Perion: Insights From Microsoft And Google Make This Stock A Buy

Summary

- Perion's revenues are generated through advertising on Microsoft Bing and on Connected TV.

- Microsoft's earnings give insight into the evolution of Microsoft Bing.

- Alphabet's earnings give insight into the evolution of CTV.

- Perion will update guidance tomorrow. The stock has dropped by 15%. Unjustified, I believe.

grinvalds/iStock via Getty Images

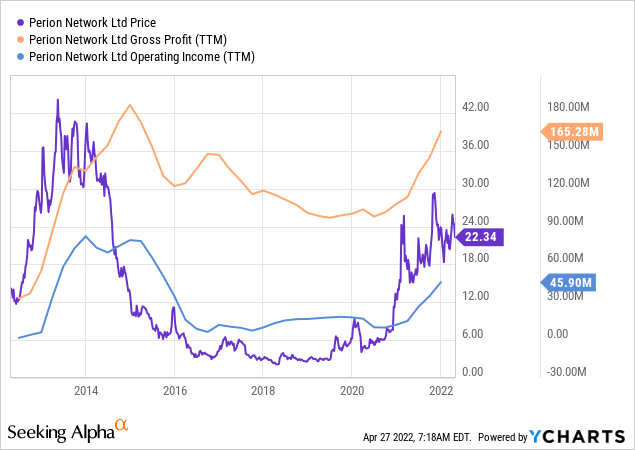

Perion (NASDAQ:PERI) is a rather small (market cap of around $1 billion) demand-side ad tech platform that mainly focuses on two advertising spaces: "Search," through Microsoft Bing, and "Display," through, among others, Connected TV.

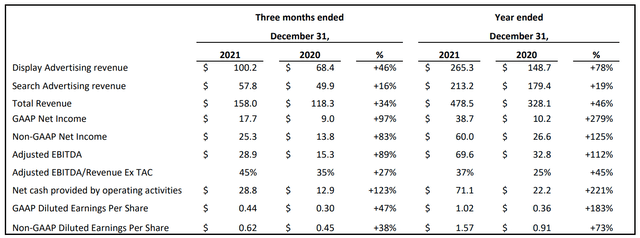

In 2021, more than half of the revenue was generated through Bing while the other half was generated in the Display division. By year-end, however, the "display" division had outgrown (also fueled by acquisitions) the "search" division.

Perion's focus on both divisions has shaped over time as CEO Doron Gerstel has divested unprofitable activities and invested in these fast-growing segments. As shareholders started to see the results of this turnaround in 2021 in the form of strong revenue and earnings growth, share price multiplied threefold.

Perion's strong focus on only these two divisions improves prediction confidence. Let's examine what we can expect from Perion in 2022, in order to be one step ahead of management's updated guidance tomorrow morning.

Indeed, on April 4, management indicated that it will review its guidance on the 28th of April. Since, the stock has declined by 15%. Clearly, investors are not expecting any raise in guidance. Since, Alphabet (GOOG) (GOOGL) and Microsoft (MSFT) have published their earnings, providing indications of the CTV and Search ad markets. Let's have a look.

Q1 of Perion will be very strong

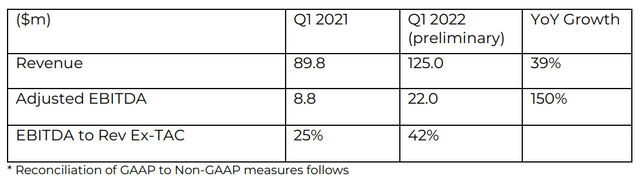

On the 4th of April, Perion provided investors with a concise trading update: Over the first three months of 2022, revenue increased by +39%, while aEBITDA increased by +150%.

Strong numbers, although revenue's Q-o-Q decline of -21% is not that much better than the -24% Q-o-Q decline in Q1 2021. Perion has thus "lapped" its revenue growth, indicating that - in the case of Perion - there has been no slowdown in ad demand as of yet.

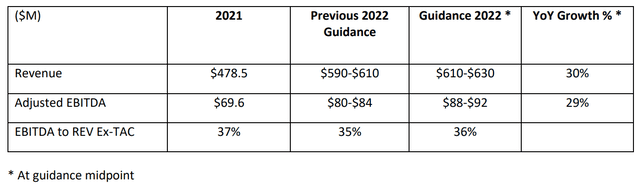

Current full year guidance

Current guidance dates from the 10th of February, 2022.

Perion would have to generate $495M in revenue from Q2 through Q4, which is 28% more than Q2-Q4 2021. This indicates that management expects the ad market to remain strong, and Perion's services growing along with the market.

Learning from Microsoft and Google

For Perion, demand to its services has not decreased, nor decelerated since the end of last year. Let's compare this evolution to Bing's and YouTube's.

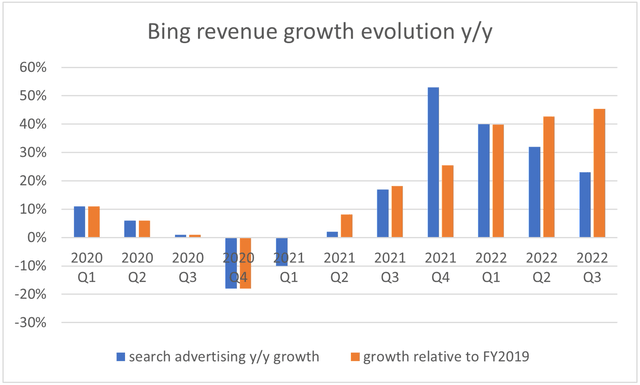

Bing's revenue growth is on the decline again

Microsoft's Bing reported a 23% growth in revenue over the past quarter (2022 Q3, or Jan-March 2022). Given Perion's revenue growth of +39% in the past quarter, it's clear the highest growth has come from the "display" division (as it's now unlikely that its search division has grown by more than +39%).

For Bing, last quarter was the third consecutive growth decline.

However, such a decline was to be expected due to weak comparables at the end of 2020 and the beginning of 2021. Revenue relative to the same quarter in 2019 is up by 46%.

However: If we assume that revenue growth in 2022 Q4 relative to 2019 Q4 will only slightly increase from the current level (46%), revenue growth in the next quarter will only be 17%. Worse, revenue growth in 2023 Q1 and Q2 will decline to mid-single digits.

Prior to 2020, Bing's revenues increased annually by only 5%-10%. Since, growth seemingly increased, but the strong growth in 2021 has been because 2020 numbers were so weak. We see growth returning to historical levels.

Hence, I find it hard to believe that Perion's "Search" division will repeat its +19% growth from 2021, and growth in Q2-Q4 might be halved to 10%.

Google: YouTube is conquering Connected TV

I believe that YouTube ad revenue is at least to some extent correlated with CTV ad spend, as YouTube ad spend is a good indication of advertisers' willingness to spend on alternatives to linear TV, such as CTV.

Given Perion's revenue growth of +39%, which should be even larger for the "display" division, it stunned me that YouTube advertising revenues only grew by +14%. This is much lower than last year's increase of +49% (and +46% for the full year). Alphabet blamed this on strong comparables, although YouTube's revenue increased by +25% in Q4 while also dealing with strong comparables. Sure, some of that missed revenue will be due to an increase in YouTube subscriptions, and other missed revenue is due to lower demand in Europe (where Perion is not active), but still.

To me, this shows that Perion's display division is significantly outperforming its peer.

Moreover, on the earnings call, it has gotten very clear that Alphabet believes strongly in the CTV market:

- "We're enthusiastic about what's ahead for connected TV."

- "Over 135 million people in the U.S. were reached via YouTube on connected TVs in December."

- "YouTube accounts for over 50% of ad-supported streaming watch time on connected TVs... And over 35% of viewers in this group can't be reached by any other ad-supported streaming service."

- "In the year ahead, we will give YouTube's connected TV viewers new smartphone control navigation and interactivity features"

Having read these quotes, I have the feeling that most of YouTube's ad growth is driven by its CTV segment. Why not just invest directly into the hyper-growing CTV segment, then?

Conclusion

Investors have not been very impressed with Perion's trading update on the 4th of April. Since, the stock has dropped by 15%.

I believe this decline is unjustified. Bing's revenue growth has declined some, while YouTube's revenue growth has fallen off a cliff. Looking back, Perion's results are relatively much stronger. Microsoft and Google have both experienced a decline in ad demand, which Perion did not.

It's increasingly becoming clear that even if the ad market cools off further (which I expect it will), Perion should be able to grow its "display" division significantly. That's very attractive as the division should represent some 80% of total revenues by now. Therefore, I'm quite sure that management will raise its guidance tomorrow, seemingly contrary to investors' expectations.

At the current valuation, less than 8x forward EV/EBITDA, it could prove very profitable to buy stock sooner (today) rather than later.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PERI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.