SoFi: The Story Is Far From Over As SoFi Isn't Just Student Loans

Summary

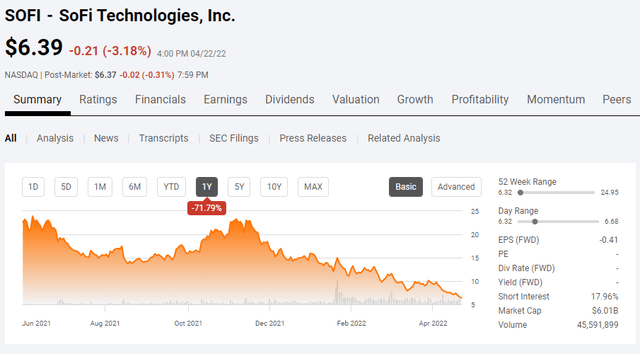

- Shares of SOFI have declined -71.79% since its IPO causing investors to see nothing but a sea of red in their accounts.

- Mr. Market's perception that SOFI is a student loan business needs to change as SOFI has evolved into a one-stop-shop for personal finance.

- In 2021, SOFI grew its revenue and EBITDA with its student loan segment operating at less than 50% and is projecting 45% revenue growth in 2022 assuming the same conditions.

- Every large company started small, and even Amazon declined from $105.07 to $6.71 during the dot.com bubble. SOFI's current share price is an opportunity.

- I do much more than just articles at Barbell Capital: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Justin Sullivan/Getty Images News

Is Apple (AAPL) just a computer company? Is Amazon (AMZN) just an e-Commerce company? Is Alphabet (GOOGL) just a Search Engine? Does The Coca-Cola Company (KO) just sell Coca-Cola? The answer is no to all these questions. The largest companies all started from a singular idea and transformed into diversified conglomerates. Do you know what companies like AAPL, AMZN, GOOGL, and KO have in common? They all started small, didn't skip steps, endured adversity, and succeeded through all the trials and tribulations. These are all recognized brands that are associated with something larger than their original focus. SoFi Technologies (NASDAQ:SOFI) was founded in 2011 by Stanford Business School students and, in 2012, introduced its Student Loan Refinancing product. Almost a decade has passed since SOFI was the first company to refinance federal and private student loans, and to this day, the SOFI brand is synonymous with student loan financing. While student loan refinancing put SOFI on the map, it's become its Achilles heel.

SOFI's inaugural year as a public company has been nothing but a disaster. Since SOFI's IPO, its shares have declined by -71.79%. Most of the investment community has a false understanding of what SOFI does and how it's impacted by the student loan moratorium. Only President Biden knows if he will cancel student debt, extend the moratorium, or restart payments in August. Regardless of his decision, SOFI isn't going to fade away into the night. How quickly the market forgets that SOFI's student loan refinancing business has operated at less than 50% of pre-Covid levels for the past two years, yet 2021 was a record year. SOFI is assuming that the moratorium won't end in 2022. Their adjusted full-year guidance still calls for 45% in YoY adjusted net revenue growth to $1.47 billion and increasing 2021's adjusted EBITDA to $100 million. SOFI is a one-stop-shop for personal finance with an extensive diversification of products. SOFI's chart resembles a company that is reliant on the moratorium to end due to get back to business, not a company that's growing its member base, product offerings, revenues, and EBITDA. The notion that SOFI lives and dies with the moratorium is incorrect, and the market's perception of SOFI's business needs to change. I stand with Anthony Noto and Derek White and have the utmost confidence that SOFI will become one of the largest financial institutions in America. Go back and look at a chart of AAPL or AMZN; how many people would have loved to invest at their lows? The question becomes is SOFI a broken company or a broken stock? My capital is on the side that SOFI is a broken stock, and I continue to buy more shares as new lows are created.

Understanding what SOFI has become as the trifecta of SOFI, Galileo, and Technisys has created a 360-degree entity

There is a scene in the movie Moneyball where Billy Beane says to David Justice I'm not paying you for the player you used to be; I'm paying you for the player you are. This line represents my feelings on SOFI because I am not investing in SOFI for the student loan company it used to be, I am investing in SOFI because of the company it has become.

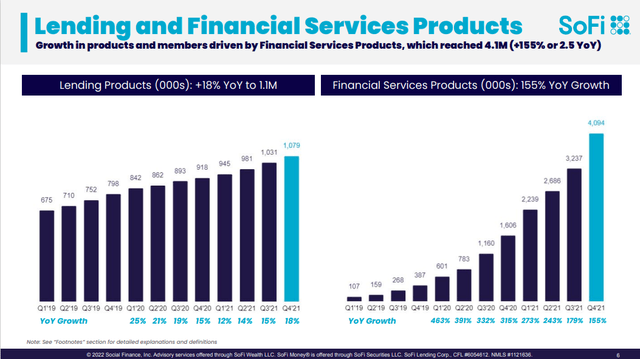

When Anthony Noto took over, SOFI was a student and personal loan financing company. Galileo and Technisys were acquired during his tenure, and a one-stop shop for personal finance provided 5.17 million products to 3.46 million members. SOFI offers its customers 1.08 million lending products and 4.09 million financial service products. Classifying SOFI as simply a student loan company couldn't be further from the truth.

To better understand Mr. Noto's vision, you need to understand why Galileo and Technisys were acquired and how they complement each other. SOFI's mission has always been to help people achieve financial independence and to get there, SOFI needs to offer its members superior products. To better serve its members and differentiate itself from its competitors, SOFI needed to be vertically integrated and own every aspect of its backend. Vertical integration allows SOFI to innovate and bring products to market faster while lowering costs.

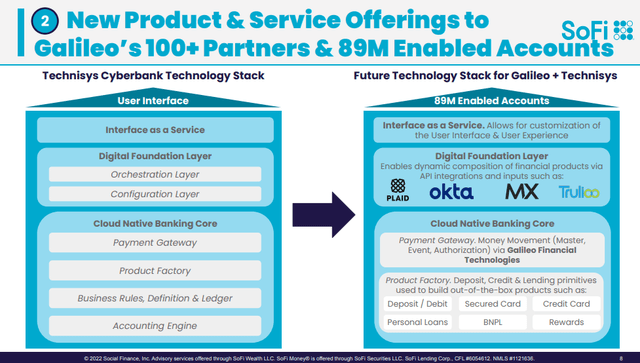

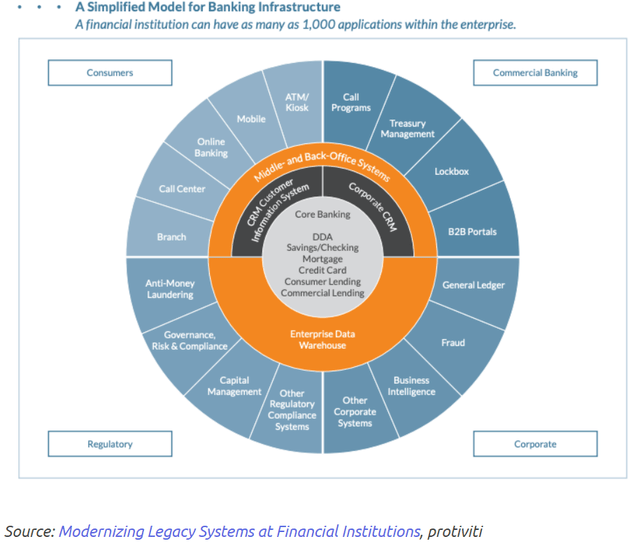

The first step to vertically integrating SOFI was acquiring Galileo. Galileo is a payment processor in the debit and ACH networks and provides software through APIs, allowing its partners to build products seamlessly. SOFI has products that run on different technology cores. SOFI's checking and saving run on 1 core. SOFI's Invest product runs on a different core from a different partner, and SOFI's credit card runs on a separate core for yet another partner. While a 360 platform could be tied together through different product cores from different partners, SOFI's vision is to build every product on 1 unified core to offer a best-in-class product for their members and clients.

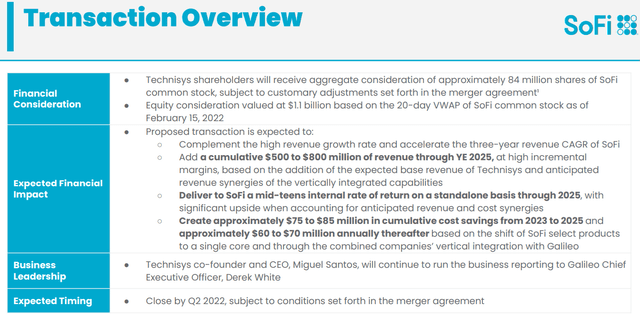

The second step was acquiring Technisys, which serves several purposes. Having already acquired Galileo, SOFI wanted to acquire a banking platform that would benefit Galileo's clients and achieve full vertical integration internally for the SOFI platform and create the ability to offer a vertically integrated turnkey solution for digital finance companies. Technisys allows SOFI to run in a multi-product core with the capability to add future products on the same core that don't exist today. Technisys has the ability to be multi-tenant and allow third parties to integrate on top of it seamlessly. The important aspects are that SOFI members will benefit from outstanding products while Galileo's clients will have the ability to go where they need to go through unmatched flexibility.

SOFI is the AWS of Fintech the market just doesn't understand what that means yet

If you have read a transcript from one of SOFI's recent earnings calls or seen an interview with Mr. Noto or Derek White, the AWS of Fintech has probably appeared. The questions become, what is the AWS of Fintech, and what does it do for SOFI's business? Galileo enables companies such as SOFI to create digital finance businesses and bring them to market. Technisys accelerates SOFI's AWS of Fintech vision by allowing SOFI to create the end-user interface, offer professional services, and provide the modern multi-product core banking platform.

The Technisys Cyberbank Core is a cutting-edge technology platform developed to boost a bank's business into a full digital transformation. The marriage between SOFI, Galileo, and Technisys creates an unmatched trifecta in the digital bank infrastructure space. The combination of SOFI having its banking charter and Galileo & Technisys having the ability to offer products through SOFI is where the magic occurs. Galileo can leverage SOFI's banking license to become a sponsor bank for its existing and new clients as an additional service. The end goal is connecting Galileo's payment processing with the Technisys Cyberbank platform backed by SOFI's banking charter on one unified full-stack.

This is where the AWS of Fintech is born, and Banking-as-a-Service (BaaS) is unleashed. SOFI is now the only company that can offer a turnkey full-stack digital banking solution. SOFI provides the tools for a financial brand to build the end-user interface, conduct all payment processing, provides the digital backend core banking and ledger system on the cloud on a single full-stack backed by SOFI's banking license. Eventually, every multi-product financial services company will need to transition off outdated systems to cloud-native multi-product cores. Unlike other companies, SOFI is unlocking its truest potential by creating a best-in-class lineup across the board. SOFI is driving superior unit economics by owning every aspect of its product and not enlisting third-party vendors. Vertical integration is critical to quicker deployments, delivering better services and products, and utilizing economies of scale to drive margins. Galileo allowed SOFI to vertically integrate SoFi money while Technisys expanded into vertically integrating checking, savings, and credit cards.

Galileo

Anthony Noto and Derek White are playing 4-D chess while others are playing checkers in the park. The acquisition of Galileo and Technisys allows SOFI to create a frictionless environment that works exactly how they envision it, bring new products to market when they desire, and lowest their annual costs by owning the entire backend. Transitioning SOFI's checking, savings, and credit card to Technisys technology stack will create $75 - $85 million in cumulative cost savings from 2023 to 2025. From 2025 forward, SOFI will benefit from roughly $60 - $70 million of cost savings on an annual basis.

Galileo does the backend payment processing for many Fintech companies such as Robinhood (HOOD), Purple, and Greenlight. SOFI acquired Galileo because they evaluated the cost and difficulty of building and maintaining the backend, and this endeavor would redeploy resources from building their end product experience for members. What Galileo offers is difficult to replicate; that's why you see companies such as HOOD as a client. A small segment of companies competes with Galileo, and an even smaller segment competes with Technisys. To my knowledge, there isn't a single company that can replicate what the combination of Technisys and Galileo can create; then, when you throw in SOFI's banking license, the barrier of entry for a replica product becomes additionally fortified. Once the full stack is built, it will be the only complete end-to-end out-of-the-box digital banking solution.

The BaaS business segment that SOFI intends to offer will solicit Galileo's clients first and move on from there. While this endeavor will reward SOFI's business operationally and monetarily, it will do the same for all of Galileo's clients. Galileo's clients will have the ability to move their business onto a full-stack, lower their overall costs, and improve their business operations. Approximately 80% of financial institutions run core banking systems they built themselves. These banking institutions use software designed in the pre-internet era for physical branch banking. As banking has become digitized, there's been exponential growth in the volume of transactions and inquiries. Banking systems can't keep up. They simply weren't built to handle the pressures created by the modern, digital front-end that their customers required and they deployed. For regional banks and other financial institutions to meet the future's personal finance demands, they are going to need to overhaul their backends and sunset their antiquated technologies. I have a feeling that SOFI's BaaS platform will be adopted by many small to mid-size banks; otherwise, they won't be able to compete in the digital age.

Why I believe SOFI is an investment worth holding

Execution. In a short period of time, Anthony Noto and SOFI's leadership have executed on every pivotal aspect of the business thus far. No matter what aspect, financials, membership, or products, SOFI is rapidly growing, strengthening its brand. The student loan moratorium started in March of 2020, providing SOFI with only 2 full months of revenue from this business segment. In the face of adversity, SOFI grew its adjusted annual revenue by 38% ($170 million) YoY. For the entire 2021 fiscal year, the student loan moratorium was in effect and SOFI grew its adjusted annual revenue by 63% ($389 million) YoY. SOFI isn't taking any chances and is baking in the future possibility of the moratorium not being lifted in 2022 and has forecasted a 45.55% ($460 million) YoY increase in revenue to $1.47 billion. Anthony Noto has previously said he will hold SOFI accountable to EBITDA as a standard of profitability. SOFI has forecasted a $70 million (233.33%) increase in EBITDA for the 2022 fiscal year from $30 to $100 million.

As a long-term investor, I am not worried about a thing and continue to buy shares into weakness. These revenue and EBITDA projections are not reflective of a full year of positive impacts from the banking license, cost synergies from moving onto a full-stack environment from Technisys and Galileo, or a student loan business operating at full capacity. SOFI is projecting 45.55% YoY revenue growth in 2022 without these positive effects.

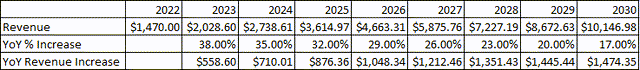

If I was to create what I believe to be a conservative revenue model out to the fiscal year 2030, I could see SOFI generating over $10 billion in annual revenue. On a sliding scale methodology, where SOFI's YoY revenue increase declined from 38% in 2023 to 17% in 2030, it would put 2030's revenue at $10.15 billion. At a 10% EBITDA margin which is probably very low, SOFI would generate $1.02 billion of EBITDA is 2030.

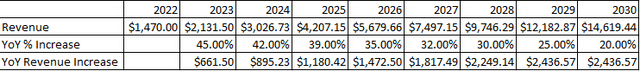

If I get more aggressive with the revenue growth due to positive business impacts and have a 45% revenue YoY growth rate in 2023, which gets scaled down to 20% in 2030, SOFI could do $14.62 billion of revenue in 2030. At a 10% margin, that's a $1.46 billion EBITDA projection.

I don't have a crystal ball, and these projections could be off by a country mile, or they could be underestimating SOFI's future. They are just hypotheticals. Anthony Noto has said his personal goal for SOFI is to be a top ten financial institution. Bank of America (BAC) did $92.22 billion of revenue in the TTM, JPMorgan Chase (JPM) generated $123.73 billion, Wells Fargo (WFC) produced $81.75 billion, Citigroup (C) posted $72.76 billion, and HSBC Holdings (HSBC) did $50.48 billion. I am not sure what the ranking is, but SOFI is going to need to get past the $50 billion revenue mark to be where Mr. Noto wants to take them. Mr. Noto is currently 53, and Jamie Dimon is 66. Let's say Mr. Noto stays at the helm until the age of 70; he would need to increase SOFI's revenue by just over 34x over a 16-year period to reach $50 billion in revenue. These are all hypotheticals, but SOFI definitely has the potential of generating $10 billion+ in annual revenue in 2030 or before while powering the back end of countless financial institutions. SOFI has immense future potential, and as much as I hate to see red, I am buying shares as news lows are made.

Conclusion

I believe shares of SOFI have fallen off a cliff because the market is correlating SOFI's overall business to its student loan segment, which is operating at less than 50%. Many are in the red by 50% or more on SOFI, as the chart is an atrocity. Somehow Anthony Noto and Derek White need to change the market's perception and show the world that SOFI doesn't live and die with the student loan moratorium. I am looking forward to their upcoming earnings because an attractive membership increase and some positive color on the banking segment and the AWS of Fintech strategy could help the market realign their focus on SOFI's other businesses. Just remember, in the dot com bubble, AMZN went from $105.07 on 4/19/99 to $6.71 on 10/29/01. I am sure some AMZN investors were freaking out while others were dollar-cost averaging into their position. All big companies must start somewhere, and not a single company is impervious to market corrections. The tech crash has been ugly, and Fintech companies got decimated. SOFI's downward descent doesn't mean it will fade away into the night. I believe I understand Mr. Noto's vision and feel that he can generate tremendous value for shareholders. I am staying the course, and I will be adding to my position again before their upcoming earnings call.

Barbell Capital provides investors with a comprehensive approach that utilizes growth, value, dividends, and options for income, to generate alpha in your portfolio while mitigating downside risk. Within Barbell Capital you will find exclusive research, model portfolios, investment tools, Q&A sessions, watchlists, and additional features for its members. There is also a live portfolio dedicated to generating capital from trading, selling puts, and selling covered calls. The profits will be allocated to future capital appreciating investments and investing in dividend investments to generate income while we sleep. Join today with a two week free trial!

This article was written by

I am focused on growth and dividend income. My personal strategy revolves around setting myself up for an easy retirement by creating a portfolio which focuses on compounding dividend income and growth. Dividends are an intricate part of my strategy as I have structured my portfolio to have monthly dividend income which grows through dividend reinvestment and yearly increases. Feel free to reach out to me on Seeking Alpha or https://dividendincomestreams.substack.com/

Disclosure: I/we have a beneficial long position in the shares of SOFI, AAPL, AMZN, GOOGL, C either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.