Yatra Online: Attractive With Travel Recovery And Upcoming IPO Of Subsidiary

Summary

- Yatra Online is the second-largest online travel agency in India and the largest online corporate travel provider.

- Due to revenue decline during COVID-19 and due to lack of recognition in the US, Yatra shares are trading at a very low valuation.

- Yatra's revenue is expected to recover to pre-COVID levels and may do even better due to improved efficiency and the signing of new customers.

- Yatra recently filed for IPO in India for its wholly owned India subsidiary at potentially a multifold valuation of the parent.

- IPO of subsidiary along with recovering revenue make YTRA stock very attractive at current levels.

onurdongel/iStock via Getty Images

Yatra Online (NASDAQ:YTRA) is one of India's leading and well-known online travel agencies. Indian corporate and general consumers use it to book flights, hotel rooms, and vacation packages. Yatra stock is listed on the US Nasdaq stock exchange. When travel came to a virtual stop during the pandemic, Yatra's revenues dropped precipitously, as did its stock price.

Yatra's share prices have recovered somewhat from the lows but still hovering around a valuation of just above $100m. As the pandemic is waning, travel is picking up in India. As a result, Yatra expects the revenue to grow to the pre-pandemic level in CY2022. In addition, Yatra is planning to IPO its wholly-owned subsidiary in the still-hot IPO market in India. The projected valuation of the subsidiary is many-folds the current valuation of Yatra. The combination of these factors makes Yatra shares very attractive at current levels.

Yatra Online

Yatra (which means "travel" in Hindi) was founded by Dhruv Shringi (current CEO), Manish Amin (current CIO), and Sabina Chopra (current COO) in August 2006. It initially focused on online booking for consumers, becoming the second largest OTA in India by 2012. However, as the consumer OTA space became competitive and companies started offering deep discounts to attract customers, Yatra recognized this and switched the primary focus to corporate travel with the acquisition of the Air Travel Bureau in 2017. Though it has lower margins than consumer travel, corporate travel is very sticky as, typically, a lot of integration work is done to make travel booking seamless. This has helped Yatra get a steady stream of growing revenue.

In 2019, Ebix, Inc. (EBIX), an insurance software provider based in the USA, offered to buy Yatra at an enterprise value of $388m. A short time after the offer was made, the pandemic hit. Ebix dragged the process of finalizing the deal, and in the end, Yatra terminated the agreement and sued Ebix for damages. Yatra lost the case against Ebix. The failed agreement with Ebix, along with the impact of the pandemic, resulted in a steep drop in the stock price of Yatra, from which it still has not recovered. Yatra had to go through a round of layoffs and raise additional funds to get through this period.

Travel Recovery in India

After the excruciating second wave of COVID-19 in Q2'21, travel in India has been recovering rapidly. On March 27th, India removed the last of the travel restrictions for international flights.

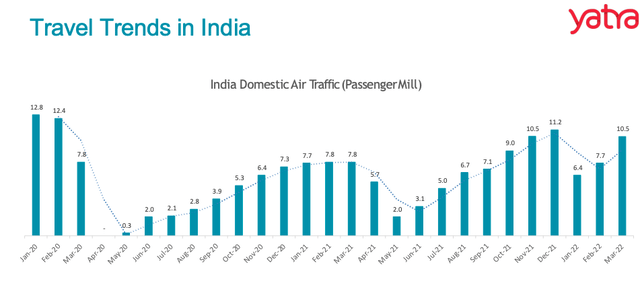

During the peak of COVID-19 in May 2021, the international passenger traffic in India was virtually nil, and the domestic passenger traffic dropped to a low of just around 2m. However, by December, the domestic traffic improved to 11.2m. Omicron wave had an impact on Jan 2022 traffic. However, by March, it recovered to above 80% of the pre-pandemic Jan 2020 levels. International traffic has also been improving, and removing the last of the restrictions should bring it back to normal pre-pandemic levels by mid-2022.

Yatra Revenue and Earnings

During the pandemic, Yatra's revenues took a beating, similar to most of the OTAs worldwide. As a result, Yatra laid off 400 people during this challenging period, hunkered down, and focused on streamlining the operations and acquiring more corporate customers.

For Sep-Dec 2021 quarter (Q3 FY-22), Yatra reported revenues of $14m, representing an increase of 32.5% QoQ and 72% YoY. It is the highest revenue for Yatra after the pandemic started. For this period, Yatra reported an EBITDA profit of $0.6m. Yatra has been working on a new freight forwarding and logistics platform for the past two years. The profits for the quarter would have been much higher if the spending on this development effort was not included. The logistics platform is expected to start generating modest revenue this year. Yatra expects revenue from the logistics platform to meet or even exceed the revenue from its OTA platform in the coming years.

According to Yatra's CEO, the business travel, where Yatra derives most of its revenue, is back to around 70% of the pre-COVID level in March 2022, and he expects it to be at the pre-COVID level in the June 2022 quarter.

Yatra India IPO

Yatra brand is not very well known in the US. The steep drop in revenue and a lack of coverage by analysts have resulted in the cratering of its stock price. Even after recovering from the lows, Yatra stock is still trading at around $1.7, giving a valuation of just above $100m. As a comparison, EaseMyTrip is another OTA with similar revenues as Yatra. EaseMyTrip has a market cap of around $1.1B in India.

The Indian stock market has done very well in the last two years, particularly the IPO market. In 2021, the IPO market in India was red hot, with companies raising more than $15B in 2021. While some loss-making fintech companies, such as Paytm (PAYTM), have done poorly after the IPO, many of the companies that went IPO in late 2021, such as Policy Bazaar and Nykaa, are holding their high valuation. The IPO market in India remains hot in 2022 despite some decline in appetite due to the Fed interest rate rise and the war in Ukraine.

Yatra management, recognizing this opportunity, decided to list the Yatra shares in India through a subsidiary. The following is the rationale provided by Yatra management for the India IPO.

Option to raise capital at potentially higher company valuation while seeking to minimize the dilutive impact for reduced balance sheet risk and improved liquidity

Access to domestic Indian institutional and retail investors, including large strategic partners, who are currently excluded from investing in Yatra Online's listing in the U.S. due to regulatory constraints

Opportunity to create shareholder base within Indian capital markets and increase equity analyst coverage

Opportunity for scarcity premium in India given limited number of listed Indian tech stocks

Yatra is a very well-known brand among consumers and corporate employees in India. However, as could be seen above, Yatra is taking its Indian subsidiary public primarily to get access to funds and unlock shareholder value.

Yatra India Subsidiary DRHP Filing

After discussing the possibility of IPO in India in Sep 2021, Yatra filed the DRHP papers with SEBI, the equivalent of SEC of the US in India, for the IPO of its India subsidiary on March 25th, 2022. Here are the highlights from the DRHP:

- Yatra India subsidiary intends to raise about $100m [Rs. 7500m] from the IPO through a fresh issue of shares.

- The IPO will also offer about 9.3m shares through an Offer For Sale [OFS] arrangement, the proceeds of which will go to the parent Yatra Online.

- The IPO funds will be used for strategic investments, acquisitions, inorganic growth, and investment in customer acquisition and other organic growth initiatives.

- SBI Capital Markets Ltd., DAM Capital Advisors Ltd., and IIFL Securities Ltd. are the book running lead managers for the issue.

While the size of the IPO is known, the valuation of the subsidiary will be known close to the listing of the IPO. Typically, companies offer anywhere from 10% to 20% of the shares in such offerings. This puts the valuation of the subsidiary between $500m and $1B, which is substantially higher than the current valuation of the parent.

Will Yatra be able to get such a valuation in India? Easy Trip Planners, one of the OTA companies comparable to Yatra, IPOed in early 2021. In Q3 CY22, Easy Trip Planners reported revenues of $11.8m compared to $14m for Yatra. However, Easy Trip Planners reported an EBITDA profit of $7m for that period as opposed to a $0.6m EBITDA profit for Yatra. It is possible that Yatra would have reported much higher profits if it were not for the spending on the logistics platform development. However, it is to be recognized that Easy Trip Planners is much more profitable than Yatra. Easy Trip Planners is currently valued at around $1.1B. This may mean that Yatra may need to go with a valuation closer to $500m rather than $1B and let the market decide if a higher valuation is warranted. Note that a valuation of even $500m for the subsidiary is about five times the current valuation of the parent Yatra Online listed on Nasdaq.

IPO process and timing

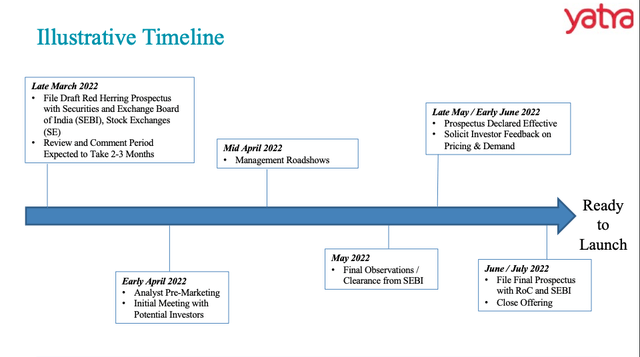

One of the most significant steps toward IPO is filing the DRHP papers. As mentioned earlier, Yatra has already taken this step. The following flow diagram provides the next steps in Yatra's IPO journey.

Based on the above chart provided by Yatra, the IPO is expected sometime in June/July timeframe, which is just a few months away.

Risks

While the potential for a multifold increase in stock price is very attractive, there are some risks. Most of these risks are already listed as part of the DRHP document.

One of the most significant risks is that the IPO may not go through at all. However, the fact that Yatra was able to get a reputable banker such as SBI Capital to take on the lead manager role suggests that the possibility of a successful IPO is high. Moreover, even if the IPO were to fail, the stock price drop would not be significant as there is not much premium tacked on for the possibility of IPO at the current price.

The other critical risk is the resurgence of COVID-19 from another variant. This is indeed a severe risk and will remain a risk until the pandemic becomes an endemic, as some have predicted, or just fades away.

Assuming that the IPO is successful, it is still possible that the valuation of the subsidiary may not be fully reflected or only partially reflected on the stock price of the parent Yatra Online. This is certainly a possibility. However, there are multiple mechanisms to correct the imbalance if the difference in valuations is high. For example, the parent could sell more shares of the subsidiary in a secondary offering and offer the proceeds as dividends or even buy back shares of the parent company. The parent could also become an attractive target for other Indian companies if the parent's valuation remains persistently low.

Conclusion

Yatra Online is a well-recognized leading OTA company in India. The recovery of corporate and consumer travel after the pandemic portends well for increasing revenue to pre-pandemic levels for Yatra.

More importantly, the pending IPO of its India subsidiary at valuations that could potentially be many folds of the parent company's valuation offers an excellent opportunity. If the IPO goes through as planned in Q3 of 2022, Yatra shares at current prices could provide significant returns in a relatively short timeframe.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of YTRA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.