Disney: Unfortunately, Mickey Mouse Walked Into The Political Trap

Summary

- Disney has had a rather troubling year in 2022, after being dragged down by Netflix and the ongoing spate in Florida.

- Netflix's recent decline in subscribers had the tech industry worried about other streaming services, dragging Disney's valuation down.

- The Governor in Florida had also taken offense to Disney's stance on “Don’t Say Gay” bill, leading to a potential loss of the Special Tax District privilege.

- We will discuss what the future holds for Disney if the Reedy Creek Improvement District is revoked.

xxmmxx/iStock via Getty Images

Investment Thesis

Since our last article on the Walt Disney Company (NYSE:DIS), the stock had retraced by -10.97% from $130.04 to $115.77. It is mainly attributed to the decline in user growth from its streaming competitor, Netflix (NFLX), and interestingly, the ongoing dispute in Florida, leading to the potential loss of the Special Tax District privilege. There have been many speculations on the matter, given the Governor of Florida's rather extreme punishment for Disney's stance on the “Parental Rights in Education” bill, also affectionately known as the “Don’t Say Gay” bill.

We will discuss what the future holds for Disney now. In the meantime, we encourage you to read our previous articles on Disney, which would help you better understand its position and market opportunities:

- Disney: Down 30% - Buy Now To Own Your Next Century Marvel Magic

The Politics In Florida Is Simply Baffling

At the time of writing our previous analysis on 11 April 2022, we could not have imagined the eventual result of the ongoing feud between the Governor of Florida, Ron DeSantis, and potentially the most iconic revenue driver in the state, Disney. The revoking of The Reedy Creek Improvement District only proves that big corporations can no longer separate their business interests from the ongoing political turmoil surrounding sensitive topics, such as Meta's (FB) Capital Riot, YouTube's (GOOG) COVID-19 alternative truths, and finally, Disney on the “Don’t Say Gay” bill.

The development is also interesting given how Disney has been historically generous in its political donations, with over $2.1M to multiple candidates and committees in 2021, notably a $50K donation to the Florida Governor himself for his re-election campaign in 2022. Nonetheless, Disney had also pledged to stop any political contribution in Florida after passing the 'Don't Say Gay' bill. Though we will not be delving deep into the “Don’t Say Gay” bill and consecutively, the political side of it, Christopher Miles, a Miami-based GOP consultant, had previously said:

If you come at Ron DeSantis directly, he will come after you. He has made that clear. It's almost like Disney gave him a nice platform to run for president, and it was a good opportunity for him to spike the football. If you draw DeSantis into a fight, he's going to go to the mat. (CNN)

For Disney, the impact of the lost privilege could be massive, given that the company would lose the autonomy of management within its properties with the supposed reduced tax advantages moving forward. Though the repeal bill was technically not signed yet, we expect it to occur, since the Governor aggressively called for it. However, given that many details are not hammered out yet, there is much speculation on the matter as well, namely:

- Disney's $1.7B municipal debt could potentially increase local taxpayers' liabilities in Orange and Osceola counties.

- Maintenance of Disney's existing assets would fall to local counties, effectively increasing residents' taxes (again) when it comes to roads, policing, fire protection, waste management, and more.

- A potential loss in taxes contribution, given that Disney pays $105M in annual taxes, on top of local property taxes worth over $280M between 2015 and 2020. In 2021 alone, the company paid nearly $153M in taxes and fees.

As a result, it is apparent that there are ramifications on the local counties, which may lead to public uproar moving forward, given that many US citizens are already struggling with the effects of the COVID-19 pandemic, unemployment, inflation, rising interest rates, rising gas prices from the ongoing Ukraine war, amongst others.

One of the reasons why Disney could have been staying silent was also that the company is aware of the contractual obligation the state has, based on the original Reedy Creek Improvement District:

Pursuant to the requirements and limitations of Florida’s Uniform Special District Accountability Act, which provides, among other things, that unless otherwise provided by law, the dissolution of a special district government shall transfer title to all of its property to the local general purpose government, which shall also assume all indebtedness of the preexisting special district. (WESH 2)

Miami Herald also reported, “State of Florida pledges...it will not limit or alter the rights of the District...until all such bonds together with interest thereon...are fully met and discharged.” In short, Jake Schumer, a municipal attorney in the Maitland law firm of Shepard, has interpreted that the state could not interfere with the special district, unless the bond debt is paid off (either by Disney or maybe the state?). Given that the existing debt is easily worth $1.7B or even more, it is unlikely that the repeal can occur, unless a loophole is found somewhere. We shall see.

On the other hand, assuming a successful repeal from the Governor, Disney undoubtedly has more than enough cash to pay for the raised taxes. The company reported revenues of $72.98B in the last twelve months, with net incomes of $3.08B, Free Cash Flow of $1.48B, and an impressive war chest of cash and equivalents of $14.4B. Moreover, given that theme parks are back in travel plans this year, Disney could easily see a massive rebound in the segment revenues domestically and internationally.

Ultimately, there was a reason why Disney built its kingdom in Florida, given that the Reedy Creek Improvement District gave the company the self-governance it needed to build the home base for the multi-billion-dollar business. However, now that there are many uncertainties regarding the repeal of the Reedy Creek special district, Disney investors could be in for a wild rollercoaster ride that will only end on 01 June 2023, while the lawmakers in Florida work through the dissolution or alternative measures to 'punish' the company.

Nonetheless, it is also essential to note that other Disney theme parks do not enjoy similar arrangements anyway, which has not affected Disney's profitability and management. As a result, there is also another possibility that the impact of the proposed repeal would be limited. Even then, Disney could always submit another application to re-establish a special district in Florida with more satisfactory terms for both parties. Otherwise, the company could take up the relocation offers by the Governors of Colorado and Texas, though we do not expect it to happen, given the massive capital required to do so. Only time will tell.

NFLX's Poor Performance Pulled Many Streaming Services Down, Including Disney+

The Decline In NFLX's Valuations

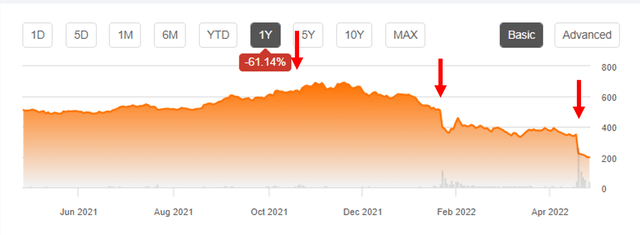

Seeking Alpha

As evident through the chart, NFLX had suffered a decline in its valuations and stock prices through the past two earnings call. The largest online streaming company had missed estimates and provided softer guidance, leading to a market-wide correction for most streaming services as well. Despite not being directly related, Disney's valuation is also affected, given that the company has a similar video streaming service that is currently unprofitable. For example, on 20 Jan 2022, NFLX fell -21.7% post FQ4'21 earnings call, with Disney also falling by -6.9%. Again, a similar trend happened on 20 April 2022, when NFLX and Disney both fell -35.1% and -5.5%, respectively.

The Decline In Disney's Valuations

Seeking Alpha

In addition, due to market pessimism about the COVID-19 Omicron variations, many international tourists avoided Disney theme parks, resulting in further downward pressure on Disney's valuations. As a result, Disney stocks had fallen by -37.12% in the last twelve months, despite millions of US citizens still visiting the home of Mickey Mouse.

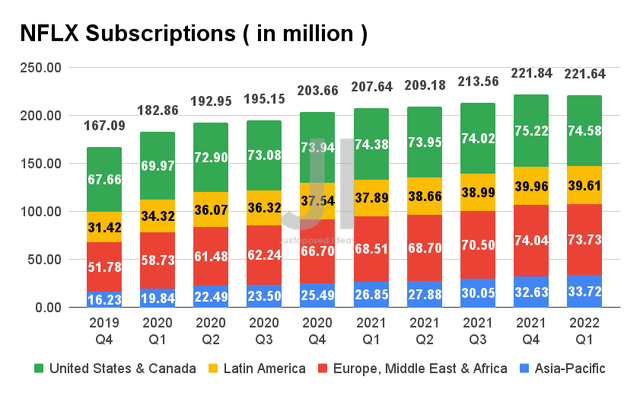

NFLX Subscriptions

S&P Capital IQ

In our opinion, the decline in NFLX's valuations is natural, given that the stock was historically overvalued and the company's lack of IP/ economic moat. In contrast, Disney has a natural advantage in the form of theme parks, Marvel Studios, Pixar, and Lucas Film franchises. Additionally, the growing number of online streaming services offered by Disney+, HBO Max (WBD), YouTube (GOOG), Amazon Prime (AMZN), and Apple TV (AAPL), among others, will also certainly cannibalize growth in user acquisition for NFLX as the largest streaming provider. For FQ1'22, NFLX reported a 200K decline in subscribers instead of the guided increase of 2.5M, potentially attributed to its price hikes, given the ongoing macro issues.

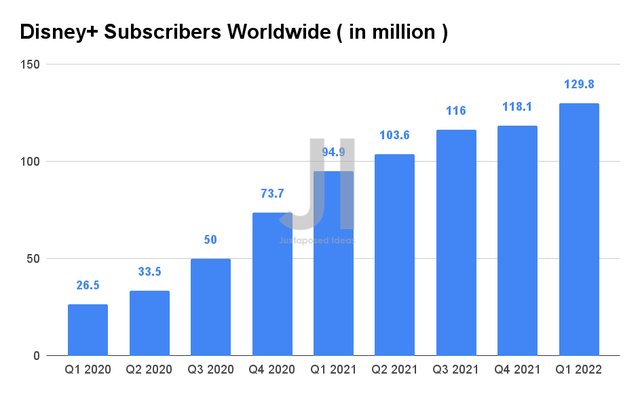

Disney+ Subscribers Worldwide

S&P Capital IQ

On the other hand, Disney had not encountered similar issues, despite an apparent deceleration in user growth. The company still recorded a 9.9% QoQ growth in subscribers in FQ1'22, while NFLX reported a -0.09% decline QoQ. In addition, its latest Disney+ release, Moon Knight, has received excellent reviews with 2nd highest premiere viewership for MCU-related shows. The show had attracted 1.8M viewers within the US over its five-day premiere, with a show rating of 34x the average series demand, though it was eclipsed by the Bridgerton Season 2 series by Netflix at 46.8x.

Nonetheless, we admit that there is ongoing revenue pressure for Disney in FY2022, given the macro issues such as the ongoing Shanghai lockdown hindering the reopening efforts for its theme park there and the limited operations for its Hong Kong theme park at 50% capacity. As a result, Disney's theme parks in China would take some time to return to normal operations. However, we expect those in California, Florida, Paris, and Tokyo to perform well, given the return of domestic and global travelers. For example, a Disneyland spokesperson had said that "Californian Disneyland tickets went on sale Thursday (14 April 2022) to great demand while overwhelming the website traffic."

So, Is Disney Stock A Buy, Sell, Or Hold?

Disney is currently trading at an EV/NTM Revenue of 3x and NTM P/E of 24.28x, lower than its 3Y mean of 4.22x and 64.25x, respectively. The company is also expected to release FQ2'22 earnings on 11 May 2022, with positive signs from its re-opened theme parks contributing to potential stock recovery. However, it is also apparent that consensus estimates have lowered their price targets for the stock, given the ongoing spat in Florida.

As a result, we are downgrading our Buy rating on Disney to Hold. Despite the upside potential, we expect the uncertainties to cause further sideways activities for Disney stock, before recovering upon more clarity on the situation.

Therefore, we rate Disney stock as a Hold for now.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.