The Indian market lost 2 percent in April, erasing some of the previous month’s gains, as a mix of global and domestic worries trigger high volatility.

Nervousness in the global market after the US Federal Reserve hinted at an aggressive rate hike, rising bond yields and crude prices, the worsening Russia-Ukraine war, mixed quarterly earnings from India Inc and relentless FII selling have kept investors worried.

Another week flashes red

During the week ended April 29, the Sensex was down 136.28 points, o 0.23 percent, at 57,060.87, while the Nifty ended 69.45 points, or 0.40 percent, lower at 17,102.5.

Among sectors, Nifty media fell 6 percent, oil & gas 2.6 percent and the IT index ended 2.5 percent lower. Nifty FMCG index rose 1 percent.

The BSE midcap index fell 1.1 percent, the smallcap index shed 2 percent and the largecap index was down 0.45 percent.

"The Nifty witnessed a volatile action in the week gone by & ultimately formed an inside bar on the weekly chart. For the last couple of weeks, the index is oscillating near its key weekly moving averages and this has developed as a triangular pattern on the daily chart," said Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas.

"On April 29, the index faced resistance near the junction of the swing high on the daily chart and the 20- DMA, ie near 17400. Thereon, the Nifty nosedived towards the end of the session & formed a bearish outside bar as well as an Engulfing bear candle on the daily chart."

Overall structure suggests that the index can continue to consolidate in the range of 17,000-17,400 and once the swing low of 16,958 is breached, the index can slide to 16,600, Ratnaparkhi said.

Foreign institutional investors (FIIs) sold equities worth of Rs 11,446.52 crore, while domestic institutional investors (DIIs) bought equities worth of Rs 9,703.04 crore during the week.

As many as 46 smallcap stocks declined between 10 and 54 percent. These included Future Consumer, Future Lifestyle Fashions, Zee Learn, Future Supply Chain Solutions, KBC Global, Future Enterprises, TV18 Broadcast, Yaari Digital Integrated Services, 63 Moons Technologies and Future Retail.

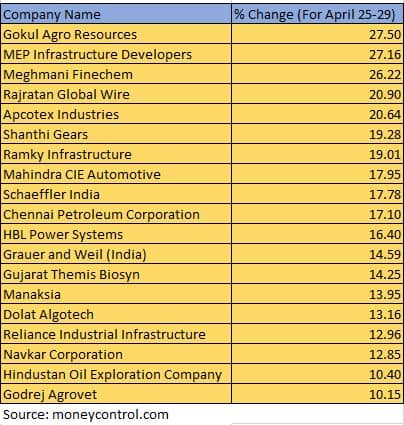

On the other hand, Gokul Agro Resources, MEP Infrastructure Developers, Meghmani Finechem, Rajratan Global Wire, Apcotex Industries, Shanthi Gears, Ramky Infrastructure and Mahindra CIE Automotive were among those which added between 10 and 27 percent.

"The Nifty started this week with a gap-down opening and then recovered from the lows of 16,900. Although the index traded within a range of 500 points throughout the week, the volatility within the range was one of the most difficult to trade. Ultimately, the index ended the week around 17400 with a loss of about half-a-percent over last week’s close," said Ruchit Jain, Lead Research, 5paisa.com.

Volatility in international markets led to moves on both sides in the Indian market as well, he said.

Midcap losers included Zee Entertainment Enterprises, JSW Energy, Apollo Hospitals Enterprises, NHPC, Indraprastha Gas, ICICI Securities, Union Bank of India and Bharat Electronics. However, gainers were CRISIL, Shriram Transport Finance Corporation, Adani Power, Aditya Birla Capital, Indian Hotels Company and MRF.

The BSE 500 index fell 0.7 percent, dragged by TV18 Broadcast, Sterlite Technologies, Tata Teleservices (Maharashtra), UTI Asset Management Company, La Opala RG, MMTC and Network 18 Media & Investments. However, gainers included Mahindra CIE Automotive, Schaeffler India, Ruchi Soya Industries, Godrej Agrovet, Hero MotoCorp and CRISIL.

Month in review

In April, the Sensex declined 1,507.64 (2.57 percent) and Nifty lost 362.25 points (2.07 percent).

On the sectoral front, the Nifty energy index added 10.6 percent, Nifty FMCG 6.5 percent and the Nifty auto index was up 5 percent. However, Nifty IT index fell 13 percent and Nifty media 9 percent.

The BSE midcap index rose 1.5 percent and the smallcap index added 1.7 percent. The Large-cap Index slipped 1.2 percent.

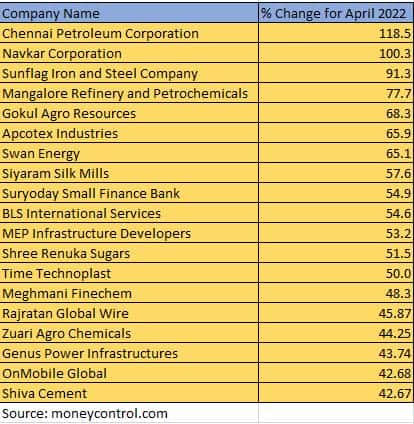

Around 270 smallcap stocks rose 10-118 percent, while 70 stocks lost between 10 and 51 percent during the month.

Chennai Petroleum Corporation, Navkar Corporation, Sunflag Iron and Steel Company, Mangalore Refinery and Petrochemicals, Gokul Agro Resources, Apcotex Industries, Swan Energy, Siyaram Silk Mills, Suryoday Small Finance Bank, BLS International Services, MEP Infrastructure Developers, Shree Renuka Sugars and Time Technoplast added 50-118 percent.

In April, FIIs sold equities worth Rs 40,652.71 crore, while DIIs bought shares worth Rs 29,869.52 crore.

Where is Nifty headed?

Yesha Shah, Head of Equity Research, Samco Securities

The Nifty has been consolidating for two weeks in the 16,900-17,350 range. A crucial support zone has been established around 16,800 and the benchmark has managed to bounce back multiple times from this level.

On the weekly chart, while the Nifty formed an inverted hammer this week after forming a Doji candle in the previous week. This is a bullish indication, as the pattern suggests that a bottom is likely to be in place and we may see a trend reversal.

Therefore, we recommend that traders maintain a bullish stance on the index for the next couple of weeks with a target of 18,000.

Amol Athawale, Deputy Vice President-Technical Research, Kotak Securities

After a robust start to the new F&O series, bulls lost momentum midway as selling pressure intensified in highly volatile trades, with strong selling in banking, oil & gas, power and realty stocks leading the slump.

Selling came on the day when most Asian indices ended in the green and key European gauges, too, were trading higher.

A sharp rise in crude prices reignited fears of inflationary pressure on the economy. Corporate earnings announced so far have failed to cheer the Street, leaving investors in a spot.

Technically, the market is holding higher bottom formation but at the same time, it is consistently taking resistance near 17,400.

The selloff is indicating a strong possibility of short-term correction as the market texture remains volatile and non-directional.

For the bulls, the 200-day SMA, or 17,300, will act as a crucial resistance and above the same, the Nifty can move to 17,400-17,550.

On the flip side, 17,000 and the 50-day SMA are the two important support levels for the index and below 17k, another correction wave up to 16,900-16,800 is not ruled out.

Manish Shah, Independent Technical Analyst

April 29 was the last trading day of the month and we have a completed monthly candle. It is a small narrow ranged candle, which is more like a key reversal bar. Now, 18,200 is acting as a barrier to any major upside. Till this level is not convincingly broken, listless action will prevail.

On the weekly chart, it is again a narrow-ranged candle with a shorter term range between 17,400 and 16,800. The range has been prevailing for two weeks. Volatility and direction has disappeared.

The Nifty is decoupled from the rest of the world. No matter which way the markets are moving around the world, the Nifty is staying flat.

What we are seeing is an extreme contraction of volatility. Whichever way the breakout comes, the effect will get magnified. Pop out of 17,400-17,450 will lead to a quick spurt towards 17,800.

On the lower side, a break below 16,800-16,700 could retest 16,400. Fireworks and a clear-cut directional movement in the Nifty is elusive as the market searches for a direction.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclosure: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.