Tuya Seeks Growth But Produces Higher Operating Losses

Summary

- Tuya went public in March 2021, raising around $915 million in gross proceeds in an IPO.

- The firm provides technology infrastructure, Internet of Things and Platform-as-a-Service services to companies worldwide.

- TUYA has grown revenue and gross profit but produces worsening operating losses, and is currently negatively affected by the Covid-19 lockdowns in China.

- I'm on Hold for TUYA in the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

metamorworks/iStock via Getty Images

A Quick Take On Tuya

Tuya (NYSE:TUYA) went public in March 2021, raising approximately $915 million in an IPO that was priced at $21.00 per ADS.

The firm provides cloud-based infrastructure in China for Internet of Things services and applications to companies worldwide.

Given the uncertainties of Tuya's revenue growth as a result of the continuing lockdowns in China and its worsening operating results, until management can demonstrate a meaningful turn toward operating breakeven, I'm on Hold for TUYA in the near term.

Company

Hangzhou, China-based Tuya was founded to develop a Platform-as-a-Service (PaaS) cloud offering to enable developers to build and host their Internet of Things (IoT) applications.

Management is headed by Founder and CEO, Xueji Wang, who was previously a Senior Director at Alibaba and was responsible for launching a number of initiatives at Alipay.

The company's primary offerings include:

Internet of Things Platform-as-a-Service

Industry Vertical Software Solutions

Cloud-based Services

The firm pursues customer relationships with businesses and OEMs primarily in the consumer IoT industry.

However, management has been expanding its efforts into a variety of other vertical sectors.

In 2020, the company 'powered over 116.5 million devices via IoT PaaS, making us the world's largest IoT cloud platform in the global market of IoT PaaS, according to CIC.'

Market & Competition

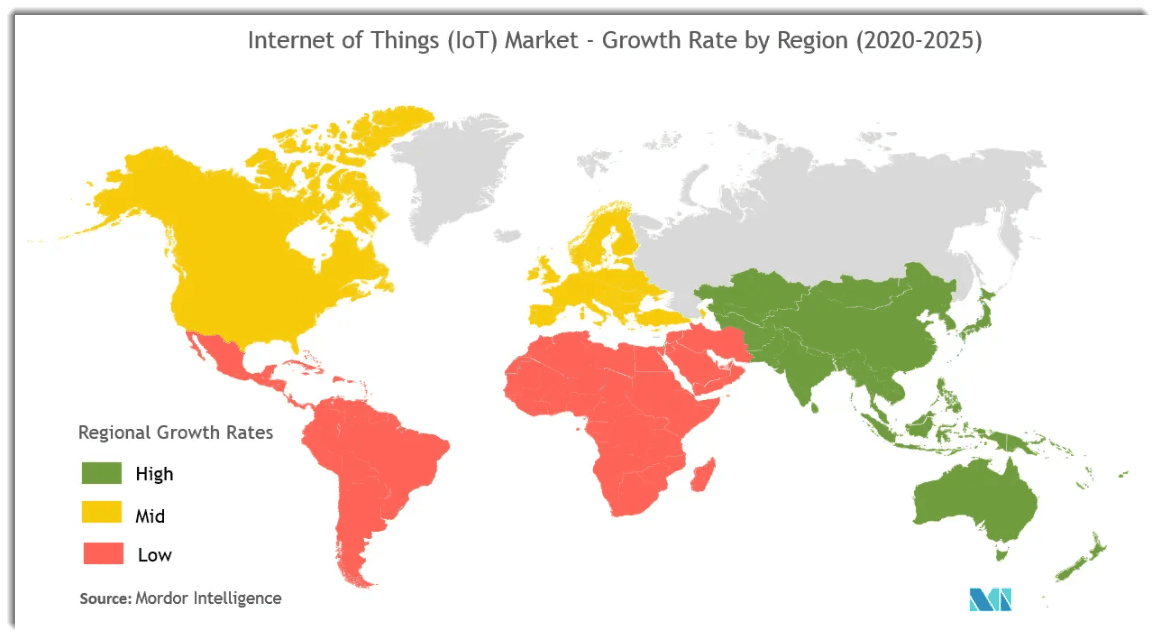

According to a 2020 market research report by Mordor Intelligence, the global market for IoT was valued at an estimated $761 billion in 2020 and is expected to reach $1.39 trillion in value by 2026.

This represents a forecast CAGR of 10.53% from 2021 to 2026.

The main drivers for this expected growth are an increasing adoption of IoT technologies across a wide range of industry verticals, including automotive, manufacturing and healthcare.

Also, a shift to manufacturing 'Industry 4.0' is placing an emphasis on complementing and augmenting human labor with robotics to reduce accidents and increase efficiencies.

Regional growth rates are estimated in the chart below:

Global Internet of Things Market (Mordor Intelligence)

Major competitive or other industry participants include:

TUYA's Recent Financial Performance

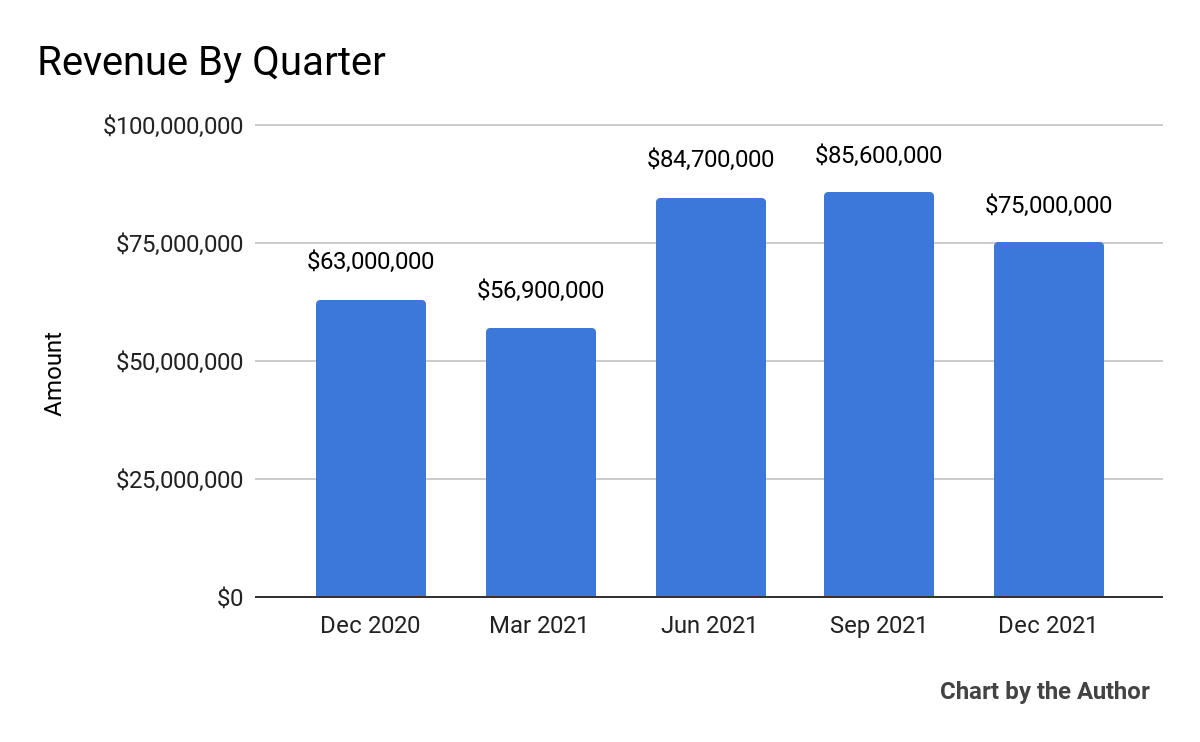

Topline revenue by quarter has grown unevenly over the past 5 quarters:

5-Quarter Total Revenue (Seeking Alpha and The Author)

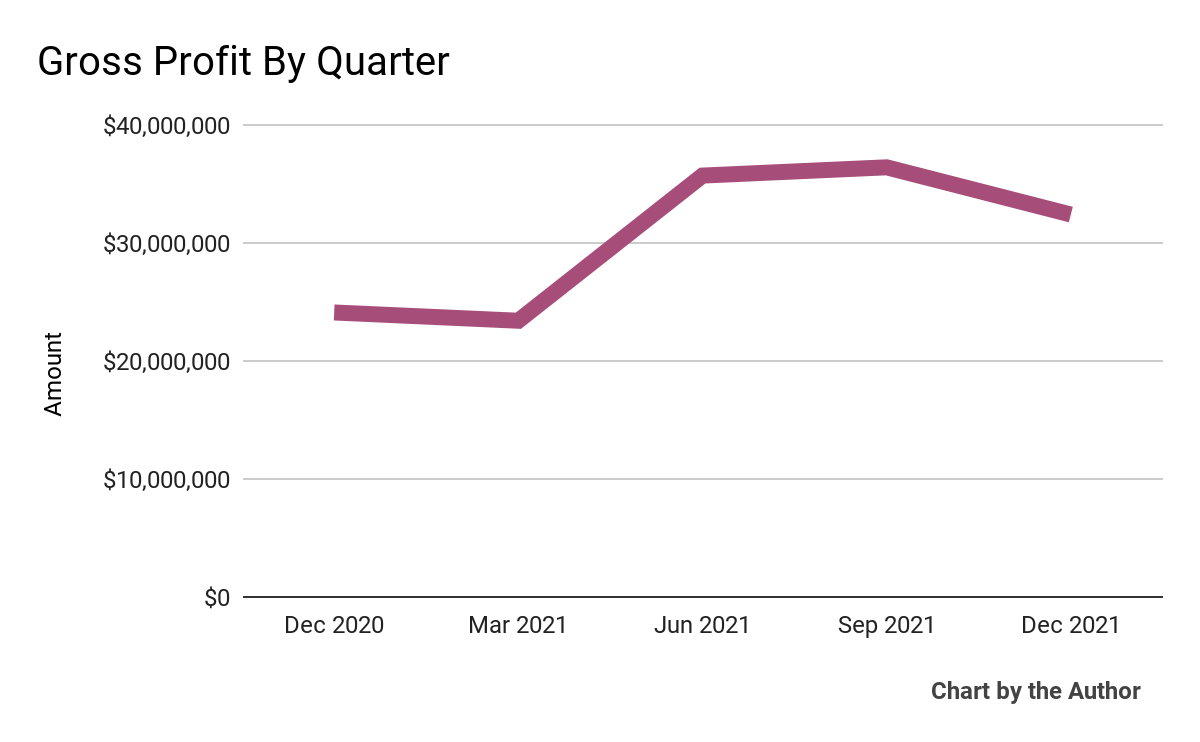

Gross profit by quarter has followed roughly the same trajectory as topline revenue:

5-Quarter Gross Profit (Seeking Alpha and The Author)

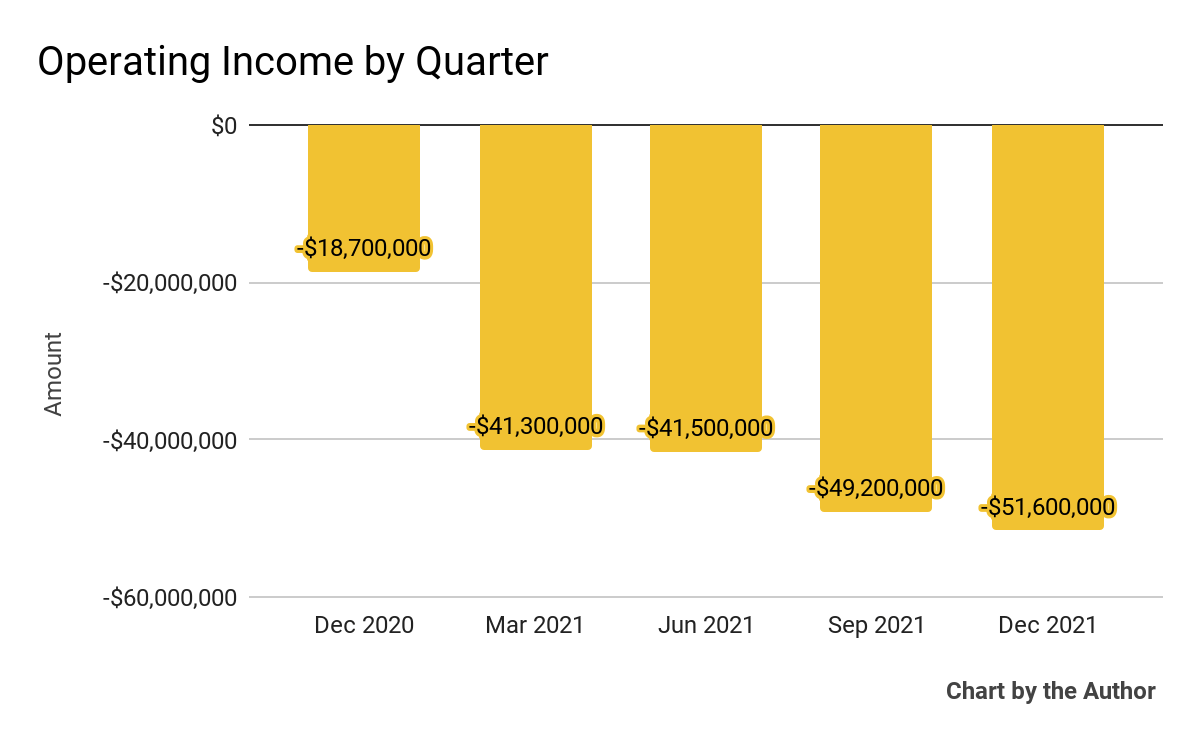

Operating losses by quarter have worsened sharply:

5-Quarter Operating Losses (Seeking Alpha and The Author)

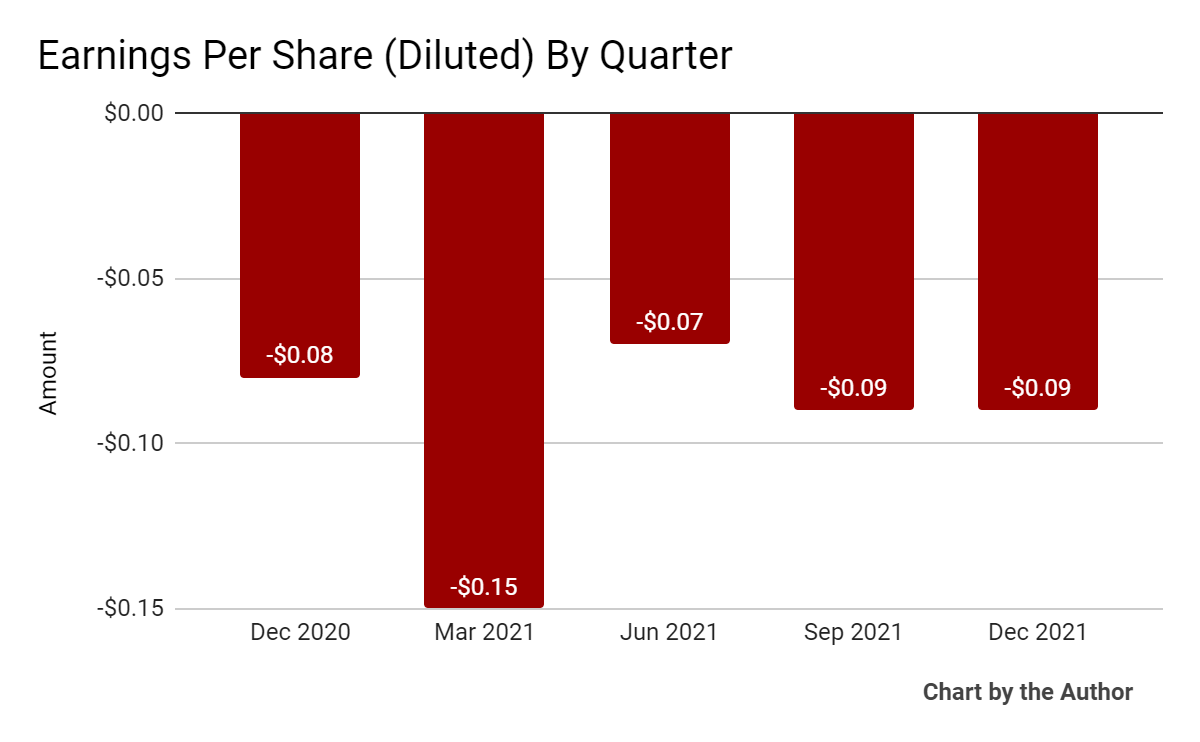

Earnings per share (Diluted) have also remained strongly negative:

5-Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

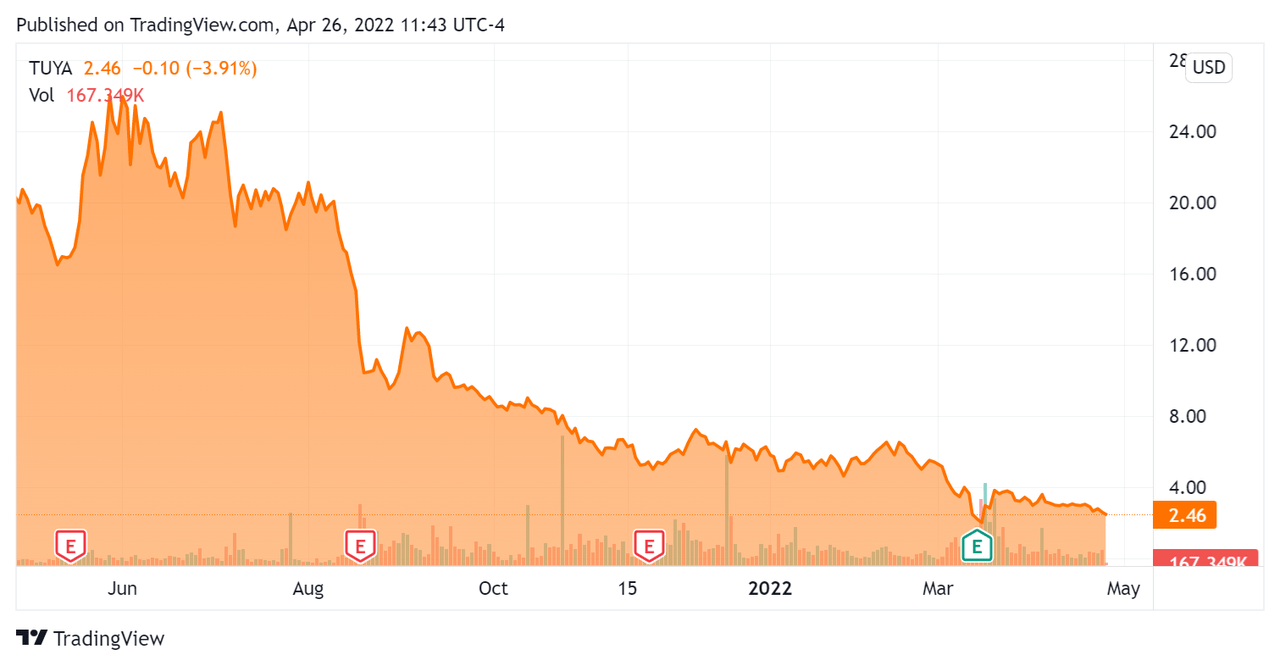

In the past 12 months, TUYA's stock price has dropped 87.9 percent vs. the U.S. S&P 500 Index's rise of .55 percent, as the chart below indicates:

52-Week Stock Chart (Seeking Alpha)

Valuation Metrics For Tuya

Below is a table of relevant capitalization and valuation figures for the company:

Measure | Amount |

Market Capitalization | $1,560,000,000 |

Enterprise Value | $520,060,000 |

Price/Sales | 4.15 |

Enterprise Value/Sales | 1.72 |

Enterprise Value/EBITDA | 0.00 |

Operating Cash Flow (TTM) | -$126,100,000 |

Revenue Growth Rate (TTM) | 67.94% |

Earnings Per Share | -$0.40 |

(Source)

Commentary On Tuya

In its last earnings call, covering Q4 2021's results, management highlighted its revenue growth, which was 68% over that of 2020.

Additionally, CEO Jerry Wang noted that its customer base rose from 5,000 in 2020 to around 8,400 by the end of 2021, representing growth of 68% over the previous year.

The firm also grew its large customer segment, those who purchase more than $100,000 per year in services, from 188 in 2020 to 311 in 2021. The annual retention rate of its top 100 IoT PaaS (Platform-as-a-Service) customers also finished the year at 99%.

However, the company faced international logistics supply chain disruptions which likely slowed its growth and increased costs, but Tuya produced increased gross profit margin.

As to its financial results, while topline growth and gross margin growth have been impressive, its operating losses have increased sharply.

The company continues to invest in R&D employee headcount, which was up by 56% by year end. Operating in a fast-moving technology space means the firm will likely have to keep its R&D at a high level, impacting its financial operating results.

In the current U.S. market environment of higher interest rates, companies with worsening losses and no credible path to operating breakeven have been punished severely and TUYA has been no exception.

Cash used in operations has also greatly increased, which can be a primary driver for lower valuations by stock market investors despite the company's growth results.

However, Tuya ended 2021 with just over $1 billion in cash, equivalents and short-term investments which is certainly enough to provide the company with ample runway.

Management expects Q1 to be its seasonally strongest quarter, but this year, that is a question mark due to the Covid-19 outbreak in the Shenzhen and Shanghai regions.

The firm recently provided estimated Q1 2022 total revenue results of between $54 million and $55 million (midpoint of $54.5 million), which was slightly higher than its year-end 2021 expectation of between $50 million and $57 million (midpoint of $53.5 million).

Given the uncertainties of Tuya's revenue growth trajectory as a result of the continuing lockdowns in China and its worsening operating results, until management can demonstrate a meaningful turn toward operating breakeven, I'm on Hold for TUYA.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is intended for educational purposes only and is not financial, legal or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or removed at any time without notice. You should perform your own research for your particular financial situation before making any decisions. Post-IPO investing carries significant volatility and risk of loss.