I have owned all these companies in the past except for Facebook and Google. I still hold Amazon, but I will be breaking down Microsoft today and why I'm not interested in owning shares today.

Investment Thesis

Microsoft (MSFT) is a large tech company with several divisions, ranging from gaming and Microsoft Office to the crown jewel of Azure Cloud services. The company has a fortress balance sheet and impressive margins. The company continues to gobble up smaller tech companies to add to their stable of products and services. Microsoft has also started to follow in Apple's footsteps, with a massive buyback program. They also have a solid track record of dividend increases. The biggest problem I have with Microsoft is the valuation. At nearly 32x earnings, I don't see a margin of safety for a company with a market cap of $2.1T.

The Business

Microsoft has diversified business segments that many of us are familiar with and use on a daily basis. Without Microsoft Office (particularly Excel), the business world would fall into chaos. Azure has been chasing down Amazon Web Services in the cloud market and is the fastest growing segment of Microsoft. I haven't followed the gaming division for a couple years since I kicked the video game habit, but they continue to occupy an important position in the market with one of the dominant consoles and platforms available. They have also continued to grow via acquisition.

Acquisitions Galore

While the Activision (ATVI) acquisition (say that 10x fast) gets most of the attention because of the size of the company and negative headlines surrounding it for the last year, it's not the only acquisition that Microsoft has been in the news for. In March, they completed the acquisition of Nuance Communications for $18.8B as well as the acquisition of ZeniMax Media, the owner of video game producer Bethesda Softworks, for $8.1B.

The Activision acquisition is an interesting arbitrage opportunity for investors. Shares have drifted down from the low $80 range into the mid $70s. I think that the acquisition will go through. At the recent special meeting for Activision shareholders, 98% of shares voted in favor of the deal. With the spread continuing to widen from the $95 per share acquisition price, buying shares of Activision now could be a relatively straightforward way to earn returns over 20%.

Valuation

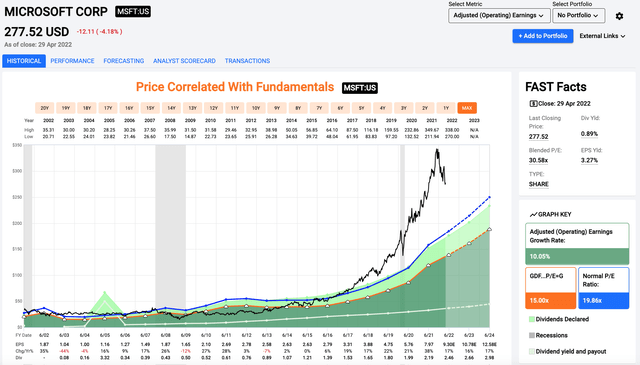

Everything I have said so far about Microsoft describes a healthy business that continues to grow. However, the valuation is too rich for me right now, and I think it will probably lead to lackluster forward returns. Shares currently trade at 31x earnings, which is well above the average multiple. I think a fair multiple would be somewhere in the 20-25x range when you look at the growth, margin profile, and size of the company.

Price/Earnings (fastgraphs.com)

For most investors, the 0.9% yield is an afterthought. The company does have an impressive track record of dividend growth and that is likely to continue. The buyback program continues at these elevated valuations. I like buybacks in theory, but this is another case where there is clearly no price sensitivity to the buyback program. They repurchased 67M shares for $20.2B in the first nine months of fiscal 2022, which is an impressive amount, but I would rather see larger dividends if I were an investor. They still had $48.5B remaining on the $60B buyback authorization at the end of the quarter, so investors can expect continued buybacks for the foreseeable future.

Conclusion

Microsoft is a business that is firing on all cylinders. Acquisitions have augmented organic growth and the company has maintained impressive margins. However, the stock is not a buy today purely based on valuation. With a market cap over $2T and an earnings multiple above 30x, now is not the time to add to or start a position in Microsoft. Investors who think that the Activision deal will go through could buy shares as the spread is nearing $20 a share.

One other factor that investors should be aware of is the potential impact of index fund outflows. There are huge sums of money tied up in index funds, with the S&P 500 (SPY) (VOO) and the Nasdaq 100 (QQQ) being the big boys in the space. Microsoft and other big tech companies are the backbone of these indices. They benefited from consistent inflows over the last decade with a significant chunk of that money flowing into their stocks. The same will be true in reverse. If money starts to flow out of the large, tech-heavy indices, most of that selling pressure will be on companies like Apple, Microsoft, and the other big tech companies.

If you forced me to pick a big tech company to buy today, Microsoft would be a close second behind Amazon. I will be the first to admit that Microsoft is a fantastic, diversified business with an impressive moat. However, investors must decide on their own how much they are willing to pay for it. I prefer to buy assets at a discount if possible, and Microsoft definitely doesn't fall into that category at the current price. It doesn't make Microsoft a sell, but it might be worth taking gains if you have held onto shares for a long time.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ATVI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.