Why I Sold Tesla And Bought Ford

Summary

- Tuesday, I sold out of my Tesla position and used a portion of the proceeds to start a position in Ford.

- Don’t get me wrong, I love Elon Musk and Tesla. Yet, business is business, and my intuition and research is telling me to make this change.

- In the following piece, I will expound on why I have decided to take profits on my Tesla position and start a new position in Ford.

jetcityimage/iStock Editorial via Getty Images

What Happened?

Today, I took profits on my long-term position in Tesla (NASDAQ:TSLA) and used a portion of the proceeds to start a position in Ford (NYSE:F). In the following sections, I will explain my reasoning for making this move.

You must take profits to make profits

I often quote my father, who was my mentor and an outstanding stockbroker. One of his mantras was "You have to take profits to make profits." The meaning behind this is the fact it's all "unrealized" paper gains until you actually sell the security and transfer the proceeds into your checking account and/or into another investment. Further, he was very disciplined regarding when profits should be taken and why. Fortunately, I fell in love with my Tesla position and have held it way longer than my father ever would have, making it one of my most lucrative investments. Nevertheless, I endured several drawdowns over the years. Now, with Musk buying Twitter (TWTR) by pledging an additional $45 billion worth of Tesla shares, I have decided to take profits and sit this one out amongst other reasons. Let me explain.

Musk's highly leveraged Tesla position increases risk

Elon is buying a majority of Twitter by taking out a $49 billion margin loan against his Tesla shares. He already has pledged a substantial amount of Tesla shares previously, bringing his margin total to $89 billion. Further, Musk is the first lienholder on the Twitter position. He is on the hook for essentially the first $33 billion of Twitter, if by some chance they can't pay the bills.

Musk has already stated it's not about the money to him, so that doesn't necessarily give me a nice warm fuzzy feeling about the prospects. Further, if for some unforeseen reason Tesla shares fall and Musk gets a margin call, that would be a major debacle. It has happened before. Nearly 10 years ago to the day, Green Mountain Coffee Roasters demoted its founder and chairman, Robert Stiller, and its lead director, William Davis, after the high-flying coffee company's share-price plunged forced the men into emergency stock sales resulting from margin calls. In fact, many companies have banned the practice at this point. Now, this is definitely a "backburner" type issue as Musk is constantly receiving new shares and options, yet it is there in the back of my mind. Further, I really don't find the new Cybertruck appealing. I like Ford's F150 Lightning pickup, which leads me to my next point.

The competition has finally arrived

The Ford F150 Lightning is now officially in production. I have done my research on the truck and I love it. Ford CEO Jim Farley said on Monday:

The company is not joking around by saying the electric F-150 lightning could be as big a product for the automaker as the Model T back in 1908.

I would have to agree. Ford plans to scale production of the F-150 Lightning even faster than competitors, with plans to boost manufacturing of the Lightning at a plant in Dearborn to 150,000 units in the next year, up from an initial target of 40,000 vehicles.

What's more, Ford has secured the lithium-ion batteries needed to meet its expected level of production of 150,000 units next year. Moreover, the company plans to prioritize supplies of semiconductor chips toward the F-150 Lightning.

Ford F150 Lightning Pickup (Ford website)

The response has been so overwhelming, Ford is no longer taking retail reservations at this time. Additionally, Ford isn't the only competition. As I'm sure you are aware, there is a plethora of new EV vehicle entrants into the race. The primary reason I've chosen to switch from Tesla to Ford is the product. Secondarily, is valuation. Let me explain.

Two completely different animals when it comes to valuation

Tesla trades at 16 times sales while Ford currently trading at 0.47 times sales. Basically, making Ford the Rodney Dangerfield of EV players – “Ford don't get no respect!” Ha! Now, Tesla may very well deserve its elevated valuation based on its growth rate trajectory and the value of said future cash flows. Nonetheless, under the current Federal Reserve regime, the value of these future cash flows may be diminished greatly by inflation and increased interest rates. I am making a conscious effort to reduce my exposure to "long-duration assets." Let me explain why Ford presents a better opportunity under current conditions.

Ford significantly undervalued

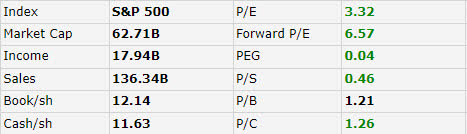

First of all, Ford is basically trading for a song at the present valuation. Ford's forward P/E of 6.57 is just over a third of the current S&P 500 Forward P/E of 19.44. The stock is trading for 1.2 times book of $12.14. If ever there was a bargain basement buying opportunity in Ford, this is it.

Ford Fundamentals (Finviz)

On top of this, management has done an excellent job of cleaning up the balance sheet. The company maintains a fortress balance sheet with $11.63 per share in cash alone. This helps me not just sleep well, but sleep like a baby at night. Furthermore, the stock has sold off substantially since the start of the year and appears to me to be at an inflection point.

Ford 2022 Performance (Finviz)

With the stock trading for rock bottom pricing and having the weak hands thoroughly shaken out over the last few months by the insipid macro environment, I suggest now is an excellent time to start a position heading into earnings. One of my top investing mentors, Sir John Templeton's quote of "Buy at the point of maximum pessimism" seems quite apropos. The market just experienced a 7 to 1 advance/decline trading day today with 7 stocks down for every 1 stock up. This qualifies as a substantial washout in my book. The baby has definitely been thrown out with the bath water in my book. Furthermore, the Ford CEO Jim Farley is a salesman extraordinaire.

Ford CEO Jim Farley is special

Ford's CEO Jim Farley has personality for days and is extremely competitive. His statement that the Ford F150 Lightning will be bigger than the model T is the proof in the pudding of what I say. Not to mention the electrifying Ford Mustang Mach-E which definitely lives up to the hype.

Farley has captured the attention of all, rivaling the likes of P.T. Barnum in some ways, much like his famous cousin Chris Farley of Saturday Night Live, who I absolutely adored. Yet, don't get me wrong, he has the wherewithal and business acumen to back it up. His career in automobiles was inspired by his grandfather who began working for Ford in 1914. I have faith that Farley will be able to present the best case for the company on the upcoming earnings call. Ford is due to report earnings on April 27th after the close.

Ford Earnings Preview

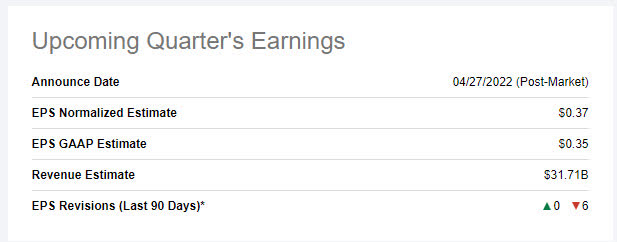

The following table details Ford's expected earnings estimates.

Seeking Alpha

You can see that there have been six downward revisions over the last 90 days. With the stock down significantly going into earnings and expectations diminished, I see the company beating estimates and rising. Even so, the real focus will be on guidance, which has already "quasi" been announced with them revealing they will produce 150,000 F150 Lightning pickups rather than the original 40,000. I am expecting Ford to pop on earnings. This is why I made the move to sell Tesla and buy Ford ahead of the announcement. Nonetheless, I have only bought one-third of the position in order to reduce risk. In these situations where I have a positive outlook on earnings, I will divide the buys into thirds. One-third before earnings to gain a foothold, one-third after earnings, and one-third in reserve to buy on any future potential weakness. I always suggest layering into new positions over time to reduce risk. Now let's wrap it up.

Wrap up

I love Elon Musk and all that he has done for the country and the world frankly. Even so, adding Twitter to his endeavors in addition to Tesla, SpaceX, Starlink, The Boring Company, and any others I may have forgotten, I think he may be reaching his limit. Further, he definitely has maxed out his Tesla margin credit card at this point, which gives me pause. Yet, the primary factor that sealed the deal for me was what I believe is Ford's superior product, the F150 Lightning, which I plan to buy as soon as available. On top of this, Ford's conservative valuation was a major selling point as well. The valuation factor is of particular import to me based on the recent change in the Federal Reserve's regime, from Dove to Hawk. And finally, I made this move in order to cash in and "realize" the substantial gains I had with my long-term Tesla position. I have held it in a tax advantaged account, so the capital gains created were not an issue for me. I bring this up because this transaction is particular to my unique situation. It may not be appropriate for all investors. That is why you should always consult a financial advisor before making any decisions regarding your investments. Thank you for your time and consideration in reading this article. I hope I provided some tidbit of value with this effort.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.