U.S. pharmaceutical sector fails to spring higher amid lackluster April performance

Diego Thomazini/iStock via Getty Images

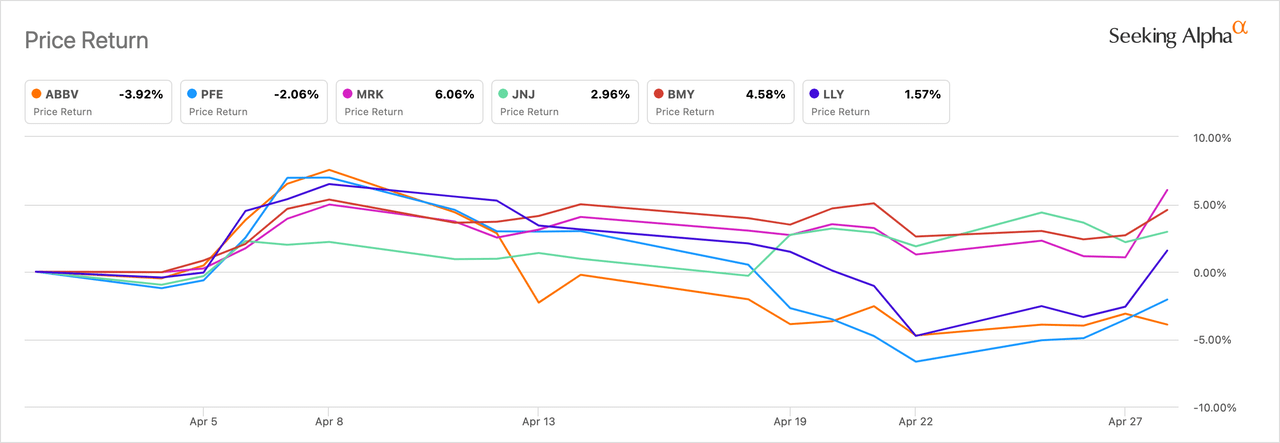

With April 2022 trading in the books, the U.S. large pharmaceutical sector had a fairly mediocre month, though it still performed better than the S&P 500 Index.

The iShares U.S. Pharmaceuticals ETF (IHE), which tracks the Dow Jones U.S. Select Pharmaceuticals Index, finished the month down 2.3%. By comparison, the S&P 500 lost 5.6% in April.

The two largest holdings in the fund are Johnson & Johnson (NYSE:JNJ) and Pfizer (NYSE:PFE), which account for, respectively, 22.5% and 20.8% of total holdings. J&J (JNJ) gained 3% in the month while Pfizer was down 2%.

The best performing large U.S. pharma in April was Merck (NYSE:MRK) with a ~6.1% return. The company surged late in the month following its strong Q1 2022 results which were driven by a 50% year-over-year increase in global revenues helped by sales of its COVID-19 pill molnupiravir.

The pharma with the second highest return in the month was Bristol-Myers Squibb (BMY) which gained 4.6%. Bristol ended the month on a down note following its Q1 results.

The worst performing large U.S. pharma was AbbVie (NYSE:ABBV), which was hit on April 29 by a quarterly revenue miss and a lowering of full-year EPS.

Read why Seeking Alpha contributor Edmund Ingham argues that Merck (MRK) is the best big pharma company to own today.