Adaro Energy: Impervious To U.S. Inflation, Recession, And The Coming Drawdown

Summary

- Adaro Energy is Indonesia's second-largest coal thermal exporter, providing for the Asian markets and now Europe.

- Growth is fantastic: Last quarter's revenues were up 145% year over year; net income was up 1265%.

- Adaro is cheap: It trades at a 7.4 P/E, a 1.7 P/S, a 1.6 P/B, and it has a dividend of 7.5%.

- It is insulated from European woes and the US asset bubble.

pawopa3336/iStock via Getty Images

"Opportunities are like sunrises. If you wait too long, you miss them." - William Arthur Ward

With a brief lead in hypersonic weaponry, Russia seized the moment to indulge its worst revanchist impulses. In doing so, it has punctured "just in time" Globalization 2.0, forcing each nation on earth to now reevaluate on its own respective energy and food security needs.

In the near term, the West's diplomatic effort to cut off the largest energy supplier in the world from its markets may well be catastrophic for inflation worldwide. Europe is already seeing enormous jumps in costs: Spain's PPI hit 41% year over year in February and inflation now hovers at 10%; Germany's March PPI was 31%. These numbers will only get worse if the lost Russian energy supplies can't be resupplied from elsewhere. We have entered a crush zone.

It will take most of 2023 and 2024 for the global flows of the energy markets to be re-circuited in what can only be described as a far more complicated and costly network. The Urals crude that is barred from Europe will eventually flow to East Asia. Russian diesel exports will head to Brazil or parts of Africa. Saudi crude, Indonesian coal, US WTI, and LNG will now cross oceans to Europe.

On April 4, EU announced it was planning to stop all Russian coal imports in mid-August [1]. In 2021, the European Union imported 46% of coal imports from Russia. There is an enormous gap to be made up, particularly in Germany and Netherlands. (More broadly, the EU imported more than 40% of its total gas consumption, 27% of oil imports, and 46% of coal imports from Russia.)

Governments across the world are now sprinting to secure their energy sources. This bodes well for Indonesia and its coal heavyweight Adaro Energy (OTCPK:ADOOY).

Enter King Coal:

We have entered a strange interstitial period - I'll call it "Coal's Interregnum" (2022 to 2024) - when the massive puncture to Europe's energy security will have the world scrambling, hand over fist, for the dark stuff. To avoid a global depression and rioting in the streets, de-carbonization targets will be shelved.

Though the dirtiest and most politically incorrect of all fossil fuels, coal travels expeditiously. It doesn't require the lead-time prep of LNG facilities or pipelines to be built; Germany's big new ambitions in this regard won't be completed until 2025.

Coal also remains the cheapest of fossil fuels. Thermal coal -the kind burned by power plants - costs at about $15 per million BTU, compared with $25 for crude oil and $35 (global price) for natural gas. For governments this is key. China is actively stockpiling, despite the Covid slowdown, obsessed with avoiding the power outages it experienced last year. India is adding to its imports, as it is experiencing intense heatwaves. In fact, India's power ministry observed a peak-power demand on Thursday, April 28 and expects demand may spike higher by 8% in May [2].

India relies mostly on coal to meet its electricity demands. While the government insists that there is sufficient availability of coal to meet its needs, the inventories of the fossil fuel are currently at the lowest they have been in the last nine years [3].

Even in Germany and Italy, coal-fired power plants that were once decommissioned are now being considered for a second life. The rush is on.

According to the International Energy Agency, this year's total coal consumption - for generating power, making steel and other industrial uses - will rise over 2% to a record of just above 8 billion metric tons. It is expected to remain there through at least 2024-2025. This is on top of 2021, a year in which the world generated more electricity from coal than any prior year, an increase of 9% from the moribund 2020.

Indonesia: A Refuge From the Coming Drawdown

Given this context, it is no surprise that Indonesia's coal exports hit a record in March 2022. Indonesia is the world's biggest thermal coal exporter. A vast country of countless islands, it is Southeast Asia's largest economy and a commodity powerhouse in many sectors.

Financially speaking, the country is quite insulated from the European crisis and the US asset bubble. It may even be helped by today's commodity inflation and efforts to find new supply chains. Indonesia booked a budget surplus of $2 billion in January as tax revenues soared. Unlike the Thai Baht Crisis era of the late 90s, ASEAN nations like Malaysia and Indonesia are not vulnerable to Fed policy tightening or western investment. The Chiang Mai Initiative solved that. Foreigners hold less than a fifth of Indonesian government debt and foreign ownership accounted for only 28% of Indonesian stocks in January, down from 37% in 2013.

Adaro: Spectacular Growth at a Great Price

The country's mining companies will post very strong earnings growth in the coming years amid soaring prices, fresh EU demand, and aggressive hoarding by India and China.

One such company, Adaro Energy - Indonesia's second-largest coal miner - is the perfect investment for today's high inflation environment. It is a low-cost, truly "under-the-radar" mining company that is about to see secular tailwinds, massive growth, and its first time in the spotlight. Its subsidiary, Adaro Energy Indonesia, has already exported around 300,000 tons of coal to European buyers in response to sanctions on Russian coal.

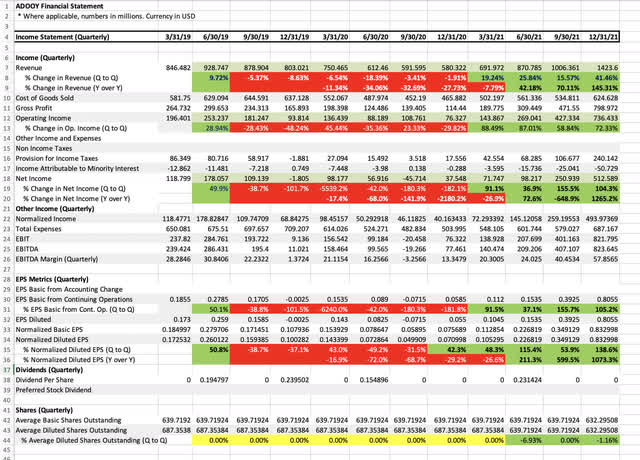

After troughing during the pandemic, Adaro Energy has seen a fantastic uptick in its topline revenue and net income:

- Q42021 revenue was up 145% year over year, from $580 million to $1.42 billion.

- Q42021 net income was up 1265% year over year, from $37 million to $512 million (and up 104.3% from Q3).

- Normalized diluted EPS for the same quarter was up 1073% year over year, and 138.6% from Q3.

The Covid doldrums are clearly behind them. (See spreadsheet)

Adaro Energy Financial Statement 3/31/2019 to 21/31/2021 (Author)

In addition, the company has reduced its share count by 8.7% over the past year. It has $2.03 Billion in cash on the balance sheet. Its dividend yield is presently 7.25%, with the next semi-annual dividend coming up around May 7, 2022. There is a lot to like.

Unlike most US equities, Adaro Energy offers the American investor access at a very low valuation. It trades at a 7.4 P/E; a 1.7 P/S; a 1.68 P/B; an EV/Assets of .65; and an EV/EBITDA of 4.287.

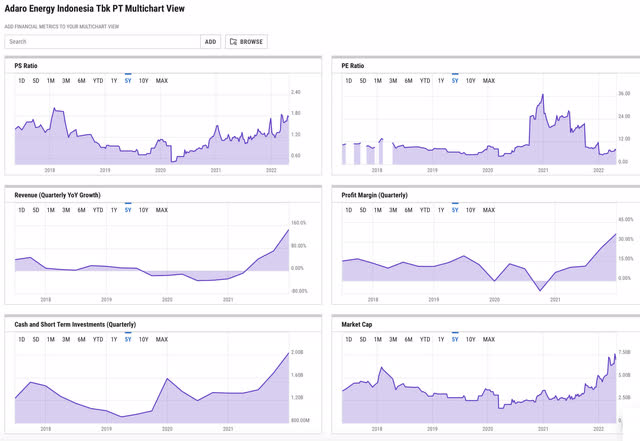

Adaro Energy: Key Ratios (YCharts)

More importantly, the company sits well outside our asset bubble. The complaint that "everything is now expensive" feels real in the US markets: the growth sector multiples are still unwinding (and will for the next 6 to 12 months), and value (think energy/ commodities) has already been quickly bid up. Even great US companies will fall with the index this year.

ASEAN stopped being trendy 10 years ago, but in recent months investors have started to look again at the under-bought region. Foreign flows into Indonesia stocks rose to $1.2 billion in February, the most since April 2019.

Future Prospects:

Unlike Peabody Energy (BTU) or Arch Resources (ARCH), Adaro doesn't suffer under intense regulatory hostility from its central government or growing ESG pressures by its main buyers in mainland Asia. In many ways, it is one of Indonesia's national champions, seen as bringing Indonesia into the 21st century.

Though unknown in the US, Adaro is a big player in Southeast Asia. It is also an adroit player. The company's diversification into coking coal and power plants has helped to buffer the company against volatility in the thermal coal market. And as the group's net income soared more than 500% in 2021, it has decided to expand to renewable energy, constructing big 200-megawatt capacity solar-powered plants with over its retired mine sites in Bintan.

It will also be building hydropower plants and aluminum smelters. Its Adaro Aluminium Indonesia is expected to produce 500,000 tons of aluminum ingots in 2024. About $1 billion may be spent on the smelter to cater for metal demand for car parts and EV components.

Given its growth, valuation, dividend, and prospects, Adaro is - at $10.90 - a rare gem.

[1] EU's full ban on Russian coal to be pushed back to mid-August -sources

[2] India's power demand touches all-time high of 201 GW

[3] India Faces Power and Water Shortages As Intense Summer Causes Countrywide Surge in Demand; Major Disruptions Likely | The Weather Channel - Articles from The Weather Channel | weather.com

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ADOOY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.