Teladoc Q1 Earnings: Drop This Name, And Don't Look Back

Summary

- Teladoc's guidance for 2022 is meaningfully lower than the guidance it put out 60 days ago. Teladoc is now expecting 23% CAGR for the rest of 2022.

- The multiple that investors will be willing to pay for TDOC stock is going to meaningfully correct downwards. And it may well overshoot. Don't hang around.

- You don't want to be an investor in a company that can't adequately forecast its own growth rates. This is a seriously poor management team.

- As always, happy to discuss why I changed my mind in the comments section.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

Marko Geber/DigitalVision via Getty Images

Investment Thesis

Teladoc (NYSE:TDOC) is a leading brand in the digital health space. I believed that this company was offering something special. I was allured by the illusion of its robust growth rates and low valuation. As such, I was very bullish on this name.

But I got this wrong. And rather than blame management for their ineptitude, I recognize the new dynamic for what it is. There's simply too much competition in this space.

This is causing Teladoc's revenue growth rates to be meaningfully lowered. Consequently, the multiple that investors will pay for this name will probably be cut in half.

Consequently, I'm now bearish this name.

I Called This Wrong

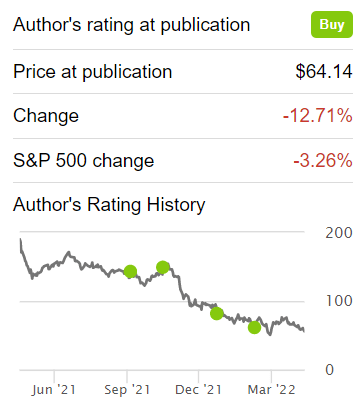

Author's coverage

I was so bullish on Teladoc. I truly felt that the company was unique. And the biggest mistake that I made, is the one that I frequently make. I trusted management's guidance.

If you remember, Teladoc had come out early, back in Q3 2021, with its guidance for full-year 2022. Normally, companies only give their full-year guidance together with their Q4 results, to have maximum visibility into the year ahead.

But not Teladoc. They had been eager to put a floor on the share price. Took out their spreadsheet, and told investors the numbers they wanted to hear. And so, here we are.

Most investors, when they get new facts, they struggle to incorporate new facts into their thesis until it's too late. They look for reasons why the market overreacted. But I've learned the hard way that the market is more often right than we give it credit.

Revenue Growth Rates Fizzles Out

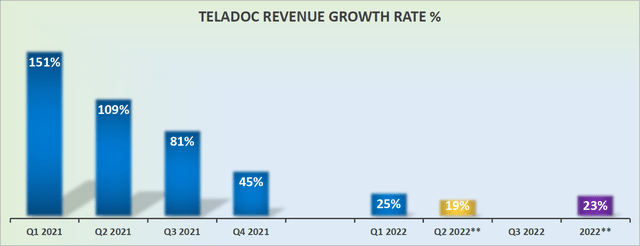

Teladoc revenue growth rates

The chart above tells you everything you need to know about Teladoc. Teladoc's fastest growth days are now in the rearview mirror. That's never a good position to be in. Why?

Because when a company is facing rapidly decelerating growth rates, the multiple that investors are willing to pay compresses.

Remember, the market is always looking forward.

Accordingly, because investors have no idea when the revenue growth rates stop decelerating, investors tend to compress the multiple a lot, to provide themselves with a margin of safety.

Again, remember that back in November, Teladoc had told the market at their analyst day that in 2022, its revenues would grow by 28% y/y.

Then, in February, Teladoc upwards revised its full-year guidance by 300 basis points to 31% CAGR. In this newly increased guidance, we were looking at a company that was much more than a COVID winner. We were looking at a company with sustainable durable growth. It was coming out of that period with a valid business model. That was enticing.

And now, approximately 60 days after Teladoc guided to grow this year by 31%, it now downwards revises its full-year guidance by 800 basis points to 23% CAGR.

Why is Teladoc's Guidance Dramatically Lower?

During Teladoc's earnings call, management highlights its "unmatched scale", "solid fundamentals", and "innovative new solutions to transform the way consumers interact with the healthcare system."

Along the way, management also peppers investors with the fact that online competition has been stronger than they previously expected. For instance, Teladoc declares that its marketing efforts are not yielding results in line with its expectations.

TDOC Stock Valuation - Too Difficult to Value

If you haven't got the numbers, nobody cares about your excuses.

Investing is never easy. But there are times when the setup is clearly the wrong one. This applies to Teladoc.

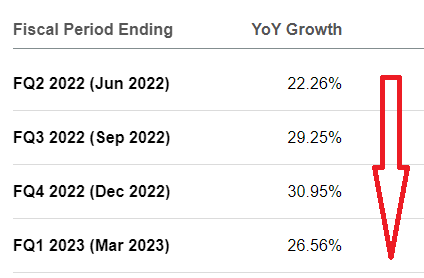

Teladoc's analysts' revenue consensus

As you can see above, Teladoc was expected to have growth at close to 30% CAGR in the second half of 2022. This was made possible as it came up against easier comps from last year's H2.

It now appears to be the case that these estimates are woefully out. As an investor, you don't wish to be around when, over the coming days, analysts from all corners will be issuing sell calls, and consistently lowering their price targets for Teladoc.

The Bottom Line

I seriously urge any reader that decides to stay long this name, not to base their argument on the fact that yesterday this stock closed at $56 per share.

And therefore, in time, it will return to this level. That's price anchoring. It's an illness that infects investors. This illness is seriously harmful to one's financial wealth. And you should tell a doc.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. There are no gimmicks and no place to hide because all I care about is delivering high performance against the S&P500.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.