Twitter Acquisition Impacting Tesla Stock: What Investors Should Know

Summary

- And so Twitter has fallen for the charms of Elon Musk, the CEO of Tesla, given the irresistible $44B offer.

- However, trouble is brewing, given that Musk had tied the fates and valuations of Tesla and Twitter together moving forward.

- We shall discuss what this means to Tesla and Twitter investors moving forward.

J Studios/DigitalVision via Getty Images

Investment Thesis

Tesla Inc (NASDAQ:TSLA) CEO, Elon Musk, finally convinced the board of directors of Twitter, Inc (NYSE:TWTR) to say "yes" to his deal. Given how Musk has been aggressively pursuing the deal, it is not hard to see why Twitter had no choice but to capitulate. In addition, Twitter might face lawsuits from its shareholders if the sale does not occur, given how Musk offered a 38% premium to its closing price on 1 April 2022. Furthermore, Musk is a well-loved figure on Twitter, with 84.3M followers on the social media platform, more than Ellen DeGeneres at 77.5M and Kim Kardashian at 72.1M.

Come what may, the $44B deal has been confirmed, with the acquisition to be completed by 2022. Assuming no further regulatory issues, Twitter will be consequently taken private as per Musk's intention. We shall discuss what this means to Tesla and Twitter investors moving forward.

What Does It Mean To Tesla?

In response to the news released on 25 April 2022, Twitter's stock rose by 5.7% to $51.70, while TSLA's stock slid by -0.7% to $998.02. It is evident that the responses from the investors have been mixed, given that no one knows what is Musk's plan for Twitter once he takes over the company. One thing is clear though, their destiny and stock valuations will be intertwined for the next few months before and after the deal is completed.

Now, what does this matter? The $44B offer comprises $13B of loans and $12.5B of margin loans from Morgan Stanley and others, combined with Musk's $21B equity commitment. It is also important to note that the $12.5B of margin loans is against Musk's existing equity of Tesla stock - "a condition which requires that the borrower thereunder satisfy a maximum loan to value ratio of 20%, which is expected to be satisfied by the contributions of a portion of Mr. Musk's unencumbered shares in Tesla, Inc. to such borrower."

So technically, Tesla as a company is vulnerable given that at least $12.5B of the stock is hedged for the Twitter deal, if not more, given that Musk needs to part with $21B of equity. (If you are interested in more of the financing details that we will not be covering, you may read the relevant SEC filing or refer to a rather bearish though in-depth analysis, Using Tesla As Collateral To Buy Twitter, by Jaberwock Research.)

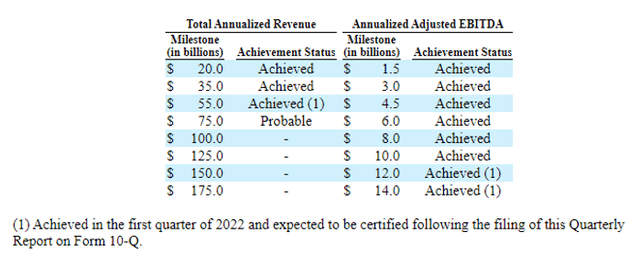

Elon Musk's 2018 CEO Performance Award

Seeking Alpha

We expect part of Musk's $21B of equity commitment to come from the $16.4B worth of capital he received from the sale of his 15.7M TSLA shares in November and December 2021. However, the CEO also needed to pay an enormous tax bill worth $11B for exercising the options. Nonetheless, the amount would be a small change, given that Musk is currently the richest person globally, with a net worth of $269.7B as of 14 April 2022.

Though speculative, given that no one knows how much cash Musk actually has on hand as opposed to non-liquid assets, Musk may also potentially encash a part of his 17% stake in TSLA at 172.6M shares. Based on share prices of $998.02 on 25 April 2022, Musk would just need to sell 21M shares to form the $21B equity required for the acquisition.

In addition, Musk would be able to access the last three tranches of his 2018 CEO bonus scheme worth over $22B, after smashing the required TSLA share price and financial growth milestones in FQ1'22. Though he needed to hold on to the shares for five years before selling sometime in 2027, Musk would have secured more than enough to pay for the rest of the loans of $25.5B, assuming similar growth in TSLA stock valuation for the next five years.

Growth In TSLA Valuations In The Past Five Years

Seeking Alpha

In the past five years alone, TSLA has reported a mammoth growth of over 1490% in valuations. Though we do not expect the stock to record a similar rate of valuation growth moving forward, there is every reason to believe that TSLA stock could still record at least another 50% growth, given its leadership in the EV race and robust Free Cash Flows. Consequently, Musk's current three tranches of 8.4M TSLA shares, each valued at $7.6B, could easily increase in value to a total of $34B in the future, if not more. It would be more than sufficient to pay off the loans and pay the relevant taxes from exercising the options then.

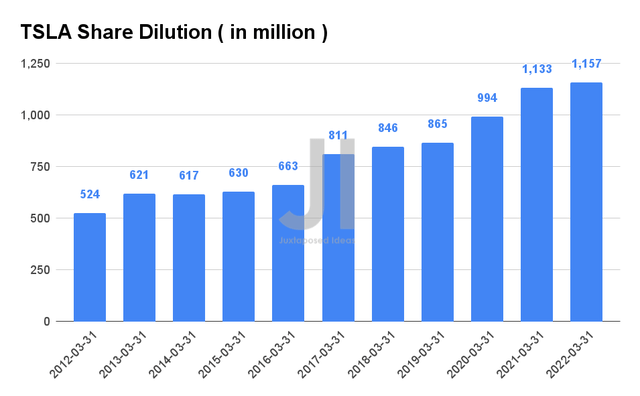

TSLA's Share Dilution

S&P Capital IQ

Nonetheless, we must admit that these share-based compensations would also continue to dilute TSLA's existing shareholders. In the past ten years, TSLA's share count has increased by over 220%, from 524M in 2012 to 1.15B in 2022. Nonetheless, given that the company has proven itself through its visionary execution despite the global supply chain issues while delivering an impressive $6.92B of Free Cash Flows in the last twelve months, TSLA's investors apparently do not mind, given the stock has also risen in valuation by over 35% in the past year. Nonetheless, based on its latest 10-Q, we do not observe any new CEO bonus schemes, in line with Musk's earlier statement. As a result, we do not expect any massive share dilution in the form of 101.3M stock option awards in the meantime.

Use Of Twitter For TSLA's Advertising and Marketing

Even so, we expect the ongoing deal and the 'final form' of Twitter to be a rather effective form of advertising for TSLA, especially since the company historically did not spend much on marketing. In addition, Musk had often shared exclusive ideas, news, and polls on his favorite social media platform, drawing massive interest and comments from his ardent fans. Given that Musk has been and will be actively participating in Twitter moving forward, Twitter will be an excellent form of advertising for TSLA, albeit an expensive one.

However, due to Musk's deep involvement in SpaceX, The Boring Company, Neuralink, and OpenAI, we are unsure how his divided attention could help TSLA grow further, given TSLA Energy's lagging performance compared to its massively successful EVs segment. In addition, Musk would open up a whole new can of worms, given that there is a massive governmental movement against the power of Big Tech companies in the social media industries, including Meta and Alphabet. As such, we recognize that the current market uncertainties may result in a potential decline in TSLA's valuation in the coming weeks.

In the meantime, we encourage you to read our previous articles on TSLA, which would help you better understand its position and market opportunities in EVs and Solar Power:

What Does It Mean To Twitter?

Besides introducing an edit button and expounding on the importance of free speech in a democratic society, Musk has not given any concrete ideas on the changes he expects to introduce to Twitter. Elon Musk, CEO of TSLA, said:

I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans. (BBC)

The TSLA CEO had previously toyed with the idea of removing ads from the platform and replacing it with a subscription-based revenue model, though at a cheaper rate than the currently offered Twitter Blue at $3 a month. However, given that the tweet is already deleted, Musk could finally be open to a double revenue model system, where premium subscribers pay for an ad-free social media experience, and advertisers would have access to free users. It is a model already used by certain social media platforms such as Spotify (SPOT) and YouTube, with Netflix (NFLX) and Disney (DIS) expected to release an ad-supported tier as well. Nonetheless, these are obviously speculative, given that Musk has yet to address key business drivers, including growth in users or revenue.

Twitter Stock Valuations Against Meta and Alphabet

S&P Capital IQ

Despite being launched in 2006, Twitter has not innovated much and, consequently, remained stagnant in valuations compared to its peers, Meta (FB) and Alphabet (GOOG, GOOGL). In addition, the former only reported 217M global daily active users, compared to Meta's Facebook at 2.9B monthly active users and Alphabet's YouTube at 2.6B. Furthermore, Twitter only reported revenues of $5.07B in the last twelve months (LTM), compared to Meta at $117.9B and Alphabet at $257.6B. Given Twitter's negative Free Cash Flow of -$378.8M in the LTM, we expect Musk to pump even more capital to keep the business afloat moving forward. As a result, it is evident that Twitter could be a liability to Tesla, given that the company has not been performing well.

As iterated above, Meta and Alphabet, as parent companies to several social media platforms such as Facebook, Instagram, and YouTube, have faced much censure from governments and society worldwide. It is due to the complicated nature of their social media platforms' algorithms, illegal content, hate/ bullying speeches, sexual content, alternative truths, and many more. For example, Facebook had been accused of playing an 'active role' in encouraging the Capitol Riot, while YouTube has been bashed as making money from 'conspiracy theories' surrounding the COVID-19 pandemic.

Given Musk's lack of experience in the social media industry, he would definitely encounter many issues and, most importantly, personal liabilities moving forward, as the owner of privatized Twitter, assuming that absolute 'free speech' is allowed on the platform. As a result, we expect the social media platform to encounter major hiccups as Musk tinkers around with his proposed changes while balancing the ever-changing regulatory requirements globally.

Most importantly, Musk has yet to expound on his leadership plans for the social media platform once it is taken private, though it is crystal clear that the board will 'cease to exist.' Now that the deal is closed and Musk is almost in control of Twitter, there is no end to the speculations about how the platform's potential will be 'unlocked' moving forward. Only time will tell.

So, are TSLA & TWTR Stock a Buy, Sell, or Hold?

Given the ongoing Twitter deal, we expect the stocks to be driven by sentiment instead of fundamentals in the next few weeks, given that TSLA had reported an excellent FQ1'22 quarter recently. TSLA is currently trading at an NTM P/E of 78.32x, lower than its 3Y mean of 133.44x. The stock is also trading lower at $988.02 on 25 April 2022, down 19% from its 52-week high of $1243.49. Nonetheless, we will still iterate our Hold on TSLA, given the ongoing uncertainties from its Shanghai Gigafactories and the somewhat 'controversial' Twitter acquisition.

In contrast, Twitter's valuations do not quite matter anymore, given that the stock will be taken private at $54.20 a share. During the takeover hype, the stock price rose 65.1% from $31.3 in February to $51.7 on 25 April 2022. As a result, given the minimal margin of profits, we doubt the stock will rise beyond the price offered by Musk. Those who still own Twitter stocks should hold on until the deal is completed, cash out, and buy other stocks, potentially TSLA, given that the company will remain highly relevant in the next few decades as the world races to be carbon-neutral by 2030. However, we also admit that at NTM P/E of 78.32x, TSLA is definitely overvalued compared to other automotive stocks.

Therefore, we rate TSLA and TWTR stocks as Neutral.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.