Billionaire Buffett Is Fighting Inflation - Here Is How You Can Too

Summary

- Warren Buffett's years of investing experience teach us how to combat inflation and rising rates.

- We apply the Buffett technique to find attractive businesses positively affected by the current environment.

- Two big dividends with yields of over 7%.

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our model portfolio. Learn More »

Co-produced with "Hidden Opportunities"

Paul Morigi/Getty Images Entertainment

If you are close to your retirement or already retired, there is no doubt inflation is the number one concern in your mind. After all, we are facing the highest inflation in over 40 years. So, the last time this happened, you were probably during the early stages of your career, with decades of earning potential ahead.

We have the opportunity to learn from the past, from experts who have done tremendously well through these challenging times. With his 80+ years of investing experience, legendary investor Warren Buffett has seen almost everything thrown at the stock market. Yet, he believes that staying invested in stocks is the best course.

"You're going to be a lot better off owning productive assets over the next 50 years than you will be owning pieces of paper" - Warren Buffett

So how do we identify a productive asset that can help you through this inflation? At the Financial Crisis Inquiry Commission in 2010, the Oracle of Omaha said the following:

"The single most important decision in evaluating a business is pricing power. You've got the power to raise prices without losing business to a competitor, and you've got a very good business" - Warren Buffett

Using the Buffett method, we have identified two high-yield picks to help your portfolio thrive against the inflationary pressures on our economy. Without further ado, let us review the picks.

Pick #1: FFC, Yield 7.8%

Flaherty & Crumrine Preferred and Income Securities Fund (FFC)

Warren Buffett has admired businesses that can earn substantial returns on invested capital throughout his investing career. Banks fit this criterion well. Their business model is easy to understand - they lend money out at a significantly higher rate than what they pay to depositors.

People who say Warren Buffett doesn't use leverage don't know anything about the Oracle of Omaha. Mr. Buffett loves the insurance business. These companies collect large sums of money (known as floats) in advance for claims to be paid in the future. They invest this money and generate massive profits in the interim.

It is no secret that the Oracle of Omaha likes preferred equity and has taken advantage of attractive opportunities on several occasions. Preferred stocks are an excellent addition to your portfolio for higher and more consistent dividends. They tend to pay a higher dividend rate than the bond market and common stocks and land in the middle in terms of risk.

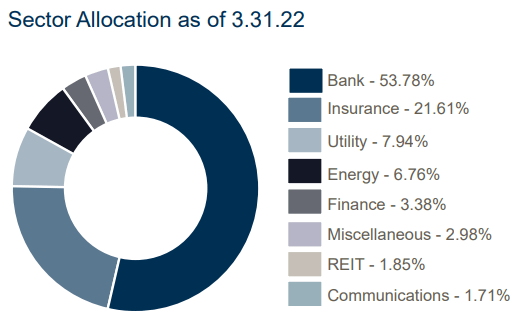

We have a CEF (Closed-End Fund) for you that brings income from an amalgamation of Mr. Buffett's favorites. FFC primarily invests in bank and insurance preferred shares, with ~75% sector allocation. (Source: FFC Fact Card)

FFC Fact Card

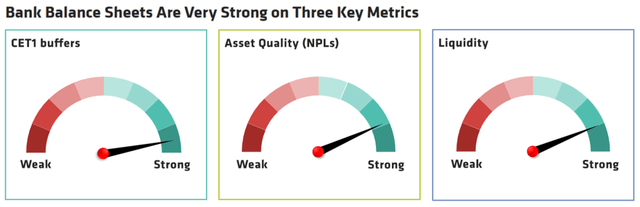

It is worth noting that banks and insurance companies are typically the primary issuers of preferred securities. The financial sector makes up 61% of the preferred market! As we recover from this pandemic, banks are emerging with stronger balance sheets than before. (Source: Alliance Bernstein)

By design, insurance companies are well-positioned for high inflation and rising rates. Higher inflation increases the coverage amount required to maintain one's standard of living. So people would have to purchase more significant policies or increase their coverage limits. Moreover, as rates rise, the pressure on insurance companies to gather premiums is lowered as they can get more yield on fewer premium dollars being received.

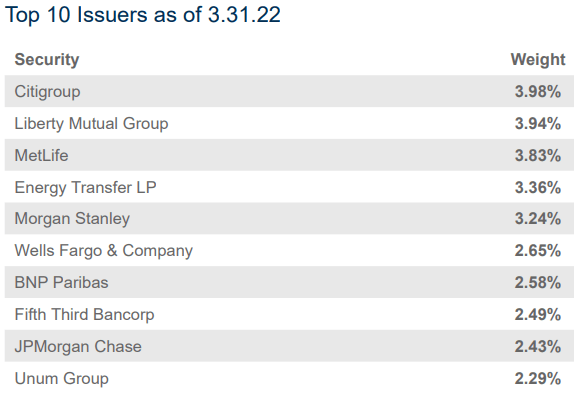

Together, this sector will experience tailwinds as the Fed raises rates to combat inflation. FFC's top portfolio constituents are some of the biggest names.

FFC Fact Card

FFC is highly diversified into 226 holdings. This means a solvency problem in one or more companies is unlikely to cause a measurable impact on this CEF and its distribution capability. Unlike some funds which aim to preserve distributions at all costs and ultimately sacrifice total returns, FFC has made cuts and raises from time to time to maintain the overall quality of the fund. This CEF entirely earns its distributions as there is no ROC component in its distributions. Moreover, during the calendar year 2021, approximately 77.9% of distributions made by the CEF were eligible for treatment as qualified dividend income ('QDI').

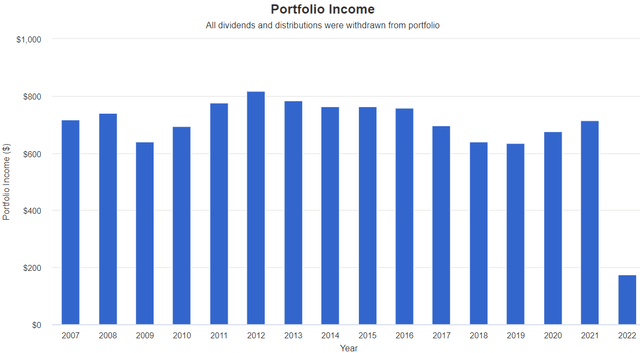

Since its inception in 2003, despite minor changes in distributions paid, FFC has never deviated from its long-term objective of filling investor pockets with predictable income. $10,000 invested right before the financial crisis in early 2007 would have produced $10,800 in total dividends till December 2021, with an average of $720 annual dividends. That is an impressive 7.2% annually paid in addition to preserving ~90% of your capital at the time of this writing. (Source: Portfolio Visualizer)

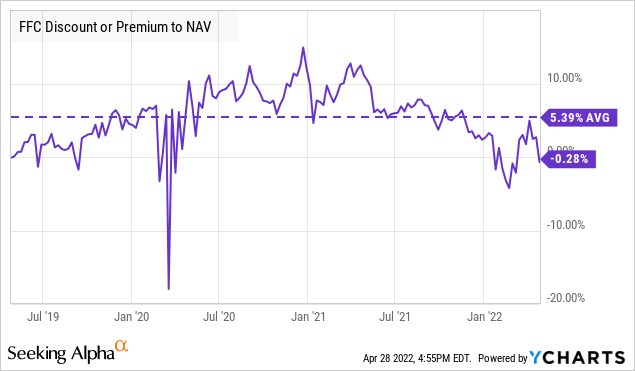

Today, FFC yields 7.8% and is trading at par with its NAV. This is a considerable discount when we analyze the premium it has traded at during the past three years.

Quality CEFs are best when purchased at favorable valuations and higher yield levels, and FFC has both those characteristics today. You can lock in this monthly paying CEF and ride the wave of rising interest rates with a basket of securities that come from some of Mr. Buffett's favorite sectors.

FFC's similar sister fund DFP (DFP) is also a good choice.

Pick #2: HT-E, Yield 7.6%

Hersha Hospitality Trust, 6.875% Series C Cumulative Redeemable Preferred Shares (HT.PC)

Hersha Hospitality Trust, 6.50% Series D Cumulative Redeemable Preferred Shares (HT.PD)

Hersha Hospitality Trust, 6.50% Series E Cumulative Redeemable Preferred Shares (HT.PE)

After two years of pandemic restrictions, Americans, flush with cash, are eager to hit the road and are paying up at resorts, roadside hotels, and urban properties. Summer is approaching quickly, and 85% of Americans plan to travel this season (according to the U.S. Travel Association). This means busy roads and airports, sold-out concerts, and packed resorts. Early studies of post-pandemic travel volumes indicate that vacationers are willing to pay higher prices for the experience, making it possible for quality travel companies to pass higher costs to their customers.

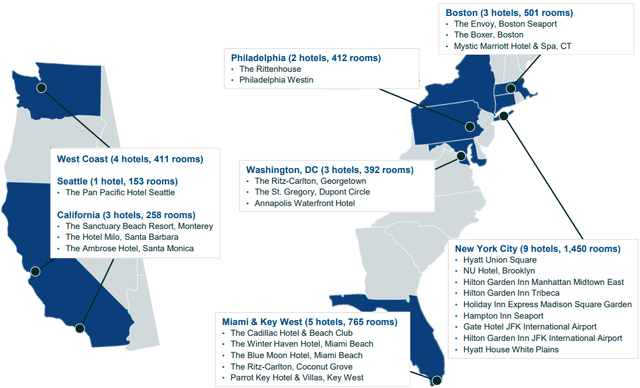

Hersha Hospitality Trust (HT) is a Property REIT (Real Estate Investment Trust)) and owns and operates 36 hotels with 5802 rooms in popular travel locations like New York City, Boston, Philadelphia, Washington, D.C., Miami, and California. (Source: March 2022 Presentation)

On April 28th, the company announced the sale of 6 non-core, urban center properties that were more oriented to corporate conferences and business travel. Pro forma for the transaction, HT will own 26 hotels in six key destination markets across the U.S.

April 2022 Transaction Presentation

Following the transaction, HT will maintain a portfolio of higher EBITDA, and more inflation-resistant luxury & lifestyle, and NYC hotels.

Warren Buffett has a proven track record of successfully investing in the preferred securities of distressed companies. Following the Great Financial Crisis, the Oracle of Omaha picked up preferred units of Goldman Sachs (GS) and Bank of America (BAC). When the hydrocarbon industry was struggling in 2020, Mr. Buffett invested in the preferred units of Occidental Petroleum (OXY). These investments proved to be highly profitable and paid dividends for years.

Warren Buffett has also appreciated companies where top executives held significant stakes in the stock. He proudly uses the reference for Berkshire Hathaway (BRK.A) (BRK.B), saying, "We eat our own cooking". Mr. Buffett says that high insider ownership provides more assurance that company leaders are working in your best interest because it's in their best interest to do so as well.

Putting these Buffett principles together, we discuss investment in the preferred units of HT. It builds confidence to note that HT insiders own 15.9% of the pool of common, preferred, & restricted shares. Remember, the common units aren't paying a dividend at the time of writing. As the hotel industry parameters show strength, we take comfort by investing in HT's preferred units.

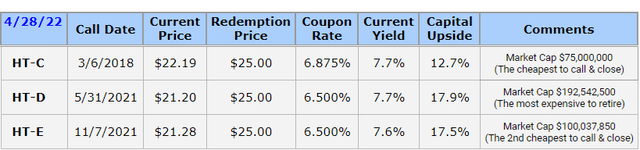

HT has three classes of preferred shares, of which Class D and Class E offer the highest upside and yield, while Class D is most likely the last to be redeemed. HT spends ~$24 million annually for all preferred classes, which is less than half its total interest expense in 2021. The hotel sector is still not out of the woods with respect to its financial performance and profitability. Hence HT's preferreds will be cash cows for the foreseeable future. The HT-D and the HT-E currently have ~18% capital upside to par value and yield ~7.6%. The REIT was forced to suspend preferred dividends for a year but promptly restored them in April 2021 by paying all missed dividend payments.

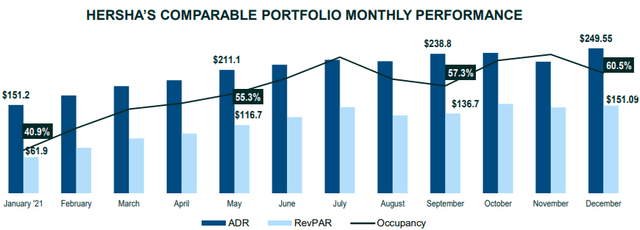

HT reported positive property level cash flow every month of 2021, indicating that the REIT has survived the brutal pandemic. As our economy recovers, HT continues to report higher occupancy, higher Revenue Per Available Room ('RevPAR'), and higher Average Daily Rate ('ADR').

The company continued this excellent performance in Q1 2022 by posting its highest EBITDA since the pandemic, and key metrics exceeding Q1 2019 performance - ADR Growth of 10.5% vs Q1 2019, Gross Operating Profit Margin of 40.8%, portfolio EBITDA Margin of 28.3%, and resort portfolio RevPAR of 28.6%.

The company recently announced the sale of six properties at the implied 2019 Cap Rate of 7.3%. This low cap rate reveals the quality of the property portfolio and management's timely intent to use recovering performance to improve HT's balance sheet. The company intends to use the proceeds to aggressively pay down debt (~$460 - $480 million), eliminate debt maturities through 2024, and achieve a respectable pro forma leverage of 4.9x - 5.1x EBITDA. It is important to note that the debt paydown plan shows mortgage debt and redemption of unsecured notes. The company's pro forma balance sheet reveals the existence of the preferred units at 3.2x EBITDA. This is your opportunity to lock in high yields from this company boasting a strong recovery in the post-pandemic America.

Leisure travel is projected to reach 2019 levels this year. However, for business travel, we may have to wait until 2024, and this matters less because HT announced the timely sale of urban business-centric properties. Moreover, this transaction comes at respectably low cap rates, without pandemic-related value erosion. HT has yet to restore an adequately covered common dividend. Hence, we invest in the recovery of this in-demand industry with the preferred units of this quality hotel REIT, with a potential upside of 17%, and a 7.7% yield to sweeten the pot.

Getty

Conclusion

Are you anxious about the market volatility due to the fear of recession, higher inflation, Fed rate hikes, and a hundred other things surrounding today's market? Do you think liquidating your equity position will do you good in this economy? Wrong; by doing so, you will be accumulating pieces of paper that will have lesser buying power tomorrow than they did yesterday.

Warren Buffett began investing during World War II. His success over the years comes from being greedy when others are fearful. There will seldom be an ideal time to enter the market. Today is as good a time to begin investing as any.

With high inflation in most retirees' minds, we go back in time to see how successful investors have navigated the situation. The key is to invest in businesses with powerful pricing power, and we have two picks that model Mr. Buffett's style of investing. Productive businesses within the U.S. equity markets are still the best defense against difficult economic conditions. I don't know about you, but I will be greedy when others are fearful.

This article was written by

I am a former Investment and Commercial Banker with over 35 years experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. As author of High Dividend Opportunities, the #1 service on Seeking Alpha for the 6th year in a row.

Our unique Income Method fuels our portfolio and generates yields of +9% along side steady capital gains. We have generated 16% average annual returns for our members, so they see their portfolio's grow even while living off of their income! 4500+ members have joined us already, come and give our service a try! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. No one needs to invest alone.

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I am also a Certified Mortgage Advisor CEMAP, a UK certification. I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Seeking Alpha, Investing.com, ETFdailynews, and on FXEmpire.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side who invest in our own recommendations, you can count on the best advice!

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space! For more information on “High Dividend Opportunities” please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Disclosure: I/we have a beneficial long position in the shares of FFC, HT.PE, DFP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, Preferred Stock Trader, Philip Mause, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities.

Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.