Microsoft: A Contrarian Pick For High Inflation Environment

Summary

- An analysis of the high inflation period during the 1970s indicates that technology can do well in this environment.

- Microsoft is one of the highest quality technology stocks available.

- The recent selloff could be a great opportunity for long-term investors to buy more MSFT shares.

- Looking for more investing ideas like this one? Get them exclusively at Tech Investing Edge. Learn More »

Mariakray/iStock Editorial via Getty Images

Thesis

Microsoft (NASDAQ:MSFT) is one of the best businesses in the world, and that won't change even if the Fed tightens or inflation remains hot. In fact, history indicates that deflationary technology can be an alpha-generating investment in this macro environment. The market seems to be ignoring this given the recent tech wreck, which creates a contrarian buying opportunity.

Lessons From History

The last time that inflation was a real issue was back in the 1970s. In particular, the period from 1975-1982 had very high inflation ranging from 6% to 14%. During this period, the Fed raised rates rapidly from 5.82% to 11.2%, and they peaked at a stunning 22.36% in 1981.

Hopefully inflation will begin to moderate and we won't see rates anywhere near that high in the future. But investors should be prepared either way, and anchor their portfolio with stocks that can do well in any environment.

If recent price action is any indication, energy and materials are the best sectors to own when inflation is high and rates are rising. The argument makes sense; inflation makes energy/material prices go up, which increases these companies' profits. Furthermore, stocks in these sectors are generally considered value stocks, and value traditionally outperforms growth in an inflationary environment.

However, the results from the 1975-1982 period contradict this thesis. The chart below compares the returns of leading energy and materials companies with leading "tech" companies of the time. Microsoft didn't go public until 1986, so I've used a few other companies with similar characteristics - namely low input costs - as proxies. ADP (NASDAQ:ADP) is a predecessor to modern SaaS companies like Paycom (NYSE:PAYC), and is primarily focused on payroll services. Like Microsoft, it has an asset-light business that allows its customers to realize cost savings by automating back office processes. Equifax (NYSE:EFX) is a credit bureau. And of course IBM (NYSE:IBM) was a leading technology company at the time.

| Company | Average Return '75-'82 |

| S&P 500 | 10% |

| ADP | 28% |

| EFX | 26% |

| IBM | 14% |

| CVX | 18% |

| XOM | 10% |

| APD | 8% |

| NEM | 19% |

| NUE | 48% |

Source: The Author

Admittedly, this method is not very scientific, since I've just chosen a few companies that I know were public at the time, and these results don't represent the entire sectors. Unfortunately, sectors weren't defined as they are today in the 1970s, so we'll have to make do with this.

While the three "tech" companies ADP, EFX, and IBM all outperformed the market, the results among energy and materials stocks were more mixed. Steel (NUE) crushed the market, while Air Products and Chemicals (APD) and Exxon (XOM) underperformed. Chevron (CVX) and gold (NEM) did outperform, but not to the same extent as the "tech" companies. Averaged together, the energy/materials companies returned 21% per year and the "tech" companies returned 23%.

That flies in the face of the panicked "sell tech buy real assets" narrative that's prevalent today. These results prove that multiple types of businesses can have strong returns even during times of high inflation and rising rates. While it's clear that energy/materials benefit from higher spot prices during inflation, it's also true that demand for deflationary technology can increase during times of high inflation. And that the best technology companies have strong pricing power to offset inflation.

Why Microsoft?

The interesting thing I find from past challenges whether macro or micro, I don’t hear of businesses looking to their IT budgets or digital transformation projects as the place for cuts. If anything, some of these projects are the way they’re going to accelerate their transformation or for that matter automation for example. I have not seen this level of demand for automation technology to improve productivity because in an inflationary environment, the only deflationary force is software. -Satya Nadella

There are many reasons to pick Microsoft over other companies that make deflationary technology. It has great profit margins, market leadership, strong pricing power, and a fortress balance sheet. It's one of only three companies in the world with a higher credit rating than the U.S. government. And it's one of the world's strongest brands and best places to work according to Glassdoor.

One reason unique to the current environment is how defensive Microsoft's revenue is. People won't be moving off of Azure or cancelling their Office subscriptions to save cash, because alternatives of similar quality don't exist or are more expensive (e.g. hiring developers to build your own network infrastructure). In fact, as pointed out by Microsoft's CEO above, demand for Microsoft's services as a way to cut other costs could actually increase in the current environment.

On the other hand, consumer-facing brands that make up much of the tech sector might be more at risk. If people have to tighten budgets due to inflation, they might hold off on buying a new phone or running digital ads for their business.

Looking back at the 1975-1982 period, there's actually not much evidence that more cyclical consumer brands suffered, even as there were multiple recessions from 1980 to 1982:

| Company | Average Return '75-'82 |

| LOW | 24% |

| TGT | 56% |

| MCD | 19% |

Source: The Author

Even so, a closer look shows that these companies had many years of poor performance, but offset those with great years coming out of recessions in 1975 and 1982. For example, excluding those two years, Lowe's had an average return of -7% compared to ADP's 12%.

The best approach to investing is clearly to buy great companies and hold them through the entire economic cycle. But for those who are worried about the risk of a recession caused by Fed tightening amid high inflation, it makes sense to own more defensive stocks. And I don't know of a better defensive tech stock than Microsoft.

MSFT Stock Valuation & Factor Grades

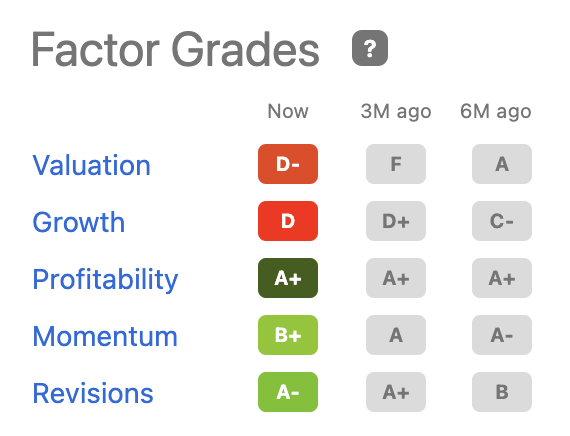

Seeking Alpha

Microsoft does very well on Seeking Alpha's factor grades for profitability, momentum, and revisions. This is no surprise given Microsoft's 38.5% profit margins, great historical returns, and recent upbeat guidance. While they get a D on their growth score, this is the case for most large cap blue chips, and Microsoft is growing faster than most other companies of comparable size with a very respectable 18% revenue growth rate.

However, the company gets a poor D- score on valuation. 30 P/E certainly isn't cheap, and this is probably the main risk with Microsoft. Even so, Microsoft is reasonably valued relative to other defensive mega caps like UnitedHealth (NYSE:UNH), Thermo Fisher Scientific (NYSE:TMO), Costco (NASDAQ:COST), and Adobe (NASDAQ:ADBE) despite growing faster than them.

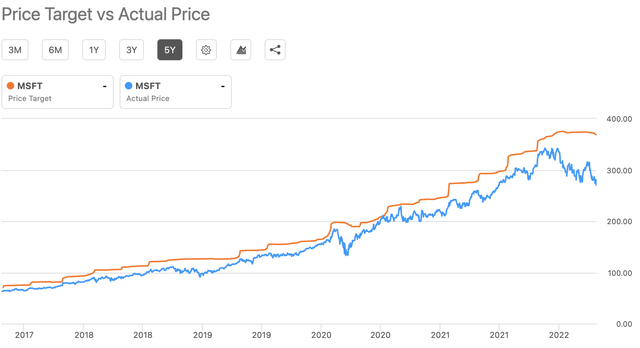

Seeking Alpha

In my view, a PEG ratio of 1.5 for one of the highest quality companies in the world is reasonable. Analysts tend to agree, and they've maintained their $366.23 average target price (implying 29% upside) even as Microsoft sold off recently. As shown in the graph above, this is one of the largest price vs target price divergences for Microsoft in recent years, and analysts don't tend to lower their target price for Microsoft when it sells off.

Risks

The main risk to Microsoft is valuation, since even though I believe that it's reasonably valued relative to its growth and quality, 30 P/E still isn't cheap. The market can be irrational in the short term, and a high P/E leaves more downside risk.

There are other more minor risks to consider. As one of the largest companies in the world, Microsoft could come under antitrust scrutiny, including for their recent Activision acquisition. They could also be targeted by hackers, especially considering their recent support of Ukraine. And given enough time, competition could become more of a risk.

Conclusion

History shows that inflation and rising rates don't mean doom for the stock market, not even for tech stocks that have been under fire lately. Microsoft is one of the highest quality and most defensive tech stocks available. Despite this, it's been selling off with everything else, giving investors a rare chance to buy the company at a price well below analysts' target. I continue to hold Microsoft as one of my largest positions.

I'm Kennan Mell, the author of Tech Investing Edge. My service is focused on long term growth opportunities for investors with a 10+ year time horizon. I use my "edge" from working in the tech sector to understand tech companies' long term growth potential and share my best investment ideas with members.

If you're interested in detailed analysis of high tech industries like cloud, SaaS, cryptocurrency, and cybersecurity, you might like my service. I'm currently offering a two week free trial to new members, so I hope you'll check it out!

This article was written by

Kennan is a software engineer who has worked at companies of all sizes, from as large as Google to as small as a single person. He's received job offers from all of the famous FAMG companies, and graduated cum laude from the Paul Allen School of Computer Science at the University of Washington. Although not an investor by training, he enjoys applying his technical knowledge to analyze high tech companies and find investment opportunities for a long term time horizon.

---

Kennan will be launching a Marketplace service on Seeking Alpha called Tech Investing Edge. The service will share research on great growth stocks in high tech industries like SaaS and cryptocurrency, combining qualitative and quantitative research with a focus on timely events and opportunities. Subscribers will be able to ask questions and request research about stocks they're interested in.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.