The market seems to be unpredictable in terms of its direction as it has been seeing extreme volatility since last week. The benchmark indices reversed some of the previous day's gains and closed lower by one percent on April 27 due to weak global cues amid elevated energy prices, the Ukraine-Russia war and growth concerns.

The BSE Sensex fell 537 points to 56,819, while the Nifty50 plunged 162 points to 17,038 ahead of the expiry of April derivative contracts, and formed a small-bodied bearish candle which resembles a Hammer kind of pattern formation on the daily charts as there was some recovery from the day's low.

"A symmetrical triangle-type pattern was formed on the daily and in the 60-minutes chart; currently, placed at the lower end of a triangle around 16,900 levels. The lower area of 16,800 has now become significant valuation support for the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He further said the formation of small directionless candle patterns and formation of a triangle pattern and repeated testing of 16,900-16,800 levels could hint at a possibility that the market is preparing for a bigger move. Previously, the downside breakout and upside breakout of around 17,000-16,800 levels have resulted in sharp follow-through moves.

He says the overall chart pattern indicates that the Nifty is now preparing for a big movement. "The overall chart pattern is weighing high on the downside. The support of 16,800 seems to be a crucial base for long positions. Immediate resistance is placed at 17,150 levels."

The broader markets were also caught in a bear trap with the Nifty Midcap 100 and Smallcap 100 indices declining 0.86 percent and 0.6 percent respectively, while the volatility spiked up to 20.61 levels, up 7.4 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,961, followed by 16,884. If the index moves up, the key resistance levels to watch out for are 17,113 and 17,188.

Bank Nifty also closed lower, falling 376 points to 36,029 on April 27. The important pivot level, which will act as crucial support for the index, is placed at 35,792, followed by 35,555. On the upside, key resistance levels are placed at 36,221 and 36,413 levels.

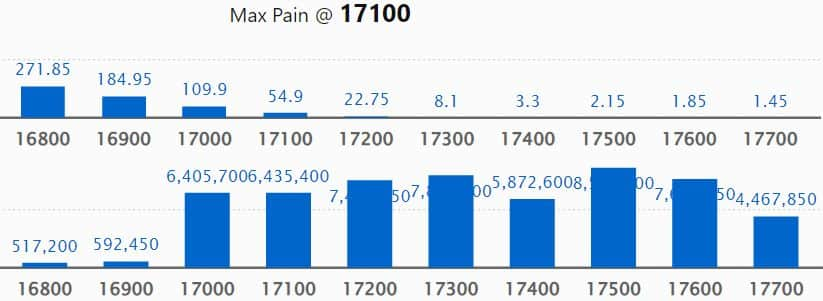

Maximum Call open interest of 85.51 lakh contracts was seen at 17,500 strike, which will act as a crucial resistance level in the April series.

This is followed by 17,300 strike, which holds 78.63 lakh contracts, and 17,600 strike, which has accumulated 76.13 lakh contracts.

Call writing was seen at 17,000 strike, which added 40.99 lakh contracts, followed by 17,100 strike which added 39.55 lakh contracts, and 17,600 strike which added 22.17 lakh contracts.

Call unwinding was seen at 17,800 strike, which shed 12.59 lakh contracts, followed by 18,000 strike which shed 3.84 lakh contracts and 17,900 strike which shed 3.11 lakh contracts.

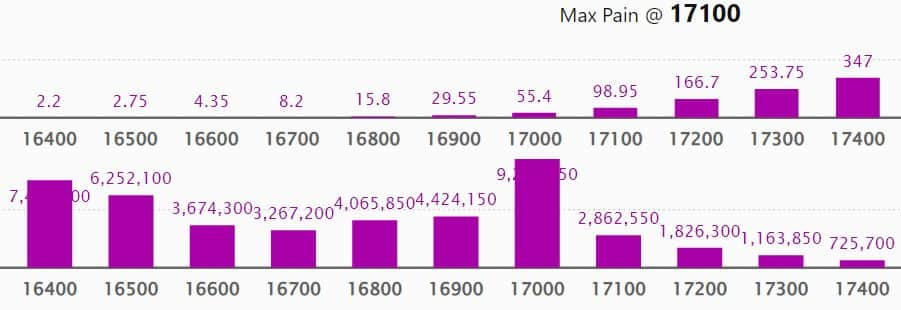

Maximum Put open interest of 92.99 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the April series.

This is followed by 16,400 strike, which holds 74.29 lakh contracts, and 16,500 strike, which has accumulated 62.52 lakh contracts.

Put writing was seen at 17,000 strike, which added 17.62 lakh contracts, followed by 16,500 strike, which added 10.24 lakh contracts and 16,400 strike which added 8.63 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 26.1 lakh contracts, followed by 17,100 strike which shed 11.81 lakh contracts, and 17,500 strike which shed 2.68 lakh contracts.

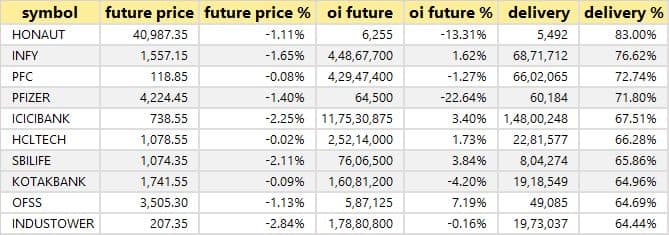

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Honeywell Automation, Infosys, PFC, Pfizer, and ICICI Bank, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Bajaj Auto, Aditya Birla Capital, Chambal Fertilizers, Apollo Tyres, and Ipca Laboratories, in which a long build-up was seen.

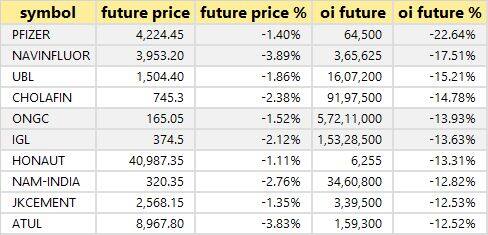

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Pfizer, Navin Fluorine International, United Breweries, Cholamandalam Investment, and ONGC, in which long unwinding was seen.

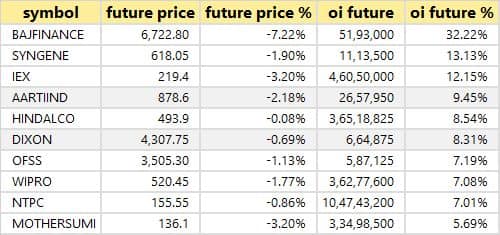

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Bajaj Finance, Syngene International, Indian Energy Exchange, Aarti Industries, and Hindalco Industries, in which a short build-up was seen.

24 stocks witnessed short-covering

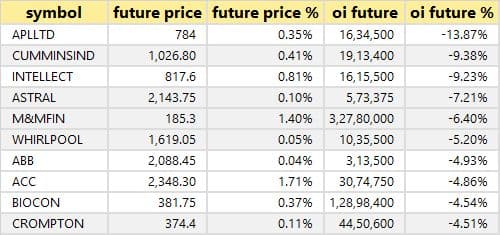

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Alembic Pharmaceuticals, Cummins India, Intellect Design Arena, Astral, and M&M Financial, in which short-covering was seen.

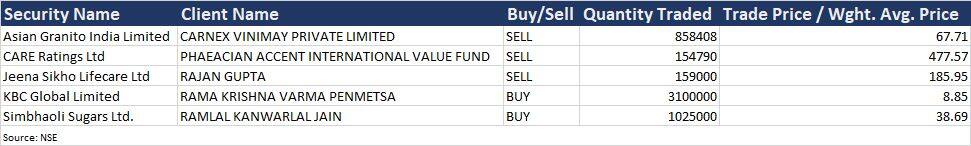

(For more bulk deals, click here)

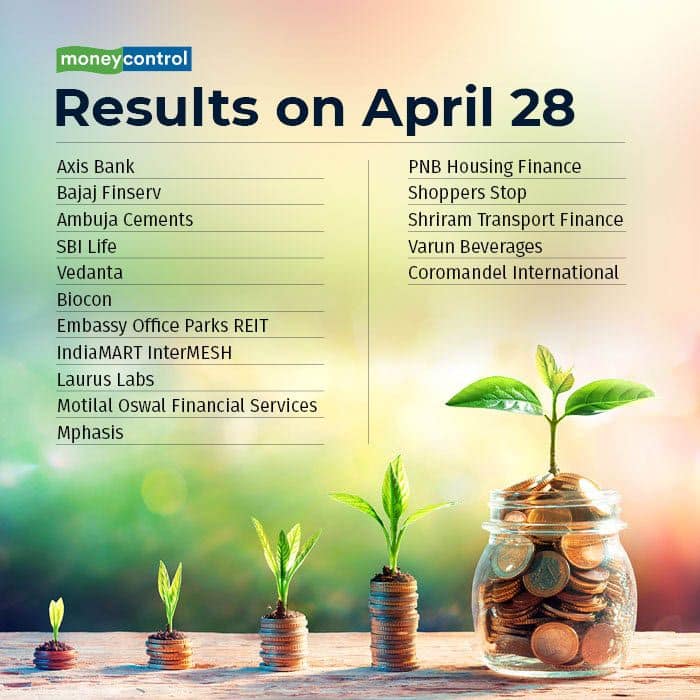

Axis Bank, Bajaj Finserv, Ambuja Cements, SBI Life Insurance Company, Vedanta, Agro Tech Foods, Biocon, Coromandel International, Embassy Office Parks REIT, Fineotex Chemical, IIFL Finance, IndiaMART InterMESH, Laurus Labs, Motilal Oswal Financial Services, Mphasis, Procter & Gamble Hygiene & Health Care, PNB Housing Finance, Shoppers Stop, Shriram Transport Finance, Sterlite Technologies, and Varun Beverages will release quarterly earnings on April 28.

Stocks in News

ONGC: The state-owned oil and gas exploration company has signed an MoU with Norway-based Equinor ASA for exploration and production, and clean energy.

Tata Consumer Products: Life Insurance Corporation of India bought 1.36 lakh equity shares in the company via open market transactions on April 26. With this, LIC's shareholding in the company stands increased to 5.008 percent, up from 4.993 percent earlier.

Persistent Systems: The company reported a good set of numbers as it clocked a 14 percent sequential growth in profit at Rs 200.9 crore driven by topline as well as operating income. Revenue rose by 9.8 percent quarter-on-quarter to Rs 1,637.9 crore during the same period, with order booking for the quarter at $361 million in total contract value. Revenue in dollar terms increased by 9.1 percent sequentially to $217.32 million in Q4FY22.

Bajaj Auto: The two-and-three-wheeler maker recorded a 10.3 percent year-on-year growth in profit at Rs 1,469 crore in the quarter ended March 2022 on incentives from the Maharashtra government for April 2015 to March 2021, but revenue dropped 7.2 percent YoY to Rs 7,974.8 crore on fall in volumes. EBITDA dropped 10 percent to Rs 1,396 crore.

Trent: The company posted a loss of Rs 20.87 crore for the quarter ended March 2022 against a profit of Rs 17.44 crore in the same period last year, as overall expenses jumped 49 percent in the same period, but revenue was very strong, growing 46.7 percent to Rs 1,328.9 crore compared to the year-ago period.

HDFC Asset Management Company: The company reported an 8.7 percent year-on-year growth in profit at Rs 343.55 crore supported by other income and lower tax cost. Revenue grew by 2.6 percent YoY to Rs 516.28 crore during the same period.

Hindustan Unilever: The company reported earnings better than analysts' estimates, with profit rising 8.6 percent year-on-year to Rs 2,327 crore on double-digit growth in topline and operating income, though margin contracted by 30 bps YoY. Revenue during the quarter increased by 11 percent to Rs 13,462 crore compared to the same period last year with flat underlying volume growth. The company said it managed business dynamically driving savings harder across all lines of P&L and taking calibrated pricing actions. The final dividend declared by the company was Rs 19 per share for FY22.

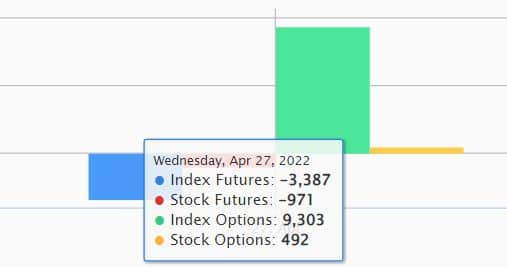

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 4,064.54 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 1,917.51 crore on April 27, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not put any stock under the F&O ban for April 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.