Perion Is Booming

Summary

- The company is experiencing significant growth, booming CTV revenues, expanding margins, and rapidly rising cash flows.

- The company has differentiating technology, giving it considerable moat and the shares are very modestly priced.

- A third of the market cap is cash, giving the company a large and growing M&A war chest.

- The main risk we can see is a significant economic slowdown or recession and/or a further substantial market decline, as the Google results foreshadow.

- Looking for more investing ideas like this one? Get them exclusively at SHU Growth Portfolio. Learn More »

Lemon_tm/iStock via Getty Images

We haven't looked for quite some time at Perion (NASDAQ:PERI), the Israeli ad-tech company, but revisiting the story we think it's even better than when we last visited. Basically, there are a number of things to salivate about for investors:

- Great growth profile, at least in part based on M&A (the company has a $330M war chest, so this looks anything but done).

- Serious differentiators are creating a considerable moat.

- Greatly improved financials

- Expanding margins and cash flow

- Very reasonable valuation

However, as the results from Google (GOOG) (GOOGL) show, although much of that could be specific to YouTube, the ad market could slow down considerably on a worsening economic outlook.

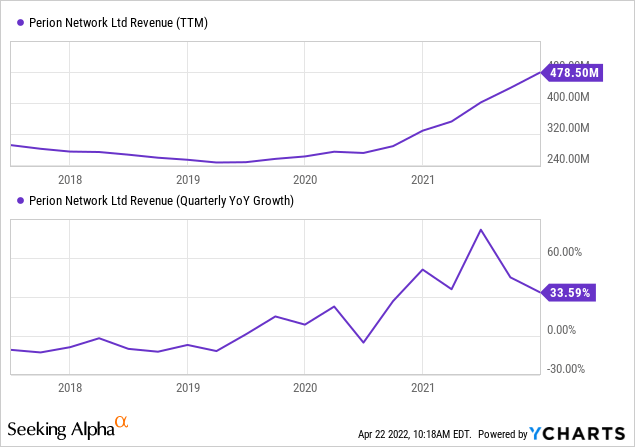

Growth

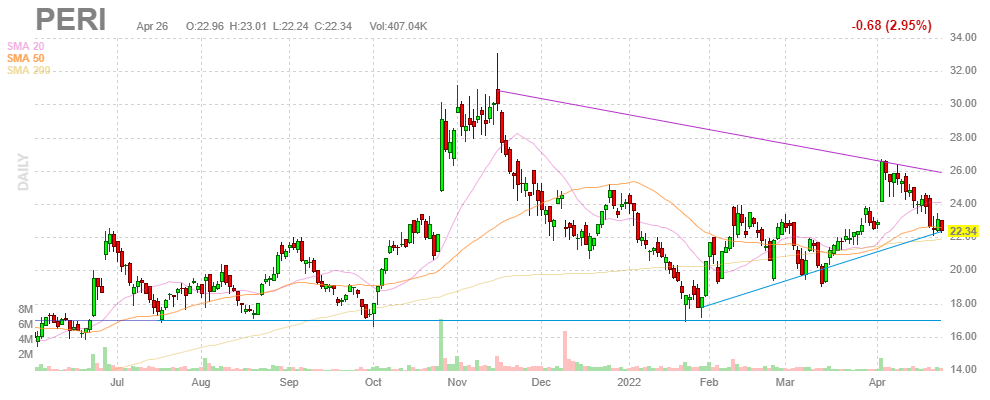

FinViz

We see three main drivers for the company's solid growth profile:

- Presence in high growth segments like CTV/video

- M&A

- Differential solutions

Let's look at that growth:

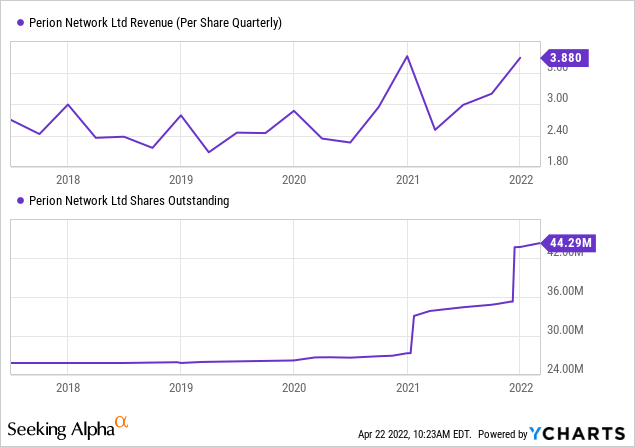

The growth took off halfway through 2019, which is when we were covering the stock and mainly considered it a value play. The growth is a little less impressive on a per-share basis given the substantial dilution:

They acquired Vidazoo last year and the share binge last year has given them a war chest of some $330M (which is expanding by the day as the company also generates significant amounts of cash), so this isn't likely to have been the last of their M&A activity.

Differentiators

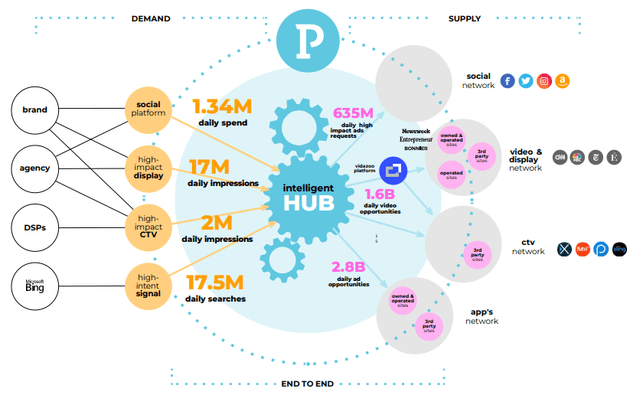

- iHub

- Vidazoo platform

- SORT cookieless tech AI based

- Cross-screen synchronization

- High-impact/personalization ads

- Inventory check

iHub

iHub is a recently introduced AI-driven technology, which aims to cut out steps in the market process that is, cutting out middlemen not unlike what Digital Turbine (APPS) purports to do with its DSP and SSP acquisitions. FY22 will be its first year in operation and it will lead to:

- Reduced operational cost (contributing $6M in FY22)

- Reduced TAC

- Increased customer value

From the Q4CC:

Perion diversification strategy is very much calling from the ability to drive revenue from both sides of the open web, but more importantly, of this side is our ability to connect all our assets, either from the demand side or from the supply side into this intelligent hub.

Connecting everything into iHub not only allows the generation of revenue from both sides of the open web, but it also enables synchronization of screens as the three pillars of digital ad: search, social, and display.

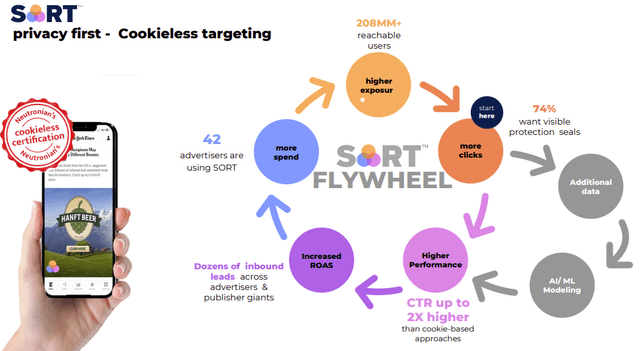

SORT

- The company isn't dependable on cookies. Only 14% of revenue is cookie-dependent, and this is set to reduce further with the introduction of SORT, their cookieless solution.

- SORT is based on AI and hundreds of smart groups they have, people that have certain traits are likely to hit on this type of ad.

- The company is co-marketing the solution with advertisers that are associated with consumer privacy.

- It produces a flywheel effect: ads using it have a visible protection shield, which produces a CRT 2x that of cookies, as consumers feel safe. Higher ROAS attracts more ad spending, creating more data, improving the AI, increasing CRT and ROAS even more, etc.

- The flywheel effect is already becoming visible as 42 advertisers were using it already by the time of the Q4CC (February 9) and this has subsequently grown to 100+ by April 4.

- Management argued during the Q4CC that SORT would produce some $15M in additional ad budget from customers.

- The company is also working on offering SORT as a service to publishers that want to adapt the privacy technology.

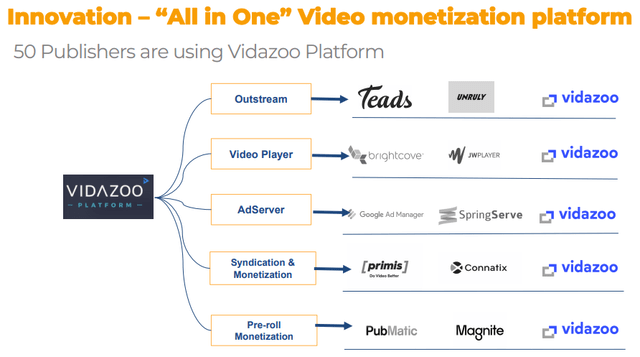

Vidazoo platform

They bought Vidazoo last October for $93.5M and the company was immediately accretive. Vidazoo offers:

- A proprietary online video player and integrated server which makes it very easy for customers to upload, manage and stream video ads.

- A sophisticated yield management platform, automatically optimizing and prioritizing publishers' direct campaigns and open marketplace demand based on specific KPIs. The solution will be included in Perion's iHub

- A rich video content and ad marketplace, connected to 20+ programmatic platforms, which Perion will expand with its existing buy-side relationships.

From the Q4CC:

Vidazoo is able to incorporate out stream the video player, ad servers, syndication, monetization, and pre-roll monetization into one platform.

A third of the installed base, some 50 publishers are already using it. This is a real technology moat.

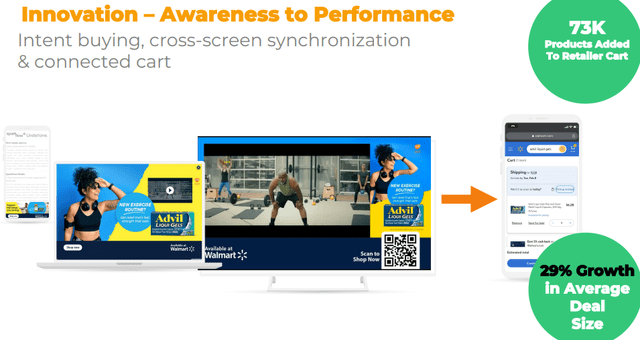

High impact

With the help of its tech, the company is enabling several high-impact forms of video ads which are already comprising 70%-75% of CTV revenue, like:

Personalization in the retail vertical. The company executed an $800K campaign for Pfizer for Advil, gap between awareness and performance (actual sales).

Perion proposed to narrow that gap with screen synchronization and with the help of Connected Cart 2.0 inventory management, offering ads with close substitutes when the inventory of the original product has run out. The result is that Pfizer increased their business with them to $1.8M.

Live CTV:

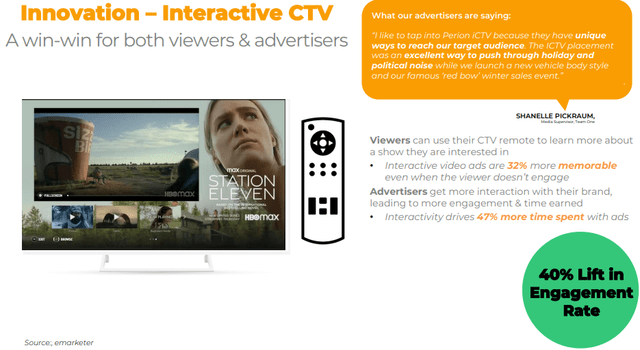

Interactive CTV:

Cross-screen synchronization

The ability for optimizing channel mix and cross-screen synchronization came with their acquisition of Undertone a few years back, from the website:

Perion’s technology works in the background to continually balance the right mix of channels – from display to video/CTV and even voice – to improve ROAS.

This ability drives bigger campaigns, the average deal size increased by 29% y/y to $139K.

Q4 and FY21 financial results

Management predicted baseline growth at 15% CAGR until 2024 on their investor day, acquisitions add to that growth. The organic growth mostly comes from CTV/video, growing at 311% to $46M in Q4 but of course, Vidazoo added most of that. CTV is now 29% of revenue ($46M out of $158M).

However, for the year CTV grew 300% and 123% pro forma (that is, organically) so this is really a high growth area for the company, no doubt. CTV added 31 new customers in Q4 and now 92 or 20% of their 412 active customers are using this channel up from 10% in Q4/20.

They report in two segments, Display Ad which grew 46% (23% pro forma) on the basis of CTV growth, so this segment is growing faster than their baseline growth even on an organic basis.

The other segment is Search, based on their partnership with Microsoft (MSFT) Bing which was extended for another four years in November 2020 and Perion won Microsoft's Advertising Supply Partner of the Year, so we think worries about dependency on Microsoft should have subsided considerably in the last couple of years.

Search benefited from the pandemic as it gave people more time to research stuff and purchases before buying, and management argues that these new habits will remain. Some more metrics from Q4:

- Search +19% in FY21 and +16% in Q4 to $57.8M, 35 new publishers added for a total of 114.

- Revenue ex-TAC $64.6M 41% of rev, up from 37% on mix and direct sell

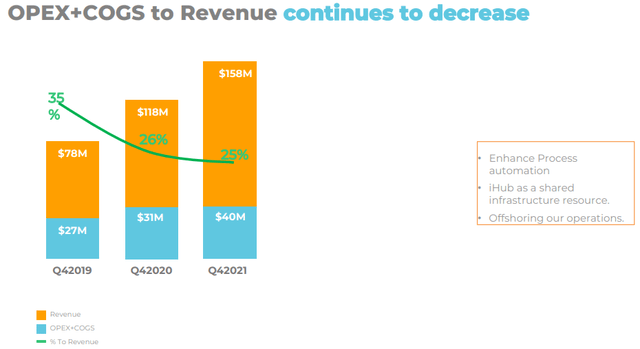

- OpEx 25% of rev (vs 26% Q4/20) on process automation and offshoring

- Net income +97% $17.7 EPS $0.44 (vs $0.3 in Q4/20)

- Non-GAAP +83% to $25.3M (EPS $0.62)

- Adj EBITDA $28.9M or 18% of rev (vs 30%) ex-TAC 45% vs 35% in Q4/20

- TAC was $93.3M or 59.1% of revenue, down from 63.2% of revenue in Q2/20.

There are already preliminary Q1/22 results:

- Revenue $125M

- Adj. EBITDA $22M (or 42% margin)

- SORT has now been used by 100+ campaigns

Vidazoo and SORT were main drivers, which bodes well for the rest of the year.

FY22 Guidance

Management has raised guidance three times since October 26, 2021 and will probably do so again when they announce the definite Q1/22 numbers (April 28), but here is the guidance they put out during the Q4CC:

- Revenue of $620M

- Adj EBITDA at $90M (42% margin)

- SORT will generate $15M in ad revenue

Margins

Management predicts a 42% EBITDA margin (ex-TAC) in Q1, which is greatly above last year's Q1 (25.1%), and what investors should appreciate is that Q1 is seasonally the weakest quarter. From Q4CC:

about 20% in Q1, 24% in Q2 and Q4 and more than 30 32% in Q4.

Basically, the guided Q1/22 margin (low season) is almost as good as the Q4/21 margin (44.8%) the high season when they do 50%+ more revenue compared to Q1.

This indicates to us that EBITDA margins are likely to expand significantly in FY22 and increase the likelihood of increased guidance, above what they guided during the Q4CC, which was for a 36% adjusted EBITDA margin for FY22.

There is also some cost-cutting, like moving some operations to India.

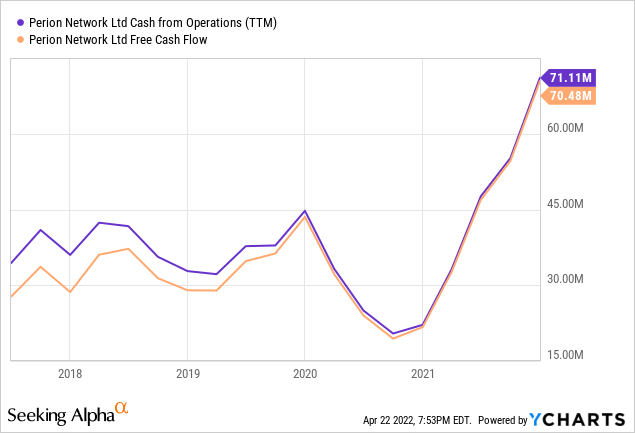

Cash

The graph speaks for itself:

- Operational cash +123% to $28M versus $12.9M in Q4/20

- Cash and equivalents at yearend at $322M (vs $60M at the end of 2020), $230M from two financings

So their war chest for further M&A is already large and increasing by the day while valuations in the sector are coming down.

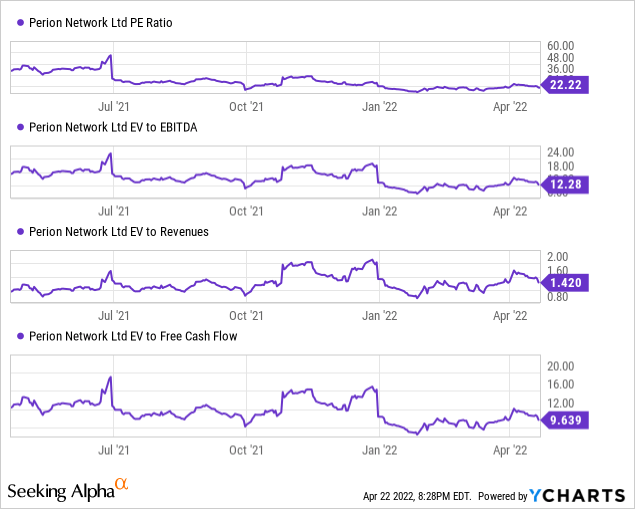

Valuation

EPS estimates are for $1.17 this year rising to $1.43 this, which makes the shares reasonably priced on an earnings basis, but take the following into consideration:

- A third of the market cap is cash, which the company also generated in significant and rapidly increasing quantities since last year. Cash flow could top $100M in FY22, which would bring the cash flow/EV considerably lower, low enough to call the shares outright cheap.

- The company has a good growth profile, we think their organic growth can be 20% although we have to see how that holds up during a slowdown or recession. M&A adds to the growth.

- Margins are expanding on their new tech solutions.

- The above analyst consensus EPS numbers are almost certainly going to be raised after the definite Q1 numbers come in.

Conclusion

Markets notwithstanding, we think that Perion is very attractive here. The company has some unique solutions that give it some moat, it's well-positioned for the CTV bonanza, especially after the acquisition of Vidazoo.

The company has expanding margins and a good growth profile with three guidance increases in four months. The company has an iron-clad balance sheet with a third of the market cap in cash which gives it a huge war chest for additional acquisitions. The shares are cheap.

The main risk is how much a significant economic slowdown or even recession would have on company performance, given the cyclical nature of the ad industry, but CTV and especially the high-impact segment of that might escape the brunt of that.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities which we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models which have the potential to generate considerable operational leverage.

This article was written by

I'm a retired academic with three decades of experience in the financial markets.

Providing a marketplace service Shareholdersunite Portfolio

Finding the next Roku while navigating the high-risk, high reward landscape.

Looking to find small companies with multi-bagger potential whilst mitigating the risks through a portfolio approach.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PERI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.