Sony: Consumer Weakness/Inflation Risk Offset By Yen Weakness

Summary

- Sony is a Japanese Consumer Entertainment provider with multiple segments of opportunity outside their home country.

- Any reduction in consumer spending over the short term will be easily offset for Sony, thanks to favorable Yen conversion rates and the ability to raise prices.

- Therefore, the current slide in share price may lead to a unique opportunity for those looking for safety in the current market.

David Ramos/Getty Images News

Sony is An Indestructible Consumer Electronics/Entertainment Company

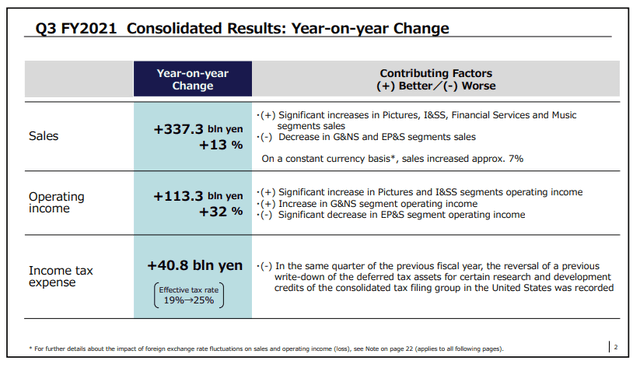

Most people are familiar with Sony (NYSE:SONY), a large Japanese electronics and entertainment provider. However, consumer spending is currently facing difficult comparisons, and is being reflected by negative revenue growth. In fact, based on constant currency, Sony revenues fell 7% YoY last quarter. On paper, however, they grew 13% YoY.

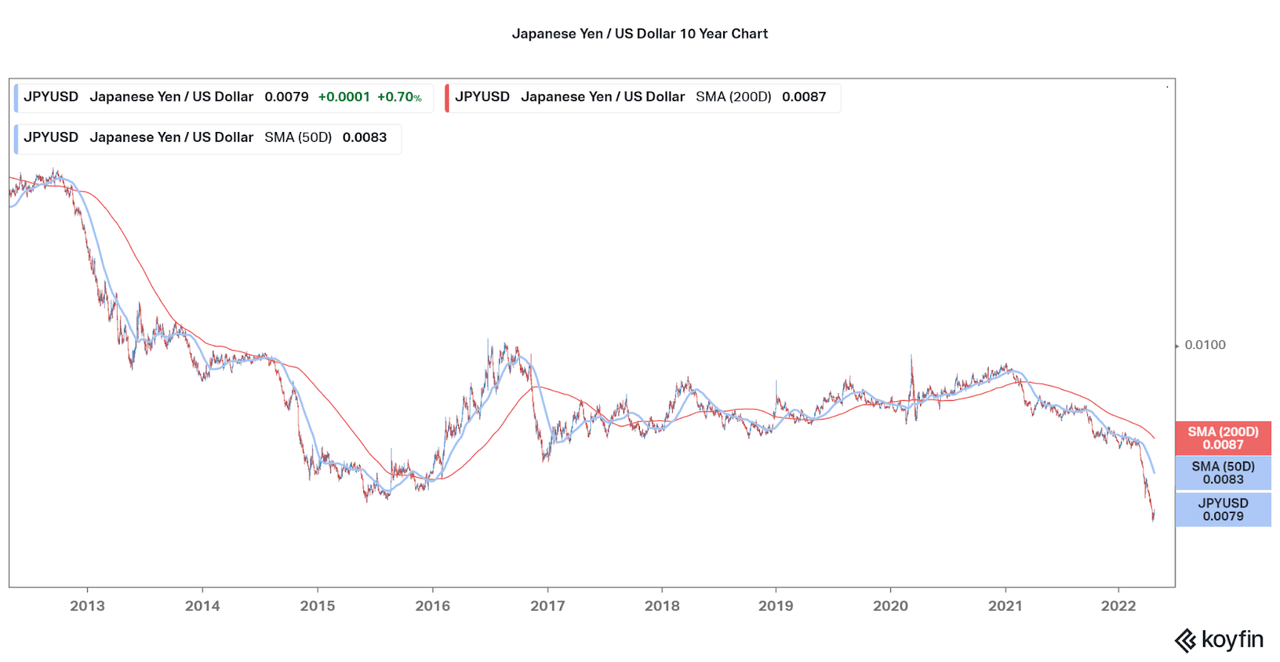

The fact remains that a favorable situation is forming due to forex conversions. At the moment, the Yen is performing the worst it has in decades, and this has exacerbated a decade long decline since the GFC. This may seem like a negative for the Japanese company, but since a majority of revenues are obtained with currencies that are not Yen, revenues are boosted (comparatively).

Increased Yen-based revenues have the ability to increase R&D and investments in the country over the short-term and also provide stability to the share price during the current market weakness. As a result of the falling share price over the past few months, I assume the current share price is becoming quite fair. Also, considering the significant US inflation that is occurring the company can increase prices across all revenue segments and offset demand declines. Lastly, recent headline games exclusive to PlayStation (i.e., Horizon Forbidden West and Gran Turismo 7), successful movies & TV, and even music segments all offer recession-beating growth drivers.

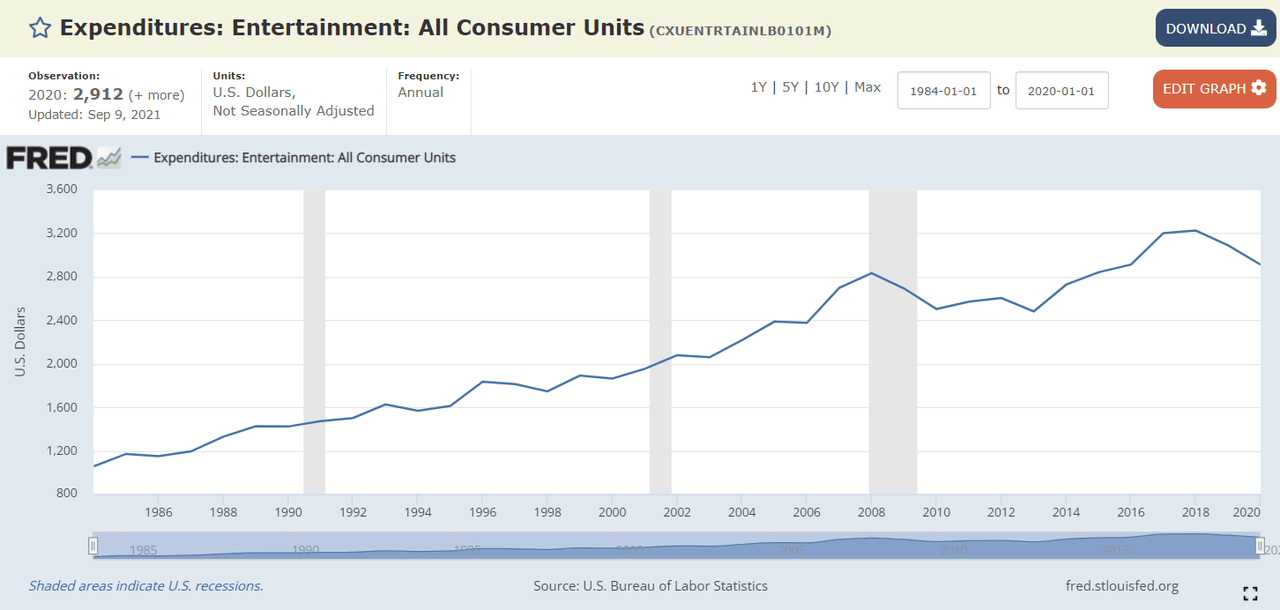

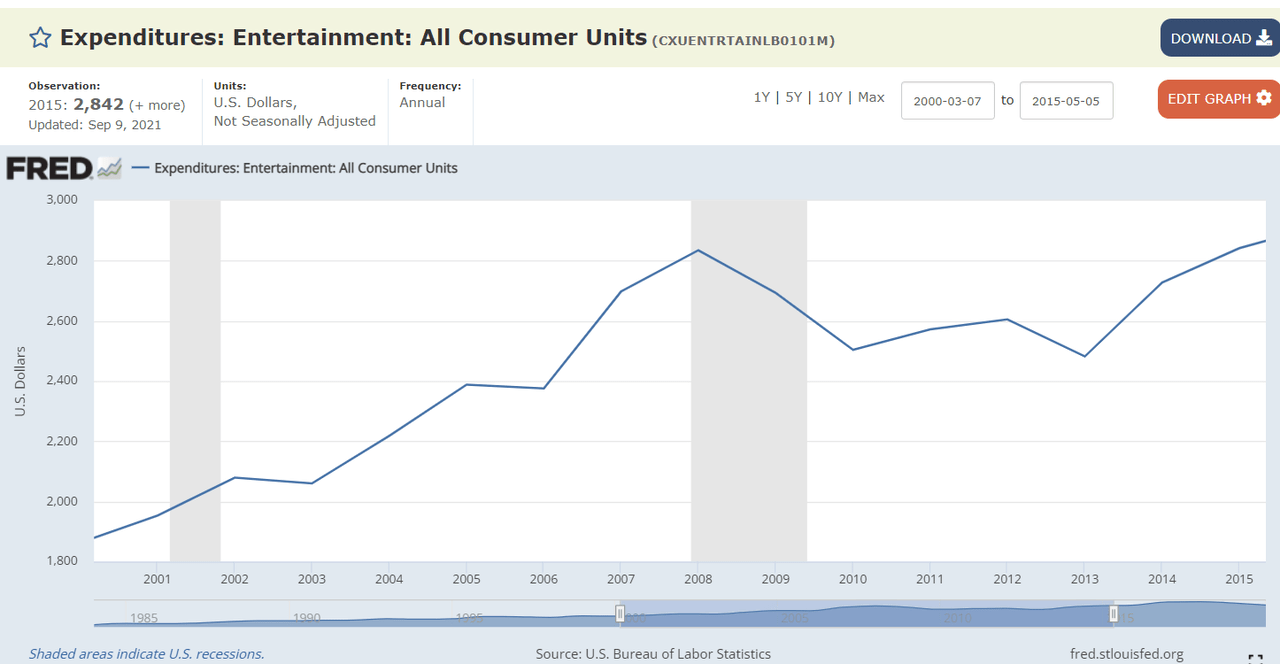

The two charts below highlight how entertainment spending has performed over the past decades, including a focus on the GFC. While many believe that a recession is in store, I personally find that little data points to a GFC-type recession is in store. During the GFC, total expenditures fell by 10%, 5% per year starting in 2008. Then, it took until 2014 for spending to return to normal. Remember this, as it will be important in regards to Sony's performance in the same period.

FRED FRED

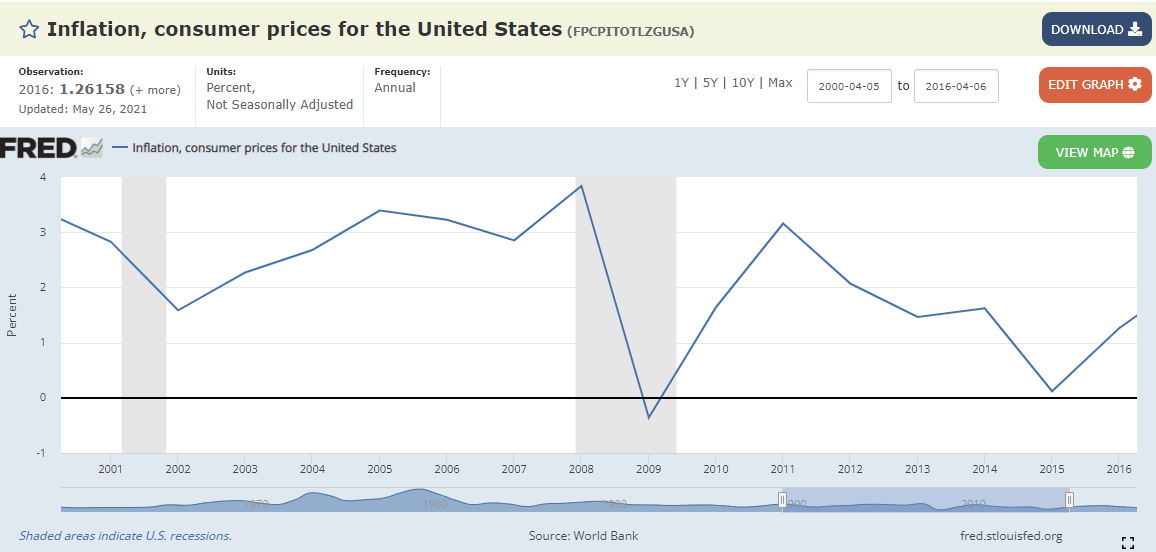

One driver for the recession is the incredible amount of inflation that is occurring in the US, over 8% at a peak YoY. While highlighting how strong demand is/was over the past few years, we can see that the high inflation prior to 2008 was a potential signal for the coming recession and subsequent decline in consumer spending. In fact, inflation fell so much that it even went negative, for the first time since prior to FRED data collection.

FRED

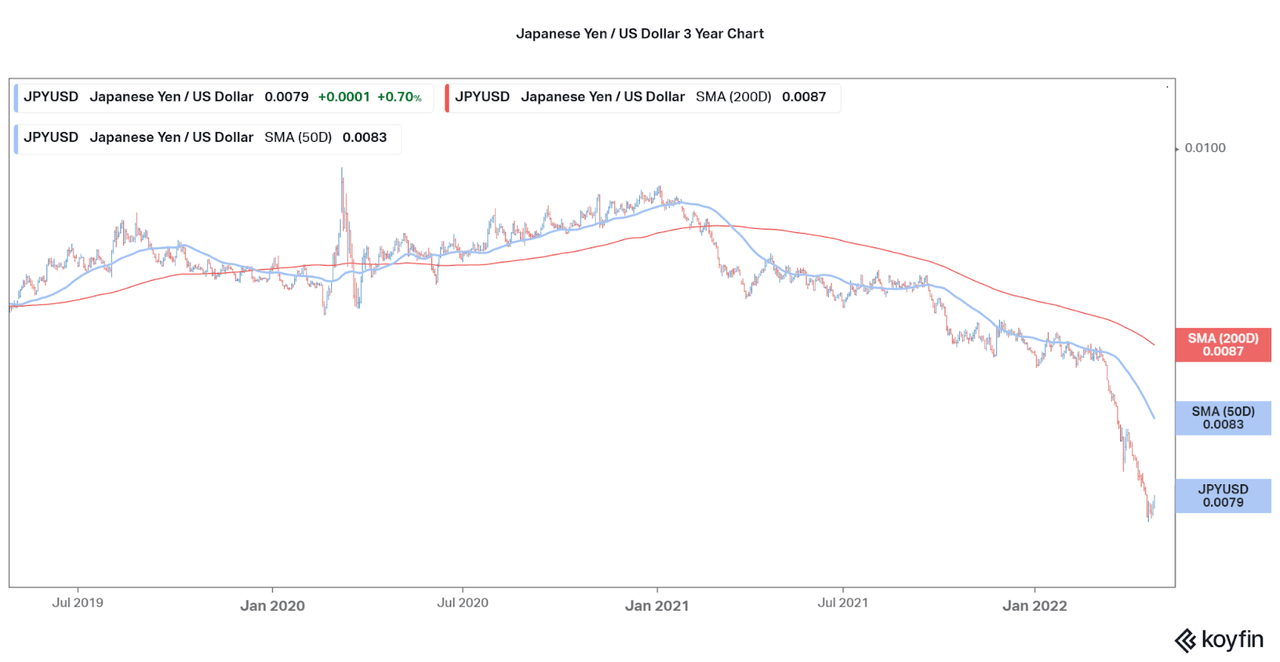

The last economic point I will bring up is the decline of the Yen. Over the past few months, one of the worst declines in the value of Yen has occurred, bringing JPY to USD down to 0.0079: 100 yen is now around 90 cents. When I traveled around the country for a few months in 2019, the conversion was about 0.90 cents per 100 yen. This same pattern is repeated in other currencies and is a result of central banks increasing interest rates while the Bank of Japan fails to do the same.

The usual safe-haven currency is now being seen as more risky due to rising fuel costs and the overall weakening economy. This means that USD has an increase in purchasing power of 20% in a very short time. Considering Japanese inflation has been typically low or negative for decades, and ranged between +0.5-1.5% during the pandemic, we can assume foreign currency remains favorable. Therefore, when Sony converts foreign currency to Yen, they instantly gain a huge revenue boost compared to the years prior for only one reason.

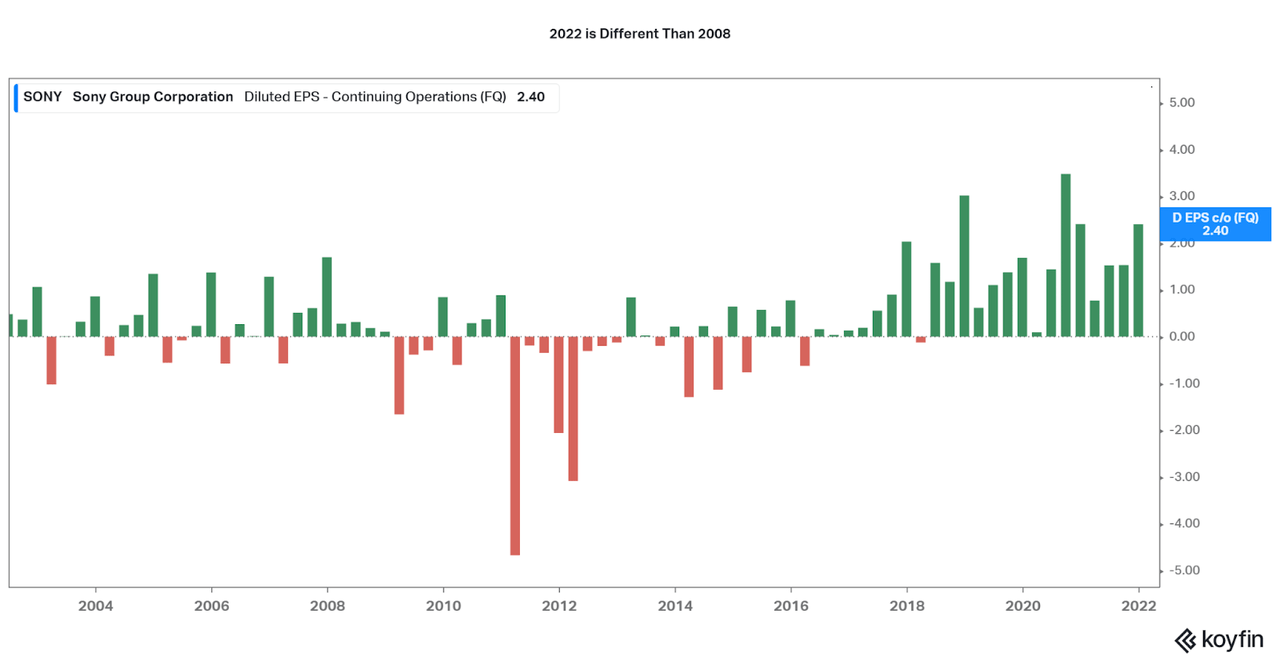

Koyfin Koyfin

My Hypothesis:

Sony sales will outperform peers thanks to foreign currency benefits, even if recessionary pressure reduces spending up to 20% in two years, based on US entertainment expenditures.

My Problems:

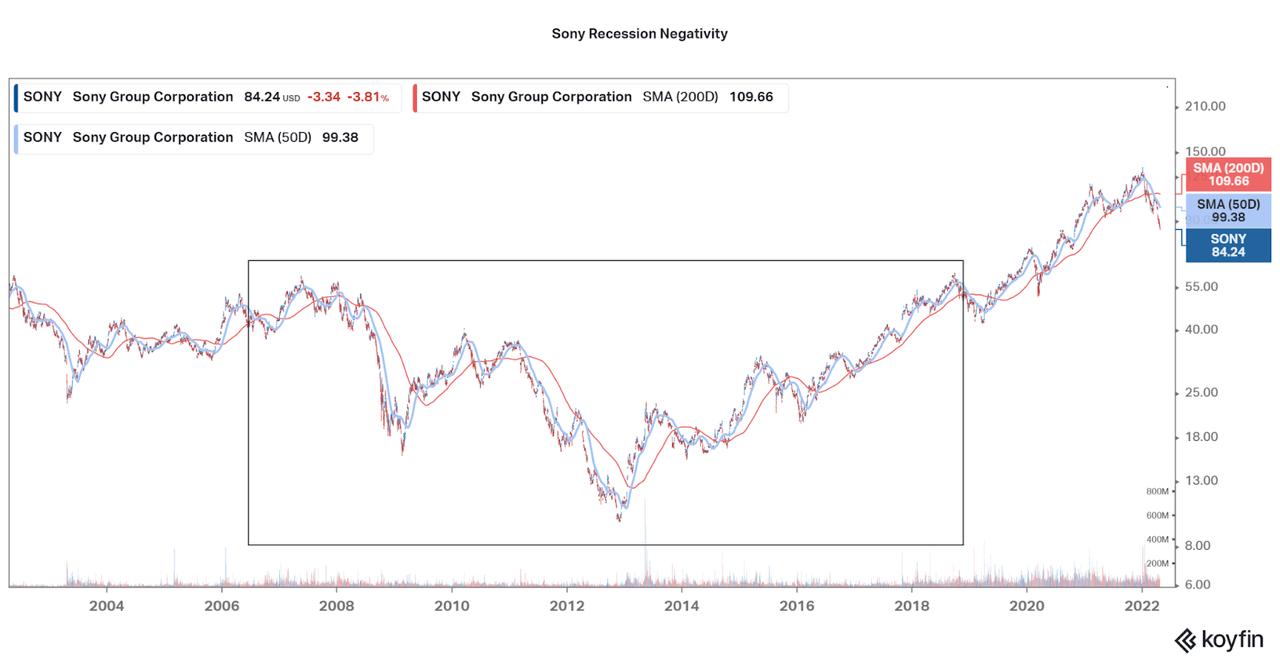

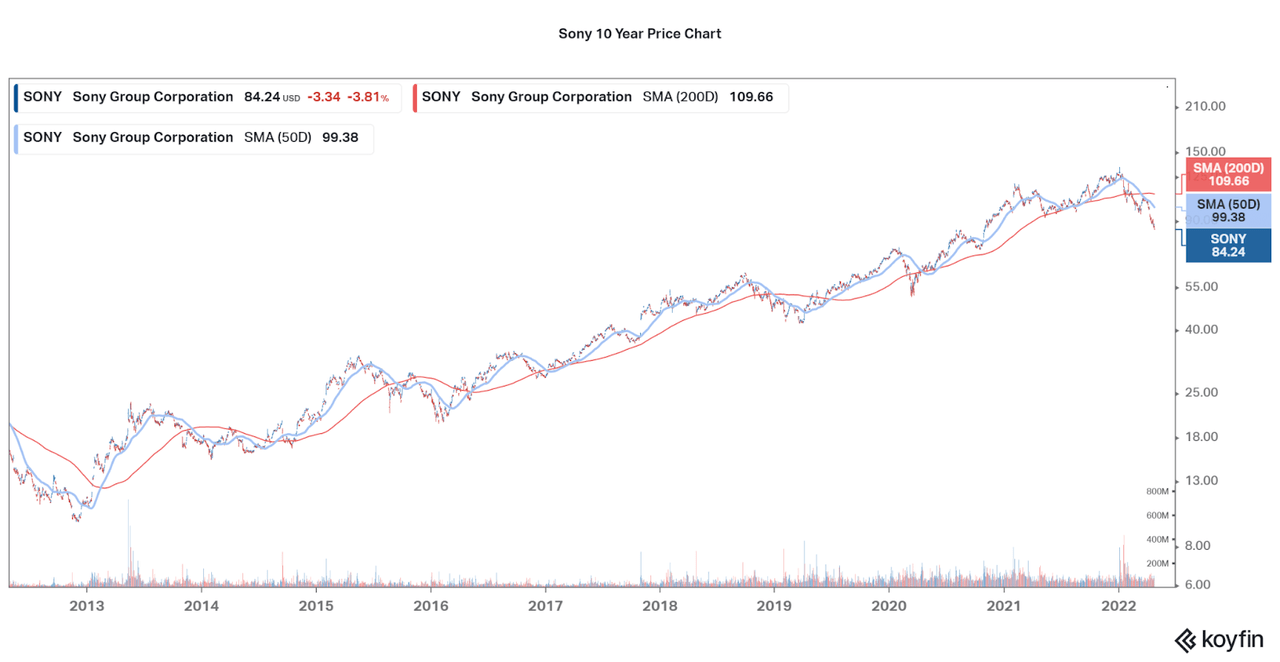

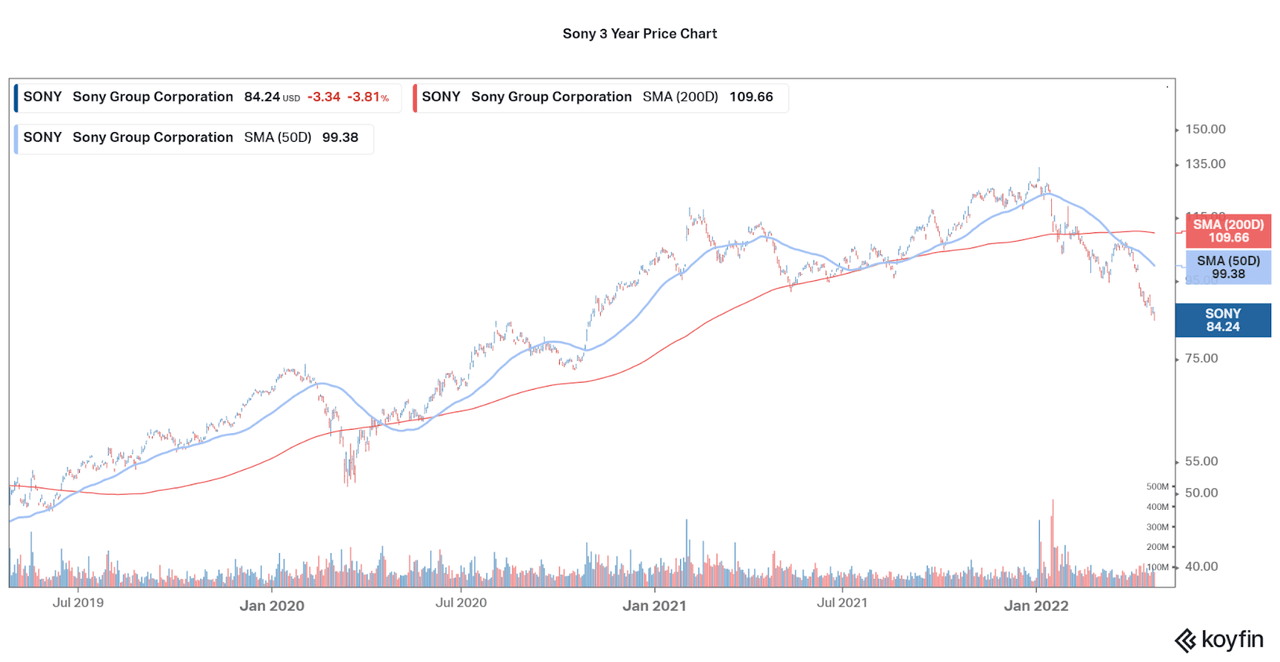

Sony's share price chart

- Current Valuation

Sony's share price does not highlight a company that can ride through a recession. In fact, the company fell almost 80% from peak to trough. Due to the GFC, US consumer spending fell, directly impacting Sony revenues, but at the same time, money was flowing from USD to Yen due to Yen's Safe-haven status. This is an opposite effect to what is occurring right now: Yen weakness. Therefore, Sony should now have stronger performance than in ~2008-12. Further, business success beyond macro factors, such as advancements in Entertainment and Gaming, have led to tremendous success over the past 10 years. Sony is up more than 6x from 2012 lows, 10x at recent highs at the end of 2022.

Koyfin Koyfin

There is, however, a BIG asterisk to the share price performance argument: financial performance. Contrary to US expenditure data, revenues fared relatively well, and rebounded quickly in 2010 and 2011. Unfortunately, bottom-line performance was poor, and net income remained negative for many years. As a result of reduced operational expenditure and investment, revenues took a swift decline leading through 2017.

One major cause of this is from the currency weakness, as internal Japanese costs were extremely high. Another is that future success was significantly hampered by a close to 10,000 staff layoff program. It is an important case study in the effect of reducing costs and future growth. However, fret not, peak to trough quarterly revenues only fell 12.3% YoY for 2012, or 7.3% in 2017. The lowest annual revenues (2017) were a meager $57.9 billion USD, bad right?

Koyfin

We can also look at how operational performance and efficiency is increasing significantly over the past few years. Stable net income and earnings per share offer a different picture than what occurred in years prior. In fact, the last earnings report already listed favorable conversion rates, allowing revenues to grow 13% (compared to -7% with constant currency). Just wait until the next few quarters come out, and some investors will be caught by surprise.

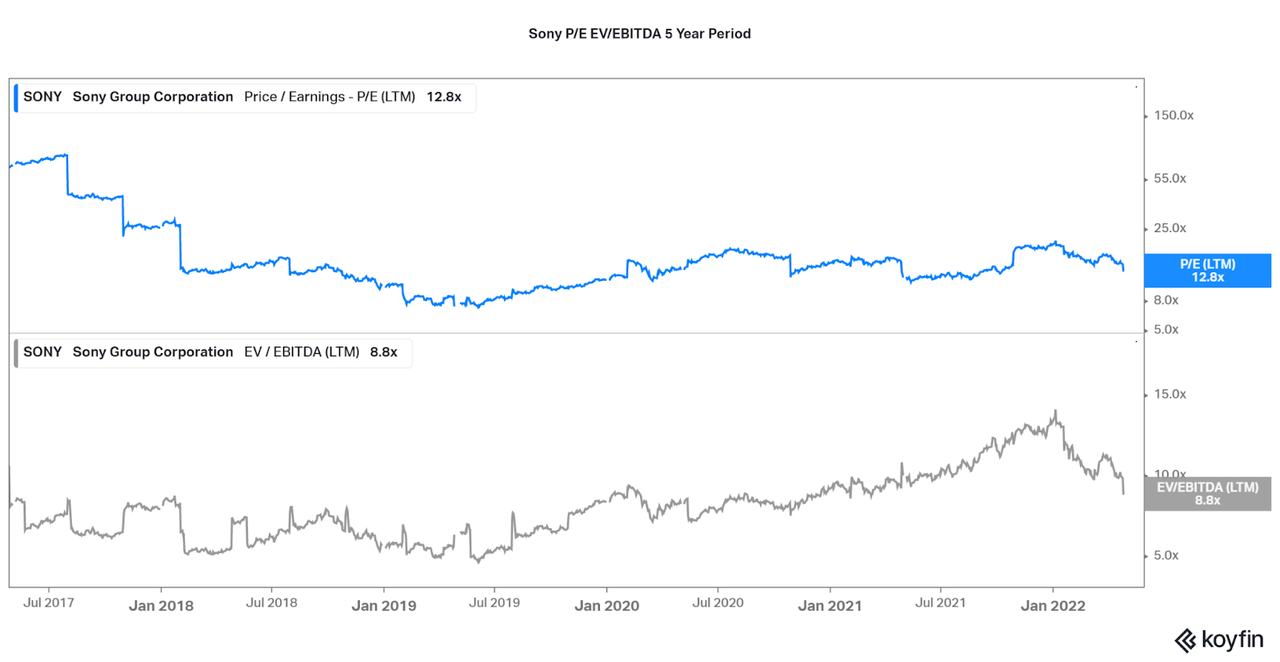

Valuation Risk

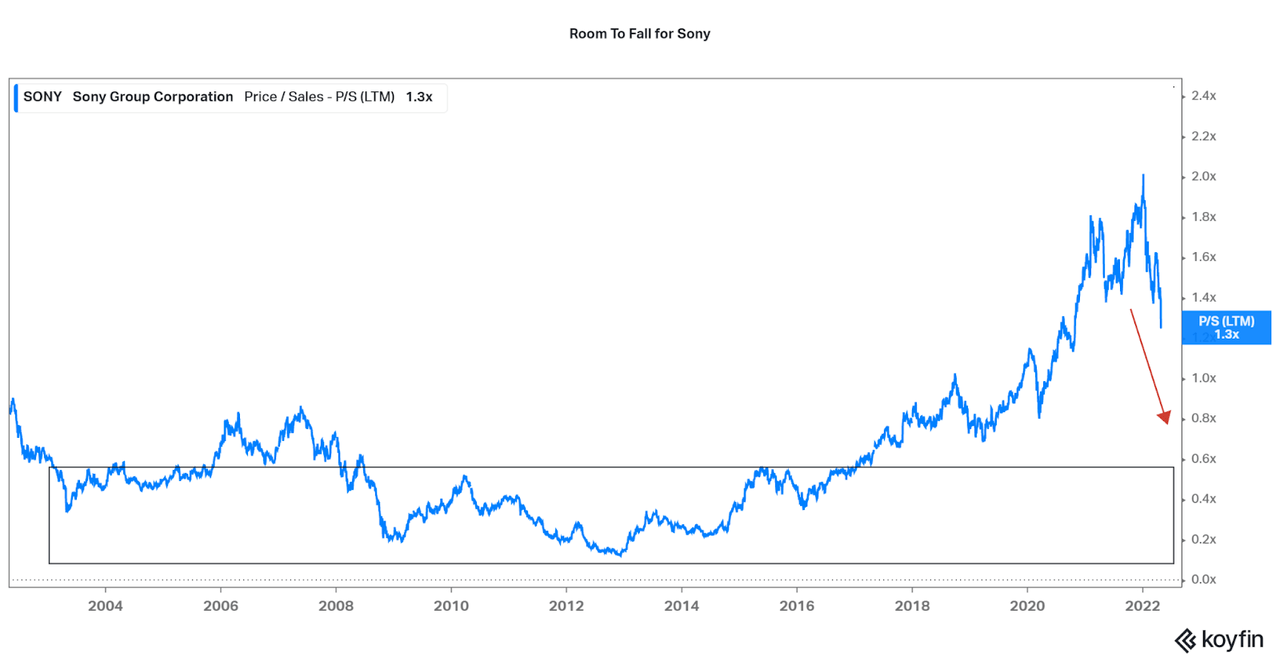

One issue is if you look at the company from purely a valuation standpoint, as many do admittedly. While the Price to Earnings ratio is close to multi-year lows, it remains above 2019 lows. Favorable increases in profitability have allowed for the earnings metrics to be quite low, especially compared the periods of poor performance. I find the Price to Sales ratio is offers better insight, but slightly weakens my arguments.

Koyfin

Sony's improved earnings have also led to a climb in the P/S. While far off the high of 2.0x revenues. The current P/S of 1.3 remains far above any time in the past 20+ years. If investors so choose, they can set a valuation back down well below a 1.0x ratio. While I expect performance to exceed expectations and not be hindered by macro factors over the next few years, the current downward trend is quite strong. While it is important to consider how far the company can fall, it is also important to consider that Sony has the capacity to support a higher valuation.

Koyfin

Conclusion

As revenues keep climbing higher, and Yen weakness supports cheap in-house investment, I believe efficiencies will allow Sony to see strong performance in the latter half of the decade. The fall off the cliff highlights poor investor sentiment, rather than a measure of fundamentals. Therefore, I believe an uptrend will mirror the recent sharp decline, at the least. Over a longer timeframe, I believe Sony has plenty of content and innovation R&D to support growth over the years, especially if Yen weakness remains. I will see if full year earnings are worth an update in May.

Koyfin

The company is an example of a stable conglomerate with plenty of franchises to support nearly perpetual revenues, similarly to Disney (DIS), Warner Bros. (WBD), etc., but with far more diverse endpoints. Not to mention their wide diversity of electronics and necessary financial and device lines that offer the typical Japanese moat-like company profile. This makes the companies a safe bet in difficult times (based on the provided data points). I will be looking to establish a position over the next few months, with multiple investments to reduce volatility. If only they had a dividend, then they would really be an inflation beater! Wait, they do, but it is a negligible 0.5% semi-annual yield.

Anyway, I hope this article has been insightful. Thanks for reading and feel free if you see risks to my thesis.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SONY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.