Dynatrace: Buy It Now At A Bargain

Summary

- DT's share price tumbled after issuing its Q3 results in 2022, but I believe the selloff was not caused by this alone.

- The company's revenues are strong, its TAM is great, and the business has a record of consistent revenue growth and healthy cashflow.

- Investors can now pick up a piece of this company at a realistic price with a great upside potential.

Just_Super/E+ via Getty Images

Dynatrace (NYSE:DT) is a buy with the shares of the company now trading to what I believe to be below their fair value. The stock's violent selloff and its ARR not meeting forecasts have concerned some analysts, but I see its reduced share price as a great entry point for investors. I do believe there is more downside to be had for this stock over the short term, but also that the majority of the selling pressure has been released. Investors may be able to optimize their entries for this stock if they can wait for confirmation that momentum is shifting again to the upside.

Why DT Was Sold Off?

I believe the cause for the pullback in DT's stock mostly hinged on technical, rather than fundamental factors and was due for a price correction because the stock became overbought, not because of what was released in its quarterly earnings reports.

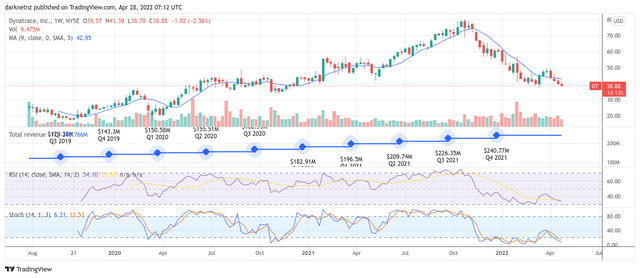

On the weekly charts, DT started trading at overbought levels in June 2021 on the Stochastics. This movement along with the steep price action towards the peak stock price of $80.13 was a warning sign that the rally was unsustainable. The RSI, a slower-moving indicator, confirmed that the stock was trading very near overbought levels all the way from the start of July to the 27th of October, which is when the company announced its Q3 2021 earnings, beating revenue estimates by 5.716M or a 2.59% surprise, and an earnings estimate by 0.02 or a 13.31% surprise. One piece of bad news from the company that was speculated to be the cause of the stock's selloff was the fact that it failed to meet its ARR target. The company's ARR rose 29% to $930 million, which missed analysts' consensus target of $942.9 million. Considering that DT only missed its target by $12.9 million as well as increasing its ARR by 29%, I don't believe this to be the direct reason for the selloff. Instead, I believe that in order for the company to have continued to trade at its expensive share price, it would need to have released a stellar earnings report and future guidance. Investors needed to feel they were not paying for something overvalued. Since the earnings report did not provide this assurance, a selloff was almost a certainty given how quickly the price of DT's shares rose in value from the period of May to October 2021.

Another bit of evidence to show that the selloff is what I believe to be technical in nature and not fundamental can be found in the daily charts. The company's stock price has been in a downwards channel since the 3rd of December. In the days prior to its Q4 results being posted, the stock rallied in what I believe was an expectation for a great earnings report. When the company released its earnings, the market gave DT a resounding response with a record-breaking volume of 15.909M shares traded that day and a 17% reduction in its share price. Note that DT finished Q4 on $240.766M in revenue, which beat its estimate of $234.501M by 6.265M, or 2.67%. The company also beat its earnings estimate by 11.80%, but the stock continued to slide lower in its channel that began in early December which followed its technicals perfectly.

In conclusion, I think the market corrected DT's share price to a more realistic valuation. I believe this because investors at one point were paying $70.97 for $2.84 of the company's sales, or a P/S ratio of 24.99. The company's results so far have been impressive but by no means meteoric to justify such a steep share price for a low unit of sales.

The bottom line is that company's selloff is good news for new investors because it now provides a realistic entry with appreciable upside potential. I expect this stock to break out of its downwards channel shortly as the company is set to follow up on its strong performance in FY 2021.

Company Overview

Dynatrace is a software-intelligence monitoring platform that assists in simplifying enterprise cloud environments and accelerates digital transformation. Specifically, DT's AI causation engine improves the tracking, automation, and analysis of big data of its users, leading to more efficient and cost-effective digital assets. The company has a number of marquee clients on its books including Kroger, TSB Bank, SAP CX, the Australian government, and many others, which all add to the quality of its earnings.

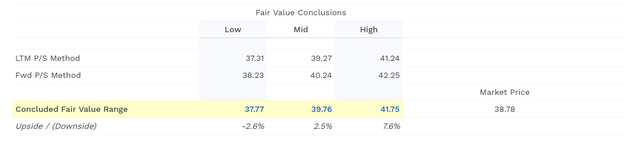

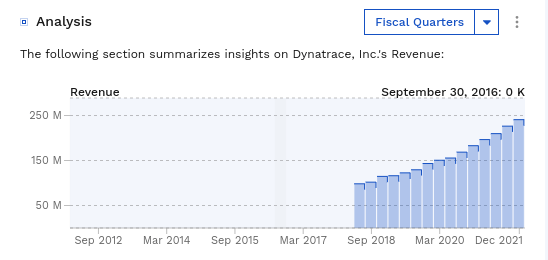

DT currently has a 63.02% 5-year return to shareholders, beating the S&P 500 by 18.06%. The company has a consistently high and stable YoY and QoQ revenue growth for the last three FYs, ending at 28.89% in 2021. The company is also profitable, with a gross profit margin of 83.4% for the last twelve months.

Finbox

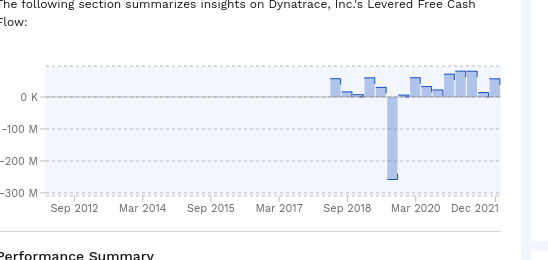

The business generates a healthy amount of cash each quarter except for a few exceptions. The business's latest twelve months of levered cash flow sits at $231.5 million.

Finbox

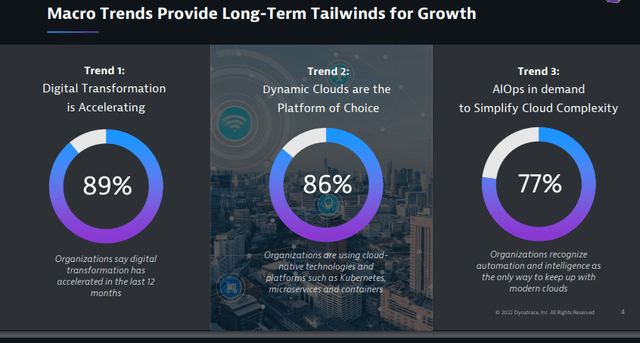

These figures show that DT has a stable and growing business that's already producing cash from its operations. It is also nicely positioned to take advantage of a few macro trends to increase its cash flow, and ultimately its stock price, to higher levels. The three trends the business is closely aligned with include digital transformation, dynamic clouds, and automation and intelligence.

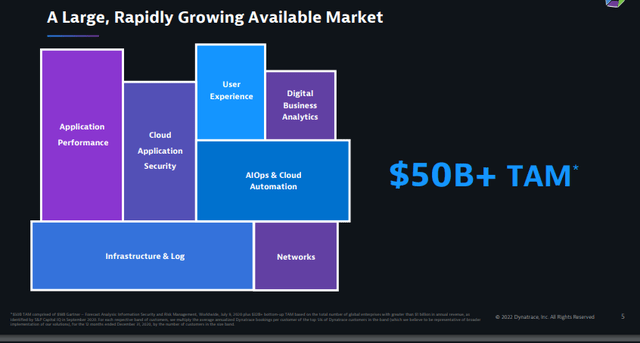

DT has a $50B+ addressable market, while its market cap currently sits at $11.11B, meaning it currently has a 22.22% ownership.

Financials

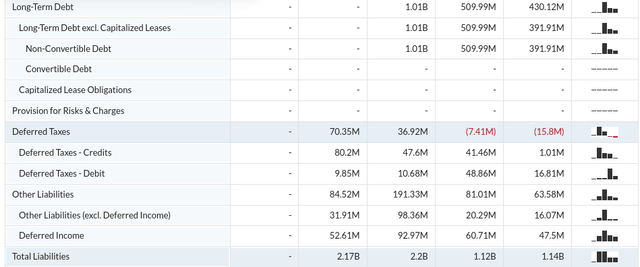

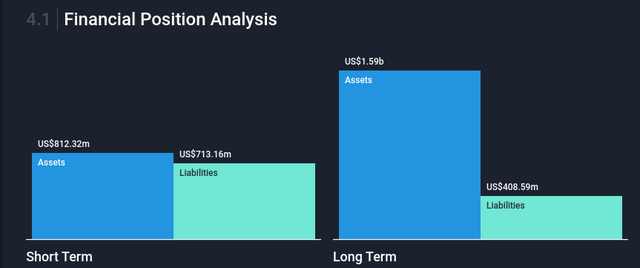

Two figures of note in DT's financials are its leverage and the growth of SG&A expenses. The company has worked hard to pay down its long-term debt while also increasing its assets. Long-term debt decreased from 1.10B to 430.12M in three FYs. This gives the company a current ratio of 1.14.

One concerning aspect of the company's financials is its number of short-term liabilities. The business has a quick ratio of 0.94. Although this is not terribly concerning as the business is generating enough cash, it is something that investors should keep in mind. The debt of the company is also unlikely to be a problem partially because DT has an $11.11B market capitalization.

The company's SG&A expenses are growing faster than its yearly revenues. These expenses took a short dip last FY but this trend could be concerning if it continues to rise.

Valuation

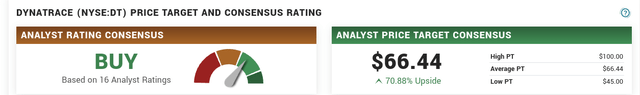

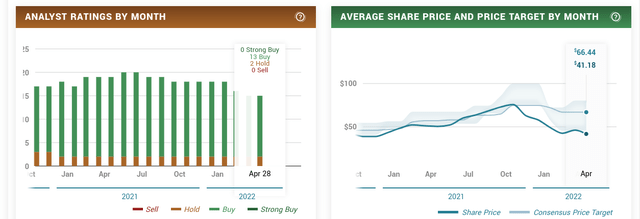

DT has a lot of upside potential according to analysts who cover this stock, at 70.88%. It should also be noted that analysts have had a very successful history in predicting the price and earnings of this stock too, which I feel gives credibility to their forecasts.

At present, the stock is trading near the very bottom of the aggregate of analysts' price targets. The average PT for this stock is $66.44, although I believe this to be a little optimistic given that Wall St tends to overestimate the average share price of a given stock.

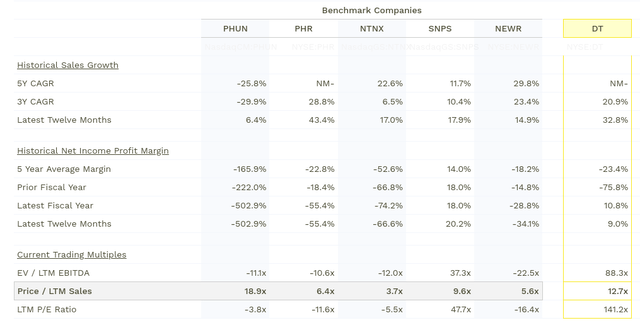

My own price target for this stock can be found in the below comps table using a selection of 5 other peer companies. This comparison was made using the Price / LTM sales or simply the Price / Sales ratio. The companies chosen include Phunware (PHUN), Phreesia Inc (PHR), Nutanix Inc (NTNX), Synopsys, Inc. (SNPS), and New Relic Inc (NEWR).

Also, note that this valuation was made for historical growth numbers and not projected forward. For DT this means it is a very conservative estimation as I strongly believe the company's revenues and cash flows will increase moving forward as it continues its trend. In this model, the fair value of this stock has a 2.5% to 7.6% potential upside, but again this is not accounting for material improvements in the company's revenues or profitability, so I believe it to be very much an underestimation of the company's potential for a higher share price.

Risks

One risk of my comps model is that investors will get a different fair market price if they choose a different peer universe. However, I feel that the companies that were chosen accurately reflect the firm's real-world competitors.

A risk that was given in the company's most recent 10-K is that it operates in new and unpredictable markets. This means that although the company can do its best to provide an estimation, there is uncertainty as to how fast and wide its TAM will grow, which could harm the company's investors and the business itself.

COVID-19 was also stated as a serious problem for the company. The virus disrupted its operations, causing its physical offices to close and employees to relocate and start working from home. It was also stated that the virus affects the demand for its products, particularly in industries that are heavily affected by it. This may reduce the customer's willingness to pay and use DT's products as revenues need to be saved or used elsewhere.

Conclusion

The selloff in DT's share price was due to the company becoming overbought over a short time period. One small piece of bad news was enough for investors to realize they were sitting near the peak and the selling caused an appropriate downtrend. Now that shares of DT can be bought cheaply with large upside potential, I feel that now it's a great time for investors to get on board and I will also be buying shares.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.