FGB: Higher Interest Rates Make This Fund Hold Up Better

Summary

- FGB has been performing about flat for the year, which is better than most other investments at this time.

- This might be surprising since it is generally a riskier position, but this is because BDCs can actually benefit from higher interest rates.

- The fund's discount is right near our 8% buy target, but even now could be a fine time to add if you want a basket of BDCs.

- Looking for a portfolio of ideas like this one? Members of CEF/ETF Income Laboratory get exclusive access to our model portfolio. Learn More »

da-kuk/E+ via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on April 28th, 2022.

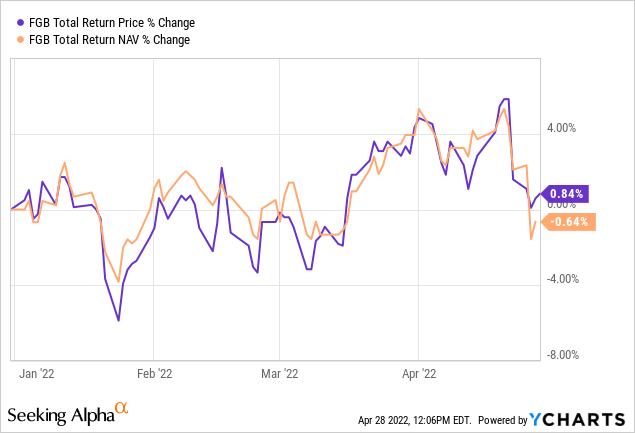

First Trust Specialty Finance & Financial Opportunities Fund (NYSE:FGB) may not have had the best history in terms of price appreciation. However, this year it has been bucking the downward movement of the overall market. It has held mostly flat through 2022, though it has slipped just a bit on an NAV basis.

YCharts

Despite being a riskier fund overall, the underlying business development companies or BDCs can benefit from increased interest rates. This is primarily because they largely borrow at fixed rates and lend at floating rates. Even though FGB can hold other types of financial "opportunities," they overwhelmingly invest in BDCs.

They can be riskier since they lend out capital to smaller to mid-sized businesses. These are the types of businesses that can be impacted the most during times of economic slowdowns. Given the performance thus far, it would seem that most BDCs have been able to hold up relatively well despite the potential for a recession that some investors predict is coming in the next year or two.

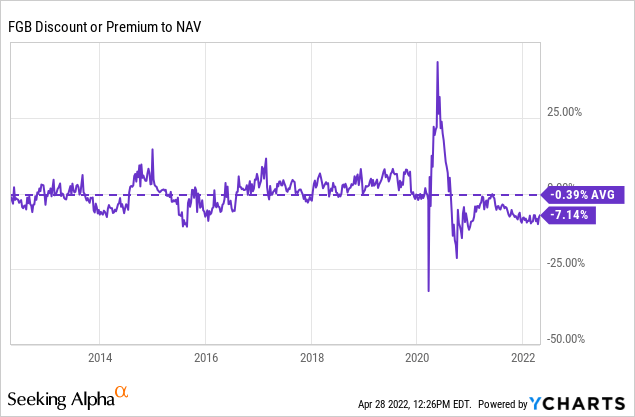

FGB isn't hitting our buy zone yet exactly, but it is coming close. The target, in this case, would be to buy at an 8% discount and then sell at parity.

The Basics

- 1-Year Z-score: -0.29

- Discount: 7.14%

- Distribution Yield: 8.19%

- Expense Ratio: 1.49%

- Leverage: 12.11%

- Managed Assets: $71 million

- Structure: Perpetual

FGB has an investment objective to "seek a high level of current income. As a secondary objective, the fund seeks an attractive total return." To achieve this, the fund will "invest, under normal market conditions, at least 80% of its managed assets in a portfolio of securities of specialty finance and other financial companies that the Fund's sub-advisor believes offer attractive opportunities for income and capital appreciation."

The fund is quite small, and that means larger investors might not feel comfortable investing in this fund, or those investors that want to get in and out of funds quickly might not get that opportunity with this fund.

The fund has a moderate amount of leverage, which makes it riskier than holding a basket of BDCs on its own. Remember, BDCs can have some high leverage of their own, so this is leverage on leverage. That could be why First Trust hasn't leveraged this fund up even further.

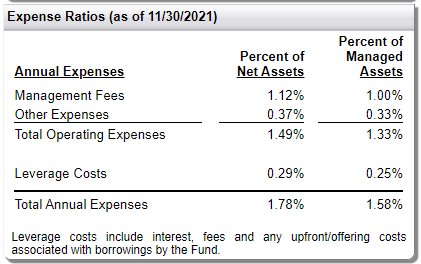

The fund's expense ratio comes to 1.49%, and it comes to 1.78% with leverage expenses. While BDCs often have fixed-rate borrowings, traditional CEFs do not generally have fixed-rates. This is the case with FGB as they borrow at 1-month LIBOR plus 85 basis points. Therefore, higher rates mean higher interest expenses for this fund. At the same time, it shouldn't impact the underlying holdings too negatively.

FGB Expenses (First Trust)

Performance - Nearing Buy Zone

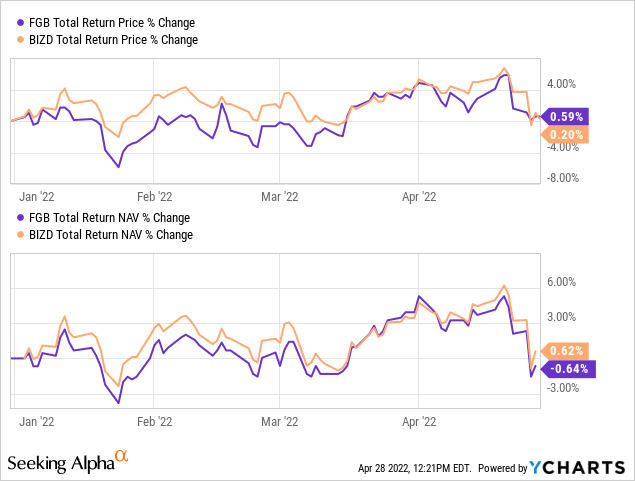

As we highlighted above, this fund has been holding up relatively well on a YTD basis. This is in line with the VanEck BDC Income ETF (BIZD). BIZD is a fair benchmark to provide some comparison, but the ETF is not leveraged. On a YTD basis, BIZD has actually been able to hold up a bit better in terms of total NAV return - touching positive territory at the time of writing. On the other hand, FGB has been able to close its discount a bit, so the actual total share price return has favored FGB.

YCharts

This helps highlight why CEFs can be a great idea to hold when they are at deeper discounts. Despite a minor underperformance so far on an NAV basis, shareholders would still be better off.

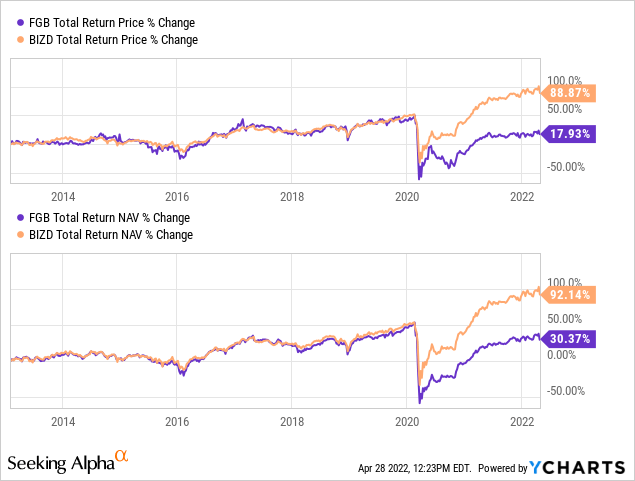

Over the longer term, we can see that these funds provided similar returns until around 2020. This is because even that modest amount of leverage had permanently damaged FGB.

YCharts

As the fund went through 2020, they had borrowings of $25 million and then reduced this down to just $6.5 million. That's quite a sizeable cut percentage-wise for a small fund.

Over the longer term, there was a time when FGB regularly traded at a premium. That's why over the last decade, the average discount has come in at a fairly shallow level. The discounts really haven't been persistent until 2020. In 2008/09, a deep discount was also present.

YCharts

Distribution - 8.19% Distribution Yield

One of the reasons to own a CEF is due to the higher distribution yields that they can often pay. They can do this because they utilize leverage on top of distributions with capital gains or return of capital. BDCs also are higher-yielding instruments since they are also required to pay out most of their earnings.

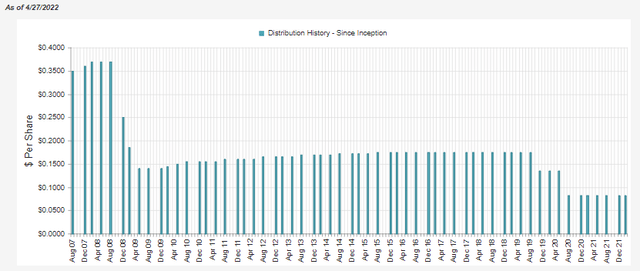

The current distribution yield for FGB comes to 8.19%. On an NAV basis, this comes to 7.60%. They have cut several times but have been primarily due to 2008/09 and 2020. However, they had a trim in 2019, too. There wasn't any deep sell-off that was especially noteworthy - unless you count the Q4 2018 slump.

FGB Distribution History (CEFConnect)

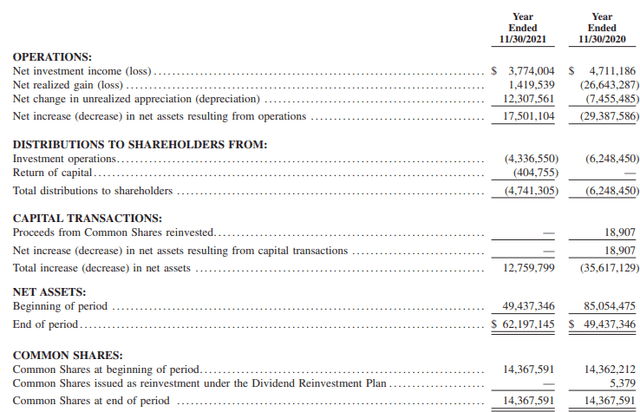

In terms of distribution coverage, due to those dividends and distribution from the underlying BDCs, we often see higher net investment income for the fund. That then translates into higher NII coverage.

FGB Annual Report (First Trust)

In their last fiscal year, we can see that NII coverage came to almost 80%. The remainder was made up through realized gains.

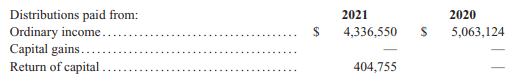

When it comes to tax classifications, most of the distributions are characterized as ordinary income. This also makes sense since BDCs are often collecting interest on their outstanding loans.

FGB Annual Report (First Trust)

FGB's Portfolio

Overall, FGB's portfolio is narrowly invested. According to CEFConnect, they held only 29 positions. This has been fairly consistent since I began following the fund. Their turnover isn't all that high either. In the last fiscal year, turnover was reported at just 8%. That means they are not doing a lot of buying and selling of their underlying positions.

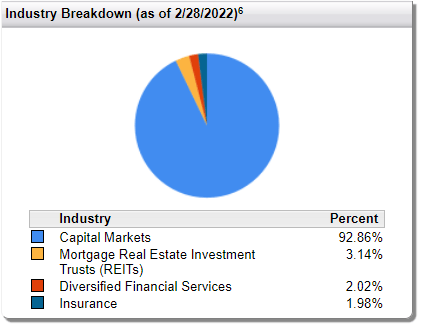

As mentioned above, FGB is dominated by its BDC positioning. They list some REIT exposure, but these are through mREITs. Then they also list exposure to diversified financial services and insurance. This was fairly close to the weightings of the fund in our previous update at the end of November. However, BDC exposure had come down a touch from the 96.26% it had previously reported.

FGB Portfolio Weighting (First Trust)

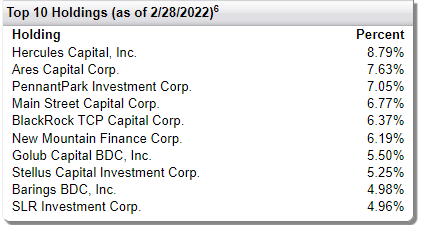

Taking a look at the fund's top ten holdings, we see some of the familiar names we saw the last time. In fact, every position is the same, but some weightings shifted as would naturally be the case as the market gyrates. They hold several of the more popular BDCs. Overall, there are only around 50 BDCs the last I knew, so there isn't a huge basket to choose from if they stay invested in that market area. If they branched out into other financial offerings, they could certainly diversify more broadly.

FGB Top Ten (First Trust)

The largest holding continues to be Hercules Capital (HTGC). I have had this BDC get mentioned several times by readers and ran across it on FGB many times; I decided to do a deep dive into the name under the Cash Builder Opportunities profile. Overall, it seems to be a fairly attractive BDC that has delivered some attractive returns and income to investors. It makes sense that we continue to see it in FGB's portfolio and as its largest position.

From there, we have Ares Capital Corp (ARCC) as its second-largest position, exactly the place it was in our previous update as well. ARCC is the largest BDC on the market at the moment.

Main Street Capital (MAIN) is another of the more popular BDCs around today. In fact, on the Seeking Alpha platform, it has more followers than ARCC does. MAIN has 58.94K followers, and ARCC has 54.65K followers. That seems to be the power of a monthly dividend.

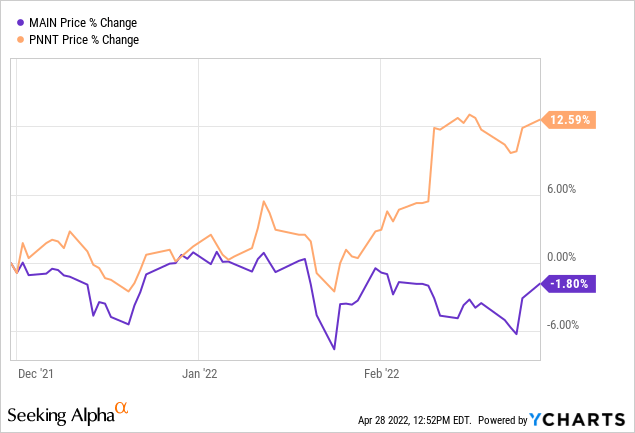

MAIN had previously come in as the third-largest weighting for FGB, but this has now slipped under PennantPark Investment Corp (PNNT). The main reason for this seems to be due to the performance of PNNT far surpassing MAIN's during the time period we are looking at. That would be between the end of November and the end of February.

YCharts

Conclusion

FGB is right near buy territory, but it could easily still be picked up by investors at this time. Ideally, we would want to see a deeper discount to add more downside protection ultimately. However, that doesn't mean that we will ever see that level, and if an investor really wants a basket of BDC exposure, FGB could be a great option. Putting capital to work in BIZD is always an option as well until FGB gets to a larger discount. One of the downsides there is that the quarterly distribution varies, where FGB pays a generally more consistent quarterly payout.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Feel free to follow me on StockTwits as well, if you are over there too!

Disclosure: I/we have a beneficial long position in the shares of MAIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.